Handling Rounding Differences in VAT within Wafeq

Occasionally, users of Wafeq may encounter discrepancies when filing VAT on FTA portal due to rounding differences. Here's a guide to understanding and managing these discrepancies:

1. Understanding the Rounding Discrepancy

Inside Wafeq, several rounding actions take place for each transaction. Consequently, the resulting VAT may not precisely equate to 5% of the Taxable amount reported to the FTA portal.

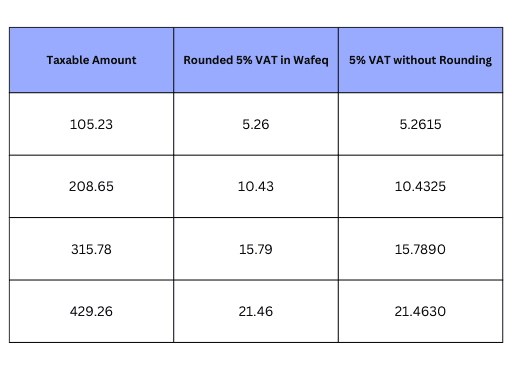

Consider the following example:

Aggregate Analysis:

Aggregate Analysis:

- Taxable Amount: 1,059.92

- Sum of Rounded VAT: 52.94

- 5% VAT on Total: 52.95

- Difference: 0.01

In Wafeq, the amount shown under VAT is 52.94 (Number 2) because it sums up the VAT of each individual transaction. But when filing in the FTA portal using the total taxable amount of AED 1,058.92, a VAT value of AED 52.94 is incorrect, as 5% of AED 1,058.92 is AED 52.95 — revealing a difference of AED 0.01.

2. Rectifying the Discrepancy

To align with FTA portal requirements:

Retain the taxable amount of AED 1,058.92, as this serves as the basis for VAT.

For the VAT field, compute 5% of the total taxable amount. In our example, 5% of AED 1,058.92 gives AED 52.95, which is the accurate value you should input into the FTA portal.

3. Bookkeeping Adjustments

Post-filing the VAT, an entry is essential to close the filed VAT. The regular entry suggestion is:

- Debit: VAT 52.94

- Credit: VAT Payable 52.94

However, due to the rounding difference, it's advisable to adjust VAT in the books and recognize the accurate VAT payable:

- Debit: VAT 52.94

- Debit: Rounding 0.01

- Credit: VAT Payable 52.95

This approach ensures that your books stay accurate and aligned with the FTA's expectations.

In summary, while rounding discrepancies can occur, following these steps will ensure your VAT filings are accurate and compliant with FTA requirements. If any further questions arise, always feel free to reach out to the Wafeq support team for assistance.

![New Product Features [March-2023]](/_next/image?url=https%3A%2F%2Ffirebasestorage.googleapis.com%2Fv0%2Fb%2Fwafeq-docs.appspot.com%2Fo%2Fmedias%252Fda960b17_%D8%AA%D8%AD%D8%AF%D9%8A%D8%AB%D8%A7%D8%AA%20%D9%86%D8%B8%D8%A7%D9%85%20%D9%88%D8%A7%D9%81%D9%90%D9%82%20%D8%A7%D9%84%D8%AC%D8%AF%D9%8A%D8%AF%D8%A9%20%5B%D9%85%D8%A7%D8%B1%D8%B3%202023%5D.png%3Falt%3Dmedia&w=3840&q=75)