New Product Features [January -2024]

![New Product Features [January -2024]](https://firebasestorage.googleapis.com/v0/b/wafeq-docs.appspot.com/o/medias%2Ffc1d64b5_Help Center - EN Article Cover-16 (1).png?alt=media)

In our relentless pursuit to enhance the efficiency and user experience of Wafeq, we are thrilled to announce our latest product updates for January 2024. These updates are designed to empower your business with more control, clarity, and compliance in financial management. Here's what's new:

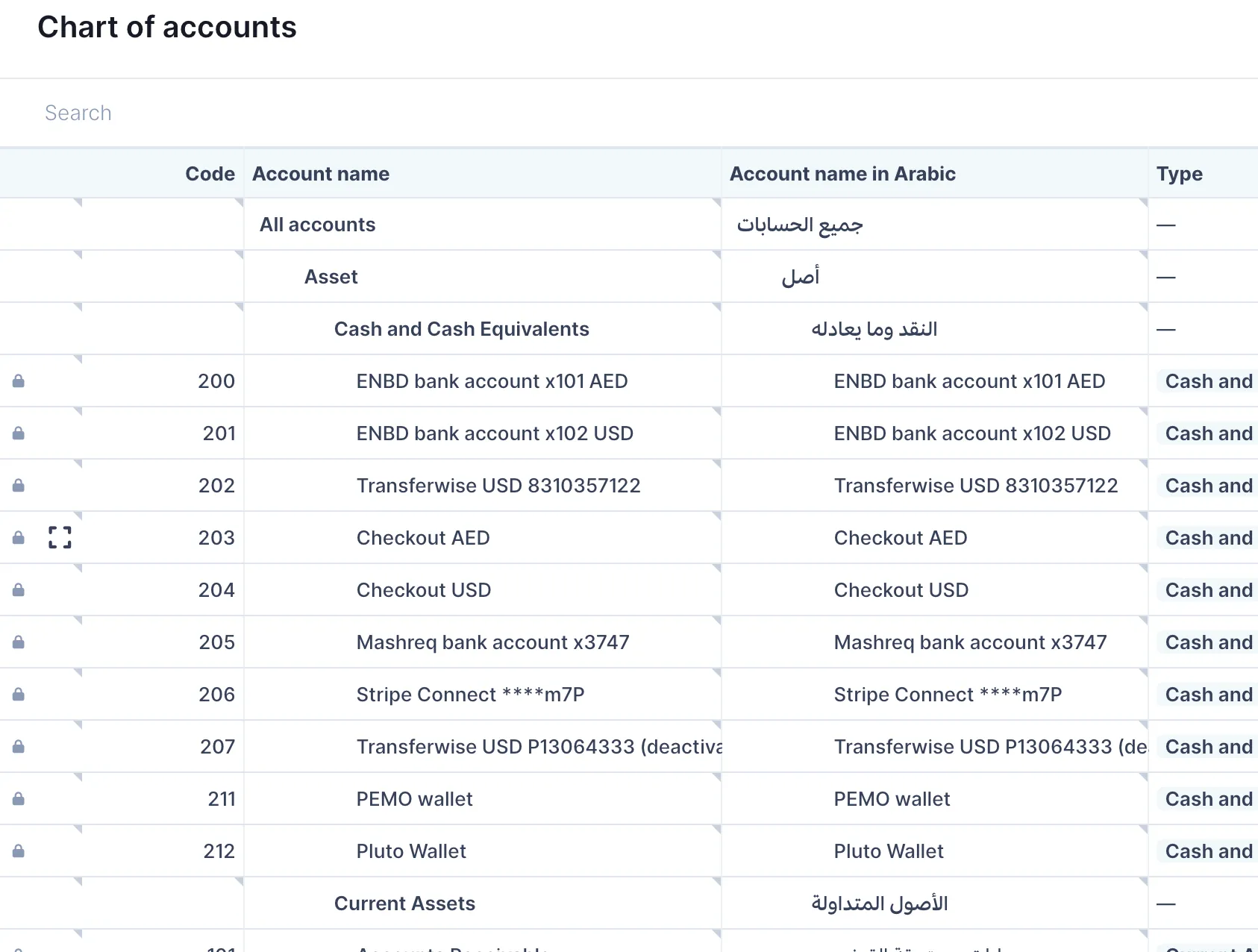

Enhanced Chart of Accounts

We’ve changed the way you view your financial structure with a significant improvement to our chart of accounts. The new tree-view format provides a clearer, more organized representation of your company’s financial accounts, making navigation and comprehension of your financial data easier than ever. This intuitive layout allows for a better understanding of the relationships between different accounts, enabling more strategic financial planning and analysis.

