EBITDA: Calculation, Meaning, And Traits

EBITDA is liked and condemned by many at the same time, but why is this relatively simple indicator so controversial? Read on to find out everything you need to know about the matter and see whether EBITDA is something your firm can take advantage of.

EBITDA meaning

Earnings before interest, taxes, depreciation, amortization, or EBITDA, is an alternative metric to net income for profitability.

It is widely used in financial analysis as a measure of a company's operational performance.

EBITDA aims to reflect the cash profit generated by a company's core operations by eliminating non-cash depreciation and amortization expenses, taxes, and debt charges that are influenced by the capital structure. This makes it a useful tool for comparing the profitability of companies across industries and sectors.

Some publicly traded corporations include adjusted EBITDA statistics in their quarterly reports, which generally exclude extra expenses like stock-based compensation. This practice is meant to provide a clearer picture of the underlying business performance.

EBITDA has received more attention from businesses and investors, leading to criticisms that it can exaggerate a company's profitability. However, when used correctly, EBITDA can be a powerful tool for financial analysis.

Main takeaways

- EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) is a commonly used indicator of fundamental company performance.

- EBITDA is determined by leaving interest, tax, depreciation, and amortization costs in the firm's net income.

- EBITDA enables investors to evaluate organizational profitability after costs in light of choices made about financing, tax planning, and discretionary depreciation schedules.

- EBITDA is considered useless by some, including Warren Buffett since capital expenses are excluded.

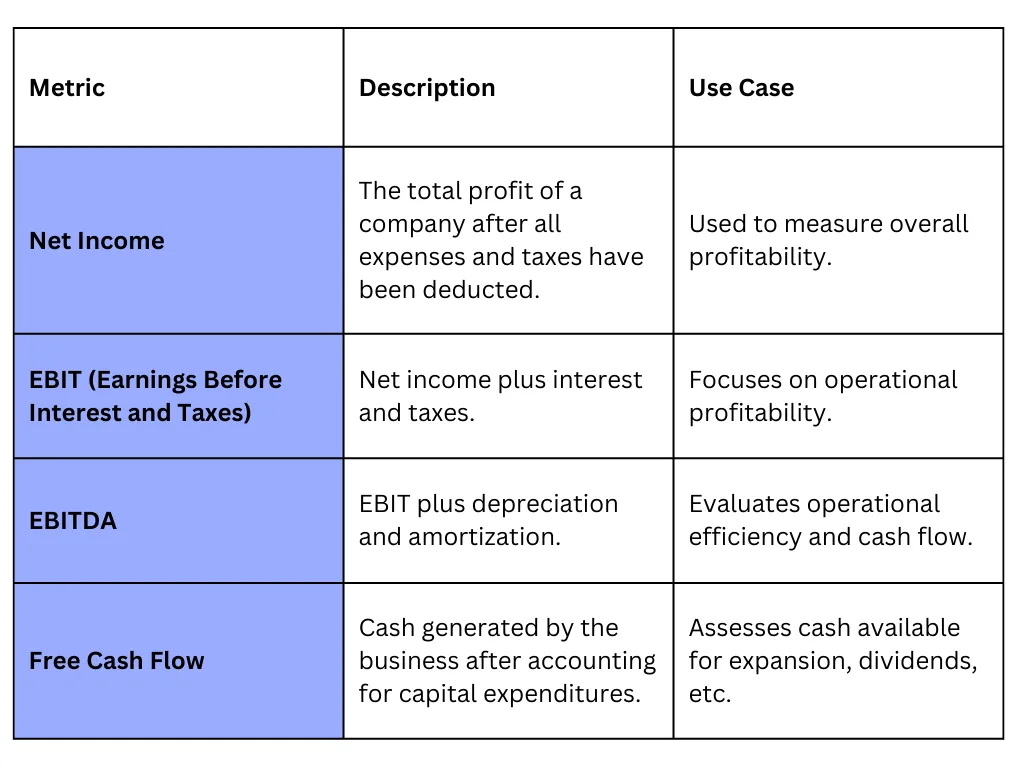

Comparing EBITDA with Other Financial Metrics

To understand EBITDA better, let's compare it to other key financial metrics:

Formulas and Calculations for EBITDA

Even if it is not reported, EBITDA may be easily determined from a company's financial records. Depreciation and amortization data are often presented in the footnotes to operating profit or on the cash flow statement, whereas profits (net income), tax, and interest figures are provided on the income statement.

Starting with operating profit, also known as earnings before interest and taxes (EBIT), and then adding back depreciation and amortization is the standard method for computing EBITDA.

