Accounting Provisions Explained: From Theory to Journal Entries

A finance manager at a growing manufacturing company receives an unexpected call: a customer has filed a warranty claim for a major product defect. The manager quickly opens the financial system, realizing that no provision had ever been made for such incidents. The next few hours are spent recalculating financial statements, adjusting profits, and explaining the situation to the CFO. Situations like these highlight the importance of provisions in accounting — those carefully calculated amounts that protect businesses from future financial shocks and ensure accuracy in financial reporting. In this article, we’ll explore what provisions are, how they work, and how you can record and manage them efficiently with tools like Wafeq.

What Is a Provision in Accounting?

A provision in accounting is an amount set aside from a company’s profits to cover a probable future liability or loss whose exact value or timing is uncertain. It represents a present obligation arising from a past event, which is expected to result in an outflow of economic resources. In simpler terms, provisions are anticipations of expenses or losses a business expects to face in the future, such as bad debts, legal claims, or product warranties. Even though the exact cost or date is unknown, provisions are recorded in the current accounting period to reflect the company’s true financial position.

Why Provisions Are Created in Accounting

The primary purpose of a provision is to ensure that financial statements reflect all known liabilities — not just those that are certain or already paid. This is a direct application of the accrual concept and the matching principle, which requires expenses to be recognized in the period when they are incurred, not when cash is paid. Provisions therefore:

- Improve financial accuracy and transparency.

- Prevent profit overstatement.

- Help businesses plan for future obligations with confidence.

- Support compliance with IFRS (IAS 37) and local standards, such as SOCPA in Saudi Arabia.

Provisions vs. Contingent Liabilities

It’s important to distinguish between a provision and a contingent liability.

- A provision is recognized in the books because the obligation is probable and can be estimated reliably.

- A contingent liability, On the other hand, is only disclosed in the notes to the financial statements since the outcome is uncertain or cannot be reliably measured.

Accounting Criteria for Recognizing Provisions

Under IAS 37 – Provisions, Contingent Liabilities and Contingent Assets, provisions must be recognized when:

- The company has a present obligation (legal or constructive) as a result of a past event.

- An outflow of resources will probably be required to settle the obligation.

- The amount can be reliably estimated.

These three conditions form the accounting foundation for provisions and guide companies on when and how to recognize them.

These three conditions form the accounting foundation for provisions and guide companies on when and how to recognize them.

Characteristics of Provisions

For a liability to qualify as a provision, it has to meet specific accounting criteria. These characteristics ensure that the amount recorded truly represents a present obligation, not a mere future risk or estimation. Below are the key characteristics that define a provision in accounting:

- Present Obligation A provision must represent a current responsibility of the business resulting from a past event. For example, if a company sells products with a warranty, it incurs an obligation to repair or replace defective items. This obligation exists today, even though the actual repair may happen in the future. The obligation can be legal (arising from a contract or law) or constructive (arising from established practices or expectations).

- Result of a Past Event A provision arises from an event that has already occurred. The past event must create a binding duty or expectation that the company would need to settle an obligation. For instance, if an employee has earned end-of-service benefits, the company must recognize a provision for this liability because the service has already been rendered.

- Probable Outflow of Resources There must be a reasonable expectation that the company will have to spend resources (such as cash or assets) to settle the obligation. If there is only a small or remote chance of payment, then it should not be recognized as a provision but rather disclosed as a contingent liability.

- Reliable Estimate The amount of the obligation must be reasonably estimable. While the exact figure may not be known, accountants must make a best estimate based on available evidence, historical data, or expert judgment. This ensures that provisions are not arbitrary but based on sound financial reasoning.

- Periodic Review and Adjustment Provisions are not permanent figures. They should be reviewed at each reporting date to ensure accuracy. If the circumstances change — for example, a legal case is settled or the repair estimated cost decreases — the provision must be adjusted or reversed accordingly.

