The Importance of Trial Balance for Business Owners

Accurate financial records are the backbone of any successful business, and a trial balance is a vital component of financial reporting. It offers a snapshot of your company's financial position at a specific point in time. In this comprehensive guide, we'll explore the concept of trial balance, its importance for business owners.

By understanding the trial balance, you'll be better equipped to improve your business performance.

Understanding the Trial Balance

A trial balance is a financial report that lists all general ledger accounts, along with their respective debit and credit balances. It ensures that the total debits equal the total credits, indicating that the double-entry bookkeeping system has been properly maintained. The trial balance serves as a foundation for preparing financial statements like the balance sheet, income statement, and cash flow statement.

Are you ready to simplify your financial management and streamline your trial balance process?

Are you ready to simplify your financial management and streamline your trial balance process?

The Importance of Trial Balance for Business Owners

A trial balance offers numerous benefits to business owners, including:

a) Error Detection: A trial balance helps identify discrepancies in accounting records, such as missing transactions, duplicate entries, or incorrect account balances.

b) Financial Statement Preparation: The trial balance is a base for preparing financial statements, giving business owners a clear view of their company's financial position.

c) Financial Health Assessment: Regularly analyzing the trial balance helps business owners gauge their company's financial performance and identify potential areas for improvement.

d) Compliance and Audits: Maintaining an accurate trial balance ensures compliance with regulatory requirements and makes the auditing process smoother.

Read more: Consolidated financial statements.

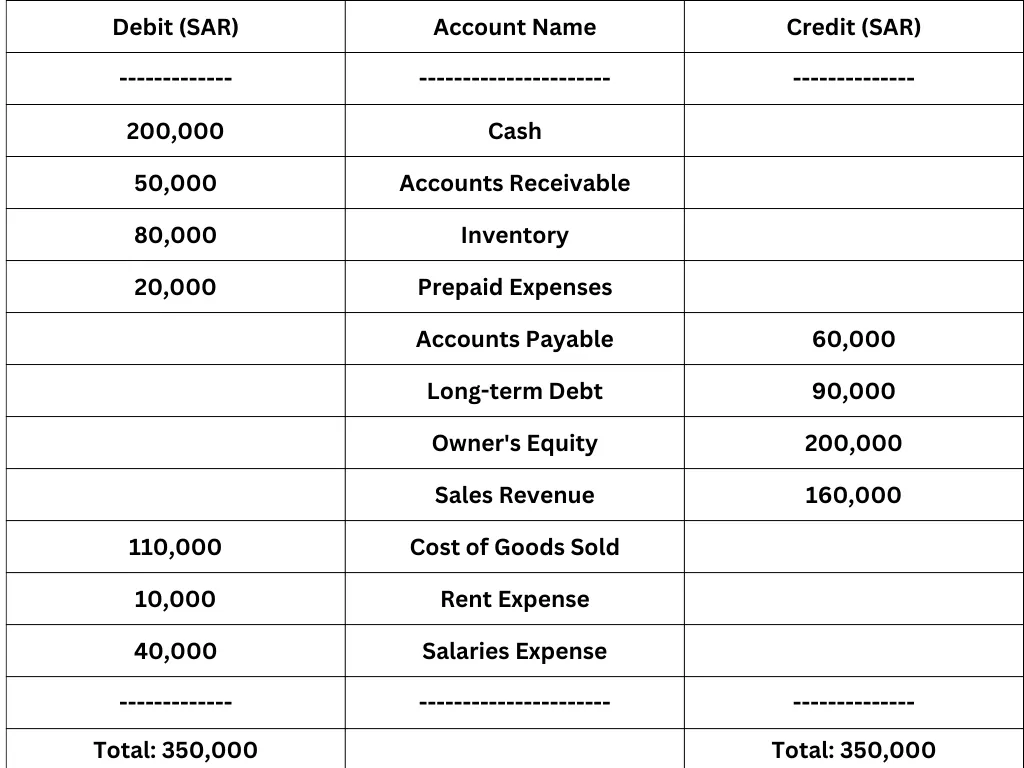

Components of a Trial Balance

A trial balance consists of the following components:

a) Account Names: All general ledger accounts, including assets, liabilities, equity, revenue, and expenses.

b) Debit Balances: The total debit amounts for each account.

c) Credit Balances: The total credit amounts for each account.

How to Prepare a Trial Balance: A Step-by-Step Guide

a) List all General Ledger Accounts: Begin by listing all the general ledger accounts in your accounting system.

b) Determine Account Balances: Calculate the ending balances for each account by totaling the debits and credits.

c) Create the Trial Balance: Arrange the accounts in a tabular format, with columns for account names, debit balances, and credit balances. Ensure that the total debits equal the total credits.

Analyzing the Trial Balance and Identifying Errors

Analyze the trial balance to identify any errors or discrepancies in your accounting records. Common errors include:

a) Transposition Errors: Errors due to misplacing digits within a number.

b) Omission Errors: Errors due to forgetting to record a transaction or accidentally deleting an entry.

c) Posting Errors: Errors due to posting an entry to the wrong account or posting an incorrect amount.

d) Recording User Errors: Errors due to recording a debit as a credit or vice versa.

Correcting Errors and Adjusting the Trial Balance

After identifying any errors, make the necessary adjustments to your accounting records and update the trial balance accordingly. This may involve correcting errors, adding omitted transactions, or adjusting account balances.

Periodic Review and Maintenance of Trial Balance

To maintain an accurate trial balance, it's essential to review and update it periodically. This process includes:

a) Reconciling bank statements: Compare your bank statements with your accounting records to ensure consistency and accuracy.

b) Verifying account balances: Regularly review account balances for accuracy and make adjustments as needed.

c) Closing temporary accounts: At the end of each accounting period, close temporary accounts, such as revenue and expense accounts, and transfer their balances to permanent accounts, like retained earnings.

Read more:- How is Wafeq's accounting software changing the game for BNPL in MENA with Tabby?

Importance of Accounting Software in Maintaining Trial Balance

Accounting software can significantly streamline the process of maintaining an accurate trial balance by:

a) Automating data entry: Accounting software can automatically record transactions, reducing the likelihood of manual errors.

b) Facilitating error detection: Advanced accounting software can identify discrepancies and alert business owners, making it easier to maintain an accurate trial balance.

c) Generating real-time reports: Accounting software allows business owners to access their trial balance and other financial reports in real-time, enabling them to make informed decisions.

Read More: 5 Reasons Why You Need An Invoice Maker Online For Your Business.

Choosing the Right Accounting Software for Your Business

When selecting accounting software, consider the following factors:

a) Scalability: Choose software that can grow with your business, accommodating an increasing number of users and transactions.

b) Customizability: Opt for software that can be tailored to your specific industry and business requirements.

c) Integration: Ensure the software integrates with other essential business tools, like invoicing, payroll, and inventory management systems.

d) Ease of use: Select user-friendly software that can be easily understood and operated by your team.

Read More: The Benefits of Electronic Invoicing for Business Owners and Accountants. Simplifying Sales Invoices: A Guide for Business Owners and Accountants.

Conclusion

A trial balance is an indispensable financial tool for business owners, helping them identify errors, prepare financial statements, and assess their company's financial health. By understanding the concept of trial balance and regularly analyzing it, you can make better-informed decisions and improve your business performance. Embracing the right accounting software can further streamline the process, ensuring accuracy and efficiency.

Discover Wafeq - the ultimate financial solution designed to meet the unique needs of your business.

Discover Wafeq - the ultimate financial solution designed to meet the unique needs of your business.

.png?alt=media)