Grasp the Fundamentals of E-Invoicing Before Launching Your Business in Saudi Arabia

The advent of e-invoicing has reshaped the dynamics of modern business, making it an indispensable tool for companies looking to optimize their financial operations and improve overall efficiency.

In this comprehensive guide, we'll explore the essential aspects of e-invoicing, explore its business implications, scrutinize critical features, and provide actionable insights for adopting the right e-invoicing system for your organization—especially if you're doing business in Saudi Arabia.

Are we looking for an e-invoicing solution approved by ZATCA? Wafeq is your answer. Click here to explore our top-of-the-line features.

Are we looking for an e-invoicing solution approved by ZATCA? Wafeq is your answer. Click here to explore our top-of-the-line features.

Understanding the Essence of E-Invoicing

E-invoicing, or electronic invoicing, essentially refers to the digital transformation of invoice management. This technology negates the need for paper invoices and manual data entry, thereby elevating the efficiency, accuracy, and cost-effectiveness of the process.

In the context of Saudi Arabia, the government has been increasingly emphasizing the importance of transitioning to electronic systems under its Vision 2030 program. Businesses are encouraged to adopt e-invoicing as a trend and an integral part of their modernization efforts.

Related topics: How to start a Business in Saudi - Full Checklist.

Unpacking the Significance of E-Invoicing

An e-invoice serves as a digital counterpart to a traditional paper invoice, encompassing all necessary details like invoice number, date, payment terms, etc. But why is this important?

For Saudi businesses, e-invoicing is not just a luxury; it's a necessity. With VAT regulations becoming more complex, companies can navigate these complexities through e-invoicing, ensuring they're compliant with local laws and tax obligations more effortlessly.

E-Invoicing: The Operational Backbone of Businesses

E-invoicing acts as a catalyst in operational efficiency for businesses. Its benefits range from streamlined communication with suppliers and clients to enhanced cash flow management, attributes that are particularly relevant for Saudi businesses aiming for sustainable growth.

For instance, companies in Saudi Arabia's growing SME sector can drastically reduce their operational costs and improve supplier relations by adopting e-invoicing. Moreover, industries like retail and construction, which often deal with intricate invoicing requirements, can also significantly benefit from e-invoicing's capabilities.

Key Attributes of E-Invoicing Systems

E-invoicing solutions offer a myriad of features aimed at amplifying efficiency and compliance:

Automation & Efficiency: Automate routine tasks like recurring invoices, a critical feature for Saudi businesses dealing with long-term contracts or subscription models.

Security & Compliance: Saudi Arabian laws are stringent about data security. E-invoicing systems often comply with local and international standards, ensuring that sensitive data remains secure.

Selecting an Ideal E-Invoicing Solution for Your Saudi Business

When choosing an e-invoicing system, Saudi businesses should look for scalability, integration capabilities, and compliance with Saudi tax regulations, including VAT compliance and zakat calculations.

Implementation Roadmap

- The transition to e-invoicing involves several steps:

- Evaluate your existing invoicing practices.

- Choose an e-invoicing solution compliant with Saudi Arabian regulations.

- Conduct staff training sessions.

- Migrate existing data into the new system.

- Run a pilot test, possibly with a local Saudi supplier or client, to evaluate the system’s efficacy.

- Roll out the system across your business network in Saudi Arabia, providing ongoing support and periodic assessments.

Tackling Potential Challenges

Embracing new technology often comes with its share of hurdles. For Saudi businesses, this might involve initial resistance from long-standing suppliers or internal departments. The key to a smooth transition lies in effective change management and leveraging local expertise.

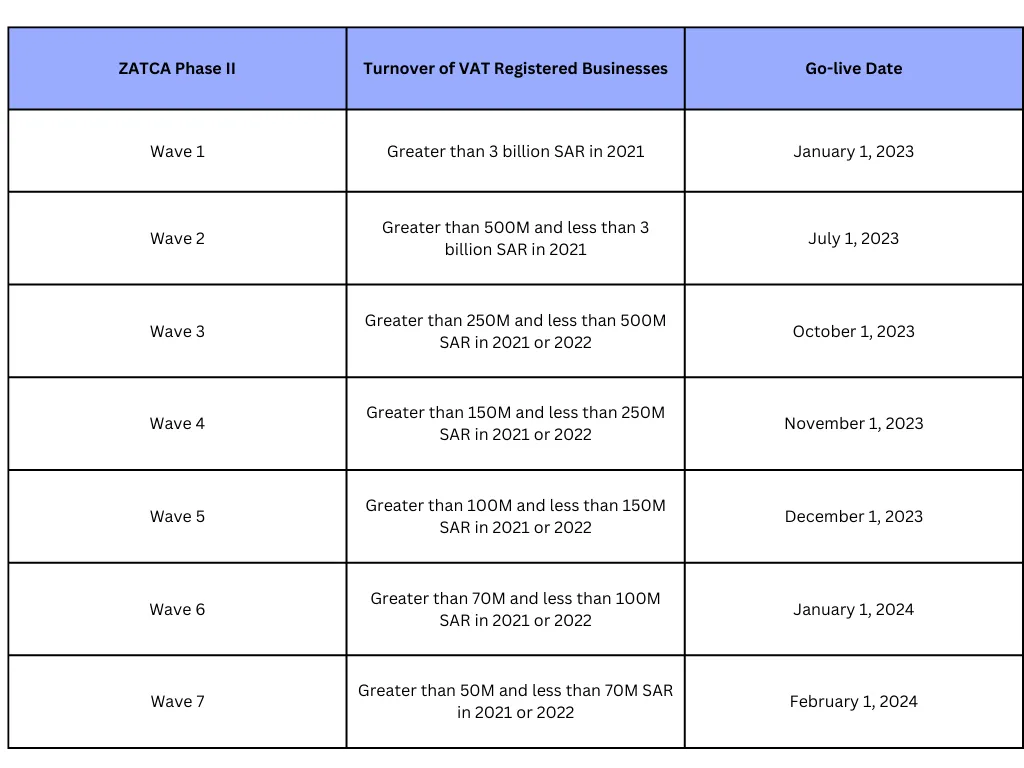

Identify which wave your organization falls into:

Steps to open a commercial shop in Saudi.

Conclusion

E-invoicing isn't just a financial tech trend; it’s the future of effective business management, especially in dynamic markets like Saudi Arabia. As the Kingdom continues to modernize its business landscape, understanding and implementing e-invoicing could mean the difference between merely surviving and thriving in today's competitive environment.

Make the shift to Wafeq—the best e-invoicing solution in Saudi Arabia. Streamline your business finances today!

Make the shift to Wafeq—the best e-invoicing solution in Saudi Arabia. Streamline your business finances today!

.png?alt=media)