How to Record Earned Discounts in Accounting

Have you ever wondered why paying your supplier a little earlier could make your business more profitable, actually? This is where, in accounting, the concept of earned discounts comes into play. These discounts are more than just small savings—they reflect smart financial management that directly affects your cash flow, expenses, and overall profitability. Understanding how to record them properly can make a significant difference in the accuracy of your financial statements. In this article, we’ll explore what earned discounts are, why they matter, and how they are treated in accounting—with practical examples and expert insights to guide you through the process.

What is an Earned Discount?

An earned discount is a decrease in the amount payable to a supplier when a buyer meets specific conditions, usually related to early payment of invoices under credit terms.. In other words, when a company pays its supplier before the due date stated on the invoice, it may be rewarded with a financial discount. This discount is referred to as earned because the buyer has actively complied with the agreed-upon terms, typically by paying earlier than required.

For example,

For example,

If an invoice states “2/10, net 30,” the buyer is entitled to a 2% discount if payment is made within 10 days.

If the full invoice amount is due without a discount, the payment is made after 10 days but before 30 days. The 2% reduction, if taken, is what we call the earned discount.

It is important to distinguish earned discounts from trade discounts. While trade discounts are reductions in the listed price offered upfront and usually not recorded separately in accounting books, earned discounts are directly tied to payment behavior and must be recorded properly in the accounting system.

In accounting terms, earned discounts are typically treated as a reduction in the cost of purchases (for the buyer) or a reduction in revenue (for the seller), depending on the perspective. This makes them an essential element of accurate expense recognition and financial reporting.

How can Earned Discounts Improve Cash Flow and Profitability?

Earned discounts are not just minor savings on invoices; they carry broader financial and strategic importance for businesses. Properly leveraging these discounts can improve a company’s financial health, enhance supplier relationships, and reflect positively on its reputation for financial discipline. Here are the key reasons why earned discounts matter:

- Cash Flow Optimization Paying suppliers early to take advantage of earned discounts reduces overall expenses. Even a 2% discount on regular purchases can accumulate into significant annual savings, freeing up resources that can be redirected toward growth or investment.

- Improved Profitability Earned discounts directly increase gross margins by lowering the cost of goods purchased. This is especially valuable for businesses operating in competitive industries where margins are tight.

- Strengthening Supplier Relationships Consistently taking advantage of early payment discounts signals reliability and trustworthiness to suppliers. This often leads to stronger business relationships, preferential treatment, or even better terms in the future.

- Financial Efficiency and Discipline Properly tracking and recording earned discounts reflects strong internal controls and efficient cash management practices. It demonstrates that a business is reducing costs and also strategically managing working capital.

- Competitive Advantage Businesses that actively manage earned discounts can price their products or services more competitively because of reduced input costs, giving them an edge over competitors who miss these opportunities.

How to Record Earned Discounts in Accounting Journal Entries[With Practical Example]

Earned discounts must be recognized properly to ensure accurate expense and revenue reporting from an accounting perspective. There are two common methods of recording earned discounts: the gross and the net methods.

1. Gross Method

Under the gross method, purchases are initially recorded at the full invoice amount. If the company pays early and qualifies for a discount, the earned discount is recognized at the time of payment.

Example:

Example:

A company purchases goods worth 10,000 SAR on credit.

Terms: “2/10, net 30” (2% discount if paid within 10 days). The company pays within 10 days.

Journal Entries at purchase:

Journal Entries at purchase:

DR CR

Purchases (Inventory) 10,000

Accounts Payable 10,000

Journal Entries at payment within the discount period:

Journal Entries at payment within the discount period:

DR CR

Accounts Payable 10,000

Cash 9,800

Purchase Discounts Earned 200

- Here, the 200 SAR represents the earned discount, reducing the cost of purchases.

2. Net Method

Under the net method, purchases are recorded at the net amount (assuming the discount will be taken). If the company fails to pay within the discount period, the lost discount is recorded as an expense.

Example:

Example:

Using the same transaction above (10,000 SAR, 2/10, net 30).

Journal Entries (assuming discount will be taken) at purchase:

DR CR

Purchases (Inventory) 9,800

Accounts Payable 9,800

Journal Entries at payment within the discount period:

Journal Entries at payment within the discount period:

DR CR

Accounts Payable 9,800

Cash 9,800

Journal Entries if the company misses the discount and pays after 10 days:

Journal Entries if the company misses the discount and pays after 10 days:

DR CR

Accounts Payable 9,800

Purchase Discounts Lost 200

Cash 10,000

- The lost discount is considered a financing cost, showing inefficiency in cash management.

