Two Systems, One Asset: How to Handle Depreciation in Accounting and Tax

In the final weeks of Q4, the CFO of a mid-sized manufacturing company reviewed two very different reports. One showed a steady, predictable decline in asset values, which is the accounting team’s depreciation schedule. The other, prepared by the tax advisor, reflected aggressive write-offs and front-loaded expense deductions. Both were correct, yet strikingly different!

How can the same machine lose value in two different ways together? Welcome to the world of accounting depreciation vs. tax depreciation, a dual system every finance professional must master to ensure accurate reporting, compliance, and strategic planning.

What is Accounting Depreciation?

Accounting depreciation is the systematic allocation of the cost of a tangible fixed asset over its useful life. It is grounded in the accrual accounting principle, which requires that expenses be recognized in the same period as the revenues they help generate. This concept ensures that the financial statements reflect a business's actual economic value and performance over time.

Depreciation in accounting is not about market value; rather, it is a deliberate method to spread the cost of using an asset over multiple periods.

For example, suppose a company purchases a delivery vehicle for SAR 100,000 with an expected useful life of 5 years. In that case, it might record an annual depreciation expense of SAR 20,000 using the straight-line method.

For example, suppose a company purchases a delivery vehicle for SAR 100,000 with an expected useful life of 5 years. In that case, it might record an annual depreciation expense of SAR 20,000 using the straight-line method.

Common methods of accounting for depreciation include:

- Straight-Line Method: Equal depreciation expense every year.

- Declining Balance Method: Accelerated depreciation in early years.

- Units of Production Method: Based on actual usage or output.

Accounting depreciation is governed by financial reporting standards such as IFRS or GAAP, and the choice of method must be consistently applied. Depreciation also impacts key economic indicators such as net income, asset values, and return on assets, making it a crucial tool for financial reporting and performance measurement.

What is Tax Depreciation?

Tax depreciation refers to the deduction of a portion of a fixed asset’s cost over time for tax purposes, according to rules set by the tax authority (ZATCA). Unlike accounting depreciation, which is based on matching expenses with revenues, tax depreciation is designed to provide a legally allowed method for reducing taxable income.

In Saudi Arabia, tax depreciation is regulated by the Zakat, Tax and Customs Authority (ZATCA). Businesses must follow specific asset classifications and depreciation rates defined in the implementing regulations of the Income Tax Law. Assets are grouped into categories such as buildings, vehicles, computers, and machinery, each with a predefined annual depreciation rate, often using the declining balance method.

For example:

For example:

- Buildings may be depreciated at 5% per annum.

- Computers and software at 33.3%

- Vehicles and machinery at 25%

Tax depreciation does not necessarily reflect the actual wear or usage of the asset; instead, it follows the legal framework to ensure uniformity and ease of tax calculation. Importantly, tax depreciation often accelerates the expense recognition compared to accounting depreciation, offering potential short-term tax benefits through faster deductions.

Key characteristics of tax depreciation:

- Set by tax authority guidelines.

- May differ significantly from accounting methods.

- Not intended to reflect economic reality but to comply with tax rules.

Know more about: Depreciation Meaning Simply Explained.