EBITDA is calculated using two different formulas, one based on operating income and the other on net income. The corresponding EBITDA formulas are:

EBITDA formulas

EBITDA = Operating Income + Depreciation & Amortization

and

EBITDA = Net Income + Interest Expense + Depreciation & Amortization + Taxes

Read more about Revenue vs. Income.

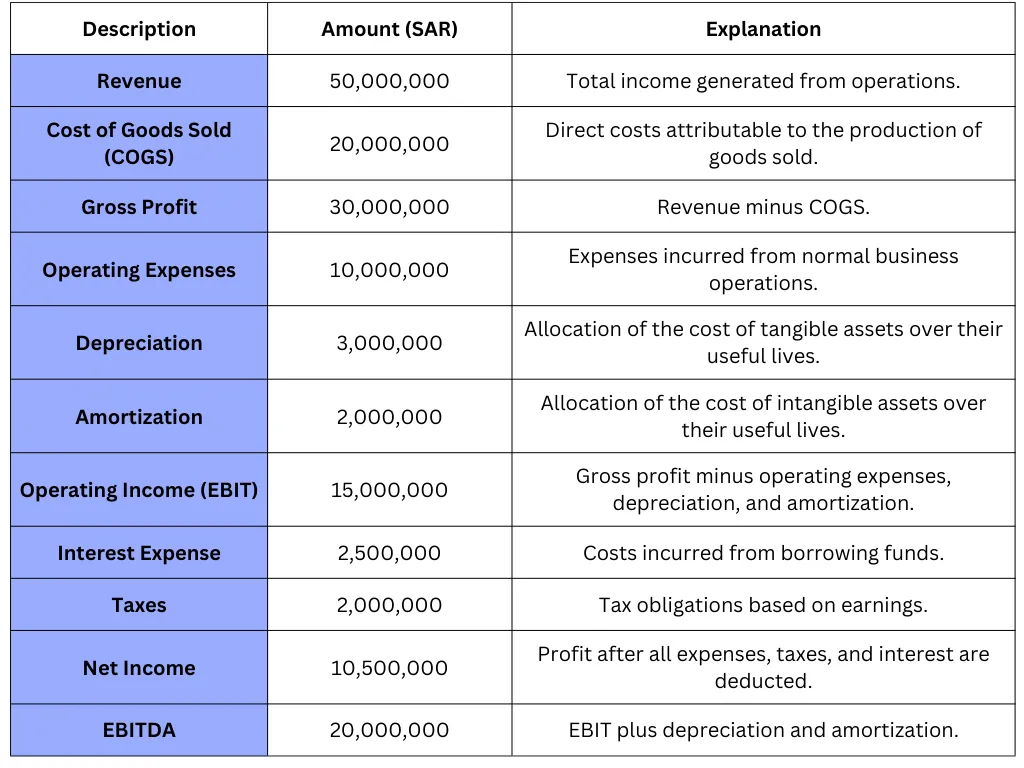

Detailed Calculation Example

Let's illustrate how to calculate EBITDA using a practical example:

Recognizing EBITDA

EBITDA is net income (profits) plus the reimbursable costs of interest, taxes, depreciation, and amortization. Regardless of the depreciation assumptions or financing strategies utilized by the firms, EBITDA may be used to analyze and compare the underlying profitability of those companies.

EBITDA is frequently employed in valuation ratios, similar to profits, most notably in conjunction with enterprise value as EV/EBITDA, commonly referred to as the enterprise multiple.

In the study of asset-intensive sectors with a lot of property, plant, and equipment and consequently large non-cash depreciation expenses, EBITDA is very often utilized. In some industries, the expenses that EBITDA does not include may mask changes in underlying profitability, as is the case, for instance, with energy pipelines.

Meanwhile, amortization is frequently used to deduct the cost of creating software or other intellectual property. EBITDA is one of the metrics used by early-stage technology and research businesses to describe their success.

Operational performance may not be correlated with annual changes in tax assets and liabilities that must be reported on the income statement.

Interest rates, debt levels, and management choices between debt and equity financing all affect interest expenses. The focus remains on the cash earnings produced by the company's operations after excluding all of these things. Naturally, not everyone likes EBITDA. According to CEO of Berkshire Hathaway Inc. (BRK.A) Warren Buffett, "References to EBITDA make us shiver." Depreciation is a real expense that cannot be avoided. Therefore, EBITDA is not "a relevant measure of success," in Buffett's opinion.

EBITDA Hands-On Example

A corporation makes SAR 50 million in revenue and spends SAR 10 million on overhead and SAR 20 million on the cost of goods sold.

The operational profit is SAR 15 million after depreciation and amortization costs of SAR 5 million.

SAR 2.5 million is spent on interest, leaving SAR 12.5 million in revenues before taxes.

