Comparison of VAT Return Filing Processes in Saudi Arabia, the UAE, and Bahrain

With the growing adoption of the value-added tax (VAT) across the Gulf Cooperation Council (GCC), businesses are increasingly required to understand and comply with distinct VAT return filing processes in each country. Saudi Arabia, the UAE, and Bahrain have frameworks, timelines, and digital infrastructures, creating complexity for finance professionals operating across borders. Understanding the differences between these VAT return systems is essential for ensuring compliance, avoiding penalties, and maintaining operational efficiency. As technology evolves, platforms like Wafeq have emerged as strategic tools that simplify tax filing processes and reduce human error, particularly in the Gulf market.

This article provides a comprehensive comparison of VAT return filing procedures in Saudi Arabia, the UAE, and Bahrain, focusing specifically on how Wafeq supports accounting and finance teams in meeting tax obligations.

Overview of VAT in the Three GCC Countries

The Gulf countries underwent a major shift in their fiscal policies when they adopted Value Added Tax (VAT) as part of the Unified GCC VAT Agreement. While Saudi Arabia, the UAE, and Bahrain follow the same foundational principles, each country has developed its own regulatory and administrative approach to VAT implementation and collection.

Saudi Arabia

Saudi Arabia was the first GCC country to implement VAT in January 2018 at a 5% rate, and later increased it to 15% in July 2020. The Zakat, Tax and Customs Authority (ZATCA) oversees VAT regulations. The country is also leading in e-invoicing through its Fatoora initiative, rolled out in two phases, which makes Saudi Arabia the most advanced in VAT digital transformation in the region.

United Arab Emirates (UAE)

The UAE introduced VAT in January 2018 at a 5% rate. The Federal Tax Authority (FTA) manages VAT compliance, and returns are filed through a centralized online portal. The UAE does not mandate e-invoicing, offering greater flexibility, but also increasing the potential for manual errors.

Bahrain

Bahrain introduced VAT in January 2019 at a 5% rate, later increasing it to 10% in January 2022. The National Bureau for Revenue (NBR) is responsible for VAT enforcement. The country relies more heavily on manual processes and traditional form-based submissions. Despite the shared GCC VAT framework, key differences remain in how each country executes VAT in practice, particularly in technology adoption, e-invoicing mandates, and administrative procedures.

Core Requirements for VAT Return Filing

The requirements for filing VAT returns vary across Saudi Arabia, the UAE, and Bahrain in terms of tax periods, filing forms, and submission channels. Here is a detailed breakdown for each country:

Saudi Arabia – ZATCA

- Regulatory Authority: Zakat, Tax and Customs Authority (ZATCA)

- Tax Periods: Monthly or quarterly, based on annual revenue.

- Submission Channels: ZATCA online portal.

- Return Form: Unified VAT return including domestic and international sales and purchases.

- Required Attachments: Tax invoices, e-invoicing reports (Fatoora), import statements.

- E-invoicing: Fully mandatory for all VAT-registered taxpayers (advanced integration in place)

United Arab Emirates – FTA

- Regulatory Authority: Federal Tax Authority (FTA)

- Tax Periods: Quarterly (some large companies file monthly)

- Submission Channels: FTA’s online portal

- Return Form: VAT201, which includes: Standard-rated domestic supplies, Exports, Zero-rated supplies, Input VAT

- Required Attachments: not usually uploaded, but must be maintained for audit.

- E-invoicing: Not currently mandatory.

