How does a General Ledger Accountant impact Financial Reporting?

At the end of every reporting period, financial statements are reviewed, figures are reconciled, and accuracy becomes non-negotiable. Behind this process stands the General Ledger Accountant, responsible for ensuring that every financial transaction is correctly recorded, properly classified, and aligned with accounting standards. The reliability of financial reports depends heavily on this role.

For this reason, the general ledger is widely regarded as the foundation of financial reporting, and understanding the responsibilities of the GL Accountant is essential for finance teams, auditors, and decision-makers alike.

What Is a General Ledger?

When we mention the general ledger, we refer to the central accounting record that contains all of an organization’s financial transactions. Think of it as the master consolidated record where every financial event, such as sales, purchases, payments, and receipts, is ultimately stored and summarized. In practice, transactions are first recorded in journals and then posted to the general ledger, which is structured by account type, such as assets, liabilities, equity, revenue, and expenses. Once captured, the general ledger enables accountants to generate key reports, such as the balance sheet and income statement.

This makes the general ledger the foundation of an organization’s financial record-keeping system—a place where raw transaction data becomes organized, consistent, and ready for analysis.

What Does a General Ledger Accountant Do?

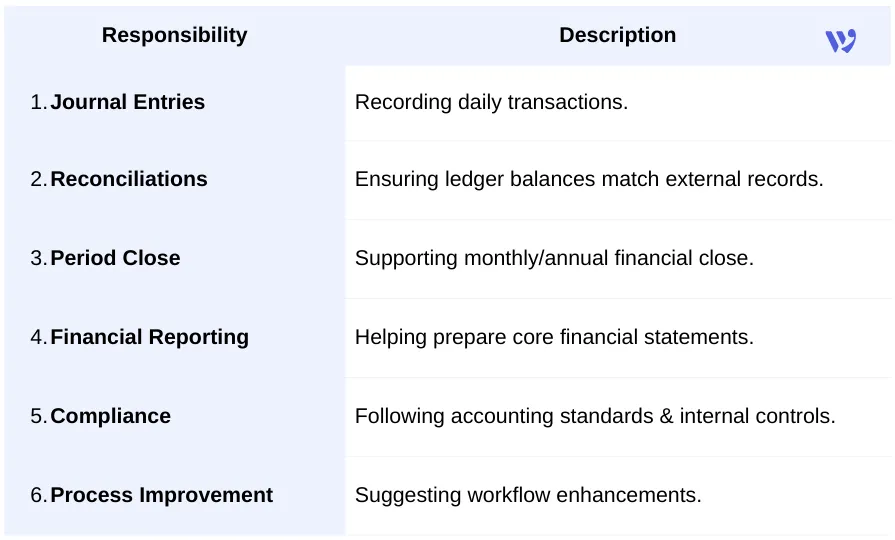

A General Ledger Accountant plays a critical role in a company’s finance function by ensuring that financial transactions are accurately recorded, reconciled, and reported in the general ledger, the company’s central accounting record. At its core, the job involves:

- Recording and posting journal entries: involves everything from sales and expenses to accruals and adjustments that affect income and balance sheet accounts.

- Reconciling accounts: Comparing balances in the ledger with external records (like bank statements) to identify and fix discrepancies.

- Supporting the month-end and year-end close process: Preparing and posting adjusting entries so financial statements reflect the correct figures at period close.

- Preparing financial reports and analyses: Helping produce key outputs like balance sheets, income statements, and supporting schedules for stakeholders.

- Ensuring compliance: Ensuring that accounting practices meet both internal policies and external standards such as GAAP or IFRS.

Beyond these core tasks, a General Ledger Accountant often collaborates with auditors, supports budgeting and forecasting activities, and identifies opportunities to improve accounting processes. In essence, this role serves as the guardian of financial accuracy, providing reliable numbers that leadership and external parties depend on for decision-making.

Key Skills & Tools for a General Ledger Accountant

To excel as a General Ledger Accountant, certain skills and tools are essential. These not only ensure accurate financial reporting but also improve efficiency in managing complex accounting processes.

Key Skills:

- Attention to Detail: Every transaction must be recorded accurately—small errors can lead to big discrepancies in financial statements.

- Analytical Thinking: Ability to interpret numbers, identify trends, and detect inconsistencies.

- Accounting Knowledge: Strong understanding of GAAP, IFRS, and internal accounting policies.

- Communication: Collaborating with auditors, finance teams, and management requires clear and precise communication.

- Problem-Solving: Reconciling accounts or resolving discrepancies often requires creative and methodical approaches.

Essential Tools:

- ERP Systems: Platforms like SAP, Oracle, or Microsoft Dynamics help automate and track transactions efficiently.

- Accounting Software: Tools such as Wafeq, QuickBooks, or Xero Simplify ledger management and reporting.

- Spreadsheets: Advanced Excel skills (formulas, pivot tables) remain vital for analysis and reconciliations.

- Financial Dashboards: Software that visualizes financial data supports quicker decision-making.

