Cash Flow Statement: How Does it Work

In today’s article, we will explore another reporting type, namely the cash flow statement. Read more to find out everything to know about this crucial document, its elements, and real-life examples regarding the topic.

The Statement of Cash Flow is the third financial statement that Abdullah must be aware of. This statement indicates how Wasslak's cash has changed over the period shown in the heading. Abdullah would be able to see a glimpse of how much cash his company makes and spends on its operating, investing, and financing activities. The balance sheets and income statements of Wasslak will be used to fill out a lot of this financial statement.

Samy showed Abdullah three financial reports: the income statement, the balance sheet, and the statement of cash flow. These reports are just one part of what good accounting software can do for business owners.

Samy now tells Abdullah what he needs to know to keep track of his transactions.

Double-Entry: Statement of Cash Flow

Accounting is based on a 500-year-old technique called "double entry," which is used in both manual systems and essential accounting software. The idea of double entry is simple, but powerful, as a company's transactions will be recorded in at least two of its accounts.

The Chart of Accounts

As part of setting up Abdullah's accounting system, he will need to make a detailed list of all the accounts that Wasslak, Inc. may require for reporting transactions. A chart of accounts is the name for this detailed list. Most accounting software uses various sample charts of accounts for different kinds of businesses.

Abdullah will discover that the chart of accounts will help him choose the two (or more) accounts engaged in each transaction. Once Abdullah's business starts, he may need to add more account names to the chart of accounts or eliminate account names that are never used. Abdullah can change his chart of accounts to best organize and report his business's transactions.

Due to the double-entry system, every transaction Wasslak makes will involve two or more accounts from the balance sheet or the income statement. Samy gives some examples of accounts that Abdullah may need to add to his chart of accounts, including balance sheet assets, liabilities, and stockholder equity. Income statement accounts could also be added, such as revenue and expense.

Use Wafeq to keep all your expenses and revenues on track to run a better business.

Use Wafeq to keep all your expenses and revenues on track to run a better business.

Sample Transaction

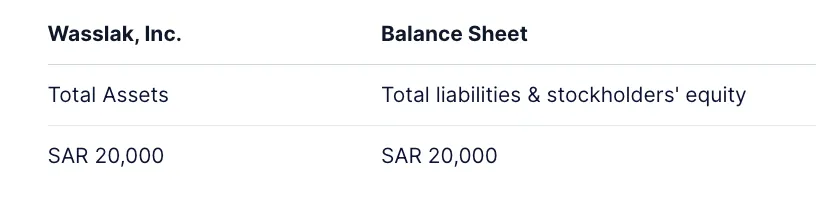

Abdullah started his business, Wasslak, Inc., on December 1, 2022. Abdullah's investment of SAR 20,000 in return for 5,000 shares of Wasslak's common stock will be the first transaction he records for his business. The accounting system for Wasslak will show that its Cash account went from SAR 0 to SAR 20,000 and that its Stockholders' Equity Common Stock increased by SAR 20,000. Both are balance sheet accounts. There are no sales yet because the company hasn’t earned any delivery fees and hasn’t spent any money, either.

The balance sheet for Wasslak will look like this after Abdullah records this transaction:

Wasslak, Inc.

December 2, 2022

Samy asks Abdullah if he can verify that the balance sheet is in balance. Abdullah looks at the SAR 20,000 total on the asset side and the SAR 20,000 total on the right side and says, "Of course, I can see that it's in balance."

Samy shows Abdullah something called the "basic accounting equation." It's the same idea as the "balance sheet," he says, but it's written as an equation.

Assets = Liabilities + Stockholders’ Equity

Assets = Liabilities + Stockholders’ Equity

SAR 20,000 = SAR 0 + SAR 20,000

The accounting equation and the balance sheet should always be in balance.

Debits and Credits

Did the first sample transaction use the double-entry system and impact two or more accounts? Abdullah looks at the balance sheet once more and says, "Yes, the transaction equally had an impact on both Cash and Common Stock."

Samy explains the next fundamental accounting idea: in the double-entry system, you must put the same transaction amount on the left and right sides of two different accounts. Accountants use the term debit instead of the word left and the phrase credit instead of right.

Abdullah asks Samy how he will know which accounts to debit, which means to enter the numbers on the left side of one account, and which accounts to credit, meaning to record the figures on the right side of another account. Samy points to the basic accounting formula and tells Abdullah that it will be simple to interpret debits and credits if he remembers this simple equation.

