What is zakat for businesses KSA and how is it calculated?

Introduction

Zakat is a fundamental element of the financial structure for organizations in the Gulf Cooperation Council (GCC) region. The Zakat, Tax, and Customs Authority provides an electronic service for collecting zakat in the Kingdom of Saudi Arabia (KSA).

Rooted in the religious foundations of Islam, it is considered one of the Five Pillars of Islam. In modern terms, Zakat is essentially a wealth tax applied to businesses owned by Saudi and GCC nationals. In this article, we explore the intricacies of Zakat, the regulations governing it, and its significance in today's digital world.

A Brief Overview of Zakat

Zakat serves as a wealth tax for business entities and a form of worship for individuals practicing Islam. Key features of this assessment for businesses include:

- Companies owned by Saudi or GCC nationals must pay Zakat.

- In mixed companies with Saudi (or GCC) and non-Saudi investors, non-Saudi investors' taxable income is subject to income tax, while the Saudi counterpart's share is subject to Zakat.

Learn more about Zakat and other essential topics for businesses in KSA with Wafeq's blog.

Learn more about Zakat and other essential topics for businesses in KSA with Wafeq's blog.

Calculating Zakat in KSA

Zakat is calculated based on a business entity's net worth, technically referred to as the "Zakat base." As per Government regulations, it equals 2.5% of the organization's Zakat base.

Example:

Example:

Assume a Saudi-owned company has a Zakat base of SAR 1,000,000. The Zakat payable would be:

Zakat = 2.5% * 1,000,000

Zakat = SAR 25,000.

ZATCA 's Online Portal for Zakat Services

ZATCA online portal offers a range of sub-services, including:

- Zakat registration

- Immediate certificate

- Request for certificate

- Zakat payment

- Zakat declaration

- Amend registration details

- Zakat return amendment

- Installment plan

Streamline your business's Zakat compliance with Wafeq, an accounting software designed for SMEs in KSA.

Streamline your business's Zakat compliance with Wafeq, an accounting software designed for SMEs in KSA.

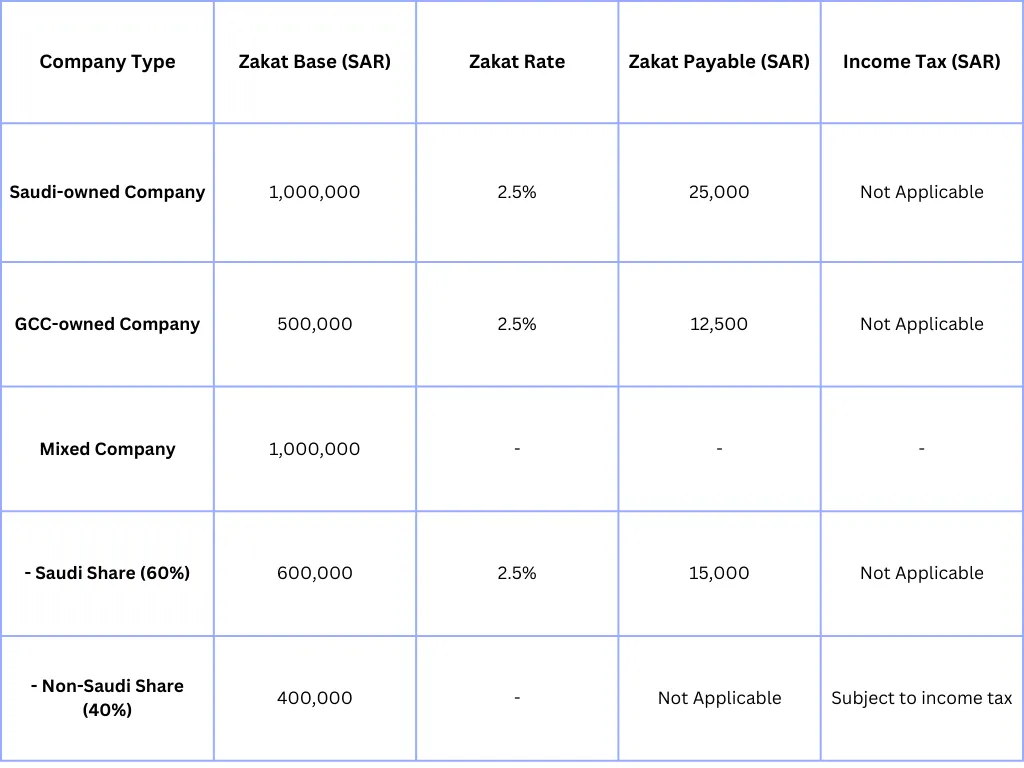

Example of Zakat Calculation for Different Types of Companies:

Frequently asked questions

How to register for Zakat?

