Depreciation vs Amortization: What's the Difference and Financial Statement Impact

Imagine a small business owner proudly purchasing a state-of-the-art machine to boost production, while also investing in a premium software license to manage operations. Months later, both assets lose value, but in very different ways; one gradually through wear and tear, the other through usage and expiration of its intangible value.

In this article, we will explore the differences between depreciation and amortization, their importance, and how to apply each correctly in accounting practices.

What is the definition of both depreciation and consumption?

Every business invests in assets, both tangible like machinery, buildings, and vehicles, and intangible like patents, licenses, or software. Over time, these assets lose value, but the way this loss is recorded differs depending on the asset type. Understanding the difference between Depreciation and Amortization is crucial for accurate accounting and financial reporting.

- Depreciation refers to the systematic allocation of the cost of tangible assets over their useful life. It represents the wear and tear or obsolescence of physical assets.

- Amortization is the gradual recognition of the cost of intangible assets over time, reflecting their expiration or usage.

These two concepts (Depreciation & Amortization) help businesses match asset costs with the revenue they generate, ensuring compliance with accounting standards and providing a clear picture of financial performance.

These two concepts (Depreciation & Amortization) help businesses match asset costs with the revenue they generate, ensuring compliance with accounting standards and providing a clear picture of financial performance.

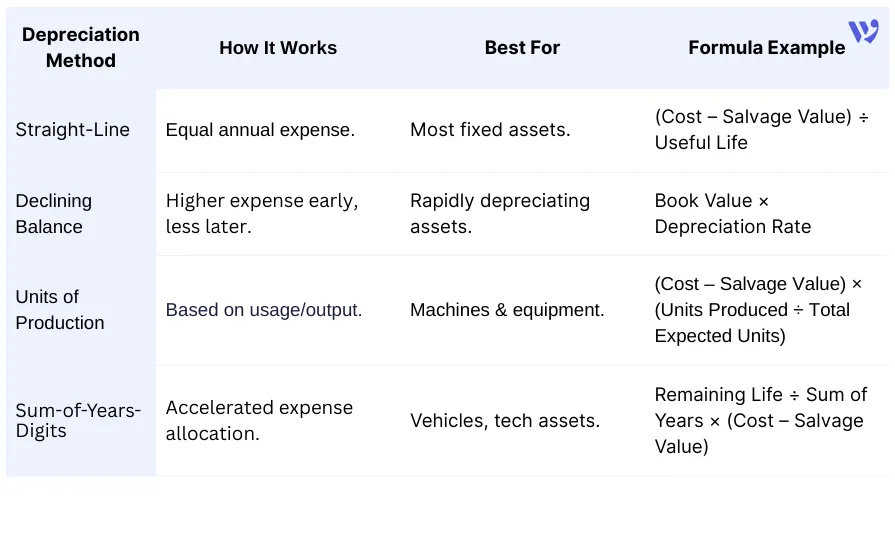

Types of Depreciation: What You Need to Know

Businesses apply different types of depreciation depending on asset usage, industry practices, and accounting standards. The main types include:

- Straight-Line Depreciation Allocates the same amount of depreciation expense each year over the asset’s useful life.

- Declining Balance Depreciation Accelerated depreciation method, recording higher expenses in early years.

- Units of Production Depreciation Depreciation is based on the asset’s actual usage or output.

- Sum-of-Years-Digits Depreciation Another accelerated method that allocates more depreciation in the early years.

