How To Secure Your Financial Data

Understanding Financial Data Security

The era of digitalization has made securing financial data a paramount concern. It's not just about protecting numbers but safeguarding the integrity of personal and business relationships, trust, and confidentiality. The importance transcends mere figures and connects to the very core of individual and business stability and success.

Recognizing vulnerabilities is the first step in securing financial data. This includes understanding the various threats like hacking attempts, malware infections, phishing attacks, and even internal breaches. Each vulnerability requires a unique approach to ensure robust protection, emphasizing the need for continuous vigilance and adaptive security measures.

Protect your financial future with Wafeq's robust data security solutions. Get started today and secure your peace of mind!

Protect your financial future with Wafeq's robust data security solutions. Get started today and secure your peace of mind!

Implementing Strong Password Practices

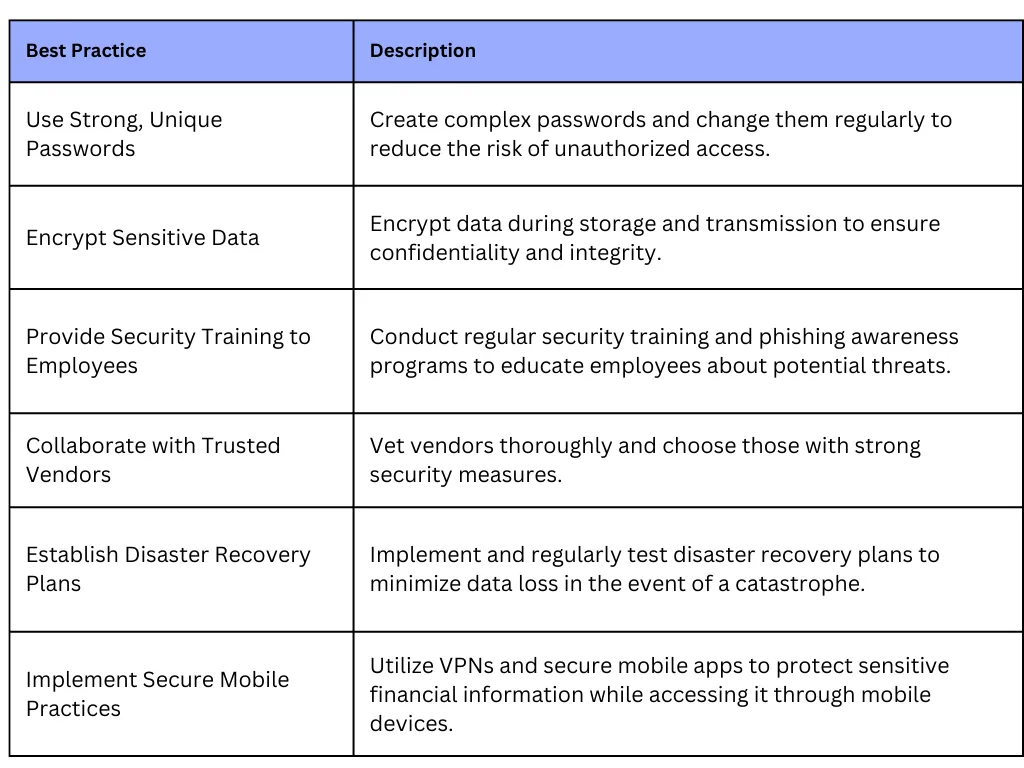

Password Complexity: A robust password is one of the frontline defenses against unauthorized access. It should be a combination of letters, numbers, and special characters, avoiding common phrases or information linked to the individual or business.

Regular Changes: Regularly changing passwords and not reusing them across multiple accounts minimizes the risk of a successful attack. It ensures that even if a password is compromised, the potential damage is contained.

Utilizing Encryption Techniques

Data Encryption: Encrypting sensitive financial data ensures that even if it falls into the wrong hands, it remains indecipherable without the proper decryption key. Encryption acts as a barrier that only authorized personnel can cross.

Secure Transmission: When transmitting data online, encryption should also be applied to the transmission itself. Secure transmission protocols like SSL/TLS protect the data as it travels from point A to point B, keeping it safe from interception.

Integrating Multi-Factor Authentication

Integrating multi-factor authentication (MFA) adds a layer of security. By requiring multiple forms of verification, MFA makes it more challenging for unauthorized users to access financial data. Whether it's a text message, a phone call, or a fingerprint, using different forms of authentication enhances overall security.

Regular Monitoring and Alerts

Multi-level monitoring and alerts are vital for securing financial data. Regular checks for unusual activities or unauthorized access and real-time alerts can prevent potential security breaches. Employing both automatic and manual monitoring systems ensures continuous vigilance over sensitive information.

Educating Employees and Users

Security Training: Providing comprehensive security training for employees and users is vital. Understanding the importance of secure data handling and being aware of potential security risks leads to a more secure environment. Regular workshops, tutorials, and online resources can help maintain an educated and vigilant workforce.

Phishing Awareness: Building awareness around phishing scams is essential in maintaining financial data security. Offering tools and training to recognize and handle phishing attempts can save organizations from significant security breaches.

Related articles: How to start a Business in Saudi - Full Checklist.

Choosing Trusted Financial Tools

Vetting Vendors: Thoroughly evaluating and vetting vendors who provide financial tools is essential. Checking their security measures, reputations, and compliance with relevant regulations helps in selecting the right tools.

SaaS Security: In an age of cloud-based applications, understanding and ensuring the security of SaaS (Software as a Service) tools is vital. Choosing providers with robust security protocols, regular updates, and a proven track record of protecting data is key to maintaining security.

Disaster Recovery and Backup Plans

Importance of Data Recovery Planning: In the event of an emergency disaster such as a cyber attack or system failure, a specific data recovery plan must be in place, allowing you to retrieve essential financial data and continue operations.

Comprehensive Backup Strategies: Implementing comprehensive and regular backup strategies ensures that financial data is available and protected against information loss.

Regularly Testing Recovery: In addition to having a recovery plan, it should be tested periodically to ensure that it will effectively work when needed.

Collaborating with Trusted Providers: Choosing data recovery and backup service providers who have a good reputation and follow best practices in security ensures reliable assistance when required.

Read More: Financial Management: A Comprehensive Guide for Accountants and Business Owners.

Mobile and Remote Security Measures

Secure Mobile Apps: Ensuring the use of secure mobile applications with strong encryption measures protects sensitive financial information while accessing it through mobile devices.

Best Practices:

Conclusion

In an era where financial security is paramount, businesses must employ comprehensive strategies to protect their financial data. Leveraging strong password practices, implementing encryption techniques, educating employees on security measures, and staying compliant with legal regulations all constitute a multifaceted approach toward financial security. Additionally, the thoughtful selection of trusted financial tools, ensuring robust mobile and remote security measures, and having disaster recovery and backup plans form an integral part of safeguarding your assets. Every element must be meticulously planned and executed, for a single breach can have far-reaching consequences. Wafeq empowers business owners and accountants with the tools and insights needed to secure their financial data, providing peace of mind and allowing them to focus on their core business functions.

Don't let vulnerabilities jeopardize your success. Utilize data-driven security measures with Wafeq. Try our services now and stay ahead of the risks!

Don't let vulnerabilities jeopardize your success. Utilize data-driven security measures with Wafeq. Try our services now and stay ahead of the risks!

.png?alt=media)