What Is A CMA (Certified Management Accountant)?

Certified Management Accountants (CMAs) are highly qualified and paid experts in finance, management, and strategy—but what do they actually do, and how can you become one? Read on to find out answers to all that and more in this article.

What Is A CMA?

A certified management accountant, often known as a CMA, is a finance expert with extensive experience in making financial decisions and a solid grasp of accounting fundamentals.

In addition to performing typical accounting tasks such as organizing and summarizing financial data, an accountant with the certification or designation of "CMA" demonstrates that they are adept in managing the financial affairs of corporations.

This Article’s Layout And Topics

- What exactly is it that Certified Management Accountants are responsible for?

- Where exactly can one become a Certified Management Accountant?

- The Steps to Getting Your Management Accounting Certification

- Designations Earned by a CMA and a CPA

- Accounting expertise required for Certified Management Accountants

Read more about ACCA Certificate.

What Are The Responsibilities And Tasks Of CMAs?

Certified management accountants, often called CMAs, are financial decision-makers who frequently work for major corporations or governments on strategic financial planning.

- Certified management accountants are abbreviated as CMAs.

- CMAs are qualified to guide businesses on various business topics, including investment management and risk management.

According to Nikki Awuma, a Certified Management Accountant at RealTruck.com,

"the emphasis on strategy and management is a big advantage of the CMA."

In other words, "getting relevant insights and actionable data out of the financials" is just as important as putting together and monitoring correct financials.

The activities of a certified management accountant on a daily basis might sometimes be the same as those of any other form of accountant: You put forth a significant amount of effort to monitor and report on financial facts.

CMAs, on the other hand, play a more significant part in the management of an organization as a whole.

According to Awuma, a CMA may be given a variety of duties and responsibilities, including

- General ledger operations and entries

- Reconciliations

- Month-end close process

- Financial reporting

- Financial planning and analysis (FP&A)

- Variance analysis

- Risk management

- Internal controls.

What Jobs Can CMAs Take, And Where Do CMAs Work?

CMAs can operate in a diverse range of fields due to the breadth and depth of their skill sets.

CMAs usually work for major corporations or governments, although they have the option of specializing in a variety of fields like education, manufacturing, insurance, communication, or even banking.

Most businesses would be well served to have someone who can review their financial data and make decisions based on what they find.

Consulting is another viable career option for certified management accountants (CMAs). For instance, the Big Four accounting firms (Deloitte, KPMG, PwC, and EY) may employ Certified Management Accountants (CMAs) on staff to assist in advising businesses on matters including cost accounting, restructuring, and mergers and acquisitions.

Job Positions For Certified Management Accountants (CMAs)

When you have a diverse set of skills, you usually have a variety of job titles that you may apply for. The following are some examples of these titles:

- Private accountant

- Corporate accountant

- Managerial accountant

- Cost accountant

- Industrial accountant

What are The Best 7 Paying Accounting Certificates?

How Can You Become A Certified Management Accountant (CMA)?

Gaining a CMA license takes a bachelor's degree. Although having a degree in accounting, finance, or an area that is closely related might be beneficial, it is not required.

Some educational institutions have programs that are tailored exclusively for the certified management accountant job path, as well as specialized classes that can assist students in preparing for the CMA test.

In the same way that it is required to have many years of job experience in accounting in order to sit for the CPA test, candidates for the CMA exam must have at least two years of relevant experience.

Therefore, having a degree in a discipline related to finance might make it easier for you to obtain the necessary job experience before taking the CMA exam.

CMA Certification In 2023

The Certified Management Accountant credential is made available by the Institute of Management Accountants (IMA).

To be eligible for this certification, you are required to hold a bachelor's degree, demonstrate competency on a test, and demonstrate experience working in management accounting.

In addition, in order to keep your certification current, you will be expected to complete the necessary hours of ongoing education.

The Certified Management Accountant exam assesses your knowledge in 12 main areas, some of which are performance management, financial planning, and strategic financial management.

