AP Accountant: How Does Accounts Payable Control Vendor Payments?

It often starts with a simple question from a supplier: “Has our invoice been processed?” Behind that question lies a chain of approvals, checks, and payment schedules that directly affect cash flow and supplier trust. When these steps aren’t managed carefully, businesses face delayed payments, strained relationships, or even compliance risks.

This is where the Accounts Payable Accountant plays a critical role—overseeing vendor invoices, ensuring accurate payments, and helping businesses maintain control over their outgoing cash. In this article, we’ll explore what an accounts payable accountant is responsible for and how businesses can better manage and control vendor payments.

What is an Accounts Payable Accountant Responsible For?

An Accounts Payable Accountant is responsible for managing everything related to vendor invoices and outgoing payments. Their role ensures the company pays the right amount, to the right supplier, at the right time—without disrupting cash flow or breaching financial controls.

At a practical level, an Accounts Payable Accountant handles the full invoice lifecycle. This begins with receiving invoices, verifying them against purchase orders or contracts, securing internal approvals, and scheduling payments based on agreed terms. According to the Corporate Finance Institute, Accounts payable functions are critical to maintaining both liquidity and supplier trust, especially as businesses scale.

Beyond processing invoices, the role also includes:

- Monitoring payment due dates to avoid late fees or supplier disputes.

- Maintaining accurate accounts payable ledgers.

- Reconciling vendor statements to ensure balances match.

- Supporting month-end closing and financial reporting.

- Ensuring compliance with internal policies and accounting standards, such as accrual accounting principles, as explained by Investopedia.

How Vendor Payments Impact Cash Flow and Business Control

Vendor payments are one of the largest and most sensitive cash outflows for any business. Even profitable companies can face cash shortages if accounts payable are not managed carefully. This is why the work of an Accounts Payable Accountant plays a direct role in financial stability.

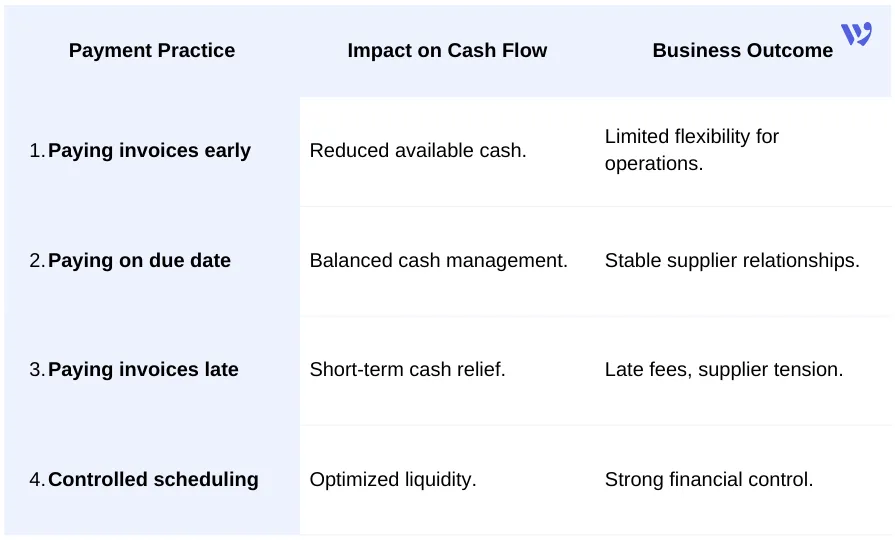

When invoices are paid too early, cash is tied up unnecessarily and cannot be used for payroll, growth, or unexpected expenses. When payments are made too late, businesses risk late fees, damaged supplier relationships, or disrupted supply chains. According to Investopedia’s explanation of cash flow management, Timing is just as important as the amount paid.

A skilled Accounts Payable Accountant helps businesses:

- Align payment schedules with cash inflows.

- Take advantage of early payment discounts when appropriate.

- Avoid duplicate or unauthorized payments.

- Maintain strong, predictable relationships with suppliers.

Vendor Payment Timing and Business Impact

Read About: How to Record Earned Discounts in Accounting.

Key Responsibilities of an Accounts Payable Accountant

On a day-to-day basis, the work of an Accounts Payable Accountant is highly structured, but far from repetitive. Each task plays a role in protecting cash flow, ensuring accuracy, and keeping healthy vendor relationships. Here are the core daily responsibilities:

- Invoice Review and Verification Every invoice must be checked for accuracy, amounts, dates, tax details, and alignment with purchase orders or contracts. This step helps prevent overpayments and fraud, a risk highlighted in accounts payable controls by Investopedia.

