How to handle Depreciation and Amortization for Fixed Assets and its application in Wafeq

Are you sure that fixed asset records tell the full story of your business’s financial health? Depreciation and amortization aren’t just accounting formalities; they shape your profit figures, impact your tax liability, and affect how investors and auditors see your operations. Yet, many companies overlook the importance of getting these entries right or automating them for accuracy and efficiency.

In this guide, you'll learn how to set up depreciation and amortization entries correctly for tangible or intangible assets and how to automate the entire process using Wafeq, saving time while staying compliant.

Key Concepts: Fixed Assets, Depreciation, and Amortization Explained

What qualifies as a fixed asset?

A fixed asset is a long-term tangible resource owned and used by a company to generate income over multiple accounting periods. It is not intended for immediate resale. Examples include buildings, vehicles, machinery, and office equipment.

Depreciation vs. Amortization

Depreciation refers to the allocation of cost over the useful life of tangible assets, while Amortization applies to intangible assets such as software, licenses, or patents. Both reduce the asset’s book value gradually and reflect its usage or wear and tear.

Key terms you need to understand

Understanding the following concepts is crucial for accurate financial reporting, tax compliance, and strategic planning. Misclassifying assets or using the wrong method can lead to misstated financials or audit red flags.

- Useful Life: Estimated period over which the asset is expected to provide economic benefits.

- Residual Value: The expected value of the asset at the end of its useful life.

- Depreciable Base: Cost of the asset minus its residual value.

- Systematic Allocation: Depreciation and amortization must follow a consistent method aligned with accounting standards.

Depreciation Methods: Choosing the Right Approach for Your Business

The depreciation method you choose affects your profit, tax reporting, and asset valuation over time. It should reflect how the asset’s value is consumed in your operations. Different methods are suitable for different types of assets and business models.

1. Straight-Line Method The asset depreciates evenly over its useful life. Best for assets that wear out evenly over time, like office furniture or buildings.

Formula:

Formula:

Annual Depreciation=

Cost - Residual Value ___________________________

Useful Life

2. Declining Balance Method Depreciates more in earlier years and less in later years, using a fixed percentage. It's suitable for assets that lose value quickly, like computers or machinery.

Formula (Double Declining Example):

Formula (Double Declining Example):

Depreciation =

2 × Straight-Line Rate × Book Value at Start of Year

3. Units of Production Method Depreciation is based on usage or output rather than time. Best for equipment whose wear depends on usage, such as manufacturing machines.

Formula:

Formula:

Depreciation per Unit =

Cost - Residual Value ____________________________

Total Estimated Units

How to choose the right method for depreciation

- Consider the nature of the asset and how it generates value.

- Align the method with accounting policy and local regulations, such as SOCPA or IFRS.

- For consistency and audit-readiness, use the same method for similar asset classes.

How is depreciation recorded in the books, and how often should entries be recorded

Depreciation is a non-cash expense, but it still reduces the book value of fixed assets and impacts your income statement. The depreciation expense must be recorded to reflect the asset’s reduced value each accounting period.

- Typically, entries are recorded monthly or annually, depending on the company’s financial policy.

- The key is consistency and matching depreciation to the periods in which the asset is used.

Journal entry format for depreciation

This entry increases expenses and reduces the asset’s net book value by accumulating depreciation in a contra-asset account.

Dr. From Acc/ Depreciation Expense Cr. To Acc/ Accumulated Depreciation

Dr. From Acc/ Depreciation Expense Cr. To Acc/ Accumulated Depreciation

Journal entry format for amortization

This is used for intangible assets such as licenses or patents. Like depreciation, it spreads the cost over the asset's useful life.

Dr. From Acc/ Amortization Expense Cr. To Acc/ Accumulated Amortization

Dr. From Acc/ Amortization Expense Cr. To Acc/ Accumulated Amortization

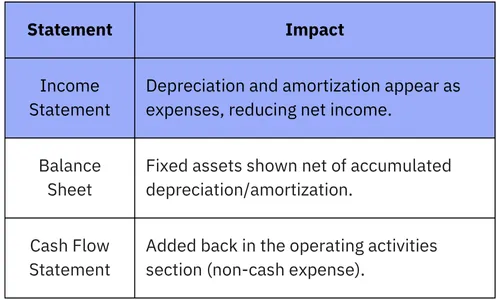

Impact of depreciation and amortization on financial statements

Managing Fixed Assets and Automating Depreciation in Wafeq

Wafeq makes it easy for finance professionals to record, track, and depreciate fixed assets accurately and efficiently. Here’s how you can handle the full lifecycle of an asset, from purchase to full depreciation, step by step.

