What is a reversing entry in accounting? And when is it used?

In accrual accounting, not all financial transactions are neatly confined within a single accounting period. At the end of each period, accountants record adjusting entries to ensure revenues and expenses are matched to the correct timeframe. However, some of these adjustments are temporary, and if not handled properly in the next period, they can lead to duplication and reporting errors. This is where reversing entries come in. Reversing entries are optional but are useful journal entries made at the beginning of a new accounting period. They reverse certain adjusting entries made at the end of the previous period to simplify bookkeeping and prevent double-counting.

We will explore reversing entries in this article, why they matter, and how they help maintain accounting accuracy, especially in fast-paced business environments or when using automated accounting systems.

What is Reversing Entry?

A reversing entry is a journal entry made at the beginning of a new accounting period to reverse or cancel out a specific adjusting entry made at the end of the previous period. Its main purpose is to simplify regular transactions in the new period without the risk of double-counting.

For example, if an accrued expense was recorded on December 31 to reflect a liability incurred but not yet paid, a reversing entry on January 1 will cancel that accrual. When the actual expense is paid in January, it can be recorded as a regular transaction without special treatment.

For example, if an accrued expense was recorded on December 31 to reflect a liability incurred but not yet paid, a reversing entry on January 1 will cancel that accrual. When the actual expense is paid in January, it can be recorded as a regular transaction without special treatment.

Reversing entries are typically used for accrued expenses and accrued revenues. They are helpful, especially in companies where different people handle end-of-period adjustments and daily bookkeeping.

Why are Reversing Entries Used?

Reversing entries are not mandatory in accounting, but they provide several operational advantages that make them highly recommended in practice, especially for companies using accrual accounting. Reversing entries are especially valuable in organizations where different teams manage month-end closing and daily operations, to ensure continuity and clarity in the accounting cycle.

Key reasons to use reversing entries:

- Simplifies bookkeeping Reversing temporary accruals allows regular transactions in the new period to be recorded without additional complexity or confusion.

- Avoids double-counting Without reversing entries, recording a payment for an already accrued expense may result in overstating expenses.

- Reduces manual intervention Bookkeepers don’t need to remember which transactions were already adjusted; they can proceed with normal entries.

- Supports automation Many modern accounting systems, like Wafeq, allow automatic reversal of entries, reducing the chance of human error.

Types of Adjusting Entries Commonly Reversed

Not all adjusting entries should be reversed. Reversing entries are typically used with specific accrual entry types that are temporary and will be settled shortly in the next period. Below are the most common types:

Commonly Reversed:

- Accrued Expenses Expenses that have been incurred but not yet paid by the end of the period (e.g., salaries, utilities). These are the most frequent candidates for reversal.

- Accrued Revenues Revenues that have been earned but not yet received. Reversing the entry prevents recognizing the same income twice, once payment is collected.

Sometimes Reversed:

- Prepaid Expenses They are usually adjusted over time, but the reverse may be applied in certain situations (e.g., temporary reclassifications)

- Unearned Revenues Typically, they aren't reversed because revenue recognition is tied to the actual delivery of goods or services. However, if initially recorded incorrectly, reversal may be needed.

Not Reversed:

These are permanent or estimate-based entries and should not be reversed:

- Depreciation adjustments.

- Bad debt allowances.

- Inventory adjustments.

How to Record a Reversing Entry with an example

Recording a reversing entry is a straightforward process, but it requires consistency and precision. Here's how it works in practice:

Step-by-Step Example:

Step-by-Step Example:

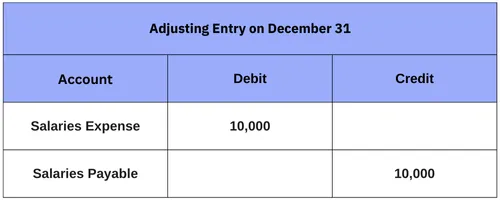

Let’s assume your company accrued SAR 10,000 in salaries payable at year-end:

The following entry reflects the expense incurred in December, even though it will be paid in January.

The following entry cancels the original adjusting entry to clear the payable from the books.

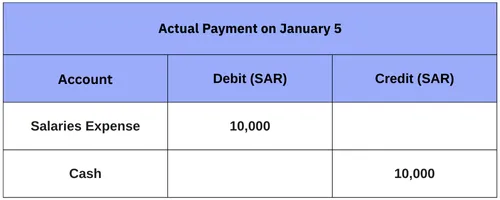

Because the reversing entry cleared the payable, you can now record the existing payment as a normal transaction.

