When and How to Use the Straight-Line Depreciation Method

Imagine buying a brand-new piece of equipment، shiny, full of promise, and essential to your company’s growth. But as the years go by, its value quietly slips away. It’s not broken, it’s just older. Every business owner or accountant faces this slow and steady loss of value, and it’s more than just numbers. It’s a reminder of how time impacts our assets and financial planning. That’s where the straight-line depreciation method comes in. It is a reliable, easy-to-understand way to recognize a steady decline. Whether you need to prepare financial statements or make investment decisions, understanding this method can bring clarity and control to your business.

What is the Straight-Line Depreciation Method?

The straight-line depreciation method is one of the most widely used and easiest ways to allocate an asset's cost over its useful life. It assumes that the asset loses value evenly over time, regardless of its usage in any given period. This method is often preferred for its simplicity and consistency, especially for assets that supply uniform benefits throughout their lifespan. Unlike the declining balance or units-of-production methods, straight-line depreciation does not consider the usage intensity or accelerated wear and tear. Instead, it offers predictability, making it a solid choice for financial reporting and planning.

Straight-Line Depreciation Method Key Characteristics:

- Equal depreciation expense each year.

- Simple to calculate and understand.

- Ideal for assets with stable usage patterns.

The formula:

The formula:

Depreciation Expense=

Cost of Asset− Salvage Value ـــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــ Useful Life

Why Use the Straight-Line Method?

Clarity and consistency are essential in Accounting. The straight-line method offers both, making it a popular choice for businesses that seek predictable and transparent financial reporting. Here’s why many finance professionals prefer it:

- Simplicity and Ease of Use It’s straightforward: the same amount of depreciation is recorded each year. This reduces errors, speeds up closing processes, and simplifies bookkeeping for both small and large businesses.

- Consistency in Financial Statements Because the depreciation expense remains constant, it helps maintain stable profit margins across reporting periods. Investors and auditors often appreciate this level of predictability.

- Useful for Uniform Assets Assets such as buildings, office furniture, and computer equipment used consistently over time are ideal candidates for the straight-line method.

- Alignment with the Matching Principle This method matches expenses with the revenue the asset helps generate uniformly. It supports accurate financial performance measurement over the asset’s lifetime.

- Compliance-Friendly In many jurisdictions, including Saudi Arabia, straight-line depreciation is accepted for financial reporting and tax purposes. This alignment makes it easier to stay compliant without maintaining separate accounting treatments.

How to Calculate Straight-Line Depreciation: Step-by-Step

Calculating straight-line depreciation is a simple and powerful way to allocate the cost of an asset over its useful life. Here’s a step-by-step breakdown:

