A Detailed Guide to Setting Up and Customizing Chart of Accounts in Wafeq

.png?alt=media)

When the newly appointed Finance Manager at a fast-growing Saudi logistics company ran her first month-end close, she encountered a frustrating maze, unclear account names, duplicated entries, and vague codes that didn’t match the company’s operations. Reporting was delayed, and her team wasted hours digging through Excel files to categorize expenses only. The problem wasn't about more data, but the absence of a clearer structure. That’s when she discovered the importance of building a Chart of Accounts that reflects how the business works.

In this article, we’ll explore how you can structure and customize your Chart of Accounts in Wafeq to ensure accurate reporting, faster workflows, and better decision-making, all while staying compliant with Saudi standards.

What is a Chart of Accounts?

The chart of accounts is a categorized list of all accounts used to record financial transactions in your accounting system. It organizes your assets, liabilities, equity, revenue, and expenses in a structured manner, making it easier to track financial information and generate reports. Each account in the chart represents a specific category where transactions are recorded.

The Importance of a Well-Structured Chart of Accounts

A well-structured Chart of Accounts (COA) is not just a technical requirement، it’s a strategic tool for business control and compliance. A properly designed chart of accounts offers several benefits:

- Accurate Financial Reporting When accounts are logically grouped and named, the company can produce financial statements that reflect true performance. This enhances the reliability of internal reports and the transparency of external ones، and facilitates the generation of balance sheets, income statements, and cash flow statements.

- Regulatory Compliance with ZATCA and Saudi GAAP ZATCA requires businesses to classify revenues, expenses, and tax-related accounts properly. A clear COA simplifies VAT return preparation, zakat calculation, and audit processes.

- Informed Decision-Making Finance and management teams rely on structured financial data to assess profitability, manage costs, and evaluate departmental performance. A clean COA helps ensure data integrity and clarity across the organization.

- Integration and Scalability In platforms like Wafeq, the COA isn’t just a static list; it’s deeply integrated with modules like invoicing, expense management, budgeting, and reporting. Proper setup reduces errors, speeds up workflows, and ensures consistency across functions. Therefore, It adapts to business growth and changing financial requirements.

- Operational Efficiency Streamlines daily accounting processes and reduces errors.

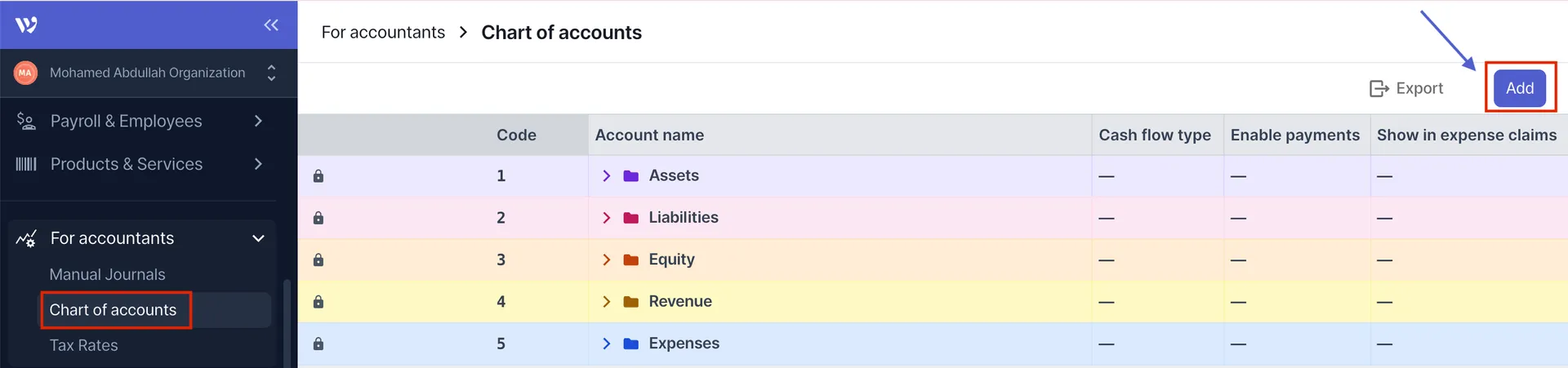

Chart of Accounts in Wafeq

Wafeq simplifies the accounting setup process by providing a default Chart of Accounts tailored for businesses operating in Saudi Arabia. This predefined structure follows best practices and complies with local accounting standards and ZATCA requirements. Key Account Categories Included:

- Assets: Cash, bank accounts, receivables, inventory, fixed assets.

