Setting up payroll

Learn how to easily manage employee salaries with Wafeq Payroll.

How does Payroll work in Wafeq?

The Payroll feature allows you to:

- List all your employees and their salaries.

- Create payslips and send them to your employees.

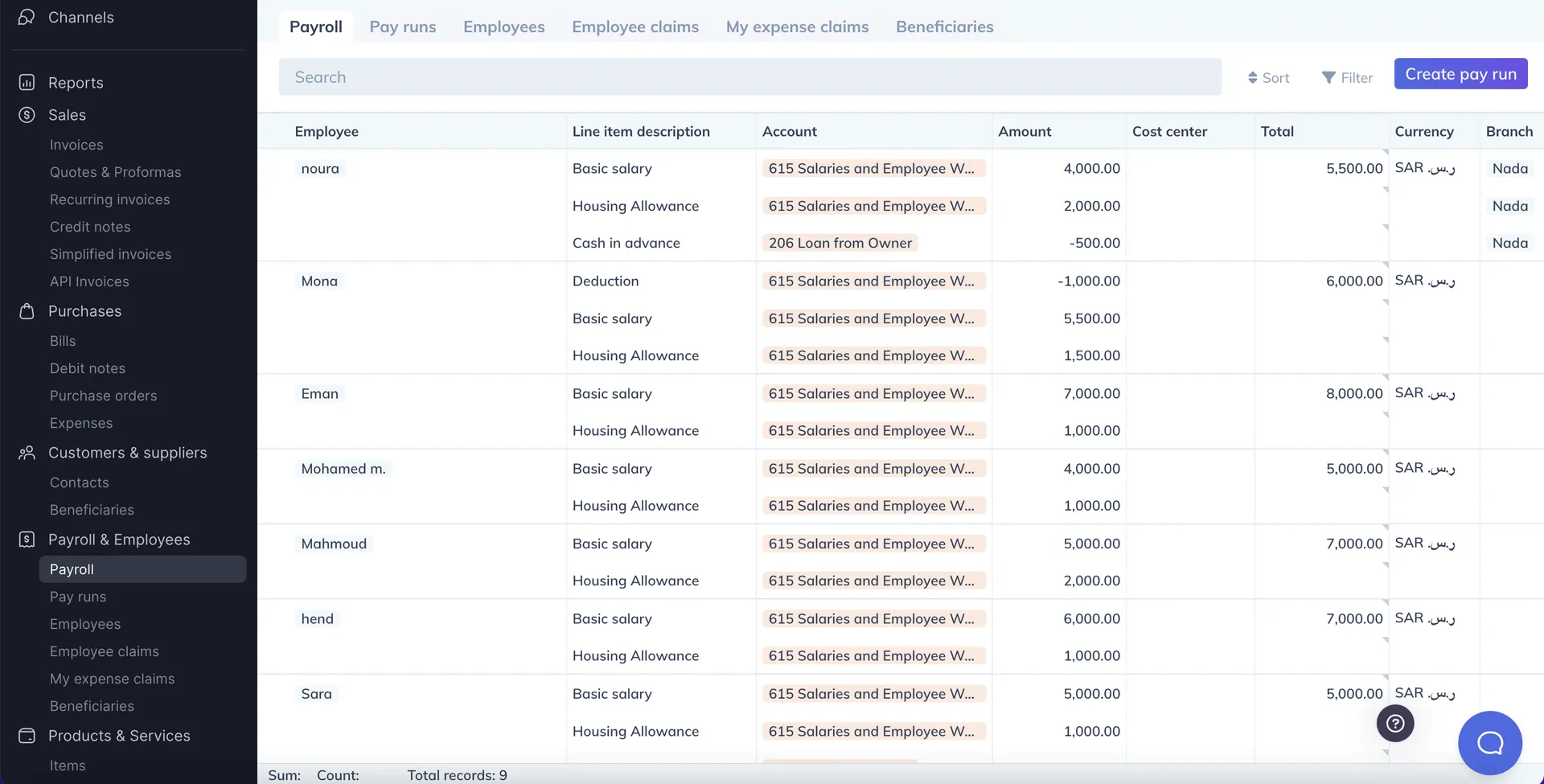

- Break down the types of payroll expenses (e.g. Housing, Basic Salary, Transporation, GOSI, etc.)

- Reimburse employee expense claims during the payroll cycle.

Step-by-step instructions

Set up payroll

- Go to

Payrollin the lef-side menu - On the Payroll sheet, list your employees, their pay items (e.g. Basic Salary, Housing) and the amounts of each pay item.

- In the

Include in pay run, chooseYes

Payroll is now ready and will serve to generate payslips for each payroll period.

Run payroll

Whenever you'd like to run payroll:

- Go to

Payrollin the lef-side menu. - Make sure

Include in pay runis set toYesfor employees you'd like to include in this pay run. - Click

Create pay run. - Draft payslips will be created for each employee.

- Set the

Period startdate, which is the date you'd like the salaries to be expenses. - Change the status to

POSTEDtoo book the salaries as expenses. Once you do that, your Profit & Loss statement will be updated.

Pay payroll

When you pay your employees:

- Go to the

Pay runsin the lef-side menu. - For each payslip, click the

+button under thePaymentscolumn. - Record a payment

Send payslips

To send payslips to your employees:

- Make sure each employee has an email address by going to the

Employeespage on the left-side menu. - Go to the

Pay runspage on the left-side menu - Check the boxes next to each payslip you'd like to send

- Click

Send payslipsin the top right corner - You will get a preview of the payslips to be sent

- Click

Sendto send the payslips.

Draft payslips

You cannot send payslips in DRAFT status. You can only send payslips that are in status POSTED or PAID.

![New Product Features [March-2023]](https://firebasestorage.googleapis.com/v0/b/wafeq-docs.appspot.com/o/medias%2Fd68397dc_Help Center - EN Article Cover-22.png?alt=media)

.png?alt=media)