Accounting Ledger: A Comprehensive Guide to Financial Transactions Management

Introduction to the Accounting Ledger

The accounting ledger is a cornerstone in the world of financial management. It represents a principal book of accounts where all financial transactions are recorded.

Definition of the Accounting Ledger and Its Importance in Recording Financial Transactions: The accounting ledger, whether in physical or digital form, is a detailed record of all monetary transactions relating to an individual account or a business.

Definition of the Accounting Ledger and Its Importance in Recording Financial Transactions: The accounting ledger, whether in physical or digital form, is a detailed record of all monetary transactions relating to an individual account or a business.

It's more than a mere list of sales and purchases; it's a critical component that reflects the financial standing and operations of a company. With a well-maintained accounting ledger, accountants can identify trends, manage resources, and make informed financial decisions.

Role of the Accounting Ledger in Organizing Business Operations

The accounting ledger is not only a static record; it's a dynamic tool that plays a vital role in the organization and management of business operations. It helps ensure that transactions are recorded accurately and consistently, contributing to transparency and accountability within the organization. The systematized layout of the ledger facilitates quick access to information and enables companies to stay compliant with regulatory requirements. Overall, the accounting ledger serves as a foundational element in effective financial management.

Ready to simplify your accounting process? Explore Wafeq's solutions now.

Ready to simplify your accounting process? Explore Wafeq's solutions now.

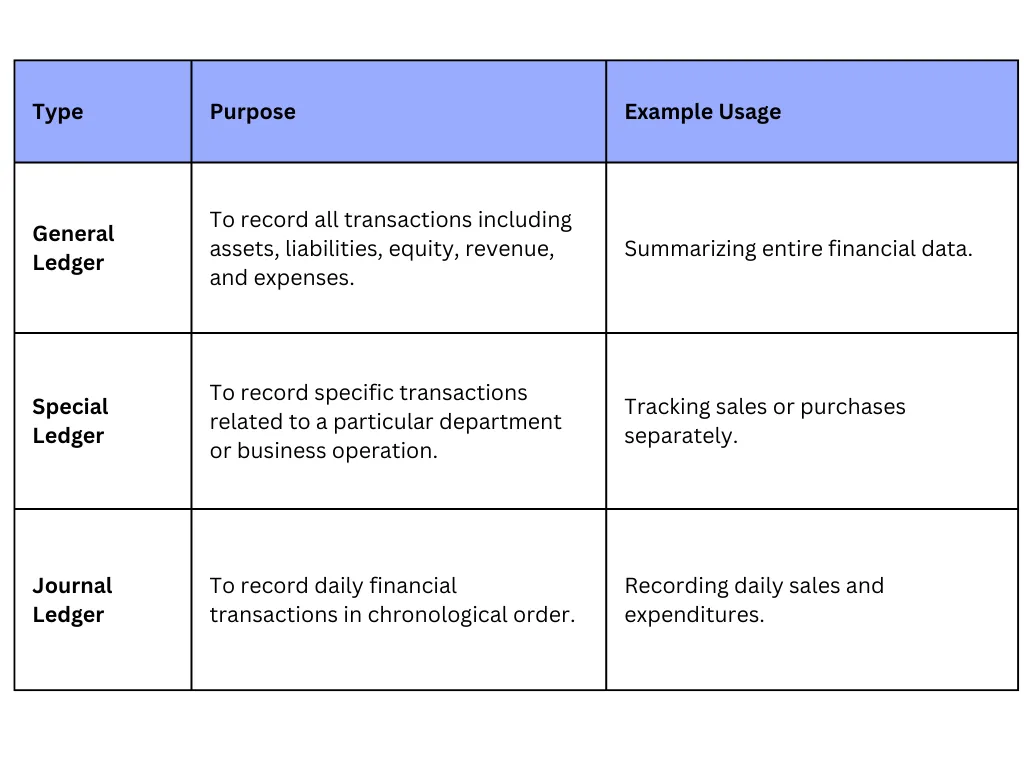

Types of Accounting Ledgers in Commercial Enterprises:

The world of accounting utilizes various types of ledgers to organize and record financial transactions. These ledgers are crucial for categorizing different aspects of a business's financial activities.

- General Accounting Ledger: This ledger is a comprehensive account of all financial transactions within a company. It includes a complete record of all the accounts needed to create financial statements and is essential for summarizing all business transactions.

- Special Accounting Ledger: The special ledger is used for specific functions or certain categories of transactions within a company. It might include accounts for particular projects or special funds and allows for detailed tracking and control over specific financial elements.

- Accounting Journal Ledger and Other Subsidiary Ledgers: The accounting journal ledger serves as the initial recording point for all financial transactions. It precedes the general ledger in the accounting process. Subsidiary ledgers, on the other hand, contain detailed information for specific types of accounts such as customers or suppliers. They offer in-depth analysis and are often linked to the general ledger for a holistic overview.

Financial Management: A Comprehensive Guide for Accountants and Business Owners.

Mechanism of Accounting Ledger Operation

Accounting ledgers are pivotal in the financial process of an organization, and understanding their mechanism is essential for effective financial management. Here's how they work:

Ordering and Organizing Transactions in the Accounting Ledger: Transactions must be recorded in chronological order, and they are often categorized by account type. This ensures that information is accessible and that all data related to an account is kept in one place. The organization of transactions helps in easy reference, tracking, and summarizing, making it vital in the accounting process.

Techniques for Recording Transactions: Various techniques are used for recording transactions, depending on the nature and complexity of the business operation. The double-entry system is a common approach, where each transaction affects at least two accounts. Modern accounting software, such as Wafeq, facilitates automated recording and streamlines the entire process, ensuring accuracy and efficiency in managing the accounting ledger.

How Wafeq Assists in Managing the Accounting Ledger

In an age where automation is vital for efficiency, Wafeq stands out by offering solutions that align with modern accounting needs. Here's how Wafeq contributes:

Integration of the Accounting Ledger with Wafeq's System: Wafeq seamlessly integrates the accounting ledger with its system, allowing for real-time tracking and updates. This integration streamlines the process, enabling a unified view of financial data and reducing manual errors.

Benefits of Using Wafeq in Organizing the Accounting Ledger: Wafeq offers many advantages in managing the accounting ledger, such as automated transaction recording, a customizable interface, effortless VAT returns, and consolidated financial statements. These features enable better control, efficiency, and accuracy, aligning with the needs of both accountants and business owners. Wafeq's solution for multi-branch and multi-organization management expands the possibilities for larger businesses, making it a powerful tool in the realm of accounting.

Read more: Lean x Wafeq: A Fintech Success Story (5 entities in 5 months).

Conclusion

The accounting ledger is the nerve center of financial operations in any commercial enterprise. It serves as a pivotal tool for recording, organizing, and analyzing financial transactions, providing a comprehensive view of the company's financial standing. By offering an accurate means of monitoring income, expenses, inventories, and other financial elements, the accounting ledger aids in making more effective strategic decisions. Precise, clear, and organized details can be a bridge towards excellence in financial management, ensuring sustainability in success and growth in today's competitive market.

Discover how Wafeq can revolutionize your accounting practices! With our cutting-edge solutions tailored to meet the diverse needs of businesses.

Discover how Wafeq can revolutionize your accounting practices! With our cutting-edge solutions tailored to meet the diverse needs of businesses.

.png?alt=media)