Handling Rounding Differences in VAT within Wafeq

Occasionally, users of Wafeq may encounter discrepancies when filing VAT on ZATCA in KSA or FTA portal in the UAE due to rounding differences. Here's a guide to understanding and managing these discrepancies:

Wafeq rounds tax amounts to two decimal places (0.01) by default. For example, if the calculated VAT is 6.578 SAR, the system will automatically round it to 6.58 SAR. This approach follows International Financial Reporting Standards (IFRS) and the guidelines issued by the Zakat, Tax and Customs Authority (ZATCA) in Saudi Arabia.

As a result, you may notice slight differences in some figures due to this rounding. In this guide, we’ll explain how rounding works in Wafeq, its impact on your financial records, and walk through a real example to clarify it.

Where Does Rounding Appear in Wafeq?

Rounding appears in all documents that include Tax calculations, such as sales invoices, bills, and both debit and credit notes. In the following example, we opened a sales invoice by going to the “Sales” section in the main menu and selecting “Sales Invoices”.

After selecting a specific invoice and scrolling to the Products and Services section, here’s what we see:

This invoice contains a single item with a unit price of 49.90 SAR and a quantity of 9. As a result, the subtotal before VAT is:

49.90 × 9 = 449.10 SAR. A 15% VAT is applied to this amount, which results in a calculated tax of: 449.10 × 15% = 67.365 SAR

Wafeq automatically rounds this value to two decimal places, so the displayed tax becomes: 67.37 SAR

If you’d like to verify the Tax rate in any invoice, you can do so manually by dividing the tax amount by the subtotal.

If you’d like to verify the Tax rate in any invoice, you can do so manually by dividing the tax amount by the subtotal.

In this example:

(67.37 ÷ 449.10) * 100 = 15.01%

This slight difference is simply the result of rounding the tax to the nearest halala (0.01 SAR).

It’s a standard accounting practice and does not affect the accuracy or validity of the invoice.

In Wafeq, tax is calculated—and rounded—at the line item level. The total tax amount you see is the sum of these rounded values.

In Wafeq, tax is calculated—and rounded—at the line item level. The total tax amount you see is the sum of these rounded values.

If the document includes a discount, Wafeq first applies the discount, then calculates tax on the reduced amount.

If the document includes a discount, Wafeq first applies the discount, then calculates tax on the reduced amount.

This increases the chance of generating tax values with long decimals (like 13.2675), which the system then rounds automatically to 13.27.

This behavior is expected, and it does not affect the accuracy of the document.

Tax rounding on invoices in the UAE

1. Understanding the Rounding Discrepancy

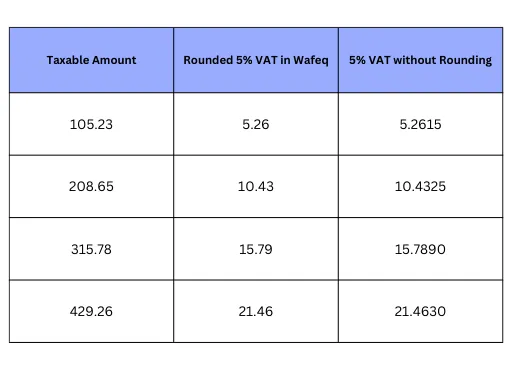

Inside Wafeq, several rounding actions take place for each transaction. Consequently, the resulting VAT may not precisely equate to 5% of the Taxable amount reported to the FTA portal.

Consider the following example:

Aggregate Analysis:

Aggregate Analysis:

- Taxable Amount: 1,059.92

- Sum of Rounded VAT: 52.94

- 5% VAT on Total: 52.95

- Difference: 0.01

In Wafeq, the amount shown under VAT is 52.94 (Number 2) because it sums up the VAT of each transaction. But when filing in the FTA portal using the total taxable amount of AED 1,058.92, a VAT value of AED 52.94 is incorrect, as 5% of AED 1,058.92 is AED 52.95 — revealing a difference of AED 0.01.

2. Rectifying the Discrepancy

To align with FTA portal requirements:

- Retain the taxable amount of AED 1,058.92, as this serves as the basis for VAT.

For the VAT field, compute 5% of the total taxable amount. In our example, 5% of AED 1,058.92 gives AED 52.95, which is the accurate value you should input into the FTA portal.

For the VAT field, compute 5% of the total taxable amount. In our example, 5% of AED 1,058.92 gives AED 52.95, which is the accurate value you should input into the FTA portal.

3. Bookkeeping Adjustments

Post-filing the VAT, an entry is essential to close the filed VAT. The regular entry suggestion is:

- Debit: VAT 52.94

- Credit: VAT Payable 52.94

- Debit: VAT 52.94

- Credit: VAT Payable 52.94

However, due to the rounding difference, it's advisable to adjust VAT in the books and recognize the accurate VAT payable:

Debit: VAT 52.94

Debit: VAT 52.94

Debit: Rounding 0.01

Credit: VAT Payable 52.95

This approach ensures that your books stay accurate and aligned with the FTA's expectations.

In summary, while rounding discrepancies can occur, following these steps will ensure your VAT filings are accurate and compliant with FTA requirements. If any further questions arise, always feel free to reach out to the Wafeq support team for assistance.

![New Product Features [March-2023]](https://firebasestorage.googleapis.com/v0/b/wafeq-docs.appspot.com/o/medias%2Fd68397dc_Help Center - EN Article Cover-22.png?alt=media)

.png?alt=media)