Handling imports and inventory

Below are the detailed steps to handle additional costs and expenses for purchased items to reflect on an item's landed cost.

In the following scenario, we will add shipping fees and import duties to our item, but the same principles can be applied to reflect any additional cost for an item.

Preparing the accounts

For that purpose, we recommend you create accounts for each cost you would like to include. This will provide you with the most flexibility when making the inventory adjustments. In our case, we'll go ahead and create these 2 accounts in our Chart of Accounts as illustrated below:

Shipping Fees

This account will hold all shipping costs associated with your imported items before we add them to the landed cost.

Account name: Shipping Fees

Account name: Shipping Fees

Type: Operating Expense

Activity: Operating

Import duties and customs fees

Similarly to shipping, this will hold the duty costs associated with your goods before we add them to the landed costs.

Account name: Import duties and customs fees

Account name: Import duties and customs fees

Type: Operating Expense

Activity: Operating

Add more Operating Expense accounts as we did above if you need to add or associate more costs/expenses with your imported goods.

Preparing the items

For every item you intend to purchase and hold in your inventory, we need to create an item entry in the Products and Services section.

Note: If you already have those items, make sure the fields match the specifications below.

Note: If you already have those items, make sure the fields match the specifications below.

Go to Items. Click Add Item. Then make sure the following information matches.

Item

Item

- Is active: Yes

- Track inventory: Yes

- Inventory account: Inventory Assets (or select from your own Current Assets accounts)

- Purchase cost: optional. This is to help you prefill the bill when you add that item to a bill.

- Expense account: Cost of Goods Sold (or another custom Cost of Sales account type).

Repeat that step for all items you wish to purchase and track in your inventory.

Generating the supplier bill

It's time to create that bill for the items you wish to purchase/have purchased. Let's add a new bill and select the overseas supplier from the list.

Start by adding items to your bill. These items should be items from your saved items in Products and Services. If you add items as free text descriptions, you will not be able to track them in inventory.

The accounts for these items will be assigned automatically to the inventory account you have selected during the item setup.

Add the relevant price tags and tax rates (since it's an import, the assumption would be that it's tax-exempt. In any case, always consult with an expert first)

Now repeat the above steps and add any additional items you're purchasing as separate line items.

Adding shipping expenses or other item-related expenses

You can either add the shipping expenses as a line item or as a separate bill (maybe the shipping is handled by a different company than the item supplier).

In any case, it’s important to note that the shipping expense is assigned to the Shipping Fees expense account created earlier. Make note of that value as you will use it later to add it to your item’s cost.

All extra expenses related to your item should be added the same way, ie, to their respective expense accounts if there are any, and make note of their values.

Record Customs Fees and VAT for the imported goods

We already have an excellent article on handling this part, which you can check on this link here

Just make sure you assign the custom fees to the Import Duties account we created earlier or to one you already have for that purpose.

Just make sure you assign the custom fees to the Import Duties account we created earlier or to one you already have for that purpose.

Adjusting the inventory to reflect the landed cost

So far, if you check your purchased items, you will notice that they only reflect the purchase cost.

We want to add and track the import duties fees and shipping fees for that item.

We do this by making a value adjustment to the inventory. That adjustment needs to come from an account. It’s up to you to decide whether you want to split these adjustments or combine them as one adjustment with multiple line items.

Single Adjustment example

We add multiple line items to our adjustment

Multiple Adjustments example

Each cost type is added separately as an inventory adjustment.

Obviously, you can mix and match. For example, you can adjust shipping with multiple line items for all the items, and then a separate one for customs with multiple line items for the items as well.

To help future auditing, we recommend also adding a reference and note to the source of this adjustment. We can add inside the Reference field something akin to “Bill B-00023 prorated on 50 units of iPhone 15”.

Recalculated Landed cost

Let’s go back to the items page and check our item:

We can see that the total value and average cost now take into account the shipping fees and customs fees. This will reflect in the COGS when you sell this item.

Please note that the balance of our Shipping Fees account will be the difference between the fees and whatever was distributed back to the inventory asset account in our inventory adjustment transaction. In our case, it was 2000 - 2000 = 0

The same applies to customs fees and any other associated costs/expense accounts for the items.

