Accounting Disclosure Explained: Full Disclosure Principle and Its Importance

Transparency is a fundamental requirement in accounting and business reporting. Financial statements are relied upon by investors, lenders, regulators, and management to evaluate performance, assess risk, and make economic decisions. However, financial figures alone do not always convey the full financial reality of a business. The full disclosure principle addresses this gap by requiring companies to disclose all material financial information necessary to ensure that financial reports are complete, clear, and not misleading.

What Is the Full Disclosure Principle?

The full disclosure principle is a fundamental accounting concept that requires businesses to include all material information in their financial statements and accompanying notes. “Material” means any information that could influence the decisions of investors, lenders, regulators, or other users of financial reports.

In simple terms, if leaving out a piece of information could mislead someone reading the financial statements, that information should be disclosed. This principle goes beyond just presenting accurate numbers—it focuses on providing context, explanations, and transparency around those numbers.

Accounting standards such as US GAAP and IFRS both emphasize this principle. As explained by Investopedia’s overview of the full disclosure principle, companies must disclose relevant details in the main financial statements or in the notes, even if those details do not directly affect the totals shown.

This is why financial reports often include footnotes explaining accounting policies, assumptions, uncertainties, and future risks. The goal is not to overwhelm readers, but to ensure they have enough information to make informed financial decisions.

Why Is Accounting Disclosure Important?

Accounting disclosure plays a critical role in ensuring the reliability and usefulness of financial information. Financial statements are widely used by investors, lenders, regulators, and management to make economic decisions, and those decisions depend on how complete and transparent the disclosed information is.

- Proper disclosure helps users understand the financial position, performance, and risks of a business. Without adequate disclosure, even accurately prepared financial statements may be misleading, as key assumptions, uncertainties, or obligations may remain hidden.

- From a regulatory perspective, accounting disclosure supports compliance with accounting standards and legal requirements. Regulators rely on disclosures to assess whether financial reporting reflects economic reality rather than merely formal compliance. For businesses, this reduces the risk of penalties, disputes, and reputational damage.

- Most importantly, strong disclosure practices enhance credibility and trust. Companies that clearly explain their accounting policies, estimates, and risks signal transparency and accountability, which can positively influence investor confidence and long-term business relationships.

What are types of Financial Disclosure in Accounting?

Financial disclosure is not limited to a single statement or report. Instead, it appears across several components of financial reporting, each serving a specific purpose in explaining a company’s financial information.

One of the most common forms is disclosure within the financial statements themselves, such as details presented in the balance sheet, income statement, and cash flow statement. These statements provide summarized financial data, but they often require additional explanation.

That explanation is provided through notes to the financial statements, which are a core element of disclosure. Notes clarify accounting policies, measurement methods, assumptions, estimates, and uncertainties. For example, companies disclose how revenue is recognized, how assets are depreciated, or how provisions are measured.

Another important type is management disclosure, often presented in the management discussion and analysis (MD&A) section. This disclosure provides qualitative insight into financial performance, operational results, future plans, and key risks that may not be fully visible in the numbers alone.

There are also specific disclosures for special situations, such as:

- Contingent liabilities and legal disputes.

- Related-party transactions.

- Subsequent events occurring after the reporting period.

- Commitments and contractual obligations.

Together, these types of financial disclosure ensure that users receive both quantitative data and the necessary context to interpret it accurately.

Together, these types of financial disclosure ensure that users receive both quantitative data and the necessary context to interpret it accurately.

Practical Example of the Full Disclosure Principle

A common and practical example of the full disclosure principle involves contingent liabilities, such as lawsuits or legal claims.

Practical Example:

Practical Example:

Assume a company is facing a legal case related to a contractual dispute. At the reporting date, the outcome of the case is uncertain, and it is not yet possible to reliably estimate the final financial impact. In this situation, accounting standards may not allow the company to recognize a liability in the financial statements.

However, under the full disclosure principle, the company is still required to disclose the existence of the lawsuit in the notes to the financial statements. This disclosure would typically include the nature of the dispute, the current status of the case, and an explanation that the potential financial impact cannot yet be determined.

Without this disclosure, users of the financial statements might incorrectly assume that the company has no significant legal risks. By providing transparent disclosure, the company ensures that stakeholders are aware of potential future obligations, even when those obligations are not yet recognized in the numbers.

- This approach aligns with accounting guidance on provisions and contingent liabilities under standards such as IAS 37 and relevant US GAAP requirements.

Disclosure Standards and Disclosure Requirements in Accounting

Accounting disclosure is governed by formal standards that define what must be disclosed, how it should be presented, and when disclosure is required. These standards aim to ensure consistency, comparability, and transparency across financial reports.

Two of the most widely applied frameworks are US Generally Accepted Accounting Principles (US GAAP) and the International Financial Reporting Standards (IFRS). While there are differences in structure and application, both frameworks are built on the same core idea: material information must be disclosed if it affects users’ economic decisions.

Disclosure requirements typically address several key areas, including:

- Significant accounting policies and measurement methods.

- Critical accounting estimates and management judgments.

- Financial risks, such as credit, liquidity, and market risk.

- Commitments, contingencies, and off-balance-sheet arrangements.

Under IFRS, for example, IAS 1 requires entities to disclose information that helps users understand the financial position, financial performance, and cash flows of the business. Similarly, US GAAP includes extensive disclosure requirements designed to prevent misleading financial reporting through omission. By following these standards, companies ensure that their financial statements provide not only accurate figures, but also sufficient explanation to support informed analysis and comparison.