- Approval Coordination Invoices usually require internal approvals from department heads or finance managers. The Accounts Payable Accountant ensures approvals are obtained efficiently to avoid payment delays.

- Payment Scheduling Based on payment terms (Net 30, Net 60, etc.), invoices are scheduled in a way that balances cash availability with supplier expectations. This is a key working-capital activity.

- Vendor Account Reconciliation Regular reconciliation of supplier statements ensures there are no missing invoices, duplicate payments, or balance discrepancies.

- Record Maintenance and Reporting Accurate records support month-end closing, audits, and financial reporting. Clean AP data improves overall financial visibility across the organization.

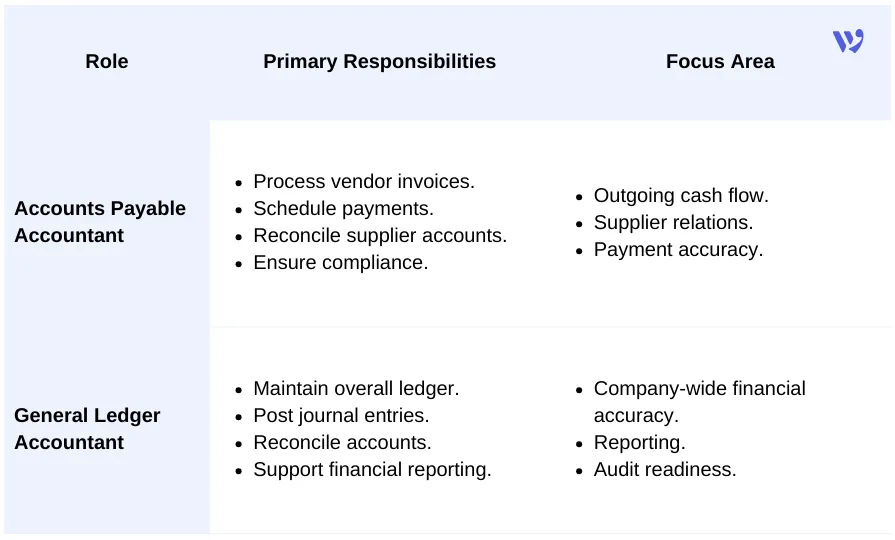

Accounts Payable Accountant vs GL Accountant — What’s the Difference?

While both Accounts Payable Accountants and General Ledger Accountants work within the finance department, their focus and responsibilities differ significantly. Understanding this distinction is essential for structuring finance teams and ensuring proper internal controls.

Know more about: How does a General Ledger Accountant impact Financial Reporting?

Supplier Payment Management Stages

Managing supplier payments isn’t a single action—it’s a structured process made up of connected stages. When these stages are clearly defined and controlled, businesses reduce errors, avoid disputes, and maintain healthy vendor relationships. This is where the role of the Accounts Payable Accountant becomes essential.

- Supplier Onboarding and Data Setup Before any payment happens, supplier information must be accurate and complete. This includes legal name, tax details, bank information, and agreed payment terms. Errors at this stage often lead to delayed or misdirected payments later.

- Invoice Receipt and Capture Invoices may arrive via email, portals, or physical copies. The key responsibility here is ensuring invoices are received promptly, logged correctly, and stored in an auditable manner—whether manually or through automation.

- Invoice Validation and Matching At this stage, invoices are reviewed for accuracy and matched against purchase orders and goods received (commonly known as 3-way matching). This step helps prevent overpayments, duplicate invoices, and fraud.

- Approval Workflow Validated invoices move through internal approval chains based on company policy. Clear approval workflows ensure accountability and prevent unauthorized payments, especially in growing organizations.

- Payment Scheduling and Execution Once approved, payments are scheduled according to agreed terms. A well-managed payment schedule helps optimize cash flow while maintaining the supplier's trust.

- Recording and Reconciliation After payment, transactions are recorded in the accounting system and reconciled with bank statements. This ensures that supplier balances and financial reports remain accurate.

- Reporting and Continuous Control The final stage focuses on visibility, tracking outstanding payables, aging reports, and payment performance. These insights help finance teams improve forecasting and negotiate better supplier terms.

