Accrual Accounting Essentials: Prepaid Expenses, Accruals, and Revenue Deferrals Explained

.png?alt=media)

In accounting, timing is everything. Whether it's recognizing revenue or recording expenses, when a financial transaction is recorded, it can significantly impact the accuracy of financial statements and business decision-making. Under the accrual basis of accounting, revenues and expenses are recognized when earned or incurred, not necessarily when cash changes hands. This concept ensures a true and fair view of a company’s financial position and performance over time.

Among the most important timing-based classifications in accounting are prepaid and accrued expenses. Understanding the difference between these two is essential for accurate month-end closings, Proper budgeting and forecasting, Compliant financial reporting under IFRS or SOCPA, and better audit preparedness.

In addition to prepaid and accrued expenses, it's equally important to understand accrued revenue and deferred revenue, which impact the income side of the equation similarly. This article presents a comprehensive comparison of these concepts, illustrated with real-life examples and journal entries, so financial professionals can apply them confidently and correctly.

What are Prepaid Expenses?

Prepaid expenses are advance payments made by a company for goods or services that will be received or consumed in the future. In accounting, they are initially recorded as assets because they represent a future economic benefit. Once the service or benefit is received, a portion of the prepaid expense is gradually expensed over time, in line with the matching principle, which aims to match expenses with the revenues they help generate. Failing to account for prepaid expenses properly can exaggerate expenses and understate net income, particularly at the beginning of a fiscal period.

Common Examples of Prepaid Expenses:

Common Examples of Prepaid Expenses:

- Rent paid in advance for several months or a year.

- Insurance premiums are paid upfront.

- Annual software licenses or subscriptions.

- Maintenance contracts are paid at the beginning of the coverage period

Illustrative Example:

Illustrative Example:

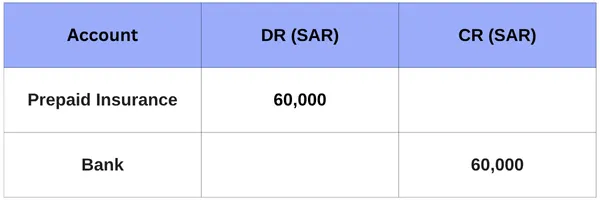

Suppose a company pays SAR 60,000 on January 1 for a one-year insurance policy. The correct treatment under accrual accounting would be:

At the time of payment (On January 1)

As the expense is incurred (at the end of each month)

Impact on Financial Statements:

Impact on Financial Statements:

- The portion related to each month is recorded as an expense, while the remaining amount stays on the balance sheet as a current asset.

- Appears initially as an asset on the balance sheet.

- It is amortized into expense over time on the income statement.

- Helps maintain accuracy in profit reporting.

Know more about: Matching Costs to Revenue With Real Examples & Pro Tips.

What are Accrued Expenses?

Accrued expenses are expenses that have been incurred during an accounting period but have not yet been paid or recorded by the end of that period. These expenses are recorded as liabilities because they represent obligations the company must settle in the future. This treatment aligns with the accrual basis of accounting where expenses must be recognized when incurred, regardless of when payment is made. Neglect to accrue expenditures can understate liabilities and overstate net income, leading to potential audit issues and misleading financial reports.

Common Examples of Accrued Expenses:

Common Examples of Accrued Expenses:

- Salaries and wages are payable at month-end.

- Utility bills have not yet been received, but are related to the current period.

- Interest expenses that have accrued but not yet been paid.

- Professional services received but not yet invoiced.

Illustrative Example:

Illustrative Example:

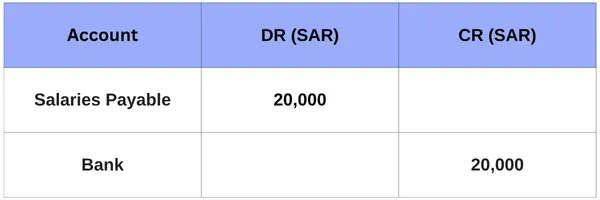

Suppose a company owes SAR 20,000 in salaries to employees for the last week of December, to be paid in early January. Under accrual accounting:

At the time of accrual (On December 31)

When payment is made (in January)

Prepaid vs Accrued Expenses: Key Differences

Understanding the difference between prepaid expenses and accrued expenses is essential for ensuring the accuracy of financial reporting. While both relate to timing, they operate in opposite directions in terms of cash flow and recognition. Here is a side-by-side comparison:

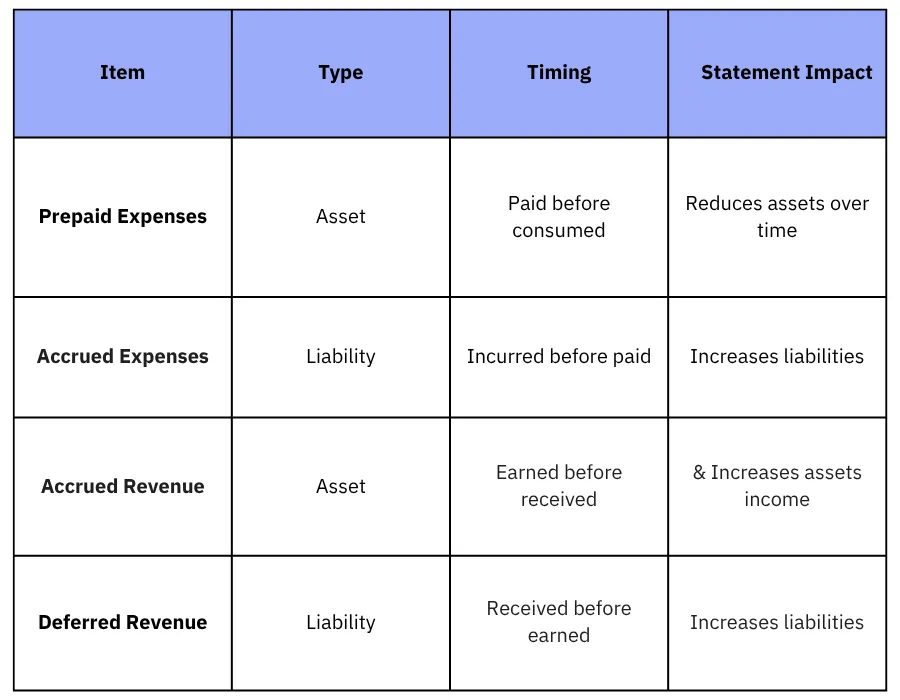

When Do We Recognize Revenue? Understanding Accrued vs Deferred

Just as expenses can be prepaid or accrued, revenues can also be classified based on the timing of recognition vs cash collectionTwo key concepts are accrued revenue and deferred revenue, and understanding them is essential for recognizing revenue correctly under accrual accounting.

What is Accrued Revenue?

Accrued revenue refers to income earned by a company for goods delivered or services rendered, but not yet billed or received in cash at the end of the accounting period. It is recorded as an asset (Accounts Receivable) on the balance sheet and as revenue on the income statement.

Common Examples of Accrued Revenue:

Common Examples of Accrued Revenue:

- Consulting services provided but not yet invoiced.

- Interest income earned but not yet received.

- Contract milestones completed but not yet billed.

Accounting Treatment:

Accounting Treatment:

Dr. Accounts Receivable

Cr. Revenue

What is Deferred Revenue?

Deferred revenue (also called unearned revenue) arises when a company receives payment in advance for goods or services yet to be delivered or performed. It is recorded as a liability because the company still owes a product or service.

Common Examples of Deferred Revenue:

Common Examples of Deferred Revenue:

- Advance payments for annual subscriptions.

- Prepaid maintenance contracts.

- Tuition is received before classes begin.

Accounting Treatment:

Accounting Treatment:

- At the time of receiving cash:

Dr. Cash

Cr. Deferred Revenue (Liability)

- As service is rendered:

Dr. Deferred Revenue

Cr. Revenue

Accrued revenue reflects earned income awaiting payment, while deferred revenue reflects unearned income awaiting performance. Both are essential for revenue accuracy, especially under IFRS and GAAP.

Accrued revenue reflects earned income awaiting payment, while deferred revenue reflects unearned income awaiting performance. Both are essential for revenue accuracy, especially under IFRS and GAAP.

Also Read: When To Choose Accrual Accounting Over Cash Accounting?

Prepaid expenses, accrued expenses, accrued revenue, and deferred revenue are all foundational to the accrual basis of accounting, which aims to match revenues and costs to the periods in which they are earned or incurred, regardless of when cash changes hands.

As a financial professional, understanding the timing and classification of these items ensures more accurate profit measurement, compliance with IFRS/GAAP, Proper asset and liability presentation, and informed budgeting and forecasting. Always review your adjusting entries at period-end to ensure that these categories are accurately recorded. Misstatements in these areas can lead to incorrect financial ratios, misleading interpretations of cash flow, and compliance risks.

Frequently Asked Questions about Prepaid Expenses, Accruals, and Revenue Deferrals Explained

What is the difference between Accrued Revenue and Accounts Receivable?

Accrued revenue refers to income that has been earned but not yet invoiced or collected. Accounts receivable represent invoiced amounts owed by customers. All accrued revenue becomes part of accounts receivable once it is invoiced, but not all accounts receivable are accrued revenue; some may relate to previous billing cycles.

Are Accrued Expenses Debits or Credits?

Accrued expenses are recorded as credits (liabilities) because they represent costs that are incurred but not yet paid. The corresponding debit goes to the relevant expense account (e.g., Salaries Expense, Rent Expense).

Where do Accrued Expenses appear on the Financial Statements?

Accrued expenses appear in the liabilities section of the balance sheet (statement of financial position). They are typically listed under Current Liabilities, as they are expected to be paid within the next accounting period.

Track prepaid expenses, automate accrued entries, and manage deferred revenue, all in one powerful, compliant platform built for Saudi businesses.

Track prepaid expenses, automate accrued entries, and manage deferred revenue, all in one powerful, compliant platform built for Saudi businesses.

.png?alt=media)