Understanding the DDB Depreciation Method and when to apply it

Have you ever wondered why some companies write off a large chunk of an asset’s value early in its first years? The Double Declining Balance (DDB) depreciation method shows a powerful way to accelerate expense recognition, especially for assets that draw value quickly in their early years. Unlike straight-line depreciation, DDB doubles the rate, providing bigger deductions upfront and reflecting actual usage patterns more realistically.

In this article, we’ll explore how the DDB method works, when to use it, how to calculate it step-by-step, and how tools like Wafeq can help automate the entire process.

What is the Double Declining Balance (DDB) Method?

The Double Declining Balance (DDB) method is an accelerated depreciation technique that depreciates an asset at twice the rate of the straight-line method. It front-loads the expense, resulting in higher depreciation charges in the early years of an asset’s useful life and lower charges in the years later.

This method is ideal for assets that are losing value quickly, like vehicles, electronics, or equipment that becomes obsolete rapidly. By recognizing expenses earlier, companies can better match costs with revenue generated by the asset in its most productive years.

Formula

Formula

Depreciation Expense =

(2 × Straight-Line Rate) × Book Value at Beginning of Year

Where:

- Straight-Line Rate = 1 ÷ Useful Life

- Book Value = Cost of asset - Accumulated Depreciation

It’s important to note that this method never depreciates an asset below its salvage (residual) value. In the final year, the remaining book value is adjusted accordingly.

It’s important to note that this method never depreciates an asset below its salvage (residual) value. In the final year, the remaining book value is adjusted accordingly.

Why Choose the Double Declining Balance Method?

Choosing the Double Declining Balance (DDB) method is often a strategic decision based on how an asset contributes to operations and its depreciation rate. This method is beneficial when an asset is most productive or loses most of its utility early in its useful life. Here are the main reasons companies adopt the DDB method:

- Accelerated Depreciation = Faster Expense Recognition The DDB method recognizes more depreciation early on, which means higher expenses at the beginning and lower net income. It is useful for companies looking to reduce taxable income during years of high profitability.

- Better Matching of Expenses with Revenue Assets like machinery, computers, or vehicles tend to be more efficient in their early years. DDB reflects the actual wear and tear pattern and matches costs to the time when the asset is generating more revenue.

- Tax Deferral Advantage (Where Permitted) While this depends on local tax laws, accelerated depreciation often results in tax deferrals; companies pay less tax now and more later. This improves short-term cash flow, which is vital for capital-heavy businesses.

- Realistic Asset Valuation DDB offers a more conservative and realistic reflection of an asset’s market value, especially for technology and equipment that depreciate rapidly in resale value.

Step-by-Step Calculation with Example

To fully understand the Double Declining Balance (DDB) method, it’s essential to see how depreciation is calculated year by year with a practical example.

Example Details:

Example Details:

Asset Cost: 10,000 SAR

Useful Life: 5 years

Residual Value: 1,000 SAR

- Step 1: Calculate the Straight-Line Depreciation Rate 1 ÷ 5 years = 20% per year

- Step 2: Double the Rate for DDB 20% × 2 = 40%

- Step 3: Calculate Depreciation Expense Each Year

method calculation.png?alt=media)

Important Notes:

Important Notes:

- In the final year, depreciation is adjusted to avoid depreciating below the residual value.

- The depreciation expense declines each year as the book value decreases.

When can DDB be used (and when not to)?

The Double Declining Balance (DDB) method is not a one-size-fits-all solution. Knowing when it fits best can maximize financial accuracy and strategic benefits while avoiding potential drawbacks.

When to Use DDB

- Assets with Rapid Early Wear and Tear Assets like vehicles, computers, and machinery often lose much of their value in the first few years. DDB reflects this reality by accelerating depreciation expense when the asset is most used.

- Industries with Fast Technological Changes Sectors such as IT, manufacturing, or telecommunications, where equipment becomes obsolete quickly, benefit from accelerated depreciation methods like DDB.

- Desire to Maximize Early Tax Deductions If local tax regulations allow, DDB can be used to defer taxable income, improving short-term cash flows.

- Matching Revenue and Expenses More Closely For assets generating higher revenue earlier in their life, DDB better aligns expense recognition with income.

When Not to Use DDB

- Assets with Long Useful Lives and Stable Usage Straight-line depreciation might be more appropriate for assets like buildings or furniture that maintain value steadily over time.

- When Financial Statements Need Smoother Expense Recognition DDB can lead to volatile earnings since it has produced higher expenses at first and lower expenses later, which may not be desirable for all companies.

- When Residual Value is Hard to Estimate DDB requires careful estimation of salvage value to avoid over- or under-depreciation.