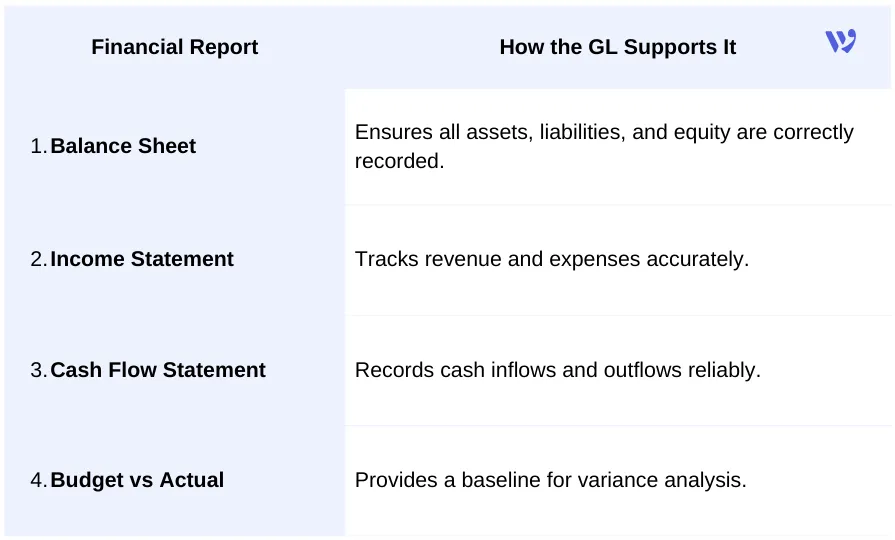

Why the General Ledger Is Critical to Financial Reporting

The general ledger is more than a collection of accounts; it is the central repository that ensures the integrity, accuracy, and completeness of financial information. Without a well-maintained general ledger, organizations would struggle to produce reliable financial statements, meet compliance standards, or make informed decisions.

Here’s why it matters:

- Accuracy of Financial Statements: Every balance sheet, income statement, or cash flow report relies on ledger entries being correct and reconciled.

- Regulatory Compliance: Governments and auditors expect companies to maintain organized ledgers that comply with standards like GAAP or IFRS.

- Audit Trail: The general ledger provides a clear audit trail, authorizing internal and external auditors to trace transactions from origin to report.

- Decision-Making Support: Executives and managers rely on general ledger data for budgeting, forecasting, and strategic planning.

Ledger Impact on Key Reports

In short, the general ledger is the foundation of trustworthy financial reporting, and the work of the General Ledger Accountant ensures that this foundation remains strong, accurate, and compliant.

Know more about: How to Review Financial Statements Step by Step.

Real-World Insights: How a General Ledger Accountant Impacts Business

While the role of a General Ledger Accountant may sound technical or behind-the-scenes, their work impacts business performance directly. Here are a few real-world scenarios:

- Month-End Close Imagine a company closing its books at the end of the month. Without accurate ledger reconciliations, financial statements could be delayed, leading to late reporting to management. A General Ledger Accountant ensures all transactions are correctly posted and reconciled, enabling executives to make timely decisions.

- Error Prevention and Risk Management A missed transaction or misclassified expense can create audit risks or even affect tax filings. By carefully reviewing each ledger entry, the General Ledger Accountant protects the company from compliance issues and financial discrepancies.

- Supporting Strategic Decisions Companies often rely on trend analysis from the general ledger for budgeting, forecasting, or assessing departmental performance. For example, a General Ledger Accountant may identify rising operational costs in one department, helping management adjust budgets or control spending.

- Automation in Action Modern tools such as ERP systems and accounting software (e.g., Wafeq) assign the General Ledger Accountant to automate repetitive tasks, focus on analysis, and provide real-time insights, transforming what was once a purely transactional role into a strategic finance function.

Also Read about: Key Tasks Every Internal Auditor Should Master.

Case Study: How a General Ledger Accountant Drives Efficiency and Accuracy

Company: TechRetail Co., a mid-sized e-commerce business in Saudi Arabia.

Company: TechRetail Co., a mid-sized e-commerce business in Saudi Arabia.

Challenge:

TechRetail was struggling with delayed month-end closings and inaccurate financial statements due to a lack of proper reconciliation in the general ledger. Management found it difficult to make timely business decisions because of incomplete or inconsistent financial data.

Solution:

The company hired a General Ledger Accountant to take ownership of the ledger. They implemented automated accounting software, streamlined journal entries, and performed regular reconciliations.

Results:

- Month-end closing time has been reduced from 10 days to 3 days.

- Financial reports became accurate and reliable, enabling management to make informed decisions on inventory, budgeting, and expansion plans.

- Audit readiness improved, with a clear audit trail maintained for every transaction.

- Cost savings were identified through better tracking of departmental expenses.

Key Takeaway:

A skilled General Ledger Accountant can transform the general ledger from a static record-keeping tool into a strategic asset that drives efficiency, accuracy, and business growth.