1. Record the purchase as a Bill

When you acquire a fixed asset, create a Bill in Wafeq. Make sure to select a Fixed Asset account from the line item to ensure the purchase is classified correctly as a fixed asset, not a regular expense.

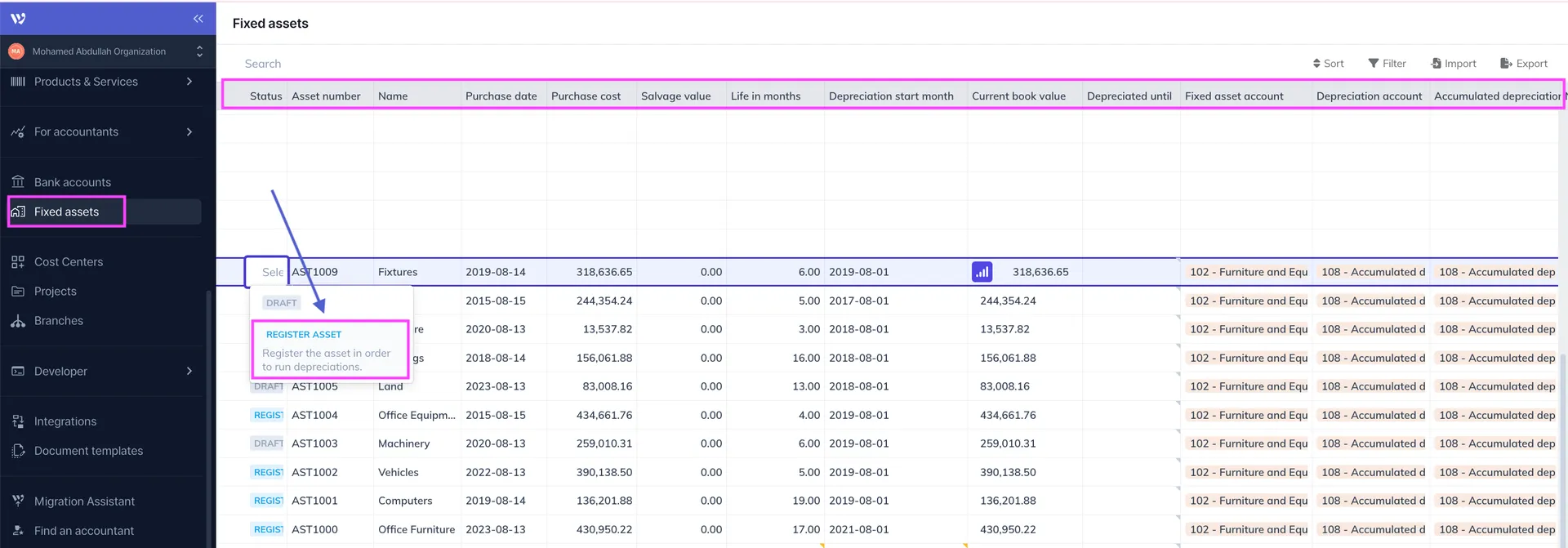

2. Register the asset in the Fixed Assets page

Go to the Fixed Assets page and enter all necessary details, as purchase date, useful life, salvage value, and the depreciation's start date.

Once the information is complete, register the asset and ensure its status is set to Registered for depreciation purposes.

3. Run depreciation

From the Fixed Assets list, mark the checkbox next to each asset you wish to depreciate. Then, click on Run depreciation.