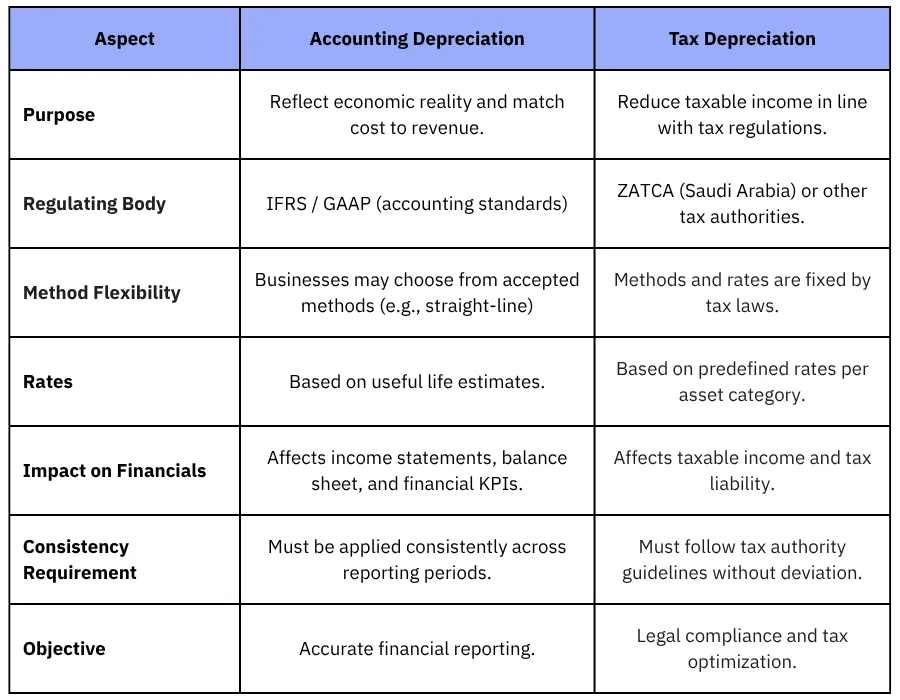

Key Differences Between Accounting and Tax Depreciation

Understanding these differences is crucial for preparing accurate tax returns for finance professionals, avoiding penalties, and optimizing the company’s tax position. While accounting depreciation and tax depreciation relate to an asset’s cost allocation over time, their purposes, rules, and impact on financial statements differ significantly.

One of the most important implications of these differences is the creation of temporary differences between book income and taxable income. These differences can result in deferred tax assets or liabilities, which need to be accounted for in the financial statements under IFRS or GAAP. For finance professionals and auditors, maintaining separate depreciation schedules, one for accounting and one for tax, is essential to ensure both regulatory compliance and financial accuracy.

Practical Example for Accounting and Tax Depreciation

Let’s look at how the same asset can be treated differently for accounting and tax purposes in Saudi Arabia.

Example 1: Delivery Vehicle Purchase

Example 1: Delivery Vehicle Purchase

Asset: Delivery Van

Cost: SAR 120,000

Purchase Date: January 1, 2023

Estimated Useful Life (Accounting): 5 years

Tax Depreciation Rate (ZATCA): 25% per year (declining balance)

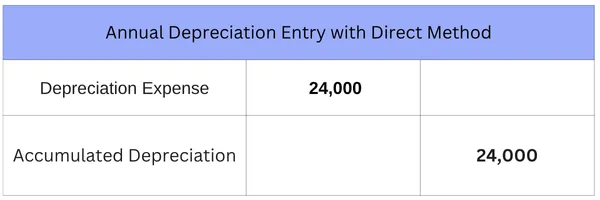

Accounting Depreciation Schedule (Straight-Line Method) Annual Depreciation: SAR 120,000 ÷ 5 = SAR 24,000 The Depreciation Expense is recorded in the income statement. The Accumulated Depreciation is a contra-asset account on the balance sheet, reducing the asset's net book value.

Tax Depreciation Schedule (Declining Balance Method):

-.png?alt=media)

Result:

Result:

In Year 1, accounting depreciation is SAR 24,000, while tax depreciation is SAR 30,000.

The difference of SAR 6,000 in tax depreciation reduces taxable income temporarily, creating a deferred tax liability.

Why does the Differentiation between Accounting and Tax Depreciation matter?

Ignoring the difference between the two types of depreciation may lead to errors in reporting, audit issues, or even regulatory penalties. Financial professionals must manage both streams precisely to maintain compliance and optimize the business’s financial position. Understanding the difference between accounting and tax depreciation isn’t just a technicality; it has real implications for:

- Financial Reporting Accuracy Accounting depreciation ensures assets are presented fairly in financial statements, which helps management, investors, and auditors assess business performance objectively.

