Commercial Papers: Details and Benefits of Smart Financial Investment

In the world of finance and business, commercial papers stand as one of the most important financial instruments used for attracting investments and financing operations. They are short-term promissory notes issued by corporations to raise funds for their daily operations.

Commercial papers are known for their flexibility and ease of trading, making them a popular choice for investors seeking good returns with limited risk. However, understanding how these papers work and the reasons that make them attractive is the first step toward smart investing.

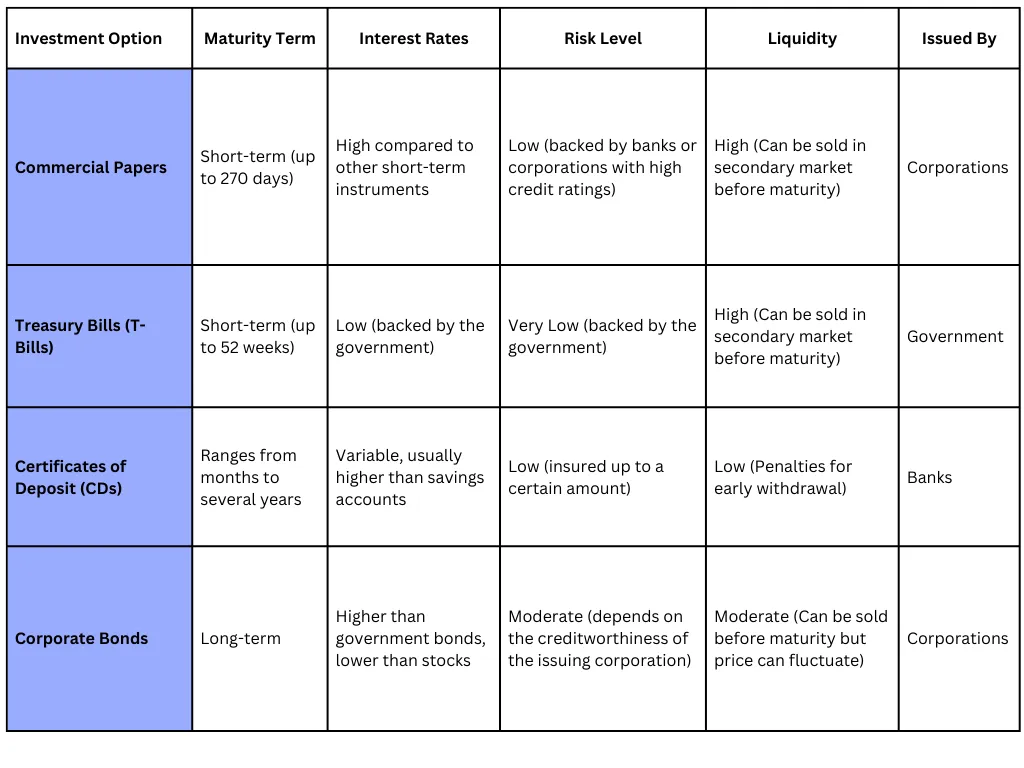

Distinguishing Commercial Papers from Other Securities

Commercial papers differ from other securities in several ways. Firstly, commercial papers are short-term debt instruments, where the typical maturity ranges from 30 days to 270 days, while other securities, such as bonds, are usually long-term.

Secondly, commercial papers are typically issued at a discount on the face value and repaid at maturity at face value, while bonds pay interest to investors. Thirdly, commercial papers do not require registration with a stock exchange, which helps speed up the process and reduce costs.

Read more: Use Of Capital In Accounting And Corporate Finance.

How Commercial Papers Work:

Commercial papers are one of the widely used short-term debt instruments in the financial market. They are issued by large corporations to finance their short-term financial needs such as working capital or cover operating expenses. Commercial papers are a promise to pay in the future and are considered unsecured loan. They can be purchased via banks or financial brokerage institutions.

Commercial papers are issued at a discount to their face value and thus the interest paid by the investor depends on the difference between the price paid at the time of purchase and the face value of the commercial paper at maturity. Commercial papers do not pay cash interest in the meantime, but pay the return on investment at maturity by repaying the face value to the investor.

Features and Benefits of Using Commercial Papers

Commercial papers have several features and benefits that make them a popular choice among corporations. They offer a cost-effective way for corporations to raise short-term funds, as the interest rates on commercial papers are typically lower than those on bank loans. Commercial papers can be issued quickly, which allows corporations to take advantage of favourable market conditions. They are also flexible, as they can be issued in any denomination, allowing the issuer to tailor the issue to the exact amount required. Furthermore, the market for commercial papers is highly liquid, which allows investors to buy and sell these instruments easily.

Risks Associated with Commercial Papers

Credit Risk: The issuer of commercial papers might not be able to repay the investment at maturity. This is why credit ratings are important when investing in commercial papers. A lower credit rating indicates a higher risk of default.

Liquidity Risk: Despite being a highly liquid market, in times of financial stress or market disruption, it could become difficult to sell commercial papers before maturity.

Interest Rate Risk: If interest rates rise, the value of commercial papers might decrease. For investors holding these instruments until maturity, this risk isn’t as significant, but it can affect those who wish to sell their commercial papers prior to maturity.

No Collateral: Commercial papers are unsecured debt instruments, meaning they don’t have any collateral backing them. If the issuer goes bankrupt, investors might lose their entire investment.

Reinvestment Risk: This occurs when the investor can’t reinvest the funds from a matured commercial paper at the same or higher rate. In a declining interest rate environment, this risk becomes more significant.

Real-World Examples of Using Commercial Papers

Corporations Financing Short-Term Needs: Many corporations use commercial papers to finance their short-term needs such as inventory purchases, accounts payable, and financing of new projects. For instance, Google's parent company, Alphabet Inc., often issues commercial papers to finance its day-to-day operations.

Banks and Financial Institutions: Banks and other financial institutions often issue commercial papers as a means of covering short-term liabilities. For instance, Goldman Sachs, a leading investment bank, may issue commercial papers to meet its short-term funding needs.

Money Market Funds: Money market funds, which are mutual funds that invest in short-term debt securities, often invest a significant portion of their funds in commercial papers due to their short-term nature and relatively low risk.

Read more: Business Budgeting Simply Explained.

Conclusion: Why Investing in Commercial Papers is a Smart Choice

Investing in commercial papers can be a smart choice for various reasons. Firstly, they offer attractive returns compared to other short-term investment options. They also provide higher liquidity due to their short maturity period, allowing investors to access their funds in a relatively short time. Furthermore, commercial papers are considered low-risk investments as they are often issued by financially stable corporations or financial institutions. Lastly, they are an excellent tool for diversification in an investment portfolio. However, like all investments, they come with their own set of risks which investors should be aware of. Hence, it is essential to understand the nature of commercial papers and seek professional advice if necessary before making an investment decision.

Use Wafeq - an accounting system to keep track of debits and credits, manage your inventory, payroll, and more.

Use Wafeq - an accounting system to keep track of debits and credits, manage your inventory, payroll, and more.

.png?alt=media)