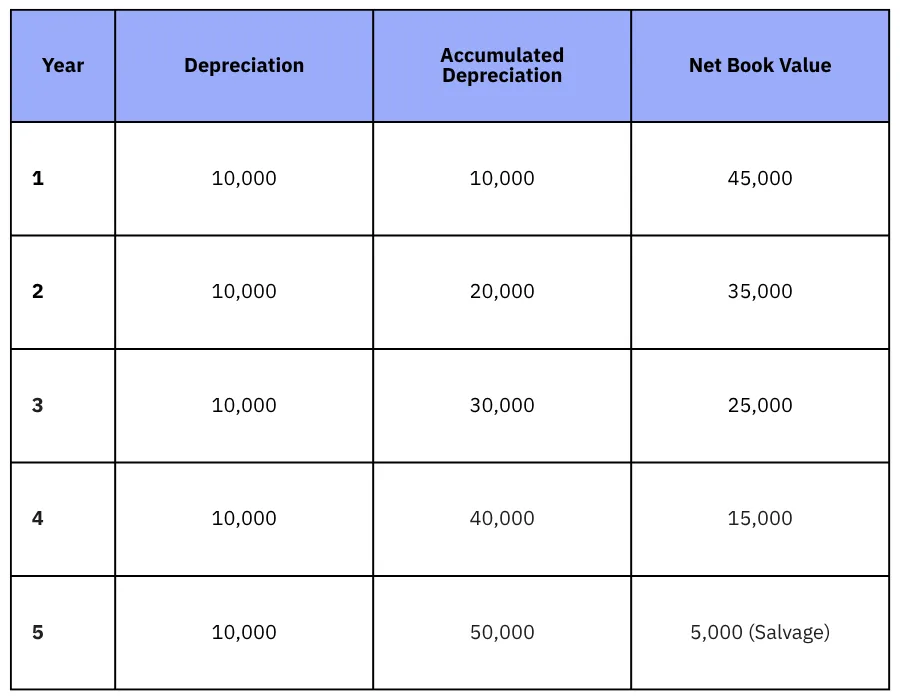

Step 1: Determine the Asset’s Cost Include the purchase price plus any additional costs to bring the asset to its usable state, such as installation, delivery, or setup fees. Example: A company purchases a machine for SAR 50,000 and pays SAR 5,000 for installation. Total cost: SAR 55,000. Step 2: Estimate the Salvage Value This is the expected value of the asset at the end of its useful life, what you anticipate selling it for, or its scrap value. Example: Expected salvage value: SAR 5,000. Step 3: Define the Useful Life It measures how long the asset is expected to provide economic benefits to the company, typically expressed in years. Example: Useful life: 5 years. Step 4: Apply the Straight-Line Formula

In our example:

In our example:

Depreciation Expense per Year = Total Cost−Salvage Value ـــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــ Useful Life

= (55,000−5,000) ÷ 5 = 10,000 SAR per year.

Step 5: Record the Depreciation in Accounting Record the depreciation expense yearly and reduce the asset’s book value.

When is the Straight-Line Method Most Appropriate?

The straight-line depreciation method isn’t just simple; it’s also highly practical when used for the right types of assets. But when exactly is it the best fit? Here are the key scenarios where this method excels:

- Assets with Predictable Use Assets that deliver a consistent level of service year after year, such as office furniture, buildings, and vehicles used for regular operations, are ideal candidates. These assets don’t typically experience fluctuating usage or accelerated wear and tear.

- Long-Term Capital Assets For long-lived assets that are not expected to have dramatic changes in efficiency or productivity, straight-line depreciation shows a reliable way to reflect their gradual aging.

Know more about: How to Evaluate Long-Term Assets in Companies.

- Financial Statement Consistency When a business values smooth and consistent expense recognition across years, this method helps create uniformity in profit margins and reporting metrics.

- External Reporting and Compliance Many auditors and regulators prefer or require straight-line depreciation, especially in markets such as Saudi Arabia. Its predictability ensures fewer discrepancies and makes compliance checks more straightforward.

Limitations of the Straight-Line Method

While the straight-line method is widely used for its simplicity, it is not without its drawbacks. In certain scenarios, it can oversimplify the true nature of how assets lose value over time. Here are some key limitations to consider:

- Ignores Actual Usage Straight-line depreciation assumes the asset depreciates at the same rate yearly, regardless of how long it is used. This can lead to inaccurate expense reporting for assets with fluctuating usage, such as machinery that operates seasonally or intensively in certain periods.

- Doesn’t Reflect Accelerated Wear Some assets lose value more quickly in the early years, especially for technology, vehicles, or equipment. The straight-line method may understate depreciation first and overstate it later on.

- Less Accurate for Short-Lived Assets For short-term assets or those prone to rapid obsolescence, straight-line depreciation may not accurately represent their financial impact, especially in fast-evolving industries as technology or media.

- Limited Insight into Asset Efficiency This method provides a flat depreciation schedule, which means it doesn’t offer insights into how efficiently the asset is being used or its condition over time.

Also read about: the DDB Depreciation Method and when to apply it.

Straight-Line Depreciation and Financial Reporting

Straight-line depreciation plays a vital role in how businesses present their financial performance. It ensures a systematic allocation of asset cost, directly affecting both the income statement and the balance sheet.

- Income Statement Impact Depreciation is treated as an operating expense. With the straight-line method, this expense remains constant each period, offering stable net income reporting over time. This predictability is helpful for internal planning and external comparisons.