Common Types of Provisions in Accounting

Provisions are not a one-size-fits-all concept. Depending on the nature of a company’s operations, industry, and financial obligations, several different provision types can appear in the books. Each serves a distinct purpose and reflects a specific potential liability.

Below are the most common types of provisions in accounting and their practical applications.

- Provision for Bad Debts One of the most frequently used provisions, the provision for bad debts (also known as the allowance for doubtful accounts), is created when a business anticipates that some customers may not pay their outstanding invoices. Example: If a company’s accounts receivable total SAR 500,000, and management expects 5% to become uncollectible, a provision of SAR 25,000 would be recorded. This ensures that profits are not overstated and that the balance sheet reflects a realistic receivable value.

- Provision for Warranties Manufacturers and retailers often offer product warranties, which create potential future costs for repairs or replacements. A provision for warranties is recognized at the time of sale, based on historical data and expected claims. Example: If a company sells electronics with a one-year warranty and expects repair costs to average 2% of sales, it records a warranty provision when the sale occurs, not when the claim arises.

- Provision for Taxation Businesses estimate their income tax liability for the current financial year and create a provision for taxation before the exact assessment by tax authorities is finalized. This ensures that the expense is recorded in the same period as the related income. In Saudi Arabia, companies prepare provisions for Zakat and Corporate Income Tax, reflecting obligations under ZATCA (Zakat, Tax and Customs Authority) regulations.

- Provision for Employee Benefits Employee-related provisions are essential in regions such as the GCC, where end-of-service benefits (EOSB) are mandatory. These provisions cover future payments due to employees upon termination or retirement. Example: A Saudi company must recognize a provision for end-of-service indemnity according to the local labor laws, based on years of service and final salary.

- Provision for Legal Claims A company facing ongoing or probable litigation must record a provision for legal claims if it’s likely to lose the case and can estimate the potential payout. The purpose is to account for possible liabilities in advance and maintain transparency in financial reporting.

- Provision for Asset Decommissioning or Restoration Some industries, such as oil, gas, and construction, have obligations to restore or dismantle assets (like equipment or sites) at the end of their use. A decommissioning provision is recorded to reflect the estimated cost of fulfilling these environmental or contractual obligations.

- Provision for Restructuring When a company decides to reorganize or close a division, it must estimate costs such as employee compensation, lease termination, or relocation. A restructuring provision ensures these costs are recognized once a detailed plan is approved and communicated to affected parties.

Accounting Treatment for Provisions: When and How to Recognize a Provision in Accounting

Accounting for provisions requires a careful balance between prudence and accuracy. The International Accounting Standard (IAS) 37 — Provisions, Contingent Liabilities, and Contingent Assets — establishes clear guidance on when and how a company should recognize and measure provisions in its financial statements.

Recognition Criteria for Provisions

A provision is recognized in the financial statements only when all three of the following conditions are met:

- Present Obligation The entity has a present legal or constructive obligation resulting from a past event. This could arise from a contract, law, or a company’s established practices that create a valid expectation among stakeholders.

- Probable Outflow of Resources It is more likely that the company will have to transfer economic resources (such as cash or other assets) to settle the obligation. If the chance of outflow is remote, no provision should be recognized.

- Reliable Estimate A reliable estimate of the obligation amount can be made. If an estimate cannot be reasonably determined, the obligation is disclosed as a contingent liability instead of being recognized as a provision.

Measurement of Provisions

Once a provision is recognized, it must be measured carefully to ensure financial statements reflect a true and fair view. According to IAS 37:

- Best Estimate The provision should represent the best estimate of the expenditure required to settle the present obligation as of the reporting date. This estimate considers risks, uncertainties, and future events that may affect the amount.

- Present Value Consideration When the effect of the time value of money is material, provisions are measured at the present value of the expected expenditure, discounted using a pre-tax rate that reflects current market assessments.

- Review and Adjustment Provisions should be reviewed at each reporting date and adjusted to reflect the actual best estimate. If it is no longer probable that an outflow will be required, the provision must be reversed.

