Understanding Closing Entries in Accounting: Importance, How to Use and Implement in Wafeq

At the end of each financial period, whether monthly, quarterly, or annually, accountants perform a series of steps to ensure the financial records accurately reflect the business's performance. One of the most critical of these steps is executing closing entries. Closing entries are a vital part of the accounting cycle. They serve the primary purpose of resetting temporary account balances, such as revenue and expense accounts, to zero, allowing for a fresh start in the next period. This process ensures that income and expense data from one period do not mix with those of another, preserving the accuracy of financial statements.

This article provides a comprehensive guide to closing entries: what they are, why they matter, how to prepare them, common mistakes to avoid, and how to perform them efficiently using Wafeq.

What are Closing Entries in Accounting?

Closing entries are journal entries made at the end of an accounting period to transfer the balances of temporary accounts to a permanent account, usually the retained earnings account (for corporations) or the capital account (for sole proprietorships). Temporary accounts include:

- Revenue accounts (e.g., Sales, Service Revenue)

- Expense accounts (e.g., Rent Expense, Salaries Expense)

- Drawings or Dividends (owner withdrawals or shareholder dividends)

- Income Summary account (used temporarily to summarize profit or loss)

These accounts are called “temporary” because they accumulate balances only for a specific accounting period. At the end of the period, their balances must be reset to zero so that the business can track income and expenses anew for the next period. This reset is what closing entries achieve. On the other hand, permanent accounts, such as assets, liabilities, and equity, carry their balances forward into the next period without being closed.

These accounts are called “temporary” because they accumulate balances only for a specific accounting period. At the end of the period, their balances must be reset to zero so that the business can track income and expenses anew for the next period. This reset is what closing entries achieve. On the other hand, permanent accounts, such as assets, liabilities, and equity, carry their balances forward into the next period without being closed.

Key Characteristics of Closing Entries:

- Always prepared after the trial balance and the adjusting entries.

- Ensure that the income statement's accounts reflect only the revenue and expenses of a single period.

- Transfer the period’s net income (or loss) to the equity section of the balance sheet.

- Maintain the integrity of financial reporting across periods.

Example:

Example:

If a business earns SAR 50,000 in service revenue and incurs SAR 30,000 in expenses, the closing entries would look like this:

Why Are Closing Entries Necessary in Financial Accounting?

Closing entries are a foundational practice in financial accounting. Without them, the accounting records would accumulate income and expense data across multiple periods, making it difficult to measure the business's performance over distinct intervals. Below are the key reasons why closing entries are essential:

1. Resetting Temporary Accounts to Zero Revenue and expense accounts must start from zero at the end of each accounting period. This is because each period's performance must be measured independently. If these balances aren't reset, the new period would carry over old data, distorting financial analysis.

Example: If sales revenue from Q1 remains in the account during Q2, the income statement will overstate the revenue of Q2.

Example: If sales revenue from Q1 remains in the account during Q2, the income statement will overstate the revenue of Q2.

2. Accurate Calculation of Net Profit or Loss By closing revenue and expense accounts into the Income Summary account, accountants calculate the net result of operations for the period. This result (profit or loss) is then transferred to Retained Earnings or Capital, updating the business's equity. 3. Ensuring Consistency Across Financial Statements Closing entries help maintain consistency and comparability in financial reporting. Each income statement should reflect only what occurred during its respective period. Without closing entries, financial statements may include mixed-period data, violating accounting principles. 4. Compliance and Audit Readiness In jurisdictions like Saudi Arabia, regulatory bodies such as ZATCA require clear and accurate records of each financial period. Properly executed closing entries support VAT filing accuracy, audit preparation, corporate income tax calculations, and Zakat reporting. 5. Enabling a Fresh Start for the New Period Once closing entries are posted, temporary accounts return to zero, and permanent accounts reflect the updated equity position. This creates a clean slate for entering transactions in the next period, and supports internal budgeting and forecasting.

Also Read: The difference between a settlement entry and an adjustment entry.

Step-by-Step Process of Preparing Closing Entries

Preparing closing entries is a systematic process that comes at the end of the accounting cycle, after all regular and adjusting entries have been posted. Below is a step-by-step guide to ensure closing entries are executed properly:

1. Review the Trial Balance After Adjustments Ensure that all adjusting entries (like depreciation, accruals and prepayments) have been recorded. The adjusted trial balance becomes the starting point for closing entries. 2. Close Revenue Accounts to Income Summary Each revenue account is debited (to zero its balance), and the total is credited to the Income Summary account.

Example:

Example:

Dr. From Acc/ Service Revenue SAR 50,000

Cr. To Acc/ Income Summary SAR 50,000

3. Close Expense Accounts to Income Summary Each expense account is credited (to zero its balance), and the total is debited to the Income Summary account.

