Understanding the Chart of Accounts: A Comprehensive Guide for Businesses

The Chart of Accounts (COA) is a systematic listing of all accounts used within a company's accounting system. It forms the backbone of the financial reporting structure, enabling the organization to classify and record transactions accurately. The COA is essential for generating consistent and clear financial statements.

Importance in Accounting

In accounting, the Chart of Accounts plays a vital role in simplifying the recording and analysis of financial transactions. It ensures that data is organized and accessible, making financial decision-making more streamlined and informed.

Overview of its Structure

The structure of the Chart of Accounts typically includes categories like assets, liabilities, equity, revenue, and expenses. These are further divided into subcategories, providing a hierarchical framework that reflects the financial position and performance of the business.

Use Wafeq - an accounting system to keep track of debits and credits, manage your inventory, payroll, and more.

Use Wafeq - an accounting system to keep track of debits and credits, manage your inventory, payroll, and more.

Understanding Different Types of Accounts

The Chart of Accounts organizes financial information into five main categories. Let's delve into each of these:

Assets

Assets represent the resources owned or controlled by the business, offering future economic benefits. These include tangible assets like machinery and intangible assets like patents.

Liabilities are obligations that the company must fulfill, usually settled with assets. Examples are accounts payable, loans, and other financial commitments.

Equity

Equity represents the ownership interest in the business. It consists of the owners' investments and retained earnings and is considered the residual interest in the assets after deducting liabilities.

Revenue

Revenue accounts record the income generated from regular business activities, such as sales or providing services. It's the primary source of funds for the company's operations.

Expenses

Expenses are the costs incurred to generate revenue. These include wages, rent, utilities, and other operating costs that are necessary to run the business efficiently.

Read more: What is Accounts Payable?

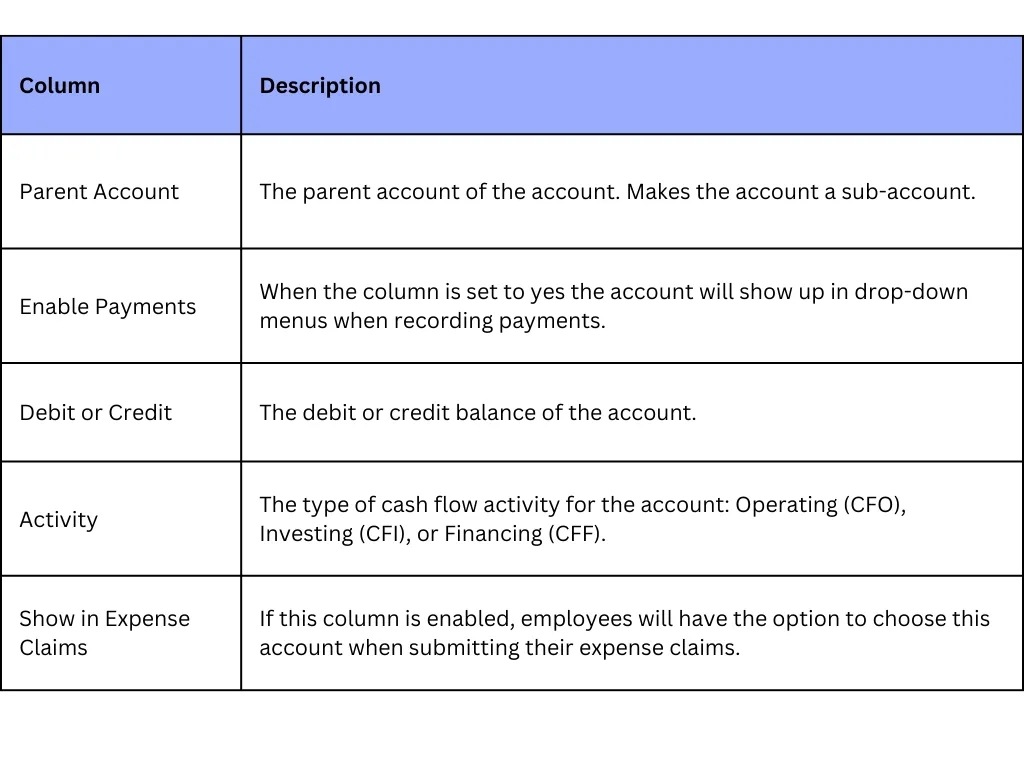

Components and Customization of the Chart of Accounts

How to Customize the Chart of Accounts for Your Business?

With Wafeq, modifying the standard chart of accounts or creating additional accounts is straightforward. Right-click on any row, then select 'Insert row.' In the account's Name column, provide the desired name, and choose the account type from the Type drop-down menu.

Deleting Accounts

To delete accounts, right-click on the account you wish to delete, then delete the row. However, deletion is not possible if:

- It's a system account reserved for Wafeq's internal system.

- The account is a bank account (deletion must be done from the Bank transaction menu).

- The account has transactions (removal of transactions is required first).

Read more: What are Accounts Receivable?

Conclusion

The Chart of Accounts plays a fundamental role in the accounting and financial management of businesses. With organized categories, numbering, titles, and customization according to industry-specific needs, it ensures compliance and alignment with both local and international standards.

Recommendations for Business Owners and Accountants

- Evaluate Current Structure: Assess your current table of accounts and identify areas for improvement.

- Utilize Wafeq’s Customization Options: Tailor your chart of accounts to your business needs with Wafeq's advanced features.

- Stay Compliant: Always follow local regulations and industry standards to maintain legality and transparency.

Invitation to Explore Wafeq’s Solutions

Explore the innovative solutions Wafeq offers to simplify your accounting processes, from automated financial reports to effortless VAT returns. Join Wafeq today and revolutionize the way you manage your business's finances.

.png?alt=media)