Zakat is subject to any activity intended to earn money or work, so once registered with the Ministry of Commerce, TIN is created for the business. Once established, you must log in to the Zakat, Tax, and Customs Authority portal to complete the initial registration at the Zakat services.

When do I become obligated to pay Zakat?

Zakat is levied on every Saudi or GCC state's establishment that suffices the Kingdom's residency requirements and conditions. It is also levied on the shares of Saudi partners in mixed companies. Zakat applies to any activity intended to generate income or employment.

When is Zakat applied to establishments?

Non-Saudi establishments: Income tax applies.

Saudi or GCC establishments: Zakat applies if GCC establishments meet residency conditions.

Mixed establishments: Zakat applies to the Saudi share of the capital, while income tax applies to the non-Saudi share of net profit.

Which entities benefit from the collected Zakat?

Social Insurance beneficiaries benefit from the collected Zakat.

What obligations must non-profit entities and charities fulfill in relation to Zakat?

Zakat is not imposed on such entities if the following conditions are met:

- No specific individual owns the funds.

- Revenues are allocated for general charitable purposes.

- The charity is licensed by responsible authorities and has defined objectives.

- Learn more in detail about Tax In KSA: Income Tax, Zakat, And Other Taxes.

Can a company's payment of Zakat to an official charity through verified Zakat accounts be considered acceptable and approved?

The relevant financial authority is responsible for collecting Zakat from all establishments subject to Zakat Law. Collected Zakat is deposited into an account designated for the Ministry of Social Affairs.

How is the Zakat amount calculated?

The amount of Zakat payable is determined based on the submitted Zakat Returns. The establishment's due Zakat is then calculated based on these returns. The due Zakat amount equals 2.5% of the Zakat Base, which represents the total sources of funding, excluding fixed assets and similar items.

The Zakat Base is calculated using the following formula:

Zakat Base = total sources of funding - fixed assets and similar items

Zakat Base = total sources of funding - fixed assets and similar items

*Total sources of funding represent the combined financial resources a business has available, including equity, retained earnings, and various types of debt. This sum helps determine the Zakat base by subtracting fixed assets and similar items from it.

What is the procedure for paying due Zakat after receiving an invoice number?

All due payments can be made to The Zakat, Tax, and Customs Authority by SADAD payment system using code number 020.

Is it allowed to delay Zakat's payment?

Delaying the payment of due Zakat is not permitted.

What expenses can be deducted from the Zakat base?

All ordinary and necessary expenses required for the business activity, whether paid or still payable, can be deducted to arrive at the net result of the activity, subject to the following conditions:

The expense must be actual and supported by documents or other evidence that allows the financial authority to verify it, even if it relates to previous years.

The expense must be relevant to the business activity and not personal expenses or other pursuits.

The expense must not be of a capital nature. Suppose capital expenses are included within the expenses. In that case, the business activity result will be adjusted, and the capital expenditure will be added to the fixed assets, and treated according to standard percentages.

Can an establishment deduct the employee's share in regular pension funds such as pension funds, social insurance, or saving funds?

Establishments are not permitted to deduct the employee's share in such funds from the Zakat Base. For accurate calculation and reporting of your books, consider using accounting software like Wafeq, designed for SMEs.

Conclusion

Understanding and managing Zakat is crucial for businesses operating in the Kingdom of Saudi Arabia and the GCC region. By leveraging ZATCA's e-services and staying up-to-date with recent developments, businesses can ensure compliance with this essential financial obligation. Wafeq, an accounting software designed for SMEs in KSA, can streamline your business's Zakat compliance and help you navigate the complexities of Zakat calculations and regulations.

Explore Wafeq and its comprehensive solutions for SMEs in KSA today.

Explore Wafeq and its comprehensive solutions for SMEs in KSA today.

-Please note that the example provided in the table above is for illustrative purposes only and might not reflect the exact calculations and rates for specific businesses. For accurate Zakat calculations, businesses should consult a professional or refer to the ZATCA guidelines.

.png?alt=media)