Key Point:

Key Point:

Both methods are acceptable, but the gross method is more common in practice as it provides flexibility and records discounts only when earned.

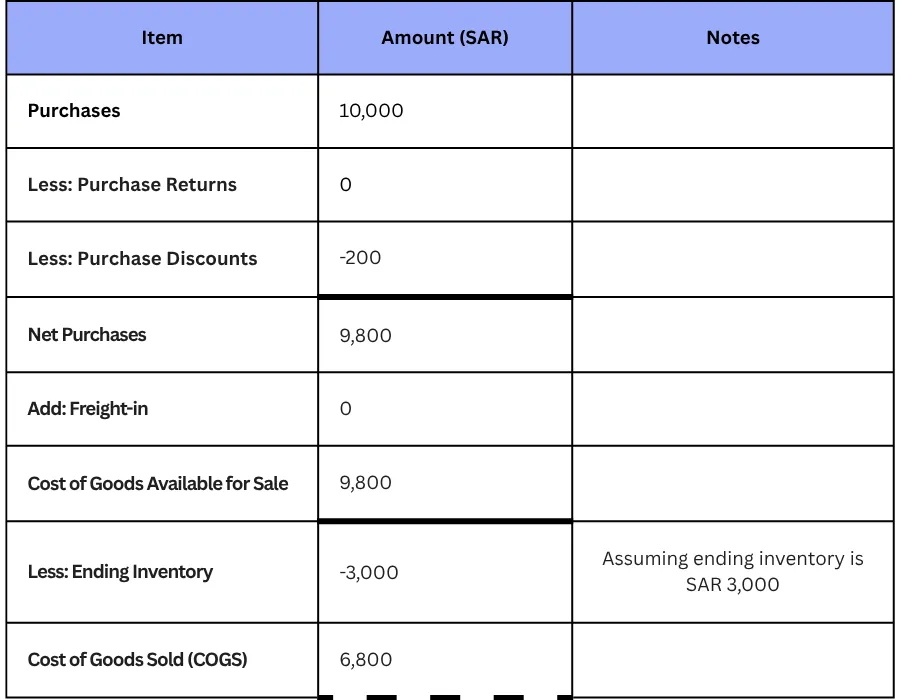

How Purchase Discounts Affect COGS

Although the journal entries differ, both methods eventually impact the net cost of inventory and therefore the Cost of Goods Sold (COGS). While purchase discounts are not presented as a separate line in external financial statements, they are included in the internal calculations that lead to the final COGS figure. In the detailed breakdown of COGS, purchase discounts typically reduce the total cost of purchases.

Here's how purchase discounts are reflected in the COGS Schedule (when tracked internally):

Here's how purchase discounts are reflected in the COGS Schedule (when tracked internally):

COGS = Beginning Inventory + Purchases − Purchase Returns − Purchase Discounts + Direct Expenses − Ending Inventory

- Note: The COGS Schedule is often part of the internal accounting records and may be reviewed during audits to support the figures reported in the financial statements.

know more about: Understanding COGS: How to Calculate and Use It for Better Financial Decisions