Example:

Example:

Dr. From Acc/ Income Summary SAR 30,000

Cr. To Acc/ Salaries Expense SAR 18,000

Cr. To Acc/ Rent Expense SAR 12,000

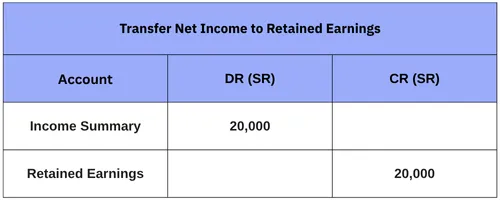

4. Close Income Summary to Retained Earnings (or Capital) Now that the Income Summary contains the net income or loss, transfer that balance to the Retained Earnings account.

If Net Income:

If Net Income:

Dr. From Acc/ Income Summary SAR 20,000

Cr. To Acc/ Retained Earnings SAR 20,000

If Net Loss:

Dr. From Acc/ Retained Earnings SAR 10,000

Cr. To Acc/ Income Summary SAR 10,000

5. Close Dividends or Drawings (if applicable) If dividends (for corporations) or drawings (for sole proprietorships) were recorded during the period, these are closed directly to Retained Earnings or Capital.

Example (Dividends):

Example (Dividends):

Dr. From Acc/ Retained Earnings SAR 5,000

Cr. To Acc/ Dividends SAR 5,000

Important Tips:

Important Tips:

- Never close permanent accounts like Cash, Accounts Receivable, or Equity balances.

- Always double-check that all temporary accounts have a zero balance after closing.

- Keep documentation of closing entries for audit and compliance.

How to Close an Accounting Period in Wafeq

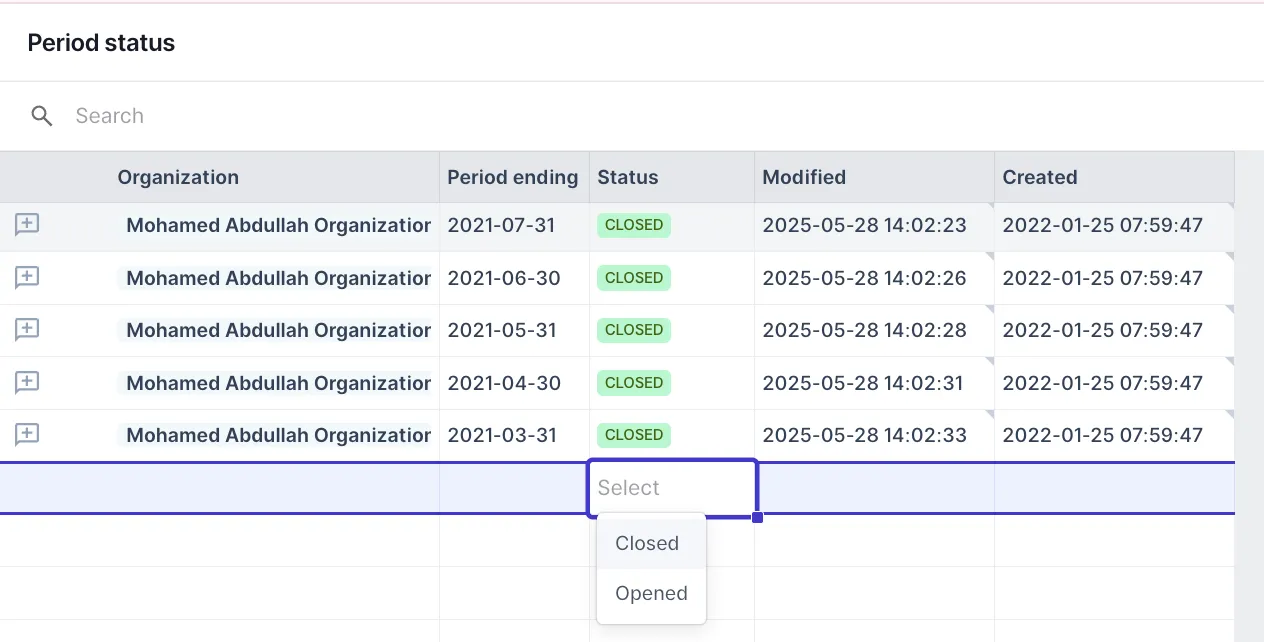

ّt’s essential to close accounting periods to prevent any changes to the books, especially after submitting tax returns or completing a financial year-end audit. This helps preserve the accuracy and integrity of your records. Follow these steps to close a period in Wafeq:

- Go to your organization’s workspace Log in to Wafeq and select the relevant organization from the homepage.

