An Essential Guide to Debits and Credits

Developing a firm understanding debit and credit is the first thing anyone engaged with accounting should do. In this article, we aim to highlight all the important basics about debit and credit; not more, not less.

Introduction to Debits and Credits

Bookkeepers and accountants use the terms debits and credits when they enter transactions in the accounting records. Every transaction amount must be put into one account as a debit (left side) and another as a credit (right side of the account).

This system makes sure that the accounting information and financial statements are correct.

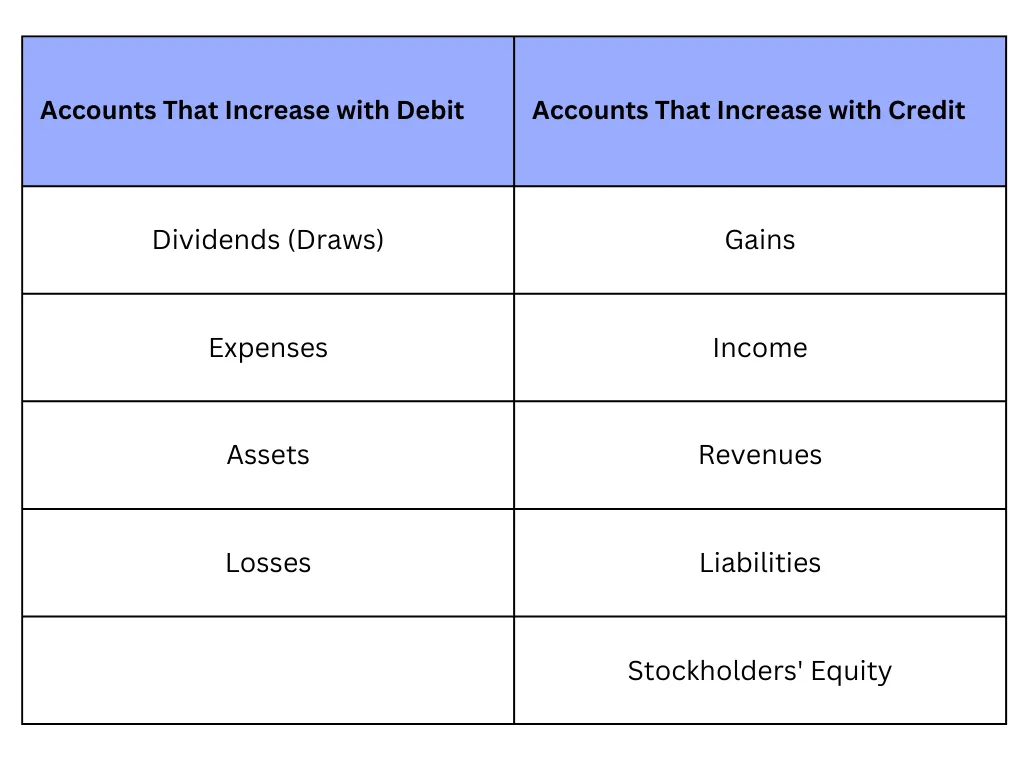

The first problem is figuring out which account would have a debit entry and a credit entry. Before we talk about debits and credits and how they work in accounting and bookkeeping, we'll talk about the accounts where they will be entered or posted.

25 Essential Accounting Terms Everyone Should Know.

Overview of Accounts

Accountants came up with a way to organize a company's financial information by putting transactions into records called "accounts”.

Depending on how big a company is and how complicated its business is, its chart of accounts may have as few as thirty up to

thousands of accounts. Thankfully, we have advanced software solutions that do the heavy lifting for us and ensure mistaking precision at all times. Like Wafeq our accounting solution.

In the chart of accounts, the accounts from the balance sheet come first, then from the income statement, as follows:

- Assets

- Liabilities

- Owner's (Stockholders') Equity

- Expenses

- Revenues or Income

- Gains

- Losses

Double-Entry Accounting

Our accounting system is called a double-entry system, as every business transaction impacts at least two accounts. A firm's chart of accounts can help choose the right accounts. New accounts can be incorporated into the chart of accounts at any point, so the system is quite flexible as is.

To illustrate, let's suppose a business borrows $1,000 from a bank. The transaction affects both the company's Cash account and its Notes Payable account, along with other potential accounts. When the business repays the bank loan, it also affects the Notes Payable and Cash accounts.

If a company buys supplies with cash, both its Supplies account and its Cash account are affected. If, on the other hand, the company purchases supplies on credit, Supplies and Accounts Payable are the accounts debited and credited.

Rent Expense and Cash are the two accounts that come into play when a company pays the rent for the current month. If a company offers a particular service and gives the client 30 days to pay, this affects both the Service Revenues and the Accounts Receivable account.

Despite the name, more than two accounts may be impacted by a single transaction in a "double-entry" system. A $300 loan payment from a company to its bank is an instance of a transaction with three accounts, namely Notes Payable, Cash, and Interest Expense.

Despite the name, more than two accounts may be impacted by a single transaction in a "double-entry" system. A $300 loan payment from a company to its bank is an instance of a transaction with three accounts, namely Notes Payable, Cash, and Interest Expense.

Those who use accounting software might not notice that two or more accounts are indeed being changed because the program is easy to use. For example, let's say you use your accounting software to write a company check. Your software automatically takes money out of your Cash account and only asks you about the other accounts that have been changed.

Read more: The Difference Between Profit And Loss And Balance Sheet.

Importance of Debits and Credits

An enterprise's books are kept in balance by debits and credits. They are always recorded in pairs, so if you take money out of one account, you must put the same amount of money into another account or account. This is essentially the core concept of double-entry accounting.

Accounts "roll up" into specific lines on a company's balance sheet or income statement, which show a company's financial health, value, and profitability. They also help people inside and outside the company, like management, lenders, investors, and tax agencies, make decisions.

Once you know which accounts are concerned in a business transaction, you must take out of at least one account and put the equivalent amount into at least one other account.

To debit an account, you record a number on the left side of the account. To credit an account, you add a value to the right side of the account.

Use Wafeq - Accounting System to keep all your transactions on track to run your business better.

Use Wafeq - Accounting System to keep all your transactions on track to run your business better.

.png?alt=media)