- Balance Sheet Representation Assets are reported at their book value, on the balance sheet, original cost minus accumulated depreciation. Each year, the accumulated depreciation increases by the same amount, reducing the asset’s net book value clearly and transparently.

- Cash Flow Statement Although depreciation is a non-cash expense, it appears in the operating activities section of the cash flow statement, contributing to adjustments from net income to operating cash flow. Straight-line depreciation provides a steady adjustment over time.

- Tax and Compliance Considerations In Saudi Arabia and other jurisdictions, straight-line depreciation is accepted for financial reporting and often for tax calculations as well, provided the method aligns with zakat and tax regulations from authorities like ZATCA. This makes it easier for companies to maintain one depreciation method for both purposes.

- Auditing and Consistency Auditors prefer methods that offer transparency and repeatability. The straight-line method meets these expectations, helping companies pass audits smoothly and maintain credibility with investors and regulators.

How Wafeq Helps Automate Depreciation Entries?

While understanding the straight-line depreciation method is essential, consistently and accurately applying it across all assets is another challenge, especially for growing companies managing dozens or hundreds of assets. This is where Wafeq simplifies the entire process with intelligent automation and full control.

- Seamless Asset Registration In Wafeq, you can register all your fixed assets in just a few clicks. Each asset entry includes key details such as purchase cost, salvage value, acquisition date, and useful life.

- Automated Monthly Depreciation Once the asset is recorded, Wafeq automatically generates monthly depreciation journal entries based on the selected method—straight-line or otherwise. These entries post to your general ledger with no manual input required.

- Custom Depreciation Schedules Wafeq supports fully customizable depreciation settings. You can apply straight-line depreciation to specific asset categories while using other methods for different types, giving you flexibility and compliance with your internal policies.

- Real-Time Financial Reports As depreciation entries are recorded automatically, your balance sheet and income statement are always up to date. You gain instant insight into net book value, accumulated depreciation, and asset lifespan—all in one place.

- Local Compliance & Audit Trail Wafeq is built for regulatory compliance in Saudi Arabia. All depreciation entries are compliant with ZATCA and Saudi GAAP, with audit-friendly documentation and easy-to-export reports.

Also Read: How to handle Depreciation and Amortization for Fixed Assets and its application in Wafeq

Depreciation isn’t just a technical accounting requirement; it’s a powerful tool for representing the business's true financial position. The straight-line method, in particular, offers clarity, consistency, and ease of application, making it a go-to choice for many businesses handling long-term assets with predictable value decline.

You ensure more accurate financial reporting, better planning, and improved compliance with local regulations by understanding when and how to apply this method. However, the real impact comes when this method is automated through powerful platforms like Wafeq, eliminating manual work, reducing risk, and keeping your books always ready for audits and decision-making.

FAQs about the straight-line depreciation method

What is the difference between straight-line depreciation and double-declining balance depreciation?

Straight-line depreciation spreads the asset cost evenly across its useful life. While the double declining balance method applies a higher depreciation rate in the early years and a lower rate in later years, it accelerates the reduction in book value.

Is the straight-line method allowed for tax purposes in Saudi Arabia?

Yes. The straight-line method is generally accepted for both financial reporting and zakat/tax purposes in Saudi Arabia, as long as it complies with ZATCA’s depreciation schedules and Saudi GAAP.

Can I switch from the straight-line method to another method later?

Yes, but only under specific circumstances and with proper justification. You must disclose the change in financial statements and explain the rationale, as required by accounting standards and auditors.

How could an asset’s salvage value be estimated?

Salvage value is estimated based on market trends, expected condition of the asset at the end of its useful life, and historical resale data for similar assets. It should be realistic and justifiable.

What happens if an asset is disposed of before its useful life ends?

The remaining book value must be calculated and recorded as a gain or loss on disposal. Any unused depreciation must be accounted for up to the date of disposal.

Start using Wafeq today to track assets, calculate straight-line depreciation, and generate compliant financial reports effortlessly.

Start using Wafeq today to track assets, calculate straight-line depreciation, and generate compliant financial reports effortlessly.

.png?alt=media)