Navigating Aged Receivables: A Comprehensive Guide for Businesses

What is Aged Receivables?

Aged Receivables are much more than a buzzword in the finance realm; they are a crucial factor for business stability.

Essentially, they represent the uncollected invoices that are owed to a company by its clients. The age categories of these invoices—commonly segmented into periods like 0-30 days, 31-60 days, and 61-90 days—provide an invaluable tool for evaluating asset liquidity and potential financial risk.

Essentially, they represent the uncollected invoices that are owed to a company by its clients. The age categories of these invoices—commonly segmented into periods like 0-30 days, 31-60 days, and 61-90 days—provide an invaluable tool for evaluating asset liquidity and potential financial risk.

Skillful management of aged receivables is pivotal for achieving a robust cash flow and ensuring the long-term viability of an enterprise.

How to Display the Aged Receivables Report on Wafeq

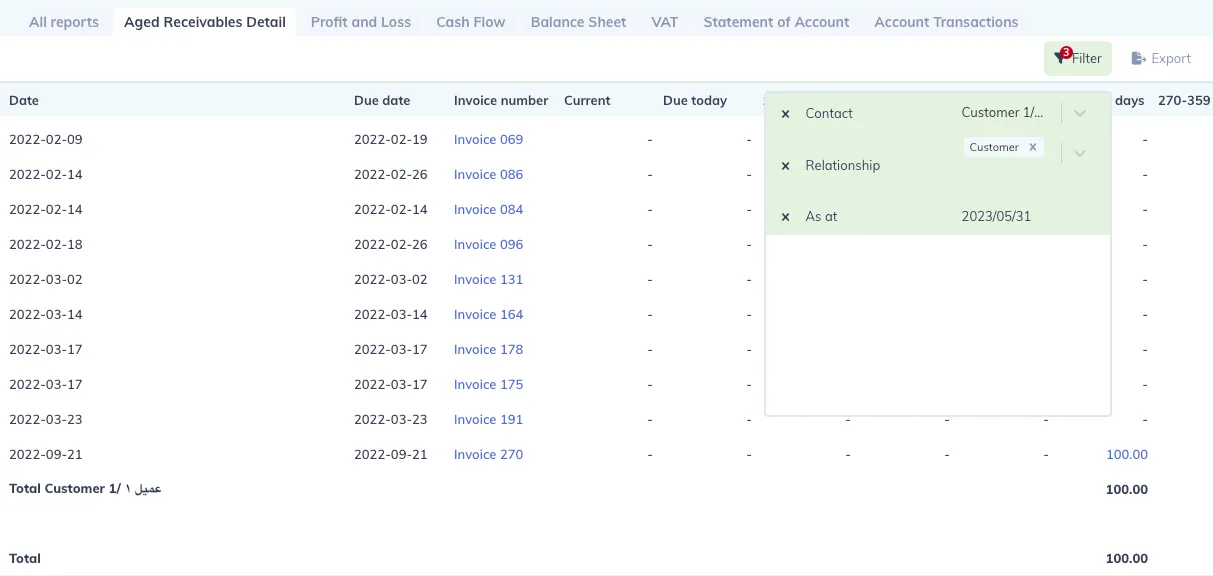

Wafeq offers two models for the Aged Receivables report: a standard report and a detailed report, which breaks down all transactions by customer. Here's how you can display them:

- Navigate to the "Reports" section from the main menu on the left.

- Under "All Reports" in the "Sales" category, you will find "Aged Receivables."

- Click on it to display the Aged Receivables report, which you can filter by contact, relationship and date.

- Additionally, you can export the report into various file formats such as PDF or Excel.

To view the detailed report that displays all account transactions, select "Aged Receivables - Detail" from the bottom of the Sales reports menu.

The Importance of Managing Aged Receivables

Strategic Necessity

Effective management of aged receivables isn't just a procedural need—it's a strategic necessity for businesses aiming for long-term success.

Capital and Operations

Unpaid invoices don't merely tie up capital; they also create operational barriers that can hinder growth.

Pinpointing Delays

An age-specific breakdown of receivables allows you to pinpoint the sources of payment delays, enabling you to strategize proactively.

Cash Flow Health

By managing aged receivables effectively, you help maintain a robust cash flow, which is the lifeblood of any business.

Beyond Finances

The benefits extend beyond the balance sheet. Proper management impacts supplier relationships, customer trust, and even your credit rating.

Risk of Poor Management

Poor management can lead to a cash flow crunch, a precarious situation that could plunge your business into a financial abyss from which recovery is challenging.

The Life Cycle of a Receivable

- Invoice Issuance

The life cycle of a receivable begins when the invoice is issued. This document serves as the formal request for payment and includes crucial details like itemized charges, tax calculations, and payment terms. Prompt and accurate issuance is crucial for a smooth accounts receivable process.

- Grace Period

Many businesses offer a grace period, a brief time window after the invoice issuance during which late fees are not applied. This is a goodwill gesture to accommodate any minor delays on the client's part.

- Due Date

The due date marks the deadline by which the payment should be made to avoid additional charges. Failing to adhere to the due date can trigger late fees and may lead to more severe financial consequences for the payer.

- Past Due

Once an invoice crosses the due date without payment, it moves into the 'past due' stage. The longer an invoice remains unpaid, the more challenging it becomes to collect the debt. This phase often involves sending reminders and possibly even negotiating new payment terms.

- Collections

If an invoice remains unpaid long enough, the business may take legal steps to collect the debt, including hiring a collections agency or pursuing the matter in court. Collections are the last resort and come with their set of challenges, such as added legal fees and potential damage to customer relationships.

Read also: What is Accounts Payable?

Conclusion

The management of Aged Receivables is not merely a financial necessity; it's an operational imperative for any business aiming for sustainability and growth. Understanding the life cycle of a receivable, from invoice issuance to collections, allows for a more organized, efficient, and compliant financial operation. With platforms like Wafeq offering robust tools for tracking and managing these receivables, businesses are better equipped than ever to maintain healthy cash flows and long-lasting relationships with clients. By taking a proactive approach to aged receivables, companies can not only mitigate financial risks but also unlock new opportunities for growth.

Use Wafeq - an accounting system to keep track of debits and credits, manage your inventory, payroll, and more.

Use Wafeq - an accounting system to keep track of debits and credits, manage your inventory, payroll, and more.

.png?alt=media)