How to prepare a balance sheet

Have you ever sat at your desk, staring at numbers, unsure if your business is doing well, truly, or just surviving? You’re not alone. Many business owners and finance professionals feel the same when they can’t see the full picture. That picture, the real story, is found in the balance sheet. It’s more than a table of numbers. It’s a reflection of your business's health, your hard work, your risks, and your progress.

What is a Balance Sheet?

A balance sheet is one of the core financial statements that provides a snapshot of a company's financial position at a specific point in time. It shows what a company owns (assets), what it owes (liabilities), and the residual interest of the owners (equity). Unlike the income statement, which covers a period, the balance sheet captures a company’s financial condition at one moment.

The Balance Sheet is structured around the basic accounting equation:

The Balance Sheet is structured around the basic accounting equation:

Assets = Liabilities + Equity

This equation must always balance, hence the name "balance sheet." When properly prepared, it reflects financial stability, solvency, and how well the company manages its resources. Businesses use the balance sheet to assess financial health, determine borrowing capacity, make investment decisions, and comply with accounting and regulatory standards.

Why the Balance Sheet Matters for Every Business

The balance sheet is not just a technical report; it’s a decision-making tool. It provides owners, investors, lenders, and auditors with a clear vision of where a business stands financially. It reveals how assets are financed, whether through debt or equity, or whether the company has enough liquidity to meet its short-term obligations.

- For business owners, it highlights how efficiently the company uses its resources and whether its growth is sustainable.

- For lenders and banks, it’s the foundation of credit assessments.

- For investors, it uncovers value and risk.

Beyond that, the balance sheet supports:

- Compliance with local regulations and tax reporting.

- Internal control and budgeting decisions.

- Investor presentations and business valuations.

Without an accurate balance sheet, any financial analysis or planning is incomplete.

Without an accurate balance sheet, any financial analysis or planning is incomplete.

The Structure of a Balance Sheet: Assets, Liabilities, and Equity

The balance sheet is divided into three main parts: Assets, Liabilities, and Equity. Each section gives insight into a different side of the business's financial standing.

Assets Assets represent everything the company owns or controls that has economic value. They are usually grouped into:

- Current Assets: Expected to be used or converted into cash within one year. Examples: Cash, accounts receivable, inventory.

- Non-current Assets: Long-term resources that are not easily liquidated. Examples: Property, equipment, vehicles, trademarks.

Know more about: Understanding Company Assets On The Balance Sheet.

Liabilities Liabilities are obligations the business owes to others, such as lenders, suppliers, or the government.

- Current Liabilities: Debts due within one year. Examples: Accounts payable, salaries payable, short-term loans.

- Non-current Liabilities: Debts due after more than one year. Examples: Long-term loans, bonds payable.

Equity Equity represents what is left for the owners after subtracting liabilities from assets. It reflects ownership in the business. Common components: Owner’s capital, retained earnings, net profit/loss.

Read Also: The Balance Sheet And Income Statement For Beginners.

Step-by-Step Guide: How to Prepare a Balance Sheet

Preparing a balance sheet may seem complicated, but breaking it down into clear steps facilitates the process. Follow this guide to create an accurate and balanced statement:

- Choose the Reporting Date Decide the exact date your balance sheet will represent. It could be the end of a fiscal year, quarter, or month. All figures must reflect this specific moment.

- List All Assets Record every asset your business owns as of the reporting date. Categorize them into current and non-current assets. Ensure reliable documentation, such as bank statements, invoices, and inventory counts.

- List All Liabilities Next, list all your obligations, dividing them into current and long-term liabilities. Include loans, unpaid bills, salaries owed, and taxes due.

- Calculate Equity Equity equals the difference between total assets and total liabilities. Include owner’s capital, retained earnings, and any additional paid-in capital.

- Apply the Balance Sheet Formula Ensure your balance sheet balances by checking that: Assets = Liabilities + Equity If not, revisit your entries for errors or omissions.

- Prepare Notes (If Needed) Sometimes, additional explanations are necessary for certain accounts, such as pending lawsuits, loan terms, or depreciation methods. Attach notes as needed.

- Review and Approve Have an accountant or auditor review the balance sheet to confirm accuracy before sharing it with stakeholders.