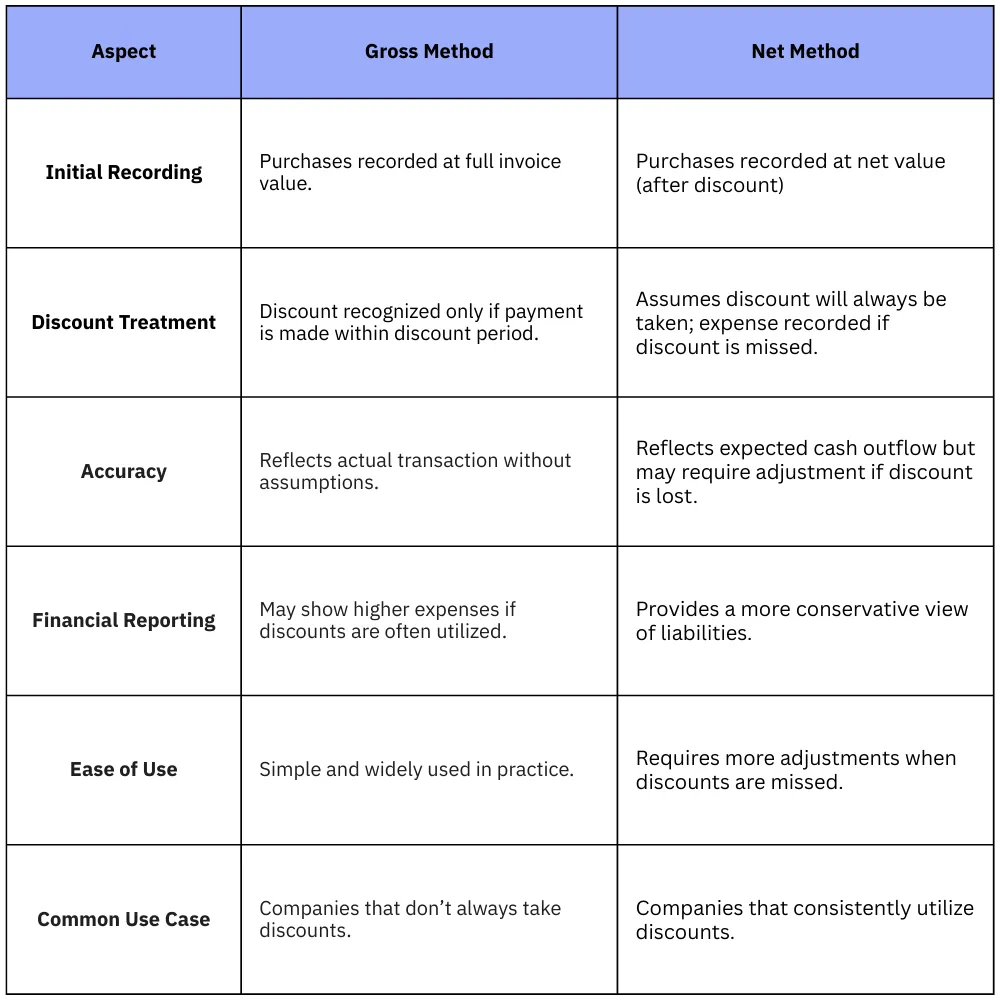

Comparison and Analysis of Gross vs. Net Method in Earned Discounts

Accountants often debate whether the gross or the net method provides a more accurate reflection of financial transactions. Each approach has its strengths and limitations, and the choice usually depends on a company’s accounting policies, reporting requirements, and internal control preferences. To simplify the evaluation, the table below highlights the key differences between the two methods.

Impact of Earned Discounts on Financial Statements

Earned discounts reduce costs and also influence how financial performance and position are presented in the statements. Understanding their impact ensures that businesses maintain accurate financial reporting and compliance with accounting standards.

- Income Statement Earned discounts are generally recorded as a reduction in the cost of purchases or cost of goods sold (COGS). This reduces expenses and ultimately increases gross profit. For sellers, offering earned discounts lowers reported revenue, but it can also accelerate cash inflows.

- Balance Sheet On the buyer’s side, when an earned discount is taken, the liability (Accounts Payable) decreases because the company pays less than the original invoice amount. This strengthens the balance sheet by reducing short-term obligations. For the seller, the Accounts Receivable balance decreases by the discounted amount, reflecting the decreased cash inflow expected.

- Cash Flow Statement For buyers, taking earned discounts leads to lower cash outflows, which improves operating cash flow. This additional liquidity can be reinvested or used to meet other obligations. For sellers, granting earned discounts results in faster cash inflows, which enhances cash flow timing, even though the total collected is slightly lower.

Accounting Common Errors in Recording Earned Discounts

While earned discounts are straightforward in concept, many businesses make mistakes when recording them in their accounting systems. These errors can distort financial statements and misrepresent a company’s actual financial performance. The most common mistakes include:

- Misclassifying Discounts as Revenue Some businesses mistakenly record earned discounts as additional income. In reality, these discounts are a reduction of expenses (for buyers) or sales revenue (for sellers), not separate income streams.

- Failure to Apply the Correct Method Companies often mix the gross and the net method, leading to inconsistent reporting. Each method has its own logic, and switching between them without a clear policy creates confusion in financial reporting.