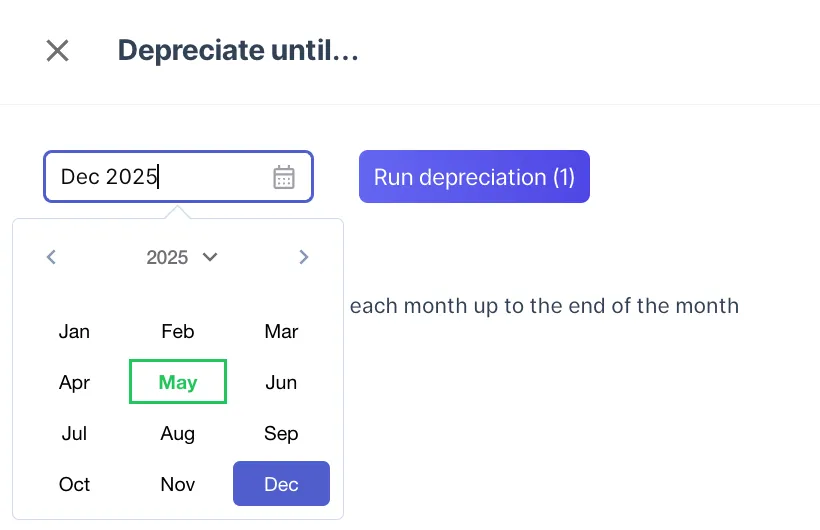

4. Choose the depreciation period A dialog box will prompt you to select the last month you want depreciation to run through. Wafeq will automatically calculate and apply monthly depreciation using the straight-line method up to that month.

5. Review recorded depreciation

To review the depreciation of any asset, click on the depreciation icon That appears, then a side panel will open showing all past depreciation entries.

6. Monitor the asset’s depreciation status The Current Book Value represents the asset’s net book value at the end of the previous month. Once this value reaches the salvage value, the asset's status will automatically update to Fully Depreciated.

Best Practices for Asset Management and Depreciation Accuracy

Effectively managing fixed assets involves more than just recording purchases and running depreciation. Accurate asset tracking and proper depreciation practices help businesses to remain compliant, avoid misstatements, and optimize financial decision-making.

- Centralized asset tracking Keep a dedicated, digital register of all fixed assets. Record details such as purchase date, supplier, invoice, asset tag or ID, location, and department. This enables traceability and audit readiness.

- Set depreciation policies aligned with SOCPA or IFRS Ensure depreciation methods, useful lives, and residual values are consistent with your accounting standards. For Saudi businesses, aligning with SOCPA is essential. If reporting internationally, IFRS standards should guide your approach.

- Review assets regularly Conduct periodic reviews to identify obsolete or idle assets, assets that need revaluation or impairment, missing or untagged assets

- Reconcile depreciation schedules with the general ledger Always reconcile your depreciation calculations with your general ledger entries. This ensures financial statements reflect accurate values of fixed assets and depreciation expenses.

- Use automation tools like Wafeq Manual depreciation tracking is prone to error and inefficiency. Wafeq’s fixed asset module automates calculations, improves accuracy, and ensures consistent monthly posting, saving your team time and effort.

Also Read: Understanding Company Assets On The Balance Sheet.

Depreciation and amortization are essential tools in presenting a fair financial picture. Every fixed asset carries cost and value over time, and how you track that value directly influences your financial accuracy and compliance.

Frequently Asked Questions (FAQs) about depreciation for fixed assets

What are the standard depreciation rates according to international standards?

There are no fixed depreciation rates under IFRS. Instead, companies must estimate the useful life of each asset based on its nature and use, and apply a systematic method to depreciate it. However, the following are commonly used industry averages, yet IFRS requires that useful lives be reviewed regularly to ensure ongoing accuracy.

- Buildings: 20 to 40 years

- Machinery and Equipment: 5 to 15 years

- Vehicles: 4 to 8 years

- Furniture: 5 to 10 years

- Computers and Electronics: 3 to 5 years

What is the difference between Accumulated Depreciation and Depreciation Expense Provision?

Depreciation Expense Provision is the expense recorded periodically (monthly or yearly) in the income statement to reflect the cost of using the asset during that period. Accumulated Depreciation is a contra-asset account on the balance sheet that holds the total amount of recorded depreciation on an asset since its acquisition. Think of depreciation provision as what you record this month, and accumulated depreciation as the running total of all previous months.

What is the journal entry for Accumulated Depreciation?

This entry recognizes the depreciation expense in the income statement and increases the accumulated depreciation on the balance sheet.

Journal Entry Example:

Journal Entry Example:

Dr. Depreciation Expense (P&L)

Cr. Accumulated Depreciation (Balance Sheet)

Start automating depreciation with Wafeq and make your financials accurate, compliant, and audit-ready every month.

Start automating depreciation with Wafeq and make your financials accurate, compliant, and audit-ready every month.

.png?alt=media)