After subtracting SAR 2 million in taxes from pretax income, net income is equivalent to SAR 10.5 million with a 20% tax rate and interest expenditure that is tax deductible.

EBITDA = SAR 20 million if depreciation, amortization, interest, and taxes are subtracted from net income.

Disadvantages Of EBITDA

EBITDA is an unofficial statistic regarding public financial reporting. Therefore, each firm may have a different method for calculating it. Companies frequently place more emphasis on EBITDA than net income since the former gives them a better appearance.

Investors should be alert when a business starts emphasizing EBITDA in results after previously not disclosing it. This may occur when businesses have taken on significant debt or are dealing with escalating capital and development expenditures. In similar circumstances, EBITDA may be used to divert attention away from the company's problems.

EBITDA Disregards Asset Costs

EBITDA is sometimes misunderstood to be a cash earnings indicator. However, it disregards the cost of assets in contrast to free cash flow. EBITDA is sometimes criticized for assuming that success is only a result of sales and operations. “Does management believe that the tooth fairy pays for capital expenditures?”, to quote Buffett once more.

How To Calculate EBITDA?

Using data from an organization's income statement, cash flow statement, and balance sheet, you may compute earnings before interest, taxes, depreciation, and amortization (EBITDA). The equation reads as follows: EBITDA is calculated as net income plus interest, taxes, depreciation, and amortization.

When Is EBITDA Good?

As it is an indicator of a company's profitability, the greater the EBITDA, the better. A "good" EBITDA, from the standpoint of an investor, is one that offers more context on a company's performance without letting anybody forget that the statistic excludes cash outlays for interest and taxes, along with the long-term cost of replacing its physical assets.

What Does Amortization Within EBITDA Mean?

A company's intangible assets' book value is gradually discounted as it pertains to EBITDA through amortization shown by an organization's income statement.

Intellectual property, such as patents or trademarks, as well as goodwill—the discrepancy between the price paid for previous purchases and its fair market worth at the time of purchase—are examples of intangible assets.

EBITDA is a helpful measure for comparing businesses with different tax laws and capital expenditure requirements or for examining them in circumstances where these factors are anticipated to alter.

It’s important to note, once again, that non-cash depreciation expenses that could not appropriately reflect future capital expenditure needs are left out from EBITDA. However, the fact that certain expenditures are excluded while others are included has made it easier for dishonest corporate managers to manipulate the measure.

Reading the footnotes that relate the stated EBITDA to net income is your greatest line of defense against such tactics.

Frequently Asked Questions about EBITDA

What is EBITDA?

EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortization. It is a financial metric used to evaluate a company's operational performance by focusing on cash profits generated from core business operations.

How is EBITDA calculated?

EBITDA can be calculated using two formulas:

- EBITDA = Operating Income + Depreciation & Amortization

- EBITDA = Net Income + Interest Expense + Depreciation & Amortization + Taxes

These formulas utilize data from an organization's income statement, cash flow statement, and balance sheet.

Why is EBITDA important?

EBITDA is widely used to:

- Compare profitability across companies and industries.

- Eliminate non-operational factors like interest, taxes, and non-cash depreciation costs.

- Assess cash flow generation from core business activities.

What are the disadvantages of EBITDA?

EBITDA has several drawbacks:

- It ignores the cost of assets, making it less reflective of cash earnings compared to free cash flow.

- It can be manipulated to exaggerate profitability.

- It excludes critical expenses like interest, taxes, and depreciation, which are real costs to a business.

Is EBITDA the same as cash flow?

No, EBITDA is not the same as cash flow. While EBITDA removes non-cash expenses like depreciation and amortization, it does not account for cash outflows such as taxes, interest, and capital expenditures.

When is EBITDA considered "good"?

A high EBITDA generally indicates good profitability. However, it must be viewed in the context of a company's overall financial health, industry standards, and capital expenditure requirements.

What does amortization within EBITDA mean?

Amortization in EBITDA refers to the gradual reduction in the book value of intangible assets, such as patents or goodwill. It excludes non-cash expenses, making EBITDA useful for comparing companies with different tax laws and capital structures.

How does EBITDA compare to net income?

Net income accounts for all expenses, including interest, taxes, depreciation, and amortization, while EBITDA focuses solely on operational profitability. This makes EBITDA a more consistent metric for comparing companies across industries.

Should I rely solely on EBITDA?

No, EBITDA should not be the sole measure of a company's financial performance. It should be used alongside other metrics like net income, free cash flow, and enterprise value to get a comprehensive understanding.

Start with Wafeq

Use Wafeq to generate more than 30 financial reports that help you run better business.

.png?alt=media)