- Timing Errors Recording the discount at the wrong time, such as recognizing it before payment is actually made, can cause discrepancies in both Accounts Payable and Accounts Receivable balances. Discounts should only be recorded when the conditions (such as early payment) are truly met.

- Ignoring Discounts in Accrual Accounting In accrual-based accounting, some businesses fail to account for discounts earned but not yet recognized at the reporting date. This can lead to understated expenses and overstated liabilities.

- Not Reconciling with Supplier Statements If discounts are not properly tracked and reconciled with supplier statements, companies may miss discounts they are entitled to, or worse, create mismatches that lead to supplier disputes.

How Wafeq Simplifies the Accounting of Earned Discounts

Managing earned discounts manually can be time-consuming and prone to error, especially when handling a large number of invoices. Wafeq’s smart accounting software automates the process of recording purchase discounts, applying the correct journal entries, and ensuring compliance with IFRS and local regulations in Saudi Arabia and the wider GCC. With Wafeq, businesses can:

- Automatic Discount Recognition that detects supplier payment terms (e.g., 2/10, net 30) and applies discounts when payments are made within the period.

- Error-Free Journal Entries through automatic generation of accurate journal entries for earned discounts, eliminating manual errors.

- Integrated Cash Flow Tracking using reminders to notify users of supplier deadlines to maximize discount opportunities and improve cash flow.

- Advanced Reporting so discounts earned appear in financial reports for clear visibility and better decision-making.

- Seamless Multi-Entity Support for businesses managing multiple entities, Wafeq applies discount accounting consistently across all branches.

Know how to add a discount to an invoice total

Also Read: Understanding Accounting Journals: Key Concepts and How to Record.

Earned discounts may seem like small percentages, but they impact a company’s profitability, cash flow, and financial reporting. Whether you record them using the gross or the net method, consistency and clarity in accounting treatment are essential. By understanding how to journalize these discounts and their effect on the income statement and balance sheet, finance professionals can make better decisions and ensure compliance with accounting standards.

FAQs about Earned Discounts in Accounting

What is an earned discount in accounting?

An earned discount is the financial benefit a buyer receives for paying a supplier within a specified discount period. Based on accounting policy, it reduces the cash outflow and is recognized as income or a reduction in purchase costs.

How is an earned discount recorded in journal entries?

Under the gross method, purchases are recorded at full value, and the discount is recorded separately when taken. Under the net method, purchases are recorded net of the discount from the start, and adjustments are made if the discount is missed.

Is an earned discount considered income or an expense?

Earned discounts are generally considered income, as they reduce the cost of goods purchased. Practically, they may be presented either as “Other Income” or deducted from the purchase cost, depending on accounting policies.

What is the difference between an earned discount and a trade discount?

A trade discount is a reduction in price granted at the time of sale and not recorded in the books—it simply reduces the invoice value. An earned discount (cash discount) is recorded only when payment is made within the discount period.

How does an earned discount affect the income statement?

An earned discount reduces the total purchase cost, which ultimately lowers the cost of goods sold (COGS). This increases the company’s gross profit. If recorded as “Other Income,” it boosts net income directly.

How does an earned discount affect the balance sheet?

Earned discounts on the balance sheet reduce accounts payable (liabilities) since the company pays less than the full invoice amount. If recorded as income, they also increase retained earnings under equity.

Which method is better: gross method or net method for earned discounts?

The gross method is simpler and widely used, especially for companies that don’t always take discounts. The net method provides a more accurate picture of expected payments but requires adjustments if discounts are missed. The choice depends on company policy and consistency.

Are earned discounts the same as purchase discounts?

Yes, the term purchase discount is often used interchangeably with earned discount. Both refer to the discount received by buyers for early payment.

Can earned discounts apply to services, or only goods?

While most earned discounts are tied to goods purchased on credit, they can also apply to services if the supplier offers early payment terms. The accounting treatment remains the same.

How do international accounting standards (IFRS/GAAP) treat earned discounts?

Both IFRS and GAAP require companies to record earned discounts consistently. Under IFRS, discounts are typically deducted from the cost of purchases. GAAP allows recognition either as a reduction of purchases or as other income, but consistency must be maintained.

From managing earned discounts to automating journal entries, Wafeq helps you stay compliant, save time, and focus on growing your business confidently.

From managing earned discounts to automating journal entries, Wafeq helps you stay compliant, save time, and focus on growing your business confidently.

.png?alt=media)