Common Challenges in Recognition and Measurement

Many organizations struggle to determine when to recognize a provision versus when to disclose it. Common pitfalls include:

- Overestimating liabilities without sufficient evidence.

- Failing to discount long-term provisions.

- Omitting the reversal of provisions when obligations expire or become less probable.

Example: Warranty Provision

Example: Warranty Provision

Suppose a company sells electronic equipment with a one-year warranty. Based on historical data, 5% of products require repairs costing SAR 300 each.

If total sales are 10,000 units, the company should recognize a warranty provision of SAR 150,000 (10,000 × 5% × 300) at year-end, reflecting the probable obligation and best cost estimate.

Disclosure Requirements

IAS 37 also requires that each class of provision be disclosed, including:

- The carrying amount at the beginning and end of the period.

- Additional provisions made or amounts used during the year.

- A description of the nature of the obligation and the expected timing of any outflows.

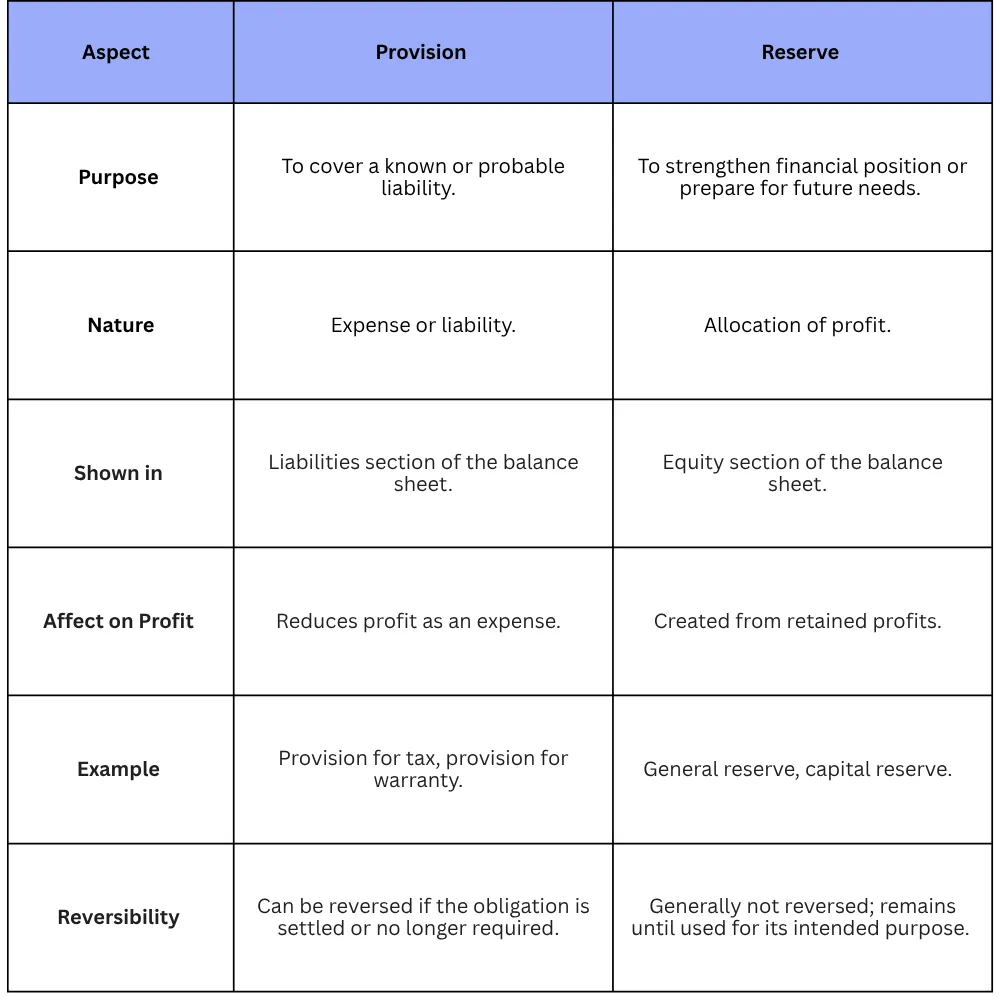

Difference Between Provisions and Reserves in Accounting

The terms provision and reserve are often confused in financial reporting — even among professionals. Yet, the distinction between them is crucial, as they serve entirely different purposes in accounting.

A provision is an amount set aside to cover a known or probable liability whose timing or amount is uncertain. It represents an expected obligation arising from past events. For Example, provision for doubtful debts (to cover potential bad debts), provision for warranty claims, and provision for legal cases.

A reserve is a portion of profit retained by a company for future use, such as expansion, contingencies, or strengthening financial stability. It is not a liability but rather part of owners’ equity. For example, the General reserve, capital reserve, and retained earnings.

Why the Distinction Matters

Failing to differentiate between provisions and reserves can misstate a company’s financial position and profitability. Provisions impact income directly, while reserves are a distribution decision by management. Proper classification ensures compliance with accounting standards and builds confidence among stakeholders and auditors.

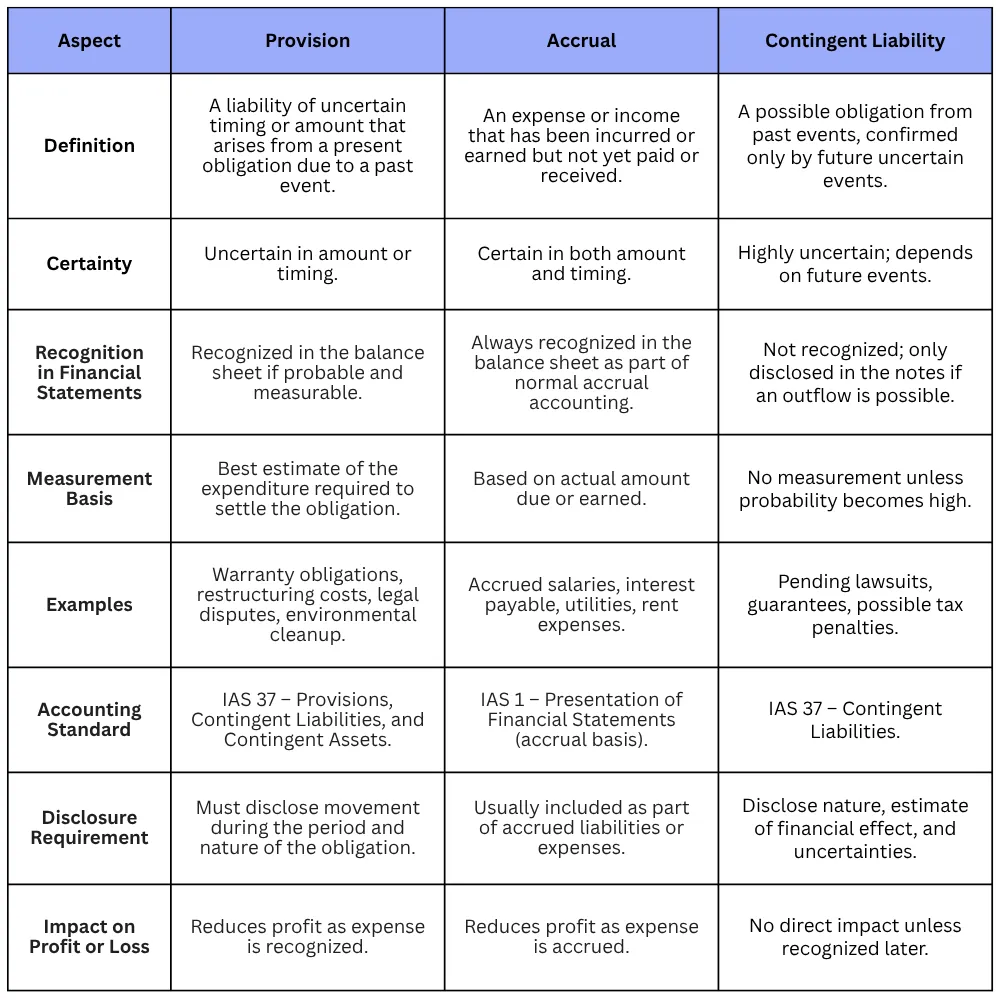

Difference Between Provisions, Accruals, and Contingent Liabilities

In financial reporting, the terms provisions, accruals, and contingent liabilities are often used interchangeably, but they represent distinct concepts with different recognition and disclosure requirements. Understanding the difference between them is essential for accurate financial statements and compliance with IAS 37.

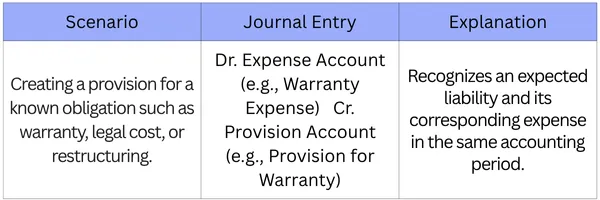

Journal entries for provisions in accounting

Recording provisions correctly ensures that financial statements reflect the true obligations of a business. Journal entries depend on the nature of the provision — whether it is newly created, adjusted, or reversed.

1. When Creating a Provision

Example:

Example:

A company estimates SAR 50,000 for product warranty costs.

→ Dr. Warranty Expense 50,000

→ Cr. Provision for Warranty 50,000

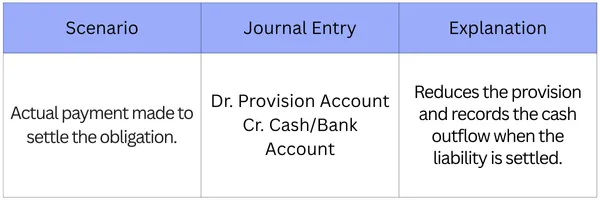

2. When the Actual Expense Occurs

Example:

Example:

If SAR 30,000 of the warranty claims are settled:

→ Dr. Provision for Warranty 30,000

→ Cr. Cash 30,000

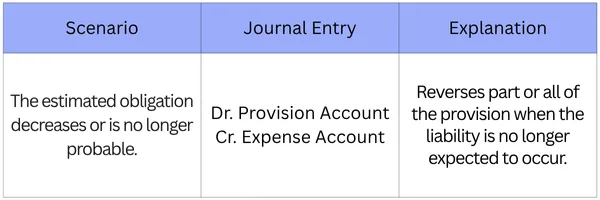

3. When Adjusting or Reversing a Provision

Example:

Example:

If management determines that SAR 10,000 of the warranty provision is no longer required:

→ Dr. Provision for Warranty 10,000

→ Cr. Warranty Expense 10,000

Presentation in Financial Statements

- Balance Sheet Provisions are shown under Current or Non-Current Liabilities depending on the expected settlement period.

- Income Statement The related expense (e.g., Warranty Expense, Legal Expense) appears under operating expense.

Best Practice Tip

Best Practice Tip

Always support provision entries with documentation — legal letters, management estimates, or historical data — to ensure transparency and compliance with IAS 37.

Common Mistakes in Accounting for Provisions

Accurate accounting for provisions requires professional judgment and compliance with standards like IAS 37. However, many businesses — especially SMEs — often make mistakes that lead to misstated financial results or non-compliance during audits.

- Recording Provisions Without Reliable Estimates Many companies record provisions based on rough guesses instead of solid data or experience. IAS 37 requires a reliable estimate of the obligation. This leads to overstated or understated liabilities and distorts profit figures.

- Confusing Provisions with Reserves A common mistake is using “provisions” and “reserves” interchangeably.

- Ignoring Changes in Estimates Some businesses fail to adjust provisions when new information arises. Therefore, they should review provisions at each reporting date and adjust them to reflect current conditions.

- Not Reversing Unused Provisions Companies sometimes leave old provisions on the books even when the obligation no longer exists. This inflates liabilities and understates profits. Businesses should regularly review provisions and reverse unused balances through the income statement.

- Misclassifying Provisions in Financial Statements Provisions must be clearly presented under the right section—current or non-current liabilities. A warranty claim expected to settle within one year should appear as a current liability.

- Lack of Documentation and Audit Trail Every provision should be backed by documentation, such as management approval, legal opinions, or supporting calculations. Without evidence, auditors may reject the provision, leading to audit adjustments.

How Wafeq Helps Automate Provisions Accounting

Accurately managing provisions requires more than accounting knowledge — it demands consistency, real-time data, and complete control over financial entries. Wafeq automates these complex steps to ensure every provision aligns with accounting standards and supports informed decision-making.

- Automated Journal Entries: Wafeq automatically generates journal entries for provisions such as bad debts, warranties, or employee benefits, ensuring correct debit and credit posting without manual effort.

- Customizable Provision Rules: Users can define accounting rules for recurring provisions, such as monthly or quarterly expense recognition, to maintain accuracy and consistency across periods.

- Integration with Financial Statements: All provision entries are reflected instantly in the balance sheet and income statement, providing a complete and real-time financial view.

- Audit Trail and Compliance: Wafeq maintains a detailed audit trail for every provision entry, making it easier for finance teams to comply with audit and regulatory requirements such as IAS 37.

- Reporting and Insights: Generate automated reports showing provision balances, reversals, and utilization, giving CFOs full visibility into future obligations and financial health.

Read Also: What Are Accounting Conventions, And Why Do They Matter?

Provisions are a cornerstone of accurate financial reporting. They ensure that companies account for potential obligations in a timely and responsible manner, reflecting a true and fair view of financial performance. By recognizing provisions, businesses uphold one of the core accounting principles — the Conservatism Principle — which safeguards stakeholders against unexpected risks and misstatements. However, managing provisions manually can be complex, time-consuming, and prone to errors, especially when multiple departments, currencies, or cost centers are involved. This is where technology becomes indispensable.

FAQs About Provisions in Accounting

What is the main purpose of a provision in accounting?

A provision allows businesses to recognize potential future expenses or liabilities before they occur, ensuring that financial statements reflect a realistic view of the company’s obligations and performance.

Are provisions considered expenses?

Yes, provisions are treated as expenses because they represent anticipated costs related to the current accounting period, even if payment will occur in the future.

How do provisions differ from accruals?

Accruals are recorded for known expenses that have occurred but are not yet paid, while provisions estimate uncertain future expenses or obligations whose exact timing or amount is unknown.

Are provisions the same as reserves?

No, provisions and reserves are not the same. Provisions are recorded to cover expected liabilities or losses, while reserves are portions of profit set aside to strengthen financial stability or fund future expansion.

Which accounting standard governs provisions?

Provisions are governed by IAS 37 (Provisions, Contingent Liabilities, and Contingent Assets), which sets out the criteria for recognition, measurement, and disclosure.

How are provisions recorded in the balance sheet?

Provisions appear under current or non-current liabilities, depending on when the obligation is expected to be settled.

What are examples of common provisions?

Common examples include provisions for bad debts, warranties, employee benefits, legal disputes, and asset decommissioning.

Can provisions be reversed?

Yes, if the obligation no longer exists or the estimate changes significantly, the related provision should be adjusted or reversed in subsequent periods.

Why are provisions important for financial accuracy?

Provisions ensure that income and expenses are matched in the correct accounting period, maintaining transparency, accuracy, and compliance with IFRS standards.

Through its smart automation, Wafeq enables finance teams to manage provisions efficiently and fully comply with IFRS requirements.

Through its smart automation, Wafeq enables finance teams to manage provisions efficiently and fully comply with IFRS requirements.

.png?alt=media)