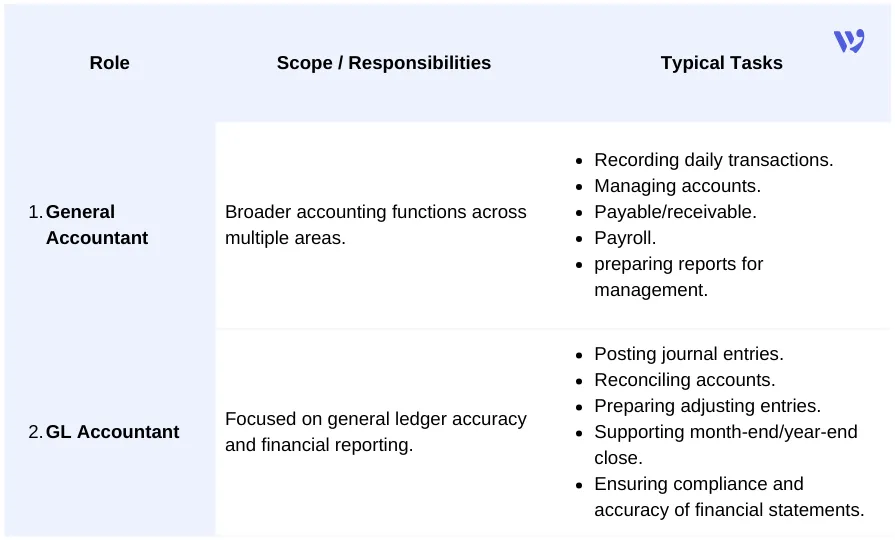

General Accountant vs General Ledger Accountant

The roles of a General Accountant and a GL Accountant often depend on the size and structure of the organization. In small to medium-sized businesses (SMBs), a single accountant may perform both functions, managing day-to-day transactions and maintaining the general ledger. In larger organizations, however, these roles are usually distinct, with the GL Accountant focusing specifically on the accuracy, reconciliation, and reporting of the general ledger.

Key Differences by Company Size:

- Small Companies: Often, a single accountant may handle both daily accounting and ledger responsibilities, making flexibility critical.

- Medium to Large Companies: Roles are more specialized. The GL Accountant ensures the integrity of the general ledger, while other accountants handle specific operational areas like payroll, accounts payable, or accounts receivable.

- Reporting & Decision-Making: In larger organizations, the GL Accountant provides a reliable foundation for financial statements, budgeting, forecasting, and strategic decisions.

- Audit Focus: The GL Accountant maintains the audit trail that internal and external auditors rely on, while accountants in other departments may only support parts of the audit process.

Read Also: Project Management Skills For Accounting: An Overview.

Amid increasing financial complexity, the General Ledger Accountant is much more than a number-cruncher. Their work ensures that every financial transaction is accurately recorded, reconciled, and reported, forming the foundation of reliable financial statements.

Organizations that recognize the importance of this role benefit from:

- Accurate and timely financial reporting.

- Smooth audits and compliance.

- Informed decision-making and strategic planning.

- Operational efficiency and process improvements.

FAQ about the role of General Ledger Accountant

Can one person be both a General Accountant and a General Ledger Accountant?

Yes, in small to medium-sized companies, a single accountant often performs both roles, handling daily transactions and maintaining the general ledger. In larger organizations, the roles are usually separated for specialization and accuracy.

How does the role of a General Ledger Accountant differ in SMEs vs large enterprises?

- SMEs: The GL Accountant may also manage operational accounting tasks, giving the role a broader scope.

- Large Enterprises: The GL Accountant mainly focuses on ledger accuracy, reconciliation, and financial reporting, which often supports multiple accounting teams and auditors.

Why is the general ledger so important?

The general ledger is the foundation of financial reporting. It consolidates all transactions, ensures accuracy, and provides a reliable source for audits, decision-making, and strategic planning.

What skills are most important for a General Ledger Accountant?

Attention to detail, analytical thinking, strong accounting knowledge (GAAP / IFRS), problem-solving, and proficiency in ERP and accounting software are essential.

Has the General Ledger Accountant role been Saudized?

Yes. The Ministry of Human Resources and Social Development (MHRSD) in Saudi Arabia announced a plan to Saudize accounting professions in the private sector, covering 44 positions related to accounting and finance, to increase the participation of Saudi nationals in these fields.

Under the decision, which began implementation in October 2025:

- Companies employing five or more accountants must achieve a Saudization rate of 40% in these professions, including General Accounting roles and other accounting specialties, with the rate gradually increasing to 70% by 2028.

- This Saudization initiative covers multiple roles in finance and accounting and is likely to include positions related to the general ledger, such as the General Ledger Accountant, if listed in the official job classification guides.

- There are requirements regarding the minimum salary for Saudi accountants to count toward Saudization targets (e.g., 6,000 SAR/month for bachelor’s degree holders).

Ready to streamline your accounting processes and ensure accurate, compliant financial reporting?

Ready to streamline your accounting processes and ensure accurate, compliant financial reporting?

Wafeq empowers accountants and finance teams with automated ledger management, real-time insights, and seamless ERP integration.

.png?alt=media)