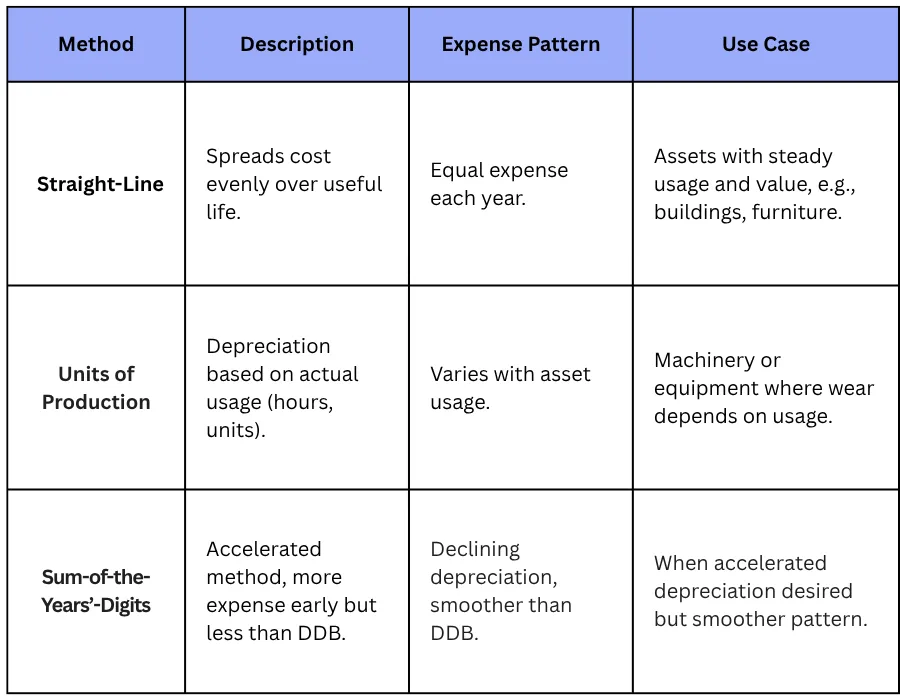

Double Declining Balance vs. Other Depreciation Methods

Understanding how the Double Declining Balance (DDB) method compares to other depreciation approaches can help you choose the best fit for your business needs and financial reporting.

How Wafeq Helps Automate Double Declining Balance Depreciation

Managing depreciation manually can be time-consuming and prone to errors, especially with accelerated methods like Double Declining Balance. Wafeq, a smart accounting software tailored for financial professionals, simplifies this process and enhances accuracy. Key Benefits of Using Wafeq for DDB Depreciation:

- Automated Calculations Wafeq automatically calculates depreciation amounts using the DDB formula based on your asset’s cost, useful life, and salvage value, eliminating manual errors.

- Customizable Asset Profiles Easily set up each asset’s details, purchase date, cost, expected useful life, and residual value so Wafeq can apply the correct depreciation method seamlessly.

- Real-Time Depreciation Reports Generate detailed reports showing yearly and accumulated depreciation. Wafeq keeps your financial statements updated with accurate expense recognition.

- ERP Integration Wafeq integrates smoothly with your existing ERP systems, ensuring depreciation data flows automatically without redundant data entry.

- Compliance and Audit Trail Maintain full audit trails of depreciation schedules and adjustments, supporting regulatory compliance and simplifying audits.

Also Read: How to Evaluate Long-Term Assets in Companies.

Understanding and applying the Double Declining Balance (DDB) depreciation method is essential for financial professionals seeking to match asset expense with usage more accurately, optimize tax strategies (where permitted), and present realistic asset valuations in financial statements. While it may not suit every asset or organization, when used correctly, DDB provides a strategic advantage, especially for high-usage or fast-depreciating assets.

Modern accounting tools like Wafeq make it easier than ever to implement DDB with precision and confidence. By automating calculations, ensuring compliance, and integrating with existing systems, Wafeq empowers finance teams to focus more on analysis and less on manual tracking.

FAQs about the Double Declining Balance Depreciation Method

Is the Double Declining Balance method allowed under IFRS or Saudi GAAP?

Yes, DDB is permitted under both IFRS, Saudi GAAP, as long as it reflects the pattern in which the asset’s future economic benefits are expected to be consumed.

Can I switch from Straight-Line to DDB after acquisition?

Changing depreciation methods requires justification and consistency. Under IFRS and Saudi GAAP, a change must reflect a better estimation of the asset's economic use and be disclosed.

What happens when the book value becomes less than the salvage value using DDB?

The DDB method is applied only until the book value equals the salvage value. At that point, depreciation stops, or a switch to Straight-Line is applied to reach the salvage value more smoothly.

Is DDB better for tax purposes in Saudi Arabia?

In Saudi Arabia, ZATCA does not mandate a specific depreciation method, but tax regulations may favor straight-line for certain fixed asset classes. DDB can still be used for internal reporting or management purposes.

Start using Wafeq today to save time, reduce errors, and ensure compliance across all your asset schedules, including advanced methods like Double Declining Balance.

Start using Wafeq today to save time, reduce errors, and ensure compliance across all your asset schedules, including advanced methods like Double Declining Balance.

.png?alt=media)