Average Sales Price (ASP): How to Calculate, Analyze, and Use It Strategically

.png?alt=media)

Imagine scrolling through your favorite online store and spotting two nearly identical chairs — one priced at AED 450 and the other at AED 1,100. You pause for a moment and think, “Do people really pay that much for this?” That exact moment of curiosity is why businesses closely track **Average Sales Price (ASP) — it shows what customers actually pay on average, not just what’s written on the price tag.

Whether you’re a business owner setting prices or a shopper trying to understand why some products cost more than others, ASP quietly shapes pricing decisions and revenue strategies behind the scenes.

What Is Average Sales Price (ASP)?

At its simplest, Average Sales Price (ASP) is exactly what it sounds like: the average amount customers actually pay for a product or service over a specific period. It’s calculated by dividing total revenue by the number of units sold.

Think of ASP as the reality check behind your pricing. Your list price might say one thing, but discounts, bundles, promotions, and customer behavior often tell a different story. ASP captures that real-world outcome and turns it into a number you can analyze and act on.

For example, if you sold 100 units and generated AED 50,000 in revenue, your ASP would be AED 500 — even if some customers paid more and others paid less.

For example, if you sold 100 units and generated AED 50,000 in revenue, your ASP would be AED 500 — even if some customers paid more and others paid less.

How Is Average Sales Price (ASP) Calculated?

The formula for Average Sales Price (ASP) is straightforward and deliberately simple:

The formula for Average Sales Price (ASP) is straightforward and deliberately simple:

ASP = Total Revenue ÷ Number of Units Sold

What makes ASP powerful isn’t the complexity of the formula, but what it reveals. It strips away assumptions and shows the actual outcome of your pricing strategy after discounts, negotiations, and customer behavior.

Let’s break it down step by step:

- Determine Total Revenue: Add up all the revenue generated from the product or service during a given period.

- Count the Units Sold: Include all units sold in that same period.

- Divide Revenue by Units: The result is the average price customers actually paid.

Example:

Example:

If a company sells:

- 200 units

- Total revenue of AED 160,000

Then the ASP is:

AED 160,000 ÷ 200 = AED 800

- Even if the original list price was AED 1,000, the ASP tells you that, on average, customers paid less — likely due to promotions, bulk discounts, or special deals.

Median Sales Price vs. Average Sales Price

While Average Sales Price (ASP) gives you the mean price paid by customers, it can sometimes be skewed by extreme values — for example, a few very expensive sales can inflate the average. That’s where Median Sales Price comes in. The median is the middle value when all prices are listed in order, offering a more accurate reflection of the “typical” sale.

Example:

Example:

Imagine selling five products at AED 100, 120, 130, 150, and 1,000.

- Average Sales Price (ASP): (100 + 120 + 130 + 150 + 1,000) ÷ 5 = AED 300

- Median Sales Price: The middle value = AED 130

Here, the median provides a more realistic picture of what most customers are paying, whereas the ASP is skewed by a single very high-priced sale. Using both metrics together provides businesses with a more comprehensive view of pricing performance.

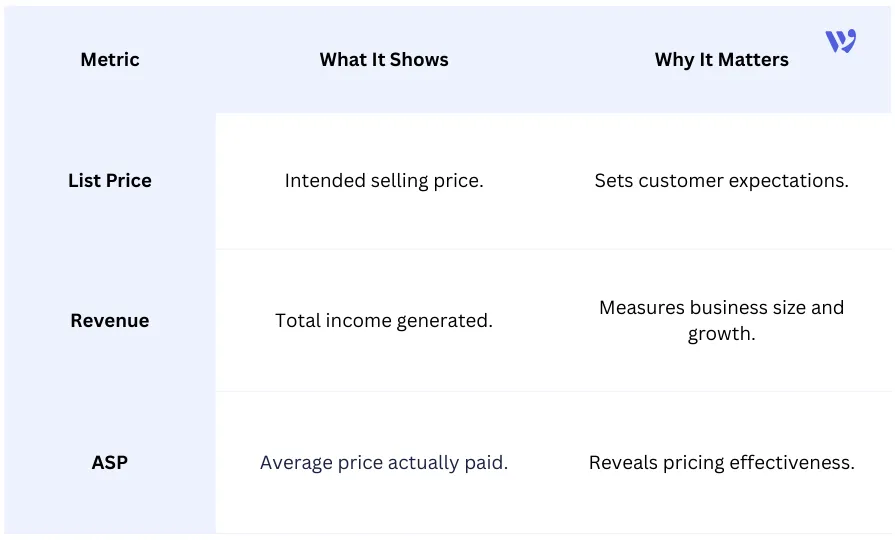

ASP vs List Price vs Revenue: What’s the Difference?

These three terms are often used interchangeably — but they measure very different things. Understanding the difference is essential if you want clear visibility into pricing performance.

- List Price is the intended price. It’s what appears on your website, catalog, or proposal.

- Revenue is the total outcome. It shows how much money the business actually brought in.

- Average Sales Price (ASP) sits in between. It explains how pricing decisions are translated into real customer payments.

In other words, revenue tells you how much you earned, while ASP tells you how well your pricing held up in the real world.

Why Average Sales Price (ASP) Matters for Business Decisions

At first glance, ASP might look like just another metric. But in reality, it’s one of the clearest indicators of how your pricing strategy performs in the real world.

Here’s why businesses pay close attention to ASP:

- Pricing effectiveness: A declining ASP can signal heavy discounting or weak pricing power, even if sales volume is rising.

- Customer behavior: Changes in ASP often reflect shifts in what customers value, premium options, bundles, or lower-priced alternatives.

- Profitability insight: Revenue Growth driven solely by volume can mask margin erosion. ASP helps reveal whether growth is healthy or fragile.