- Liabilities: Payables, accrued expenses, loans, VAT payable.

- Equity: Owner's equity, retained earnings, capital contributions.

- Revenue: Product sales, service income, discounts, and returns.

- Expenses: Salaries, rent, utilities, marketing, cost of goods sold (COGS)

This structure offers a ready-to-use foundation for companies. It reduces setup time and ensures consistency across financial reports, audit trails, and regulatory submissions. The default chart can be easily expanded or customized for companies that require more granularity or operate in multiple sectors, which we’ll cover in the next section.

Customizing the Chart of Accounts in Wafeq

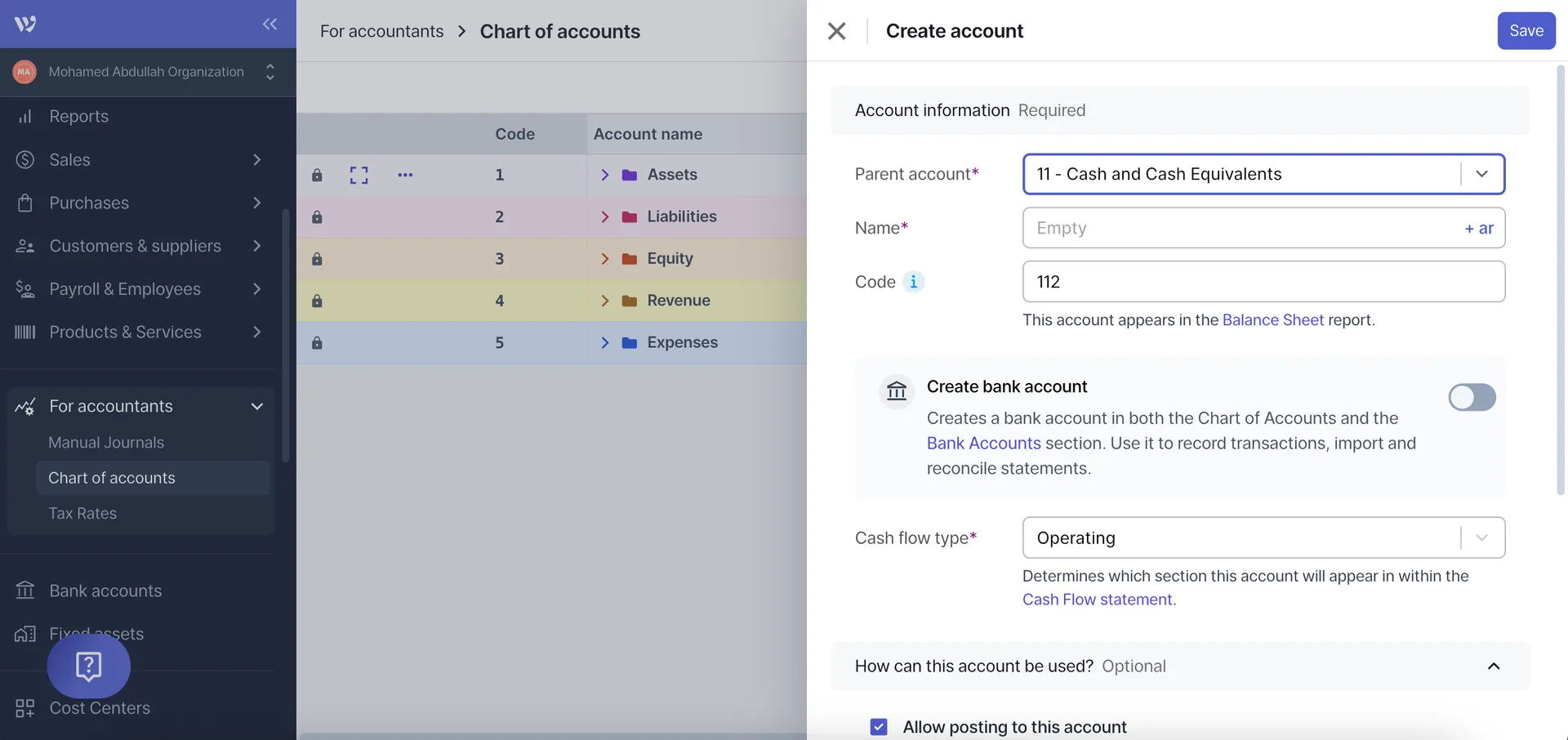

While Wafeq provides a well-structured Chart of Accounts, businesses often need to tailor it to reflect their internal reporting requirements, cost centers, or specific industry standards. Here’s how you can customize the COA in Wafeq:

- Adding New Accounts If your company requires additional accounts, for example, “Consulting Revenue” or “IT Equipment Leasing,” Wafeq allows you to create new entries under the appropriate category.