Under IFRS, for example, IAS 1 requires entities to disclose information that helps users understand the financial position, financial performance, and cash flows of the business. Similarly, US GAAP includes extensive disclosure requirements designed to prevent misleading financial reporting through omission. By following these standards, companies ensure that their financial statements provide not only accurate figures, but also sufficient explanation to support informed analysis and comparison.

What Are the Main Characteristics of Accounting Disclosure?

Effective accounting disclosure follows a set of key characteristics that ensure financial information is useful, reliable, and decision-oriented. The most important characteristics include:

- Relevance Disclosed information should directly influence the economic decisions of users. Only information that is material to understanding financial performance or position should be included.

- Completeness All material facts, assumptions, estimates, and uncertainties must be disclosed. Omitting important information may result in misleading financial statements.

- Clarity and Understandability Financial disclosures should be presented in a clear and structured manner, allowing users with reasonable financial knowledge to interpret the information without confusion.

- Neutrality Disclosure should be unbiased and objective. Information must not be selectively presented to influence user decisions in a particular direction.

- Consistency Disclosure practices should be applied consistently from one period to another to allow meaningful comparison across reporting periods.

- Timeliness Financial information must be disclosed within an appropriate timeframe. Delayed disclosure reduces relevance and limits decision usefulness.

Full Disclosure vs Limited Disclosure – What’s the Difference?

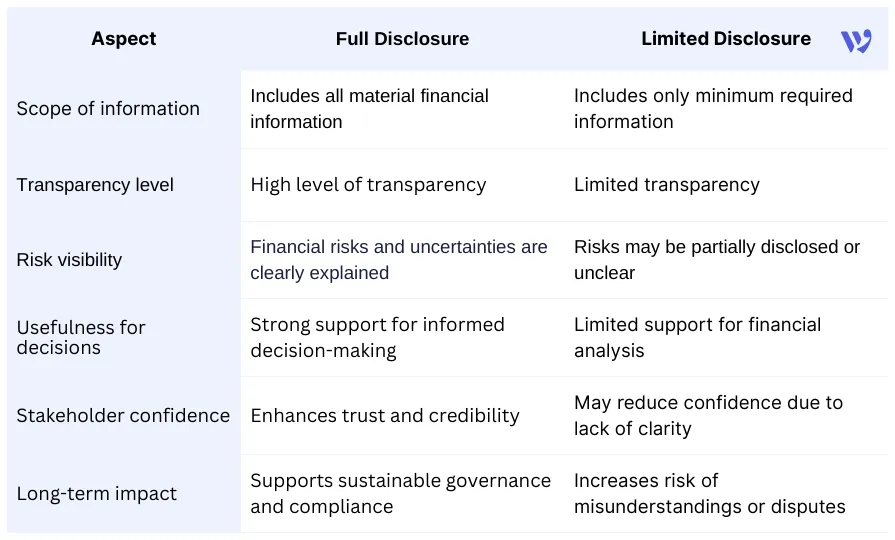

One of the most common questions in accounting and financial reporting is how full disclosure differs from limited disclosure. While both approaches may comply with minimum reporting rules, they differ significantly in transparency, clarity, and decision usefulness.

The table below highlights the key differences between the two approaches:

While limited disclosure may meet basic reporting requirements, full disclosure provides deeper insight into a company’s financial reality. For investors, lenders, and regulators, this difference can significantly affect how financial performance and risk are evaluated.

While limited disclosure may meet basic reporting requirements, full disclosure provides deeper insight into a company’s financial reality. For investors, lenders, and regulators, this difference can significantly affect how financial performance and risk are evaluated.

What Does the Full Disclosure Principle Mean for Businesses?

The full disclosure principle is more than an accounting requirement—it is a cornerstone of trustworthy financial reporting. By ensuring that all material financial information is disclosed, businesses enable investors, lenders, regulators, and other stakeholders to make informed and confident decisions.

For companies, applying the full disclosure principle reduces the risk of misunderstandings, regulatory issues, and reputational damage. Clear disclosure of accounting policies, estimates, risks, and uncertainties helps align reported financial results with economic reality rather than presenting a simplified or incomplete view.

In the long term, consistent and transparent disclosure practices strengthen corporate governance and support sustainable business growth. Organizations that prioritize full disclosure signal accountability, professionalism, and commitment to high financial reporting standards. Ultimately, the full disclosure principle reinforces the idea that financial statements are not just reports of past performance, but reliable tools for evaluating risk, performance, and future potential.

Also Read about: The Four Main Accounting Conventions.

FAQs about Full Disclosure Principle in Accounting

Is the Full Disclosure Principle Required Under IFRS and GAAP?

Yes. Both IFRS and US GAAP require companies to disclose all material information to prevent misleading financial reporting.

What are examples of full disclosure in financial statements?

Answer: Common examples include: pending lawsuits, related-party transactions, significant events after the reporting period, and detailed accounting policies.

What Is the Difference Between Full Disclosure and Transparency?

Transparency is a broader concept related to openness and clarity, while full disclosure is a specific accounting principle that defines what information must be disclosed. Full disclosure is one of the primary tools used to achieve transparency in financial reporting.

Can Too Much Disclosure Be a Problem?

Yes. Excessive disclosure of irrelevant information can overwhelm users and reduce the usefulness of financial reports. Effective disclosure focuses on material information that supports informed decision-making.

Who Is Responsible for Ensuring Full Disclosure?

Management is primarily responsible for ensuring full disclosure, while auditors assess whether disclosures are adequate and compliant with applicable accounting standards.

Wafeq Accounting System simplifies disclosure, automates reporting, and keeps your financial statements clear, reliable, and fully compliant with IFRS and local regulations.

Wafeq Accounting System simplifies disclosure, automates reporting, and keeps your financial statements clear, reliable, and fully compliant with IFRS and local regulations.

.png?alt=media)