Audits Explained: Internal vs External

Imagine discovering a financial error just days before your company’s annual audit. You scramble to find the root cause, only to realize he could have prevented it with a proper internal check months ago. Many business owners face a moment of stress when a simple oversight turns into a major compliance risk. That’s where understanding the difference between internal and external audits becomes not just helpful but essential.

Whether you're a CFO, accountant, or business leader, knowing when and how to leverage each type of audit could mean the difference between control and chaos. In this article, we’ll break down the difference between internal and external audits in a clear, practical way so that you can lead with confidence, not confusion.

What is an Internal Audit?

An internal audit is a process conducted by a company’s employees or an internal audit department to evaluate the effectiveness of internal controls, risk management, and governance processes. Internal auditors work independently in an organization but report to senior management or the audit committee. Their primary goal is to enhance operations, prevent fraud, and ensure the company adheres to policies and procedures. Unlike external audits, internal audits are not legally required for all companies; however, they are considered a best practice, especially in larger organizations or those in regulated industries. Internal audits may be routine, ongoing, or initiated in response to specific risks or concerns.

Key characteristics of an Internal Audit

- Conducted by company staff or internal audit teams.

- Focused on internal improvement and operational efficiency.

- Management and the board use reports internally.

- Often continuous or periodic throughout the year.

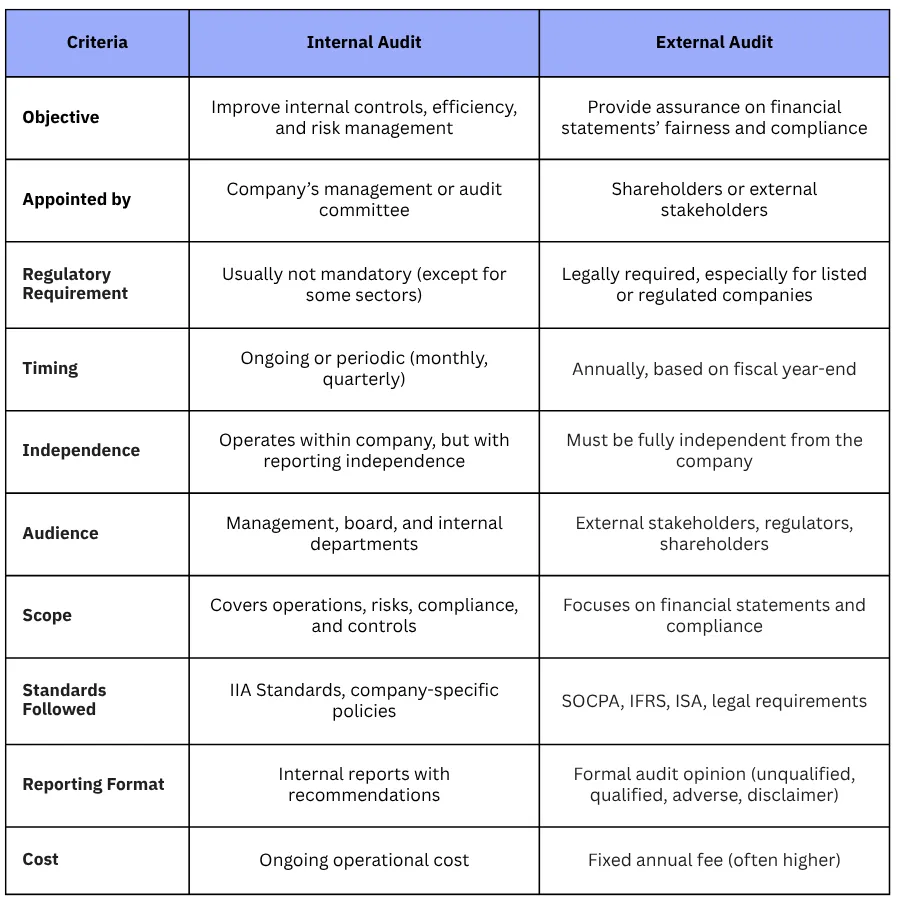

Getting the Basics Right: Internal vs. External Audit

Internal Audit: Scope, Responsibilities, and Reporting

Internal audits focus on improving the company from within. Their scope is broad and flexible, often covering financial processes, operational efficiency, IT controls, regulatory compliance, and risk assessment. Internal auditors act as advisors, identifying problems before they escalate.