Bahrain – NBR

- Regulatory Authority: National Bureau for Revenue (NBR)

- Tax Periods: Quarterly (some monthly cases for large entities)

- Submission Channels: NBR online portal

- Return Form: A relatively simple form covering taxable sales, exempt sales, and inputs

- Required Attachments: Not uploaded but must be retained for audit purposes

- E-invoicing: Not implemented

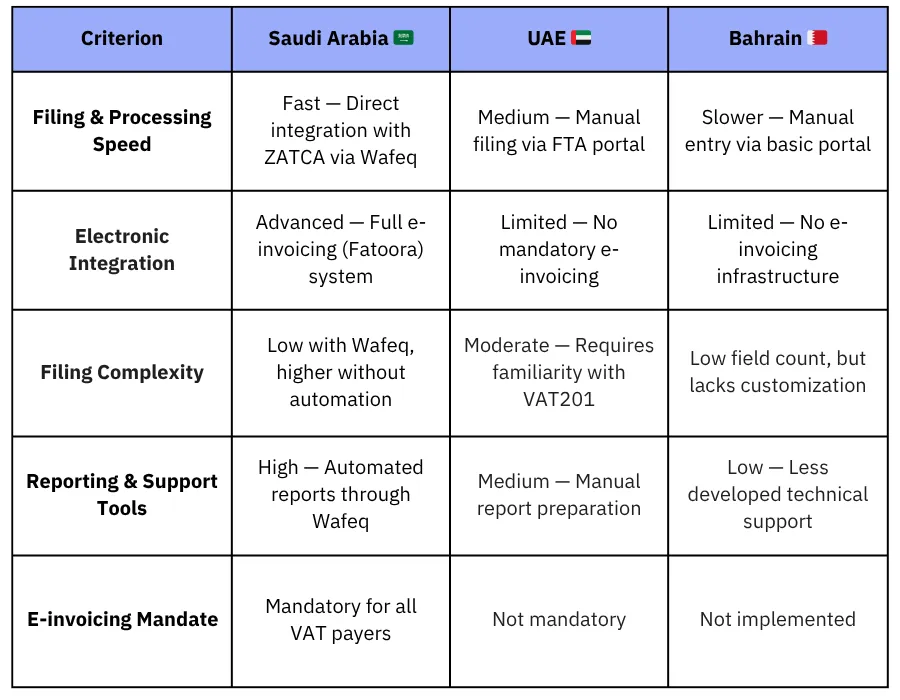

Comparative Analysis: Time, Requirements, and Complexity

Although Saudi Arabia, the UAE, and Bahrain all follow the same unified GCC VAT agreement, the on-the-ground execution of VAT return processes differs significantly in terms of digital maturity, procedural simplicity, and processing speed. The table below provides a comparative overview based on key criteria:

How Wafeq Simplifies VAT Return Filing

As VAT requirements become more complex and e-invoicing systems become more widespread, businesses need a reliable, compliant solution to manage filings efficiently and reduce accounting risks. This is where Wafeq plays a critical role, especially for companies operating in Saudi Arabia, with potential future support for other GCC countries. Key Benefits of Using Wafeq for VAT Filings:

- Direct Integration with ZATCA Wafeq allows users to submit VAT returns directly to ZATCA without logging manually into the tax portal, saving time and reducing errors.

- Automated Import of E-Invoices (Fatoora) The system pulls issued and received invoices automatically from the e-invoicing platform, categorizing them by VAT rates, ensuring precise data in returns.

- Ready-to-File VAT Reports Wafeq generates a pre-formatted VAT return fully aligned with ZATCA’s requirements, with field-by-field previews before submission.

- Automated Deadline Notifications Users receive reminders ahead of each VAT due date to help avoid late filing penalties.

- Accuracy and Error Reduction The clean user interface and auto-validation features reduce mistakes in input and output of VAT calculations.

- Archiving and Recordkeeping All past returns are securely stored within the system, simplifying both internal reviews and external audits.

Also Read: Complete guide to e-Invoicing using Wafeq.

In conclusion, the differences in VAT return filing Across Saudi Arabia, the UAE, and Bahrain proves there are varying levels of digital and regulatory maturity. Saudi Arabia leads the way with mandatory e-invoicing and direct integration between taxpayers and the Zakat authority, supported by advanced platforms like Wafeq. Investing in integrated financial solutions like Wafeq is a strategic move for organizations whose goal is to improve tax compliance and reduce administrative errors. These platforms not only simplify VAT return submission but also enable continuous monitoring, automation, and intelligent reporting.

.png?alt=media)