- Access the Period Closing feature

From the left-side menu, click on

Lock Period.

3. Add a new period lock Start to add a new Lock period to initiate a new closing entry. 4. Select the organization Choose the specific organization for which you want to close the period. 5. Choose the closing date

- Set the date by which the books should be locked, then select

Closedunder the status field to activate the closure. Note: Any attempt to add transactions dated before the closing date will be automatically rejected.

Common Mistakes to Avoid When Making Closing Entries

Even experienced accountants can make errors when preparing or executing closing entries. These mistakes can lead to inaccurate financial statements, compliance issues, or difficulties during audits. Here are some common pitfalls and how to avoid them:

- Not Reviewing Adjusting Entries First Skipping the adjusting entries stage can result in closing incorrect balances. So the solution is always to finalize depreciation, accruals, and provisions before creating closing entries.

- Closing Permanent Accounts by Mistake Accidentally zeroing out accounts such as Cash or Accounts Payable disrupts continuity. Only temporary accounts (revenues, expenses, dividends/drawings) should be closed.

- Forgetting to Close Dividend or Drawing Accounts Leaving dividends or drawings unclosed, misstates equity , or retained earnings. So the accountant should always close these accounts to the Capital or Retained Earnings account.

- Not Locking the Accounting Period After Closing Users may unintentionally post entries to a closed period. Use Wafeq’s period locking feature immediately after posting closing entries.

- No Documentation or Audit Trail Lack of clear documentation may raise audit red flags. Save all journal entries and maintain internal notes in Wafeq for transparency.

Final Checklist Before Closing the Period

Before executing your closing entries and locking the accounting period in Wafeq, it's essential to perform a structured review to avoid errors and ensure accurate financial reporting. Below is a final checklist that finance professionals should use:

- General Ledger and Journal Entries ✓ All regular journal entries are posted (e.g., purchases, sales, payments). ✓ All adjusting entries are recorded (e.g., depreciation, accruals, provisions). ✓ No unposted or draft entries remain in the system.

- Trial Balance ✓ Generate an Adjusted Trial Balance. ✓ Ensure total debits = total credits. ✓ Investigate and resolve any abnormal balances (e.g., negative inventory or overdrawn accounts).

- Reconciliation ✓ Bank accounts are fully reconciled. ✓ Vendor and customer balances are confirmed. ✓ Inventory records match the general ledger.

- Review of Temporary Accounts ✓ Revenue and expense accounts are complete and properly classified. ✓ Dividends or owner drawings are recorded (if applicable). ✓ One-time or extraordinary items are flagged and documented.

- Compliance and Audit Readiness ✓ VAT entries and returns are submitted and matched. ✓ Supporting documents are attached where required. ✓ Internal review or management approval of closing entries is complete.

- System Checks in Wafeq ✓ Period lock settings are correctly configured. ✓ All users informed of the locked period to prevent backdated entries. ✓ Reports are exported and stored securely (PDF, Excel, or system backup).

Also Read: Understanding Accounting Entries: A Comprehensive Guide.

Closing entries are more than just a procedural formality; they are a critical step in the accounting cycle process that ensures the accuracy, reliability, and completeness of financial records. By resetting temporary accounts and finalizing the books for a given period, businesses can accurately measure performance through the income statement, prepare the balance sheet for the start of the next period, comply with tax and audit requirements, and protect historical data by locking past periods from further modification.

In Wafeq, the closing process is streamlined and secure, allowing financial professionals to maintain full control and audit readiness with minimal effort. Whether you're a CFO, an external auditor, or a small business accountant, mastering closing entries helps reinforce transparency, discipline, and compliance in your financial reporting.

Frequently Asked Questions (FAQs) about Closing Entries:

What types of accounts are affected by closing entries?

Closing entries only affect temporary accounts such as revenues, expenses, drawings, or dividends. Permanent accounts like assets, liabilities, and equity remain unchanged.

Can I edit or reverse a closing entry in Wafeq?

Yes. If the period is still unlocked, you can reverse or delete the closing journal entry. However, once the period is locked, no further changes can be made unless it is manually reopened by an authorized user.

Do I need to create closing entries Monthly or yearly?

It depends on your reporting needs, as many companies close entries monthly for internal reporting and yearly for official financial statements and audits.

What happens if I don’t close the period?

- If closing is skipped, Revenue and expense accounts will accumulate over multiple periods, financial statements will be inaccurate, and there is a risk of non-compliance with tax and audit requirements.

Strong financial reporting starts with a disciplined period closing.

Strong financial reporting starts with a disciplined period closing.

Wafeq can help your finance team implement accurate and secure closing entries, comply with audit requirements, and streamline your end-of-period processes.

.png?alt=media)