- Strategic decisions: ASP directly influences decisions around product positioning, promotions, upselling, and market segmentation.

What Causes Average Sales Price (ASP) to Increase or Decrease?

ASP rarely changes by accident. When it moves up or down, it’s usually reacting to clear business decisions or market conditions. Understanding these drivers helps you control ASP instead of being surprised by it.

Here are the most common factors:

- Discounting and promotions: Frequent discounts almost always push ASP down, even if sales volume increases.

- Product mix: Selling more premium products raises ASP, while higher sales of entry-level items lower it.

- Customer segments: Enterprise or high-value customers typically increase ASP compared to price-sensitive segments.

- Bundling and upselling: Bundles and add-ons can lift ASP without raising the base price.

- Market pressure: Competition, economic conditions, or customer price sensitivity can force ASP down.

- Pricing strategy changes: Repositioning a product as premium or value-oriented directly impacts ASP.

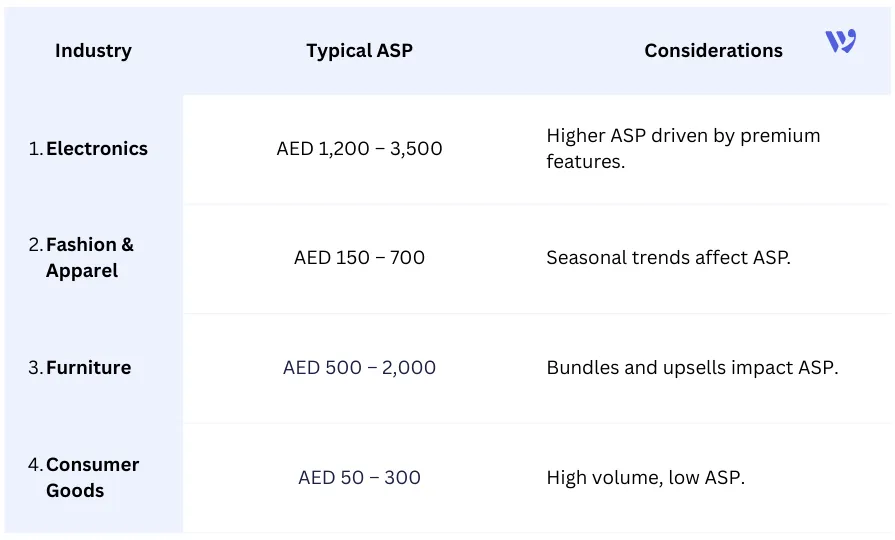

ASP Benchmarks: What’s a “Good” Average Sales Price?

So, what counts as a “good” ASP? The answer isn’t one-size-fits-all — it depends on your industry, product type, and business goals. Instead of chasing arbitrary numbers, benchmarks help you understand whether your ASP is healthy compared to your market.

Key points to consider:

- Industry standards: Different sectors have vastly different ASP ranges. For example, electronics tend to have higher ASPs than everyday household items.

- Historical performance: Compare current ASP against your own past data to spot trends. A declining ASP might signal pricing pressure or changing customer preferences.

- Competitor analysis: Benchmark against similar products in the market. Are you positioned as premium, mid-tier, or budget? Your ASP should reflect that strategy.

- Profitability alignment: A “good” ASP isn’t just high — it needs to balance revenue growth with healthy profit margins.

Table: ASP Benchmarks by Industry

How to Use ASP Strategically

Average Sales Price (ASP) isn’t just a number on a report — it’s a lens into the real impact of your pricing, product mix, and customer behavior. By paying attention to ASP, businesses can make smarter decisions that balance growth, profitability, and customer value.

Strategic tips:

- Monitor regularly: Track ASP alongside revenue and units sold to spot trends early.

- Analyze product mix: Identify which products are driving or dragging your ASP.

- Adjust pricing thoughtfully: Use promotions, bundles, and upselling strategically without eroding ASP.

- Benchmark wisely: Compare against industry standards and historical data, not just competitors.

- Integrate with strategy: Let ASP guide product positioning, marketing campaigns, and sales tactics.

Read Also: What is Profit Margin? Understanding Types and Top Strategies to Improve It for Your Business

Average Sales Price (ASP) is more than just a number — it’s a window into the real outcomes of your pricing, customer choices, and business strategy. By tracking ASP alongside revenue, product mix, and market benchmarks, businesses can uncover insights that lead to smarter pricing, better profitability, and stronger customer understanding.

Whether you’re adjusting prices, launching promotions, or analyzing sales trends, ASP provides a clear, actionable metric that bridges the gap between strategy and reality. Remember: knowing your ASP means knowing how your business performs in the real world.

FAQs About Average Sales Price (ASP)

What is the difference between ASP and list price?

A: List price is the price you intend to sell at, while ASP reflects the actual average amount customers pay after discounts, bundles, or promotions.

Why is ASP important for businesses?

A: ASP provides insights into pricing effectiveness, customer behavior, and profitability, helping businesses make strategic decisions about pricing, promotions, and product mix.

Can ASP be higher than the list price?

Yes, if customers frequently buy premium products, add-ons, or bundles, the average paid can exceed the original list price.

How often should ASP be monitored?

Ideally, ASP should be tracked regularly — monthly or quarterly — depending on sales volume and market dynamics.

How does ASP differ from the median sales price?

ASP is the average of all prices, while the median is the middle value. The median is less affected by extremely high or low sales and gives a better picture of “typical” customer behavior.

Ready to make smarter pricing decisions? Start tracking your Average Sales Price (ASP) today and see how it can transform your revenue strategy.

Ready to make smarter pricing decisions? Start tracking your Average Sales Price (ASP) today and see how it can transform your revenue strategy.

.png?alt=media)