Current Assets vs. Noncurrent Assets, Simply Explained

In accounting, it is vital to distinguish between current assets and noncurrent assets—but what exactly is the difference between these two seemingly similar classes? Read on, as this article explains exactly that using simple, hands-on examples taken from realistic scenarios.

Current Assets vs. Noncurrent Assets: An Overview

The resources a firm needs to operate and expand are assets in financial accounting. Current and noncurrent assets are the two types of assets that are listed on a firm's balance sheet and add up to the total assets of the company.

Consider noncurrent assets to be long-term since they have a useful life of more than 365 days, in contrast to current assets, which are short-term because they may be required for a company's liquidity increase.

Main Takeaways

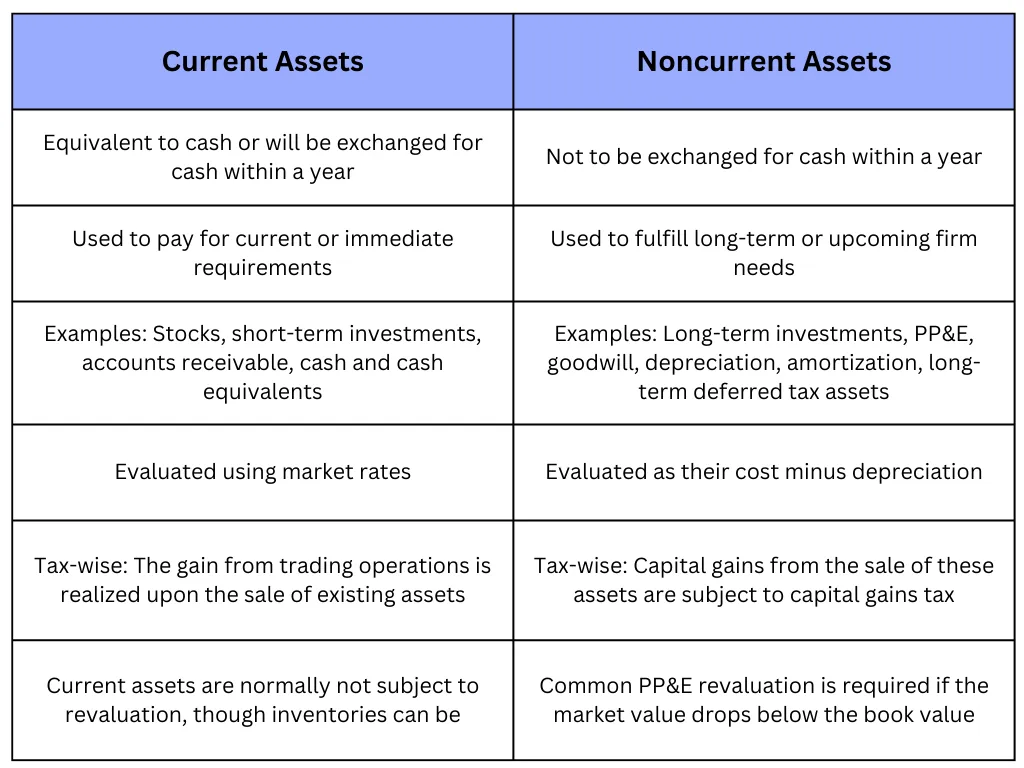

- Short-term assets, or those that can be quickly sold and utilized for a company's urgent requirements, are known as current assets. Noncurrent Assets are long-term and have an operational life of over a year.

- Cash, marketable securities, inventory, and accounts receivable are a few examples of current assets. Real estate, long-term investments, trademarks, and PP&E are a few examples of noncurrent assets.

- Noncurrent assets are typically valued at their cost less depreciation, while current assets are frequently valued at market pricing.

- Profits from selling assets owned for more than 365 days are subject to capital gains tax (noncurrent assets).

Read more: Understanding Company Assets On The Balance Sheet.

Current Assets Explained

Current assets are what a business requires to run its daily operations and pay its current expenses, and they are called short-term assets since they are typically converted to cash within a firm's fiscal year. Typically, current assets are listed at their current or market value on the balance sheet.

Current assets could consist of the following:

- Cash and its substitutes

- Payables receivable

- Prepaid costs

- Inventory

- Trading securities

The short-term debt of an organization may be settled with cash and equivalents (that may be converted). The predicted payments from clients that will be collected within a year make up accounts receivable. Because it contains raw materials and finished commodities that can be sold rapidly, inventory is also a current asset.

