Adding retention to invoices

Watch the video to learn how to add customer retention to an invoice.

Retention is a deduction applied on a sales invoice total as part of an agreement between the supplier and the customer. The customer will withhold paying the retention amount until the work is completed to their satisfaction. The supplier would then invoice the customer separately for the retention amount.

How to add retention to an invoice

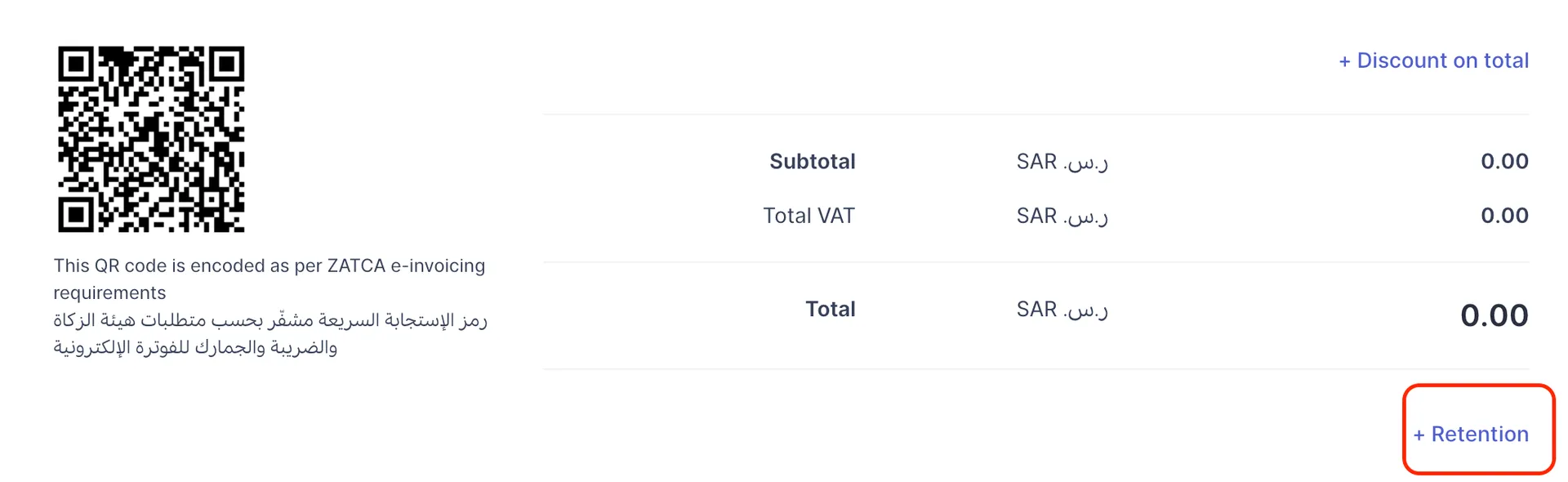

You can add retention to an invoice by editing the invoice and clicking the "+ Retention" button located after the invoice total.

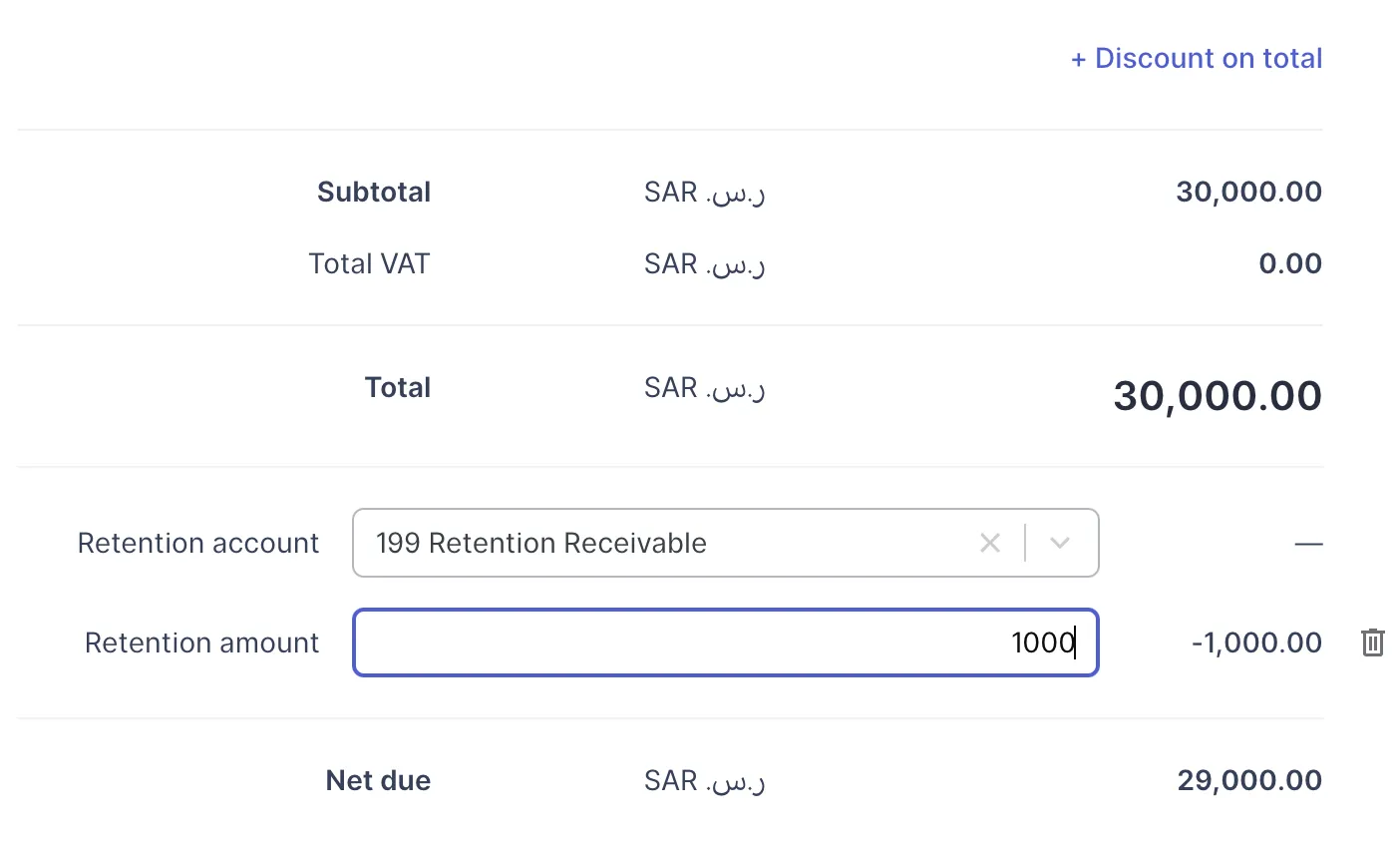

You will be asked to enter:

- Retention account: the current asset account where you would like to book this retention. For example, Retention Receivable.

- Retention amount: the amount retained

Invoicing for retention

When the customer is satisfied with the work, you can invoice them for the retention amount by creating an invoice and making sure you choose the same retention account (Retention Receivable in the example above) in the invoice line item in order to offset the Retention Receivable balance.

Retention is not taxable

Retention is not taxable

Note that you cannot apply VAT on retention.

![New Product Features [March-2023]](https://firebasestorage.googleapis.com/v0/b/wafeq-docs.appspot.com/o/medias%2Fd68397dc_Help Center - EN Article Cover-22.png?alt=media)

.png?alt=media)