Internal Audit Key Responsibilities

Internal audit reports are confidential and used internally to drive corrective actions, support decision-making, and promote transparency across departments. Internal auditors often conduct ongoing reviews throughout the year as they operate independently of the operational teams, but are still considered part of the company. The most important of these responsibilities are:

- Evaluating internal control systems.

- Monitoring compliance with company policies.

- Assessing operational effectiveness.

- Recommending process improvements.

- Preventing and detecting fraud.

- Preparing reports for management and audit committees.

External Audit: Scope, Responsibilities, and Reporting

The external audit is narrower in scope but deeper in legal accountability. Its main focus is to validate the fairness and reliability of the company’s financial statements. The process is highly structured and follows strict professional and legal standards. Their audit cycle is typically annual, and the audit opinion carries significant weight for external stakeholders and financial markets.

External Audit Key Responsibilities

Unlike internal auditors, external auditors are legally and professionally independent. Their findings are documented in a formal audit report that contains their opinion on whether the financial statements present a true and fair view. The most important of his responsibilities are:

- Verifying the accuracy of financial statements.

- Ensuring compliance with accounting standards (e.g., IFRS, GAAP)

- Evaluating risks of material misstatement or fraud.

- Assessing internal controls relevant to financial reporting.

- Issuing an independent audit opinion.

- Reporting to shareholders, regulators, and lenders.

Who Audits the Auditors? Rules that Matter

Internal and external audits are governed by different frameworks. Internal audits are shaped by the company's policy and best practices set by professional bodies such as the Institute of Internal Auditors (IIA). While not typically mandated by law, many regulated industries (e.g., banking, insurance) require internal audits as part of risk management obligations.

External audits, however, are governed by national laws, international accounting standards, and regulatory bodies. Non-compliance in external audits can lead to penalties, delisting, or legal consequences, while internal audit non-compliance typically results in operational inefficiencies, and not legal sanctions. In Saudi Arabia, for example:

- Companies listed on Tadawul have to undergo annual audits.

- Audits must comply with standards set by the Saudi Organization for Chartered and Professional Accountants(SOCPA)

- Reports may be subject to review by the CMA (Capital Market Authority) or other regulatory authorities.

Lines You Can’t Cross: Independence in Auditing

Independence is a cornerstone of auditing, especially for external audits. External auditors must be completely independent of the company they audit. This means:

- No financial interest in the client.

- No family or business ties.

- No involvement in the company’s internal decisions.

This separation ensures that the audit opinion is unbiased and credible to third parties.

Internal Auditors, while part of the organization, must also maintain a degree of independence. They should:

- Report directly to the audit committee or board, not operational departments.

- Avoid auditing their work or areas where they have decision-making authority.

Important Notice:

Important Notice:

The objectivity of both audit types is crucial. Loss of independence, perceived or real, can lead to reputational damage, regulatory action, or audit failure.

When Audits Happen and How Often They Matter

Internal Audit is Flexible and Continuous

Internal audits are typically ongoing and could happen monthly, quarterly, or as needed. Since they are driven by internal priorities, risk assessments, and strategic planning, companies are flexible to audit areas of concern at any time. The continuous nature of internal audits grants real-time feedback and course correction, which supports internal controls before issues escalate.

Internal Audits' timing is influenced by:

- Risk levels in certain departments.

- Changes in management or systems.

- Regulatory deadlines.

- Audit committee requests.

External Audit is Annual and Mandatory

External audits follow a fixed, annual schedule, often aligned with the company’s financial year-end. The timing is critical because the audit must be completed before:

- Filing tax returns.

- Publishing annual reports.

- Holding shareholder meetings.

There is no flexibility in external audit timing; missing deadlines can result in fines, delayed IPOs, or loss of investor confidence. In Saudi Arabia, listed companies must submit audited financials by specific regulatory deadlines—often within 90 days of year-end.

There is no flexibility in external audit timing; missing deadlines can result in fines, delayed IPOs, or loss of investor confidence. In Saudi Arabia, listed companies must submit audited financials by specific regulatory deadlines—often within 90 days of year-end.