Let's try it out with an example

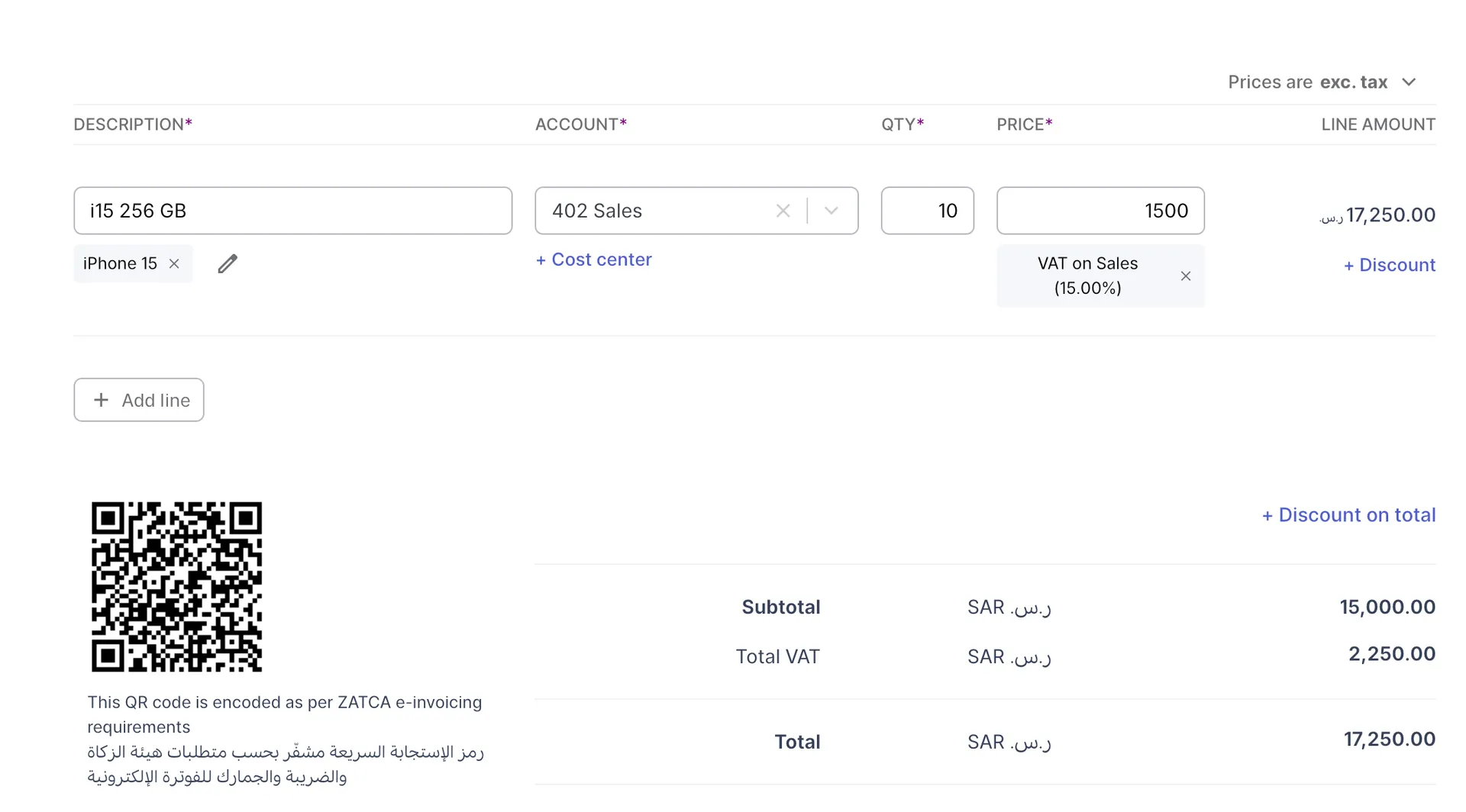

Let’s create an invoice to see the results. Let’s sell 10 items for 1500 SAR. Invoice details below:

And here’s the report showing the Cost of Goods Sold and Gross Profit.

![New Product Features [March-2023]](https://firebasestorage.googleapis.com/v0/b/wafeq-docs.appspot.com/o/medias%2Fd68397dc_Help Center - EN Article Cover-22.png?alt=media)

.png?alt=media)