Everything you need to know about the financial forecast report and a practical example of extracting it from Wafeq in two steps

Effective financial forecasting today requires far more than linear extrapolations of historical data. With the evolution of International Accounting Standards (IFRS 9) and financial disclosure requirements, organizations must now adopt advanced predictive models capable of Multi-variable sensitivity analysis to stress-test assumptions, Monte Carlo simulations for market volatility impact assessment, operational-financial linkage through KPI-driven modeling, and machine learning applications for non-linear pattern detection. These methodologies form the foundation of predictive frameworks that address the core challenge in emerging markets.

What is a Financial Forecasting Report?

A Financial Forecasting Report is a formal document that projects a company's future financial performance based on historical data, market trends, and key assumptions. It helps businesses, investors, and stakeholders make informed decisions by estimating revenues, expenses, cash flows, and profitability over a specific period (short-term or long-term).

Key Components of a Financial Forecasting Report

A well-structured Financial Forecasting Report is a critical decision-making tool for internal management, accountants, and financial auditors, providing a data-driven outlook on the company’s future financial performance. This report breaks down financial projections into key components, including:

- Executive Summary: Brief overview of the forecast’s purpose, time frame, and key findings.

- Revenue Projections: Sales forecasts by product or service, customer segment, or market, and growth assumptions (e.g., market trends, pricing strategies).

- Expense Forecasts: Fixed vs. variable costs (e.g., salaries, rent, materials) and operational and capital expenditures (CapEx).

- Cash Flow Forecast: Expected inflows like sales and investments, outflows like payments and debt servicing, and liquidity analysis to ensure solvency.

- Profit & Loss (P&L) Projection: Estimated net income (revenue minus expenses). EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization).

- Balance Sheet Forecast: Projected assets, liabilities, and equity.

- Key Assumptions & Drivers: Basis for projections (e.g., economic conditions, industry trends). Sensitivity analysis (best-case/worst-case scenarios).

- Risk Analysis: Potential financial risks (e.g., market volatility, regulatory changes). Mitigation strategies.

Types and Methods of Financial Forecasts

Companies use different types of forecasts depending on their time horizon, strategic goals, and operational needs. Here are the key types of financial forecasts used in business planning:

- Short-Term Forecasts (1–12 months) Focus on cash flow, working capital, and operational expenses, and use them for monthly/quarterly budgeting, payroll, and inventory management. For example, a 12-month cash flow projection.

- Long-Term Forecasts (1–5+ years) Strategic planning for growth, investments, and funding needs. It includes revenue trends, capital expenditures (CapEx), and profitability. For example, a 5-year financial plan for expansion.

- Rolling Forecasts (Continuous Updates) Updated regularly (e.g., quarterly) to reflect real-time data and market changes. Replaces traditional static annual budgets for agile decision-making.

- Scenario-Based Forecasts (Best/Worst Case) Examines multiple outcomes based on economic conditions, risks, or opportunities. Helps in risk management and contingency planning.

- Top-Down vs. Bottom-Up Forecasts

- Top-Down: Starts with market trends and trickles down to departments.

- Bottom-Up: Built from department-level data (sales, expenses) for accuracy.

6. Operational Forecasts Ties financial data to operational metrics (e.g., production capacity, sales volume).

Financial Forecast Report's Purpose & Benefits

A Financial Forecast Report is a strategic business roadmap, projecting future revenues, expenses, cash flows, and profitability. Its primary purpose is to support data-driven decision-making, ensuring financial stability and sustainable growth. Its Key Benefits are:

- Informed Decision-Making: It provides management with actionable insights for budgeting, investments, and cost control.

- Cash Flow Management as it predicts liquidity needs to avoid shortfalls and optimize working capital.

- Investor & Lender Confidence – Demonstrates growth potential and financial health to secure funding.

- Risk Mitigation – Identifies financial risks early through scenario analysis (best/worst-case projections).

- Strategic Planning – Aligns long-term goals with financial capabilities (e.g., expansion, R&D).

- Performance Tracking – Sets benchmarks to compare actual results against forecasts.

- Regulatory Compliance – Helps auditors and regulators assess fiscal responsibility.

Financial Forecast Report: Retail Industry

Purpose:

- Predict seasonal demand fluctuations.

- Optimize inventory procurement and markdown strategies.

- Plan for promotional campaigns and peak sales periods.

Key Metrics to Forecast:

- Same-store sales growth.

- Gross margin by product category.

- Inventory turnover ratios.

- E-commerce vs. brick-and-mortar performance.

Financial Forecasting Models

Financial forecasting models are systematic approaches used to predict a company's future financial performance by analyzing historical data, market trends, and key variables. These models enable businesses to make data-driven decisions, optimize resource allocation, and mitigate risks. Each model serves distinct purposes depending on the business context, data availability, and planning horizon. Understanding these models is critical for CFOs, financial analysts, and business owners to ensure accurate budgeting, strategic growth, and investor confidence. Below, we explore the most widely used financial forecasting models, their applications, and how to select the right one for your business needs.

- Time-Series Models Time-series models use historical data to predict future performance by identifying patterns (trends, seasonality). It's best for stable businesses with consistent historical data and short-term cash flow forecasting, but they cannot account for external shocks (e.g., economic crises). Examples: Moving Averages, Exponential Smoothing, ARIMA

- Regression Models Statistical models that examine relationships between variables (e.g., "How does marketing spend impact sales?"). They require at least 2+ years of operational data, and are best for Medium-term planning (1-3 years). Model types are Linear Regression (for constant-rate relationships) and Multiple Regression (multiple variables).

- Bottom-Up Forecasting It starts with granular data (e.g., unit sales, per-product costs) and aggregates upward. This model is highly accurate but labor-intensive and best for inventory-heavy businesses (retail, manufacturing). Its steps include forecasting individual product sales, calculating per-unit costs, and summing all components.

- Top-Down Forecasting It begins with macro-level data (market size, GDP growth) and allocates downward. It's faster than bottom-up forecasting but less precise, and best for startups and high-growth companies. Example Process: Estimate total addressable market (TAM), apply expected market share %, and allocate to departments.

- Monte Carlo Simulation This model uses probability distributions to model uncertainty by running 1,000s of scenarios. Its Key uses include risk assessment for investments and Project valuation under uncertainty, and it requires Specialized software.

