Choosing The Right Accounting Software For Your Small Business

With accounting software you can keep track of your spending and owing all in one location. Size, functionality, and interconnections are all variables in accounting software programs that you need to consider when selecting—read on to see how to choose the right accounting software for your small business.

The Importance Of Choosing The Right Accounting Software

When choosing accounting software, you should consider all options, including compliance, reporting, tracking, and available add-ons.

As a small company owner, keeping a tight watch on your cash flow should be one of your top concerns. This is why having the appropriate accounting software is essential.

You require software to assist you in doing your regular accounting duties, such as recording payments, monitoring costs, billing clients, and reconciling transactions.

In addition, your accounting software should enable you to create reports that evaluate the performance of your company from many perspectives as well as assist you in managing your company's financial health.

Use Wafeq - an accounting system to keep track of debits and credits, manage your inventory, payroll, and more.

Use Wafeq - an accounting system to keep track of debits and credits, manage your inventory, payroll, and more.

What To Consider While Selecting Accounting Software

It might be difficult to select the finest accounting software for your company. Every software has a unique collection of features, and the majority of them have a variety of price options with varying levels of capability, users, and other factors.

When choosing accounting software for your company, keep these three main considerations in mind to streamline your search.

- Cost: Would you prefer a less-priced, more basic accounting program or a more expensive one with more features?

- Usability: How many people must utilize the program? Which do you prefer: desktop software or a cloud-based solution you can access from anywhere?

- Do you require a mobile app for your accounting software? What features must the app include, in your opinion?

- Features: What is it that the accounting software is supposed to do? Do you require tools for both accounts payable and receivable? Which accounting reports must you produce?

Do you require it for inventory tracking? Do you require it to offer other services like project management, payroll, and time tracking?

Accounting Software Advantages

It's not always practical to hire a bookkeeper or accounting expert or to use an independent accounting firm. However, with the appropriate accounting software, you may do the bookkeeping yourself if your company is small.

Here are some benefits of utilizing accounting software over employing a professional accountant.

Time reduction: You won't need to wait for someone else to finish the necessary accounting procedures. With accounting software, you may complete the task yourself and have access to all the necessary tools.

- Electronic records: To comply with governmental and industry norms and regulations, accounting software will dynamically produce and keep a thorough record of your organization's financial dealings when new transactions occur.

- Greater accuracy: Software for accounting minimizes the possibility of human mistakes. This is so that thorough insights may be created without the possibility of typos or copy-and-paste mistakes by using software that connects directly to your bank accounts and pulls transactions and other data.

- All in one place: Many accounting software providers also provide extra services that may be handled, recorded, and kept an eye on from the same platform, such as payroll and tax compliance.

- Payroll optimization: With the correct accounting software, you can automate your payroll processes so that taxes and benefits are calculated and that every employee is paid accurately and promptly.

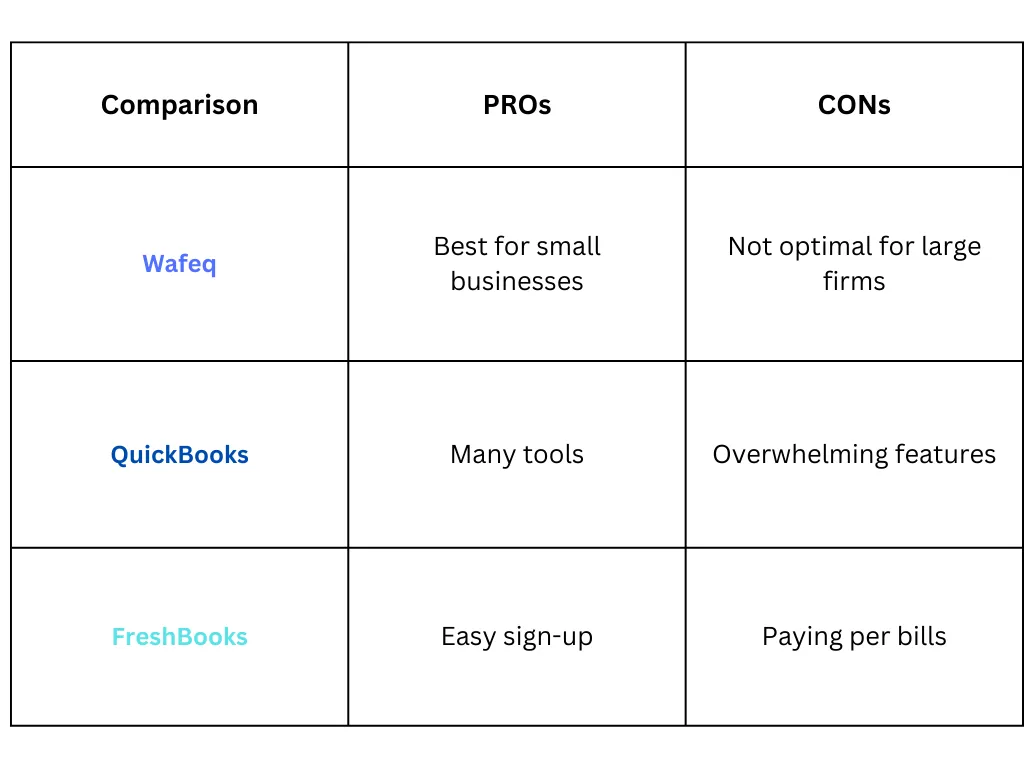

3 Top Accounting Software

Wafeq

Wafeq is all-in-one accounting software that makes accounting simple for companies of all sizes and kinds.

Every user can easily manage their finances with Wafeq’s wide array of built-in tools that are both intuitive and user-friendly.

With various pricing packages and trials, even small businesses can find their match at affordable rates.

All in all, Wafeq is the go-to solution for small business owners who’d like to do their own accounting simply, as fast as possible, and with minimal funding.

QuickBooks

QuickBooks is an accounting solution for expanding businesses, and it is well known for its long-standing products and accounting assistance.

Payroll, estimate preparation, receipt organization, and even cutting-edge automation technologies are tools that QuickBooks includes that can manage the demands of most businesses.

QuickBooks may be a great solution for those with accounting knowledge; however, beginners might struggle with the software.

Steps on How to move from Quickbooks to Wafeq.

FreshBooks is an alternative to accounting software and is packed with tools for managing your money.

FreshBooks is a viable option for contract employees since its pricing depends on the number of customers you have rather than the number of users that need access.

FreshBooks is a better fit for medium to large firms, but not so much for small businesses, as their interface could be deemed too complex.

Read more: Embracing the Future: How Cloud-Based Accounting Software Solutions Are Revolutionizing the Industry

The Conclusion

Choosing the right accounting software for your small business can be challenging. One must consider cost, features, efficiency, ease of use, and many more aspects before making a decision.

Overall, it is safe to say that Wafeq is the best option for small businesses, as it is affordable, easy to use, and has all the features you might need for doing your own accounting simply.

Give Wafeq a try—reach out now, and start your trial today!

Give Wafeq a try—reach out now, and start your trial today!

.png?alt=media)