Noncurrent Assets Simply Explained

Noncurrent Assets are long-term investments made by a corporation with a useful life of more than one year. Noncurrent Assets are not easily convertible to cash. They include things like land and heavy machinery and everything necessary for a business's long-term requirements.

Noncurrent assets are listed at the price they were purchased for on the balance sheet, discounted for depreciation and amortization, and subject to revaluation whenever the market price declines relative to the book price.

Noncurrent Assets could consist of the following:

- Land

- Plant, equipment, and real estate/property (PP&E)

- Trademarks

- Investments in the long term and goodwill when a company buys another company

Tangible and intangible assets can be used to divide noncurrent assets further.

- Property, plant and equipment (PPE) are considered fixed assets since they are physical and tangible.

- Production facilities used by automakers, for instance, would be classified as noncurrent assets.

Non-physical assets like patents and copyrights are examples of intangible assets. Because they add value to a business but cannot be easily converted to cash within a year, they are regarded as noncurrent assets.

Since a business typically retains long-term investments like bonds and notes in its books for more than a year, they are also regarded as noncurrent assets.

Current vs. Noncurrent Assets: Differences

Example Of Current Assets And Noncurrent Assets

Below is an imaginary part of Emirates' balance statement from its 10-K 2021 annual filing that shows where current and noncurrent assets are located.

In most cases, current assets are seen at the top of the balance sheet. Here, they consist of Emirates-related receivables as well as cash and financial equivalents, accounts receivable, inventory, and receivables. At the end of the business year in 2021, current assets were $29.6 billion.

Current assets come after noncurrent assets on the list. These are Emirates' long-term assets, including its hangars and warehouses, which are classified as property, plant, and equipment (PP&E). At the end of the business year in 2021, noncurrent assets totaled $139.85 billion.

The combined total assets are at the very bottom and were $169.45 billion by the end of the fiscal year 2021.

Read more about Company Assets On The Balance Sheet.

What Are Some Real-Life Examples Of Current And Noncurrent Assets?

Marketable securities, accounts receivable, cash, cash equivalents, and inventories are a few examples of current assets. Long-term investments, real estate, intellectual property, other intangibles, and property, plant, and equipment are a few examples of noncurrent assets (PP&E).

What Distinguishes A Current Asset From A Noncurrent Asset?

Noncurrent Assets include fixed assets. Various assets, including fixed assets, intellectual property, and other intangibles, are all considered noncurrent assets. A fixed asset is typically a physical item that is difficult to quickly convert to cash.

It could take several months or even over a year to sell a fixed asset for cash. Property, plant, and equipment, such as a factory, are examples of fixed assets.

Why Do Noncurrent Assets Require Depreciation?

Noncurrent Assets are written off throughout the course of their useful lives to spread out their expense. Noncurrent Assets are only depreciated to spread out the cost of the asset over time rather than to represent a new value or a replacement value.

FAQs

What Distinguishes a Current Asset from a Noncurrent Asset?

- Current Asset: Equivalent to cash or will be exchanged for cash within a year.

- Noncurrent Asset: Not to be exchanged for cash within a year, including long-term investments and fixed assets.

Why Do Noncurrent Assets Require Depreciation?

Noncurrent Assets are written off throughout the course of their useful lives in order to spread out their expense. Depreciation is used to allocate the cost of the asset over time, reflecting its decreasing value.

How Are Current Assets Evaluated?

Current assets are frequently valued at their market pricing, which reflects their liquidity and ability to be quickly converted into cash.

Can Noncurrent Assets Be Revalued?

Yes, noncurrent assets, particularly PP&E, may require revaluation if their market value drops below their book value.

How Do Current and Noncurrent Assets Affect Financial Statements?

Current assets are crucial for managing short-term liquidity, while noncurrent assets represent long-term investments and capital expenditures, impacting both the balance sheet and income statement through depreciation.

In accounting, it is indispensable to classify the assets of a business correctly. Following their traits, one can unquestionably assign each asset to its appropriate category, be it current or noncurrent assets. If you’d like to learn more about assets and their role in accounting, check out our next related article now—see you there!

Start with Wafeq

Use Wafeq to keep all your expenses and revenues on track to run a better business.

.png?alt=media)