Best Practices for Controlling Vendor Payments

Managing vendor payments efficiently is crucial to getting healthy cash flow, strong supplier relationships, and regulatory compliance. Here are some best practices that Accounts Payable Accountants and finance teams should implement:

- Centralize Invoice Processing All invoices should flow through a single system to avoid missed payments, duplicates, or unauthorized approvals. Centralization improves accuracy and accountability.

- Implement Approval Workflows Using clear internal controls and defined approval chains to ensure every payment is validated. Automated approval workflows reduce errors and delays.

- Schedule Payments Strategically Align payments with cash inflows, take advantage of early payment discounts, and avoid late fees, while payment timing is a key element of working capital optimization.

- Reconcile Vendor Accounts Regularly Matching invoices with purchase orders and vendor statements helps detect discrepancies and prevent overpayment.

- Leverage Automation Tools Modern ERP systems or AP automation tools can handle repetitive tasks, reduce manual errors, and provide real-time reporting. Platforms like Wafeq Accounting Software help businesses track, approve, and schedule vendor payments efficiently.

- Maintain Documentation and Compliance Proper record-keeping ensures audit readiness and supports financial reporting accuracy. Compliance with tax regulations and internal policies is critical to avoid penalties.

How does an Accounts Payable Accountant Improve Vendor Payment Processes?

Consider a mid-sized retail company struggling with delayed vendor payments and frequent invoice errors. Suppliers were frequently following up, cash flow reports were inconsistent, and the finance team spent hours reconciling accounts each month.

By assigning a dedicated Accounts Payable Accountant and implementing structured workflows:

- Invoice processing became centralized, eliminating lost or duplicate invoices.

- Payment schedules were aligned with cash inflows, avoiding late fees and improving supplier relationships.

- Automated reminders and approvals reduced manual errors and delays.

- Monthly reconciliations ensured accurate reporting for management and audit purposes.

How Wafeq Can Help Businesses Streamline Vendor Payments?

Managing vendor payments doesn’t have to be complicated. With Wafeq Accounting Software, businesses can automate accounts payable processes, giving the Accounts Payable Accountant more time to focus on analysis, compliance, and cash flow optimization. Key benefits include:

- Automated invoice capture and approvals to eliminate manual errors.

- Centralized payment management for complete visibility over vendor obligations.

- Scheduled payments and reminders to avoid late fees and strengthen supplier relationships.

- Real-time reporting for accurate financial insights and audit readiness.

Effectively managing vendor payments is critical for business stability, cash flow, and supplier trust. A skilled Accounts Payable Accountant ensures invoices are accurate, payments are timely, and financial controls are maintained. By combining expertise with automation tools like Wafeq, businesses can turn accounts payable from a routine task into a strategic advantage, streamlining processes and strengthening overall financial management.

FAQs About Accounts Payable Accountant and Vendor Payments

What does an Accounts Payable Accountant do?

An AP Accountant manages vendor invoices, schedules payments, reconciles accounts, and ensures compliance with company policies and accounting standards.

How can a company control vendor payments effectively?

Centralize invoice processing, implement approval workflows, reconcile vendor accounts regularly, schedule payments strategically, and leverage automation tools.

What’s the difference between an Accounts Payable Accountant and a General Ledger Accountant?

AP Accountants focus on vendor-related transactions, while GL Accountants oversee all company financial accounts, including reporting, reconciliations, and audit readiness.

How does managing accounts payable improve cash flow?

Proper timing of payments ensures cash isn’t tied up unnecessarily, prevents late fees, and allows companies to optimize working capital while maintaining strong supplier relationships.

Can small businesses benefit from an Accounts Payable Accountant?

Yes. Even in small teams, assigning AP responsibilities ensures accurate payments, avoids errors, and helps maintain trust with suppliers, while keeping cash flow predictable.

What skills should an Accounts Payable Accountant have?

Attention to detail, knowledge of accounting software and ERP systems, strong organizational skills, and understanding of payment processes and internal controls.

Is there a legal requirement for Saudization in this role?

Yes. The Saudi Ministry of Human Resources has included accounting roles, including Accounts Payable Accountant, in the Saudization (Nitaqat) program, especially in companies that employ multiple accountants.

Start streamlining your vendor payments today with the Wafeq accounting system and give your finance team the tools to stay in control and confident.

Start streamlining your vendor payments today with the Wafeq accounting system and give your finance team the tools to stay in control and confident.

.png?alt=media)