Modern accounting software like Wafeq allows users to mark adjusting entries as reversible, and the system will automatically generate the reversing entry on the first day of the new period. This saves time and reduces errors.

Modern accounting software like Wafeq allows users to mark adjusting entries as reversible, and the system will automatically generate the reversing entry on the first day of the new period. This saves time and reduces errors.

Benefits of Reversing Entries

Although reversing entries are optional, they offer significant benefits for maintaining clarity and efficiency in the accounting process. Key benefits are:

- Reduces errors Reversing entries prevent duplicate expense or revenue recognition by eliminating temporary accruals early.

- Simplifies transaction recording| Daily transactions can be recorded as usual, without special handling of previously adjusted accounts.

- Improves coordination between teams When different people handle adjusting entries and regular bookkeeping, a reversing entry ensures continuity and reduces miscommunication.

- Supports automation and faster closings Accounting systems that automate reversing entries help speed up the process of month-end or year-end closing.

- Enhances financial accuracy Avoids misstatements in financial statements by ensuring each transaction is only recorded once and in the correct period.

When Not to Use Reversing Entries?

While reversing entries are useful, they are not suitable for all adjusting entry types. Incorrect use can result in inaccurate financial reporting. Avoid reversing entries in these cases:

- Non-temporary adjustments Entries related to depreciation, amortization or bad debt allowances, are ongoing and based on estimates. Reversing them would distort the financial picture.

- Revenue recognition tied to delivery Unearned revenue or partial deliveries should not be reversed unless the original entry was incorrect. Reversal can lead to premature revenue recognition.

- Inventory-related adjustments Adjustments based on physical counts or inventory valuation changes should not be reversed, as they reflect real conditions at period-end.

- Permanent reclassifications If an adjusting entry involves a permanent change in account classification (e.g., reclassifying a long-term asset), it should not be reversed.

How Automation helps in recording reversing entries

Manual reversing entries can be time-consuming and prone to errors, especially in growing organizations or companies closing monthly books. Automation solves this by ensuring accuracy, speed, and consistency.

- Auto-generation of reversing entries Modern accounting systems like Wafeq allow users to flag adjusting entries as "reversible." The system will automatically create the reversing entry at the start of the next period.

- Reduces manual workload No need to revisit or recreate entries every month. Automation frees up accountants to focus on analysis rather than repetitive data entry.

- Improves accuracy and compliance Automated entries eliminate the risk of double-posting or missing a reversal, helping ensure financial statements reflect the correct period.

- Audit trail and visibility Every reversing entry is linked to its original adjustment, creating a clear audit trail for internal and external reviewers.

- Supports timely closings With automated reversals, teams can close the books faster, enabling timely financial reporting.

Example:

Example:

When closing December books, you record SAR 15,000 in accrued utilities. By marking the entry as reversible in Wafeq, the system creates the opposite entry automatically on January 1, no manual intervention needed.

Best Practices for Using Reversing Entries

The reversing entries are a powerful tool in accrual-based accounting that help streamline the transition between periods, reduce errors, and simplify daily bookkeeping. While not all adjusting entries should be reversed, using them correctly can improve efficiency and accuracy.

- Only reverse temporary accruals like accrued expenses and revenues.

- Use automated features in your accounting system (e.g., Wafeq) to handle reversing entries systematically.

- Document each adjusting entry, noting whether it should be reversed.

- Ensure coordination between the month-end and the daily bookkeeping teams to avoid conflicts.

- Never reverse permanent or estimate-based entries like depreciation or bad debt provisions.

Also Read: Understanding Accounting Entries: A Comprehensive Guide.

When used properly, reversing entries help maintain a clean, organized ledger, saving time, reducing confusion, and supporting accurate financial reporting.

Say goodbye to manual reversing entries. With Wafeq, you can automate your adjusting and reversing entries with just a click, ensuring accuracy, saving time, and keeping your books audit-ready at any time.

Say goodbye to manual reversing entries. With Wafeq, you can automate your adjusting and reversing entries with just a click, ensuring accuracy, saving time, and keeping your books audit-ready at any time.

.png?alt=media)