Common Methods for Calculating Depreciation

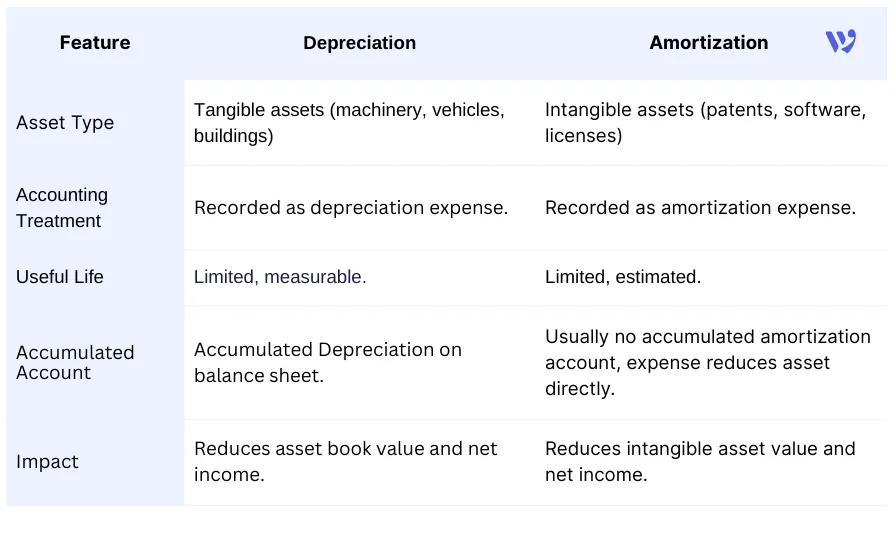

Depreciation vs Amortization: What’s the Difference?

While both depreciation and amortization allocate asset costs over time, the key difference lies in the type of asset:

Depreciation and Amortization in Financial Statements

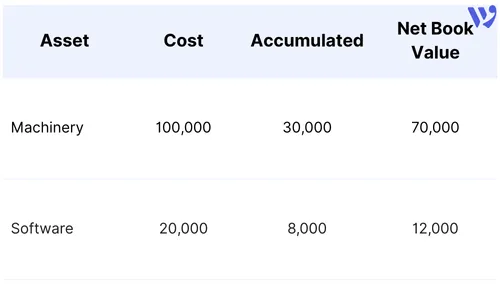

1. Balance Sheet (Statement of Financial Position)

- Depreciation reduces the book value of tangible assets.

- Amortization reduces the carrying value of intangible assets.

Tangible assets are shown at cost minus accumulated depreciation, while Intangible assets are shown at cost minus amortization.

For Example:

Also Read: Understanding Company Assets On The Balance Sheet.

2. Income Statement (Profit & Loss)

- Both are recorded under operating expenses or cost of goods sold (depending on asset use) and Reduce net income.

- Helps match asset cost with revenue generated (matching principle).

Example:

Example:

- Depreciation of machinery used in production → Cost of Goods Sold.

- Amortization of software used in administration → Operating Expenses.

Depreciation and Amortization Journal Entries

Depreciation Journal Entry

Depreciation Journal Entry

Dr Depreciation Expense

Cr Accumulated Depreciation

Amortization Journal Entry

Amortization Journal Entry

Dr Amortization Expense

Cr Intangible Asset

Read Also: How to handle Depreciation and Amortization for Fixed Assets and its application in Wafeq

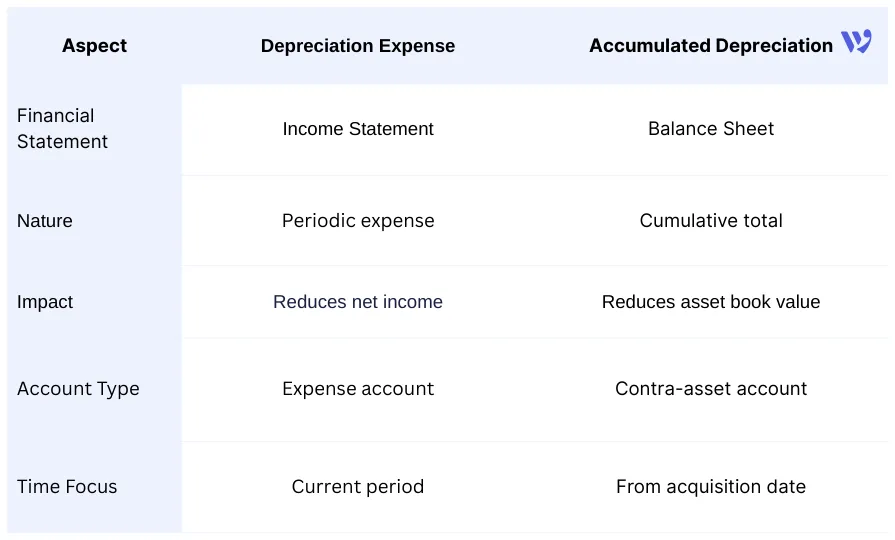

What Is Depreciation Expense?

Depreciation expense is the portion of a tangible asset’s cost that is allocated to a specific accounting period. It appears on the income statement and directly reduces net profit for that period.