- Tax Planning and Compliance Tax depreciation affects how much tax a company pays. Knowing the allowable methods and rates under ZATCA can help reduce tax liability legally and avoid penalties from non-compliance.

- Deferred Tax Accounting Differences in depreciation methods often result in temporary differences between accounting profit and taxable income. These differences must be tracked and reported as deferred tax assets or liabilities by IFRS (IAS 12).

- Cash Flow Management Faster depreciation for tax purposes leads to lower taxes in the early years, which improves short-term cash flow. This can be reinvested into operations or used to strengthen liquidity.

- Strategic Decision-Making For capital-intensive businesses, understanding how depreciation affects book and tax numbers when planning asset purchases, budgets, and financing is critical.

Best Practices for Managing Both Accounting and Tax Depreciation

To manage both accounting and tax depreciation effectively, finance professionals in Saudi Arabia should follow these best practices:

- Maintain Separate Schedules Always keep a separate depreciation schedule for financial reporting (based on IFRS) and tax reporting (based on ZATCA’s rules). This avoids confusion and ensures accurate calculations for each purpose.

- Use Reliable Accounting Software Use ERP or accounting systems (like Wafeq) that allow you to configure two parallel depreciation tracks, one for books and one for tax, and automate depreciation calculations.

- Understand ZATCA’s Categories and Rates Stay updated on ZATCA’s asset classifications and depreciation rates. Misclassifying an asset can lead to errors in tax filings or audits.

- Track Deferred Tax Impacts Using proper journal entries to record deferred tax liabilities or assets resulting from timing differences between accounting and tax depreciation.

- Reconcile Periodically At least annually, reconcile accounting depreciation and tax depreciation. Document the differences clearly to support audit trails and tax reviews.

- Document Assumptions Whether it’s the useful life, salvage value, or chosen depreciation method, maintain clear documentation for internal control and external audit readiness.

- Involve Tax Advisors Collaborate with tax advisors, especially for complex assets or when tax laws change. This helps you stay compliant and optimize tax benefits.

Also Read: How to handle Depreciation and Amortization for Fixed Assets and its application in Wafeq

Understanding the distinction between accounting depreciation and tax depreciation is essential for accurate reporting, regulatory compliance, and strategic financial planning. While accounting depreciation aligns with IFRS and provides a true picture of asset consumption for stakeholders, tax depreciation follows specific rules issued by ZATCA and directly affects taxable income. Finance professionals can ensure accuracy in both financial statements and tax filings by maintaining separate schedules, using reliable software, and periodically reconciling differences.

FQAs about Accounting and Tax Depreciation

What is the difference between useful life and economic life?

Useful life is the period during which the entity is expected to use the asset. Economic life is the total period the asset is expected to be productive, regardless of ownership. Accounting focuses on useful life, as it reflects the specific context of the reporting entity.

Is tax depreciation always different from accounting depreciation?

Not always, but often. Tax authorities (like ZATCA) provide specific rates and methods that may differ from IFRS provisions. These differences lead to temporary differences and require proper deferred tax accounting.

What are the depreciation rates under IFRS?

IFRS (specifically IAS 16) does not prescribe fixed depreciation rates. Instead, companies must estimate each asset's useful life and residual value based on expected usage, wear and tear, obsolescence, and legal or contractual limitations.

For example:

For example:

- Buildings: 20–40 years.

- Machinery: 5–15 years.

- Vehicles: 4–8 years.

- IT Equipment: 3–5 years. Each company must review these estimates at least annually.

How is depreciation calculated for fixed assets?

One common method is straight-line depreciation, calculated as:

Depreciation Expense= Cost−Residual Value ـــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــــ Useful Life (years)

Other methods include declining balance, sum-of-years-digits, and production units, depending on the nature of the asset and company policy.

Start managing your assets more effectively with tools designed for finance professionals. Wafeq can help you automate depreciation schedules for both books and tax easily.

Start managing your assets more effectively with tools designed for finance professionals. Wafeq can help you automate depreciation schedules for both books and tax easily.

.png?alt=media)