Internal vs. External Audit Reports

Internal audit reports are confidential and strategic, meant for internal stakeholders only. These typically include senior management, audit committees, board of directors, and process owners and department heads. Internal audit reports are not shared with external regulators, investors, or the public. The purpose is continuous improvement, risk mitigation, and alignment with company policies. These reports often include identified weaknesses in controls, Recommendations for improvements, Action plans with timelines, and Follow-up audits

External audit reports are formal, standardized, and shared externally. The primary audience includes Shareholders, Regulators (e.g., SOCPA, CMA), Investors and analysts, Financial institutions and lenders, and the Public (for listed companies). These reports include an audit opinion that directly affects Investor confidence, Lending decisions, Stock performance, and Regulatory compliance. Because of the public and legal significance, accuracy, neutrality, and independence are critical. A “qualified” or “adverse” audit opinion can significantly damage the company’s credibility.

What’s the Real Cost of an Audit?

Internal Audit: Continuous Investment in Risk Control

Internal audits are part of the company’s ongoing operational budget. The cost is typically absorbed through:

- Hiring and training in-house audit staff.

- Implementing internal control systems and audit software.

- Conducting periodic risk assessments.

While not immediately visible in profit-and-loss statements, internal audits are a long-term investment in governance, efficiency, and fraud prevention. The costs are manageable and scalable based on company size and industry. In growing organizations, internal audit teams may expand, requiring Specialist auditors (e.g., IT, compliance), Cross-department collaboration, and Continuous audit planning and monitoring.

External Audit: Fixed but High-Stakes Cost

External audits are typically fixed, recurring annual costs negotiated with independent audit firms. Factors affecting the fee include:

- Company size and revenue.

- Complexity of operations and subsidiaries.

- Scope of the audit (e.g., IFRS compliance, multi-entity consolidation).

Unlike internal audits, external audit fees are non-negotiable post-engagement and usually require advance budgeting. Companies, in some cases, pay additional fees for Interim audits, Special reviews, forensic audits, or Urgent or expedited reporting. While costly, external audits provide legal credibility and investor assurance that internal audits cannot guarantee alone.

How Wafeq Supports Your Internal and External Audits

Wafeq is built with audit-readiness in mind, giving internal and external auditors access to structured, reliable, and real-time financial data. Here's how Wafeq empowers your audit processes:

- Automated Journal Entries Say goodbye to manual posting. Wafeq automatically generates accurate journal entries from sales, purchases, payroll, and more.

- Audit Trail and Traceability Every transaction in Wafeq is time-stamped, user-attributed, and fully traceable, ensuring transparency and accountability.

- Centralized Supporting Documents Invoices, receipts, contracts, and payment proofs are stored and linked directly to accounting entries, streamlining documentation requests from auditors.

- Real-Time Financial Reports Whether it’s a trial balance, general ledger, or VAT return, Wafeq delivers up-to-date reports on demand, no more waiting for month-end closing.

- Multi-Level Approval Workflows Could enforce internal controls by configuring approval hierarchies for expenses, payments, and purchases. It's ideal for internal audit oversight.

- Secure Collaboration Grant external auditors restricted access to specific modules or periods, allowing efficient review without compromising data integrity.

Also Read: A guide on how to prepare for an external audit using Wafeq's reports.

Internal and external audits serve different, yet complementary purposes. While internal audits offer companies a continuous way to improve performance, identify risks, and strengthen controls, external audits provide an objective opinion that builds trust with regulators, shareholders, and the public. Understanding their distinct roles helps companies not only stay compliant but also stay ahead.

Frequently Asked Questions about Internal and External Audits

What is the main difference between an internal and an external audit?

Internal audits focus on improving internal processes and risk management. External audits estimate whether financial statements are fairly presented and compliant with standards.

Is an internal audit mandatory in Saudi Arabia?

No, internal audit is not mandatory for all companies, but it is highly recommended, especially for large, listed, or regulated entities. Some sectors (like banking or insurance) may require it.

Who appoints the external auditor?

External auditors are appointed by shareholders in general assemblies or as required by regulators such as the Capital Market Authority (CMA) in Saudi Arabia.

Can internal audit reports be shared with external parties?

Generally, no. Internal audit reports are meant for management and are considered confidential.

What are the qualifications of external auditors in Saudi Arabia?

External auditors must be licensed by the Saudi Organization for Chartered and Professional Accountants (SOCPA) and adhere to local and international auditing standards.

Get started with Wafeq today, and make your next audit faster, smoother, and more accurate to stay audit-ready year-round.

Get started with Wafeq today, and make your next audit faster, smoother, and more accurate to stay audit-ready year-round.

.png?alt=media)