What Is A CPA (Certified Public Accountant)?

.png?alt=media)

You have probably heard the term CPA before, but have you ever wondered what it stands for and what CPAs actually do? In this article, we’ll explain everything about Certified Public Accountants (CPAs), including their job, salaries, and how you can become one—read on to see it all.

What Is A CPA: Introduction To The CPA Certification

Certified Public Accountant (CPA) certification is the oldest and most well-known accounting certificate in the field.

You might think of the Certified Public Accountant (CPA) as the gold standard since everybody understands it and people greatly respect it. This is owing to the designation of special powers.

Why Is A CPA Certificate Unique?

This is the only accreditation that gives the holder the capacity to draft audit reports or provide comments on the financials of publicly listed companies.

State governments only issue work licenses to Certified Public Accountants (CPAs).

In addition to this, CPAs sign tax returns for clients as paid preparers and represent their clients before the IRS.

Why Is A CPA Certificate Necessary, And Is It Worth It?

The CPA credential is widely regarded as one of the industry's most comprehensive and all-encompassing qualifications due to its expansive scope of applicability. Thus, obtaining one can be well worth the effort.

What Do CPAs Do: Tasks, Job, Responsibilities

CPAs can perform all of the same occupations and activities that other certificates can perform; however, CPAs go into less detail than the other certifications do.

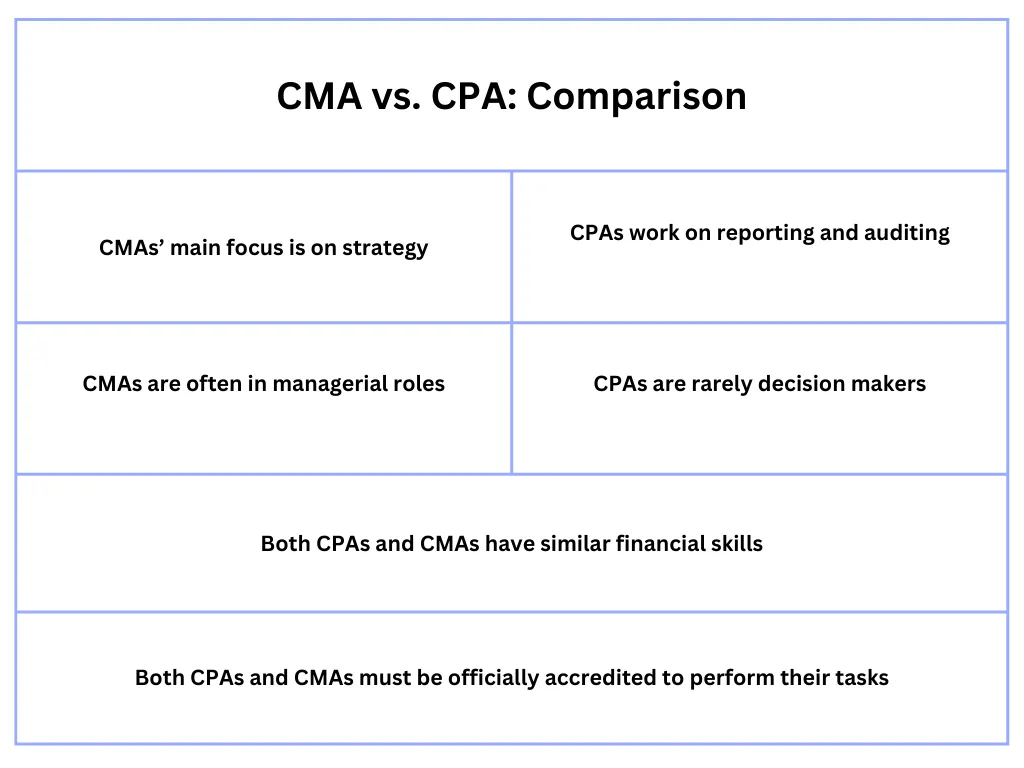

CMA vs. CPA: A Comparison

How Can You Become A CPA?

To become a Certified Public Accountant (CPA), you must attend and succeed in all four sections of the dreaded AICPA standard CPA test.

In addition, the state in which you reside requires that you have a certain level of education and job experience.

Potential CPA Careers In 2023

CPAs have a highly favorable employment prognosis, as is customary. CPAs are anticipated to have a 7% increase in job opportunities during the next ten years.

Accountants with greater experience have the potential to advance their careers to become financial managers or top executives after beginning their careers in accounting.

Will CPAs Have Jobs In The Future?

Because of the growing need for public accountants, there is a significant likelihood that job security will be maintained even if they choose a different direction.

Best CPA Employers In 2023

KPMG, Ernst & Young, RSM McGladrey Incorporated, and CliftonLarsonAllen are the four companies that are now considered to be the most desirable employers for CPA candidates.

Each of these businesses pays its certified public accountants (CPAs) very well relative to the cost of living in the region in which they are located and has a high employee satisfaction rate with their jobs.

Read more in detail about ACCA.

The Conclusion

Overall, CPA is one of the most commonly acquired official accounting titles. The main reasons behind its popularity are its versatility and the ever-growing need for the profession.

To become a CPA, one must attend the official course outlined by regulators and succeed on all the required exams which can take a few years in total.

Employment-wise CPAs have a wide array of options, including opportunities in the private and governmental sectors.

If you’d like to learn more about decision-making financial experts, namely Certified Management Accountants (CMAs), check out our related article now—see you there!

Use Wafeq - an accounting system to keep track of debits and credits, manage your inventory, payroll, and more.

Use Wafeq - an accounting system to keep track of debits and credits, manage your inventory, payroll, and more.

.png?alt=media)