Let's look at the accounting equation one more time:

Assets = Liabilities + Stockholders' Equity

Assets = Liabilities + Stockholders' Equity

The balances of the asset accounts are on the left side of the general ledger, just like the assets are on the left side (or debit side) of the accounting equation. To raise the balance of an asset account, add more to the left side of the account. In accounting terms, debit the asset account. To lower the balance of an asset account, simply credit it.

Just like liabilities and stockholders' equity are on the accounting equation's right side (or credit side), their balances are on the right side of the general ledger. Put more on the right side of a liability or stockholders' equity account to increase the balance. In accounting terms, credit the liability account or the equity account. To lower a liability or equity, debit the account, which means you put the amount on the left side of the account.

Read more about the Overview Of Liabilities And Stockholder Equity.

Because many transactions involve cash, Samy implies that Abdullah learns how the Cash account changes. Simply put, if Wasslak collects cash, the Cash account is debited; if Wasslak pays out cash, the Cash account is credited.

Samy uses December 1 as an example. In exchange for 5,000 shares of common stock, Abdullah gave Wasslak SAR 20,000 in cash, so one of the accounts for this transaction is Cash. Since cash was received, it will be debited to the Cash account.

In order for double entry to work, there must be at least two accounts. Since cash was debited to the first account, a second account needs to be credited. In this case, Common Stock is the second account that needs to be credited, as the company gave away SAR 20,000 worth of its stock. Stockholders' equity, found on the right side of the accounting equation, includes common stock. So, it ought to have a credit balance, and the account needs to be credited to reach a balance.

Accountants use the following format to show accounts and amounts:

Account Name

Account Name

Cash Account - Debit - SAR 20,000

Common Stock Account - Credit - SAR 20,000

Frequently Asked Questions about Cash Flow Statements

What is the difference between operating, investing, and financing activities in a cash flow statement?

- Operating Activities: These include the day-to-day transactions that contribute to revenue generation, such as sales of goods and services and payment of operating expenses.

- Investing Activities: These involve the purchase and sale of long-term assets, such as property, equipment, and investments in other companies.

- Financing Activities: These include transactions that affect the company’s capital structure, such as issuing stocks or bonds, obtaining loans, and repaying debts.

How can a cash flow statement be used for financial forecasting?

A cash flow statement can be used for financial forecasting by analyzing historical cash flow data to predict future cash flows. This helps in planning expenditures and identifying periods when the company might need additional financing or when it might have excess cash to invest. This analysis is a crucial tool for making informed financial decisions and improving cash management.

What are the key indicators to monitor in a cash flow statement?

Key indicators to monitor in a cash flow statement include:

Net Cash Flow from Operating Activities: This shows the company’s ability to generate cash from its core operations.

Net Cash Flow from Investing Activities: This indicates the extent of the company’s investment in new assets or the sale of existing assets.

Net Cash Flow from Financing Activities: This reflects changes in the company’s capital structure and financing activities.

Change in Cash and Cash Equivalents: This represents the difference between the cash available at the beginning and the end of the period, providing an overview of the company’s liquidity changes.

How can a company improve its cash flow?

A company can improve its cash flow by:

- Accelerating Receivables Collection: Implementing better credit policies and encouraging customers to pay promptly.

- Managing Expenses Wisely: Monitoring and controlling operating and capital expenditures effectively.

- Sound Financial Planning: Preparing accurate budgets and planning for the future.

- Optimizing Inventory Management: Avoiding overstocking to prevent cash from being tied up in inventory.

- Utilizing Financial Instruments: Leveraging loans and lines of credit to increase liquidity when necessary.

What common mistakes should be avoided when preparing a cash flow statement?

Common mistakes to avoid include:

Not accurately tracking all cash flows: This leads to inaccurate statements.

Failing to separate operating, investing, and financing activities: This causes data confusion and complicates analysis.

Delaying the recording of cash flows: This can result in an inaccurate portrayal of available cash.

Not regularly reviewing and updating the statement: This fails to reflect the company’s current financial situation accurately.

How can a cash flow statement impact investment decisions?

A cash flow statement impacts investment decisions by providing information on the company’s ability to finance investments with its internal cash flow. Companies that show strong cash flow capabilities in their statements can confidently invest in new projects, while companies with weak cash flow may need to reconsider their investment plans or seek external funding sources.

Since computers and accounting software have become more affordable, it is unusual to see small businesses using a slow, manual system. Accounting software has made it so much easier to keep track of transactions, so it is strongly recommended that everyone switch and become way more efficient.

Use Wafeq - an accounting system to keep track of debits and credits, manage your inventory, payroll, and more.

Use Wafeq - an accounting system to keep track of debits and credits, manage your inventory, payroll, and more.

.png?alt=media)