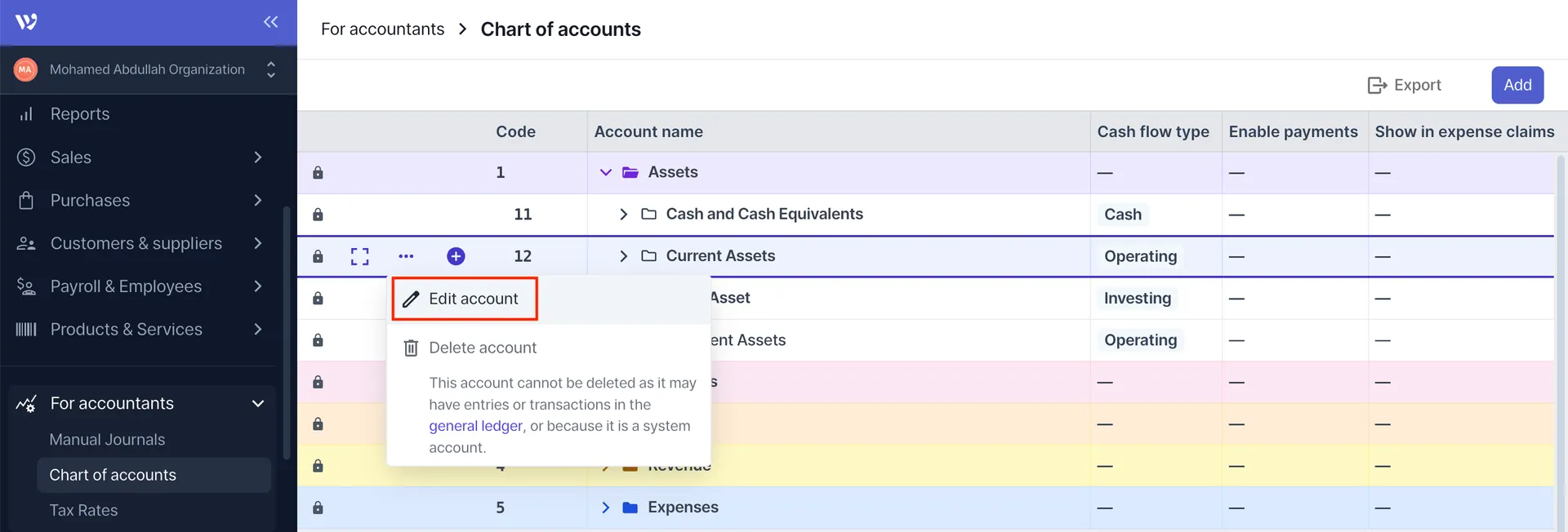

- Renaming or Reorganizing Existing Accounts Account names can be updated to match your internal terminology or reporting language. You may also reassign accounts to different parent categories if needed. You can edit the account name, description, or grouping without affecting historical transactions.

- Deactivating or Archiving Unused Accounts It's good practice to archive accounts no longer in use to maintain a clean and focused COA. Inactive accounts remain in the system for reporting purposes, but cannot be used for new entries.

- Mapping Accounts to Financial Reports Wafeq allows accounts to be linked to reporting categories used in income statements, balance sheets, and tax filings. Proper mapping ensures accuracy in VAT returns, Zakat base calculation, and Internal dashboards and budgeting.