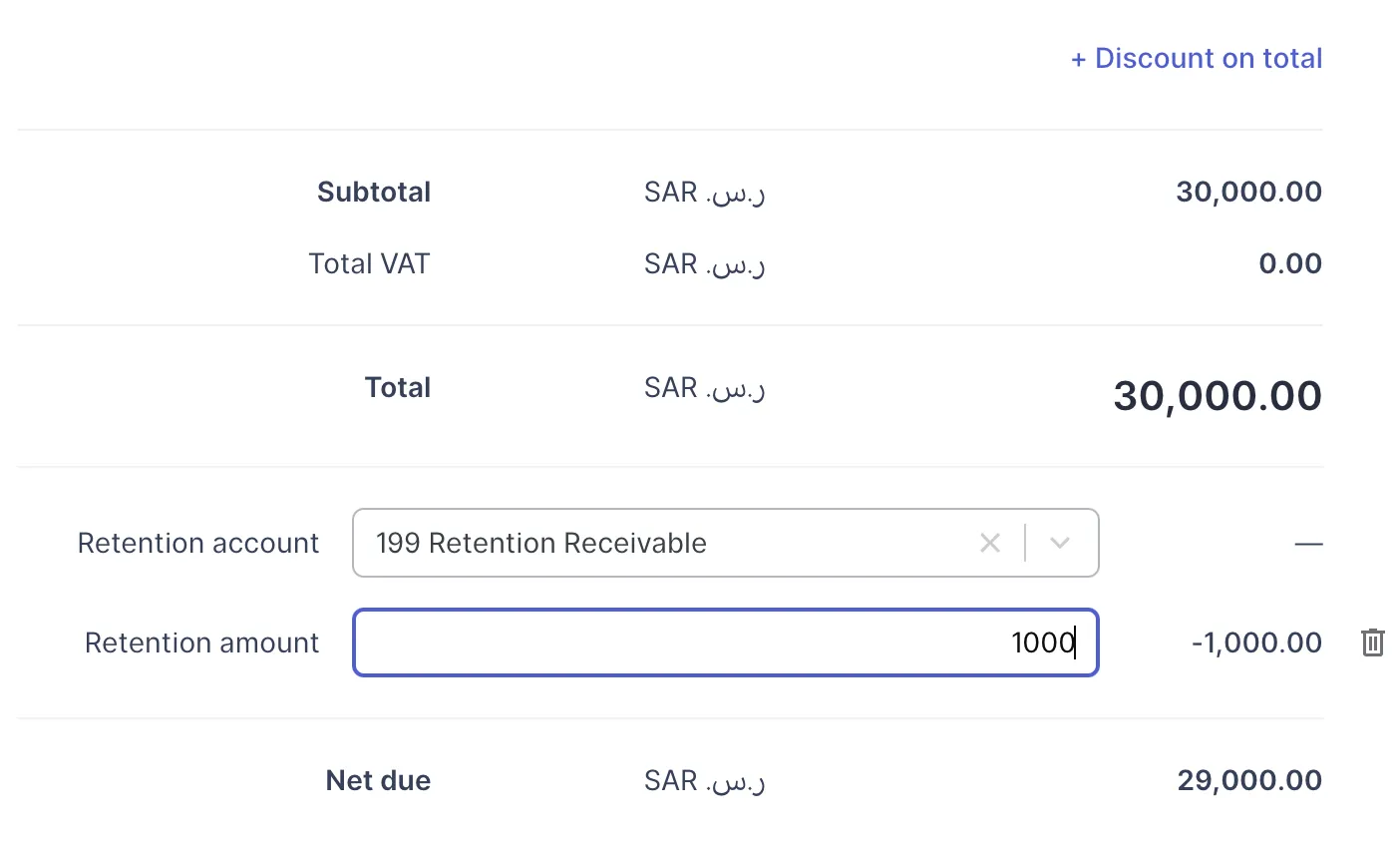

Introduction of Retention Feature

We're introducing a critical feature for businesses that deal with contracts and project-based work - Retention tracking. Retention is a common financial practice where a portion of the payment is withheld until the completion of a project to the customer's satisfaction. This ensures quality and performance, offering peace of mind to both suppliers and clients.

Adding Retention to an Invoice:

You can now add retention to an invoice with just a few clicks. By editing the invoice and selecting the "+ Retention" button, you can specify the retention account and amount. This feature is particularly beneficial for managing cash flows and providing accurate financial reports.

Invoicing for Retention:

Once your work meets the client's standards, invoicing for the retained amount is straightforward. Create a new invoice, select the same retention account, and the balance will be adjusted accordingly.

Tax-Free Retention:

Please note that retention amounts are not subject to VAT, aligning with standard tax practices and ensuring your invoices remain compliant.

E-Invoicing Phase 2 Reminder

As businesses continue to adapt to the new e-invoicing regulations, we remind our users of the crucial role that Wafeq plays in this transition. If your business is approaching Phase 2 of e-invoicing implementation, remember that Wafeq is equipped to support you through this change. Our platform is designed to meet the latest compliance requirements, and our team is ready to assist you in setting up your account for Phase 2.

If you’re preparing for Phase 2 of e-invoicing or have any questions about setting up your account to meet these new requirements, do not hesitate to contact us. Our dedicated support team is here to ensure a smooth transition and help you maintain compliance with ease.

If you receive a notification from ZATCA regarding the second phase of e-invoicing for your business? Contact us to help you set up your account.

If you receive a notification from ZATCA regarding the second phase of e-invoicing for your business? Contact us to help you set up your account.

We are committed to providing our users with the best possible tools to manage their financial processes efficiently. Stay tuned for more updates as we continue to enhance Wafeq to meet the dynamic needs of businesses today.

![New Product Features [March-2023]](https://firebasestorage.googleapis.com/v0/b/wafeq-docs.appspot.com/o/medias%2Fd68397dc_Help Center - EN Article Cover-22.png?alt=media)

.png?alt=media)