The #1 Rule for Accurate Financial Statements? Revenue recognition principle.

“Revenue is revenue only when earned.” This principle maintains the credibility of financial statements and cuts to the heart of why the Revenue Recognition Principle matters; it's the financial compass that guides companies from the illusion of sales to the truth of earned income. Whether you're a startup founder celebrating your first major deal or a CFO auditing quarterly statements, understanding when revenue counts separates healthy growth from accounting fiction.

In this breakdown, we'll unravel how this principle acts as both a shield against financial misrepresentation and a roadmap for sustainable success, because in business, what you count matters just as much as what you earn.

Revenue recognition principle meaning

The Revenue Recognition Principle is a core accounting concept that defines when and how revenue should be recorded in financial statements. According to this principle, revenue is recognized when earned and realizable, regardless of when cash is received.

Key Criteria for Revenue Recognition (Under IFRS & GAAP)

The Revenue Recognition Principle is applied when:

- Performance Obligation Satisfied: Revenue is recorded when goods/services are delivered (earned). For Example, a construction company recognizes revenue as project milestones are met.

- Measurable Amount: The transaction price can be reliably determined. For Example, a SaaS company charges $100/month; revenue is recognized monthly.

- Collectibility is Probable – Payment is reasonably assured. For Example, a retailer records revenue at the point of sale (cash or approved credit)

- Transfer of Control – Ownership risks/rewards have passed to the buyer. For Example, a car dealership recognizes revenue upon vehicle delivery, not when ordered.

Example

Example

A software company sells a 1-year subscription for $1,200.

- Cash received upfront: $1,200

- Revenue recognized monthly: $100/month (as service is delivered)

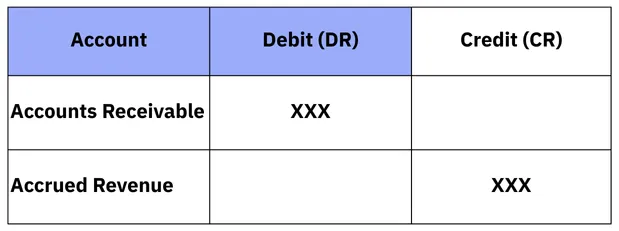

Journal of Revenue Due (Accrued Revenue)

What is Revenue Due (Accrued Revenue)?

Accrued revenue (or revenue due) refers to income that has been earned but not yet received in cash. This occurs under the accrual accounting method When a company provides goods/services but has not yet been paid.

When Does It Occur?

- Services performed but not yet billed (e.g., consulting work completed at month-end)

- Goods delivered with payment terms (*e.g., 30-day credit sales*)

- Interest earned but not yet received

The Revenue Recognition Principle in retail

The Revenue Recognition Principle dictates when retailers can count that cha-ching as official revenue, whether at the checkout counter, upon delivery, or after gift cards are redeemed. This rule ensures every dollar is recorded at the right moment. It defines when retailers can legally claim "sale complete" on their financial statements.

- At Point of Sale (Most Common) When the customer pays and takes possession of goods (cash or credit card transaction).

- Upon Delivery (E-commerce/Online Orders) When goods are shipped/delivered to the customer (transfer of control).

- For Layaway/Gift Cards Layaway: Only when the customer completes payments and takes the item. Gift Cards: When redeemed (not when sold).

What is IFRS 15 / ASC 606?

IFRS 15 (International Financial Reporting Standards) and ASC 606 (U.S. Accounting Standards Codification) are global accounting standards that govern how companies recognize revenue from contracts with customers. Both standards follow the same 5-step framework to ensure consistent, comparable revenue reporting across industries and countries:

- Identify the Contract A legally enforceable agreement between the parties should exist, like a signed sales contract or online purchase terms.

- Identify Performance Obligations Determine distinct goods/services promised in the contract. For Example, A smartphone sale (device + warranty = two obligations).

- Determine the Transaction Price Calculate the expected payment (fixed/variable, discounts, refunds). For Example, 1,000 phone price _ 50 discount = 950 transaction price.

- Allocate the Price to Obligations Distribute the price to each obligation based on the standalone selling prices. For example, 900 for the device and 50 for the warranty (if sold separately).

- Recognize Revenue When Obligations Are Satisfied Record revenue as control transfers (at a point in time or over time). For Example, Phone revenue at delivery, and warranty revenue over 1 year.

Also Read: Conservatism Principle in Accounting Explained & How to Measure It.

The Revenue Recognition Principle is more than just an accounting rule—it’s the backbone of transparent and trustworthy financial reporting. Businesses maintain credibility with investors, regulators, and stakeholders by ensuring revenue is recorded only when earned and realizable. While the principle demands discipline, especially in complex industries like SaaS, construction, and retail, its consistent application prevents financial misrepresentation and supports long-term growth. As markets evolve and transactions become more intricate, mastering this principle remains non-negotiable for financial professionals. Whether following IFRS 15 or ASC 606, the core truth stays the same: Revenue isn’t revenue until it’s truly earned.

Struggling with revenue timing? Discover how Wafeq simplifies recognition across industries

Struggling with revenue timing? Discover how Wafeq simplifies recognition across industries

.png?alt=media)