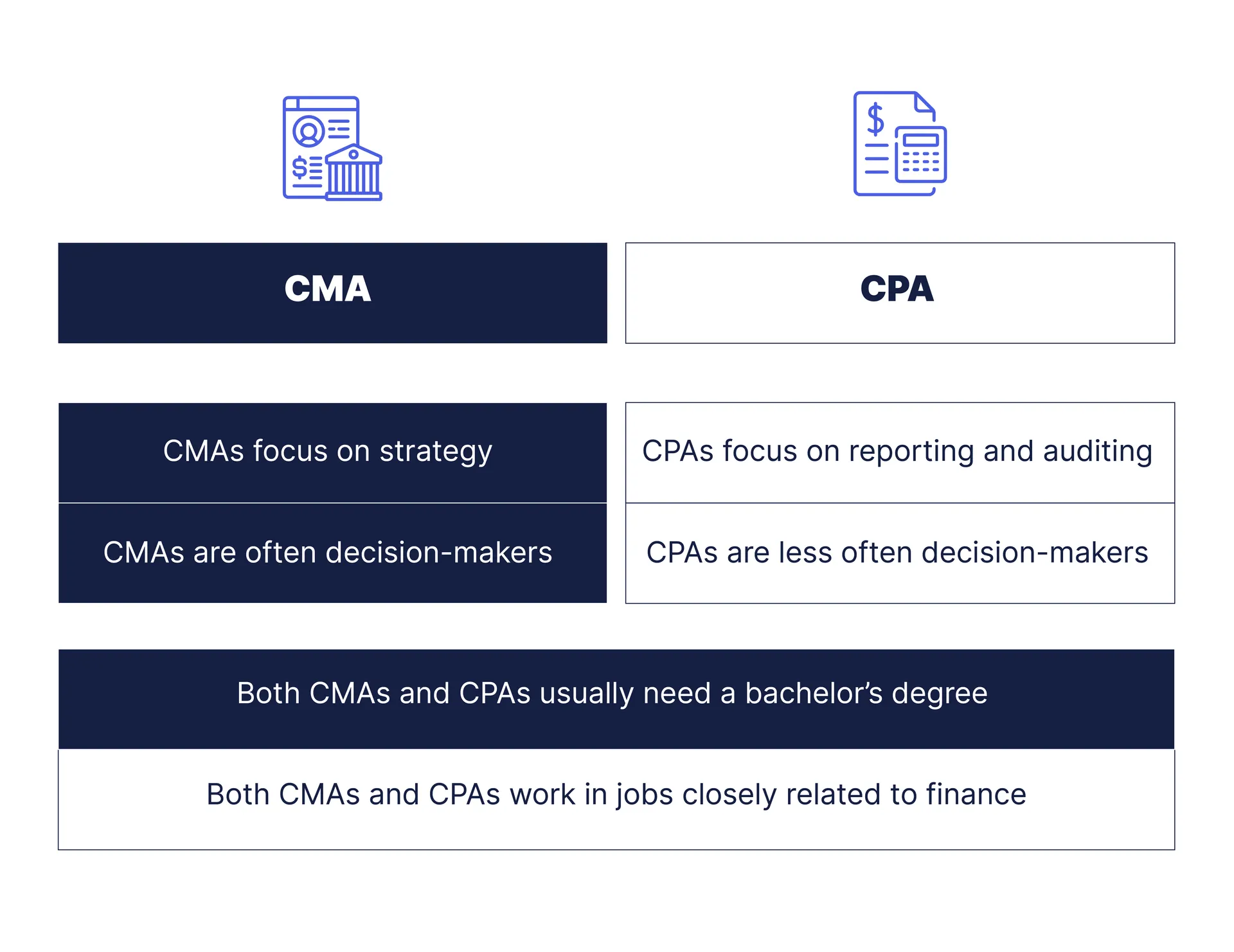

CMA vs. CPA: A Comparison

The CPA, or Certified Public Accountant, credential holds the distinction of being the most well-known accreditation for an accountant.

CPAs are largely focused on analyzing and reporting financial information, processing taxes, and doing audits of a company's financial records, in contrast to CMAs, who are primarily concerned with strategy and management.

A Certified Public Accountant license is necessary for several financial occupations. On the other hand, Certified Management Accountant (CMA) certificates are not often necessary but can be an excellent alternative for those with a history in accounting who are interested in climbing the corporate ladder.

"If someone were to tell me that they wanted to be a [Chief Financial Officer], [Vice President] of Finance, or Corporate Controller, I would prefer the CMA track over the CPA track," adds Awuma. "It's more relevant to the job market."

Expertise Required For Certified Management Accountants (CMAs)

In addition to their abilities in accounting and management, a qualified management accountant is required to have the following:

- Ability in communication

- Competence in analysis

- The particularity and a high level of familiarity with Excel

- The capability of reading and understanding financial statements

The Conclusion

Certified Management Accountants (CMAs) are important figures of all major corporations in finance.

Their combined expertise in accounting, strategy, and management allows CMAs to see situations from multiple perspectives and thus make the most educated and data-driven decisions.

CMAs earn well and are sought after, but to get a recognized CMA certification one usually needs a bachelor’s degree with specialized knowledge.

Use Wafeq - an accounting system to keep track of debits and credits, manage your inventory, payroll, and more.

Use Wafeq - an accounting system to keep track of debits and credits, manage your inventory, payroll, and more.

.png?alt=media)