Best Practices for Customizing Your Chart of Accounts

Customizing the Chart of Accounts is more than just adding or renaming entries; it’s about building a structure that supports scalability, reporting, and decision-making. Here are the best practices to follow when customizing your COA in Wafeq:

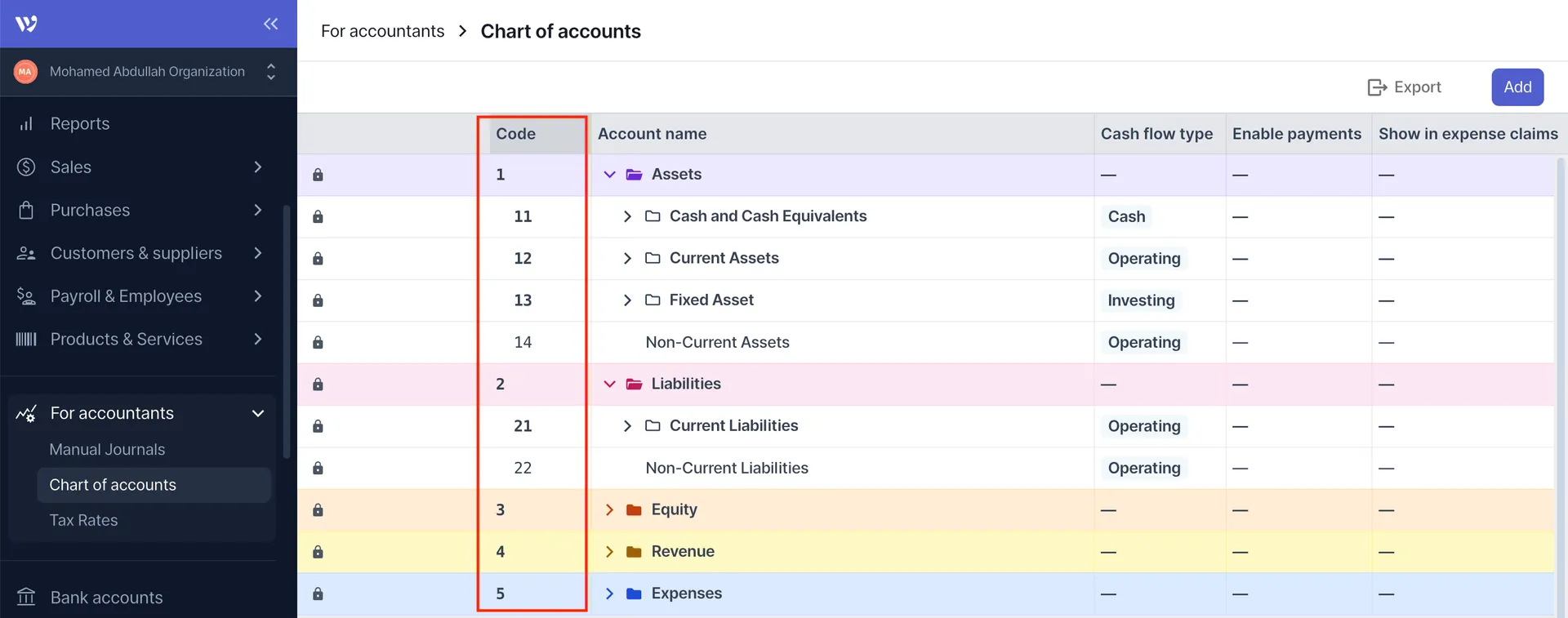

- Follow a Logical Numbering Structure Use number ranges to organize accounts by type to improve searchability, reporting, and audit readiness.

For example:

For example:

1000–1999: Assets 2000–2999: Liabilities 3000–3999: Equity 4000–4999: Revenues 5000–6999: Expenses

- Keep Naming Clear and Consistent Use standard naming conventions. Avoid abbreviations or internal jargon that may confuse new team members or external auditors. Example: Use “Office Supplies – Riyadh” instead of “OS-RYD”

- Avoid Over-Categorization While detail is helpful, too many accounts can be complicated to report. Strike a balance between granularity and simplicity. You can use cost centers or departments to capture more detail without expanding the COA unnecessarily.

- Align With Regulatory and Tax Requirements Ensure your COA structure supports accurate reporting for: - VAT filings (e.g., distinguishing taxable and exempt revenues) - Zakat calculation (e.g., separating zakat-eligible assets) - Audits and financial reviews

- Review and Clean Up Regularly Conduct periodic reviews (e.g., quarterly or annually) to archive unused accounts, merge duplicates, and update names or categories based on changes in operations.

- Document Your COA Structure Maintain a reference document or policy that explains your numbering system, naming conventions, and account purposes, which ensures consistency as your team grows.

Explore how customizing your Chart of Accounts in Wafeq can transform your business today.

Explore how customizing your Chart of Accounts in Wafeq can transform your business today.

.png?alt=media)