Key points:

- Recognized periodically (monthly or annually)

- Reflects the cost of using the asset during the period.

- Affects profitability, not cash flow.

What Is Accumulated Depreciation?

Accumulated depreciation represents the total depreciation recorded on an asset from the date it was placed in service until the reporting date. It appears on the balance sheet as a contra-asset account.

Key points:

- Cumulative amount over time.

- Reduces the asset’s book value.

- Does not appear on the income statement.

Accumulated Depreciation vs Depreciation Expense: Key Differences

Example:

Example:

If a machine costs $50,000 and annual depreciation is $5,000:

- Depreciation expense (Year 1): $5,000

- Accumulated depreciation (End of Year 1): $5,000

- Accumulated depreciation (End of Year 3): $15,000

Why the Difference Between Depreciation and Amortization Matters

Understanding the difference between depreciation and amortization is not just a technical accounting issue, it directly affects financial accuracy, compliance, and business decisions.

- Accurate Financial Reporting Using the correct treatment ensures assets are reported at the right value and expenses are allocated to the correct periods. Misclassifying depreciation as amortization (or vice versa) can distort profits and asset values.

- Compliance with Accounting Standards Accounting standards such as IFRS and GAAP clearly distinguish between tangible and intangible assets. Proper classification helps businesses:

- Pass audits smoothly.

- Avoid regulatory issues.

- Maintain credibility with stakeholders.

3. Better Business Decision-Making Clear differentiation improves:

- Asset replacement planning.

- Capital budgeting decisions.

- Cost control and profitability analysis.

For example, high depreciation expenses may signal aging equipment, while high amortization may indicate heavy reliance on software or licenses.

For example, high depreciation expenses may signal aging equipment, while high amortization may indicate heavy reliance on software or licenses.

4. Tax and Planning Implications Depreciation and amortization often follow different tax rules and rates. Applying the correct method ensures:

- Proper tax calculations.

- No overstatement or understatement of taxable income.

Depreciation Rates Table (Common Assets)

Depreciation rates vary depending on the asset type, useful life, and accounting policy. The table below shows commonly used depreciation rates based on straight-line depreciation.

.png?alt=media)

Note: Actual depreciation rates may vary based on company policy, industry standards, and local regulations.

Note: Actual depreciation rates may vary based on company policy, industry standards, and local regulations.

Practical Depreciation Examples

A company purchases machinery for $100,000 with a useful life of 10 years and no salvage value.

A company purchases machinery for $100,000 with a useful life of 10 years and no salvage value.

- Annual depreciation = $100,000 ÷ 10 = $10,000

- Depreciation rate = 10% per year

Journal Entry:

Dr Depreciation Expense 10,000

Cr Accumulated Depreciation 10,000

Also Read about: How to Handle Depreciation in Accounting and Tax.

Understanding the difference between depreciation and amortization is essential for accurate financial reporting, compliance, and sound business decision-making. While depreciation applies to tangible assets and amortization applies to intangible ones, both play a critical role in matching asset costs with the revenues they generate.

When these concepts are applied correctly, businesses gain clearer visibility into asset performance, more reliable financial statements, and better control over long-term investments. Misclassification, on the other hand, can lead to reporting errors, audit challenges, and distorted profitability.

That’s why modern accounting teams rely on automation—not spreadsheets—to manage depreciation, amortization, and asset tracking with precision.

FAQs about Depreciation vs Amortization

Where does depreciation appear in financial statements?

- Income Statement: As depreciation expense.

- Balance Sheet: As accumulated depreciation reducing asset value.

What is the difference between depreciation expense and accumulated depreciation?

- Depreciation expense is the amount recorded for a single period.

- Accumulated depreciation is the total depreciation recorded since asset acquisition.

Is depreciation a cash expense?

No. Depreciation and amortization are non-cash expenses. They reduce accounting profit but do not involve actual cash payments.

Why is depreciation and amortization important for businesses?

They ensure:

- Accurate financial reporting.

- Compliance with accounting standards.

- Better asset management and investment decisions.

Wafeq Accounting Program helps businesses automate asset accounting, calculate depreciation and amortization accurately, and reflect them correctly in financial statements, All in compliance with accounting standards.

Wafeq Accounting Program helps businesses automate asset accounting, calculate depreciation and amortization accurately, and reflect them correctly in financial statements, All in compliance with accounting standards.

.png?alt=media)