Balance Sheet Errors That Can Cost You: What to Avoid

Even small mistakes in a balance sheet can lead to poor decisions, missed financing opportunities, or compliance issues. Here are some of the most common errors and how to prevent them:

- Skipping Asset Valuation Updates Failing to update the actual value of assets, such as equipment or inventory, leads to misleading totals. So, reassess non-current assets annually and match with depreciation policies.

- Misclassifying Items Classifying a short-term loan as a long-term liability or confusing capital with retained earnings can distort your financial picture. So the Fix would be to double-check every line item classification using accounting standards.

- Forgetting Accrued Expenses or Revenues Omitting items like unpaid salaries, interest, or earned income that haven't been collected yet creates an incomplete statement. It's crucial to use accrual-based accounting and maintain schedules of recurring items.

Also Read: Accrual Accounting Essentials: Prepaid Expenses, Accruals, and Revenue Deferrals Explained

- Failing to Reconcile Accounts If bank statements, inventory records, and ledgers aren’t reconciled, the balance sheet may not balance. The Fix always performs reconciliations before finalizing the report.

- Not Matching the Balance Sheet Date with Supporting Data Using figures from different periods breaks the integrity of the report. The business has to use consistent data for all sections as of the same reporting date.

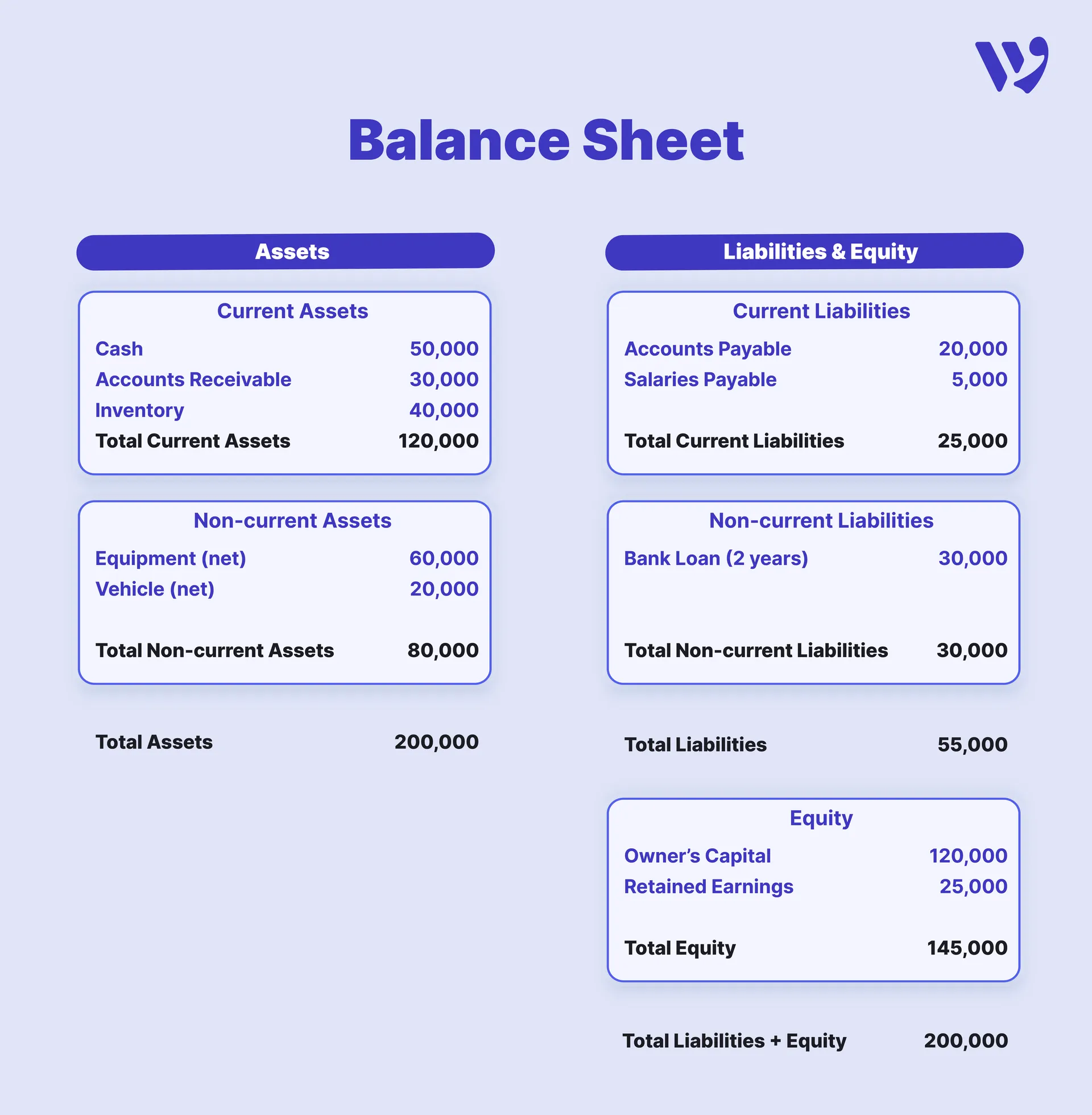

Real Example: Preparing a Simple Balance Sheet

To make the balance sheet preparation process more practical, here’s a simple example for a small business—“ABC Trading Co.”—as of December 31, 2024:

This example shows how the balance sheet formula works:

This example shows how the balance sheet formula works:

Assets = Liabilities + Equity → 200,000 = 55,000 + 145,000

You could use this structure as a base for building more detailed financial statements as your company grows.

Automating the Balance Sheet with Wafeq

Manual balance sheet preparation can be time-consuming and prone to errors, especially as transactions grow in volume and complexity. This is where Wafeq makes a real difference. Wafeq is designed to simplify and automate the accounting process for businesses in the region, ensuring accurate, compliant, and real-time financial statements, including your balance sheet.

Here’s how Wafeq helps in preparing a Balance Sheet

- Automatic Journal Entries: Every transaction, sale, expense, payroll, and bank transfer is recorded with proper accounting treatment in real-time.

- Live Balance Sheet Generation: You can view your balance sheet instantly at any time without waiting for month-end reports.

- Customizable Chart of Accounts: Tailor your accounts to fit your business type and local reporting requirements.

- ERP-Level Accuracy Without the Complexity: Wafeq handles double-entry posting, classification, and reconciliation in the background.

- Seamless Compliance: Wafeq keeps your balance sheet aligned with ZATCA requirements and supports audit readiness.

Also Read: A Comprehensive Guide to mastering the art of Budgeting for Businesses

Numbers on a balance sheet tell a deeper story; liquidity, solvency, and capital structure in one frame. Each line signals how decisions shaped the business: investments made, debts managed, profits retained or distributed. Mastering the structure isn’t only about compliance. It brings visibility into financial position, uncovers patterns, and guides funding, expansion, or restructuring plans. Reviewing it regularly supports real control that is grounded in facts, not assumptions.

FAQs about preparing a balance sheet

What’s the difference between a trial balance and a balance sheet?

A trial balance lists all general ledger balances to check for errors in posting. A balance sheet, on the other hand, is a formal financial statement that shows the financial position (assets, liabilities, equity) at a point in time.

How often should a balance sheet be prepared?

It depends on business needs. Monthly balance sheets help track performance regularly, while quarterly and annual statements are standard for financial reporting and compliance.

Can a balance sheet show negative equity?

Yes. If liabilities exceed assets, equity becomes negative; this indicates accumulated losses or insolvency risks.

Why doesn’t my balance sheet balance?

Common causes include incorrect journal entries, missing transactions, or classification errors. Use trial balances, reconcile accounts, and check equity calculations.

Is it okay to prepare a balance sheet without a professional accountant?

Yes, for teeny businesses, but for growing or regulated entities, working with a certified accountant or using software like Wafeq ensures compliance and accuracy.

Financial clarity shouldn’t take hours of manual work. With Wafeq, your balance sheet updates itself accurately, instantly, and always in sync with your business.

Financial clarity shouldn’t take hours of manual work. With Wafeq, your balance sheet updates itself accurately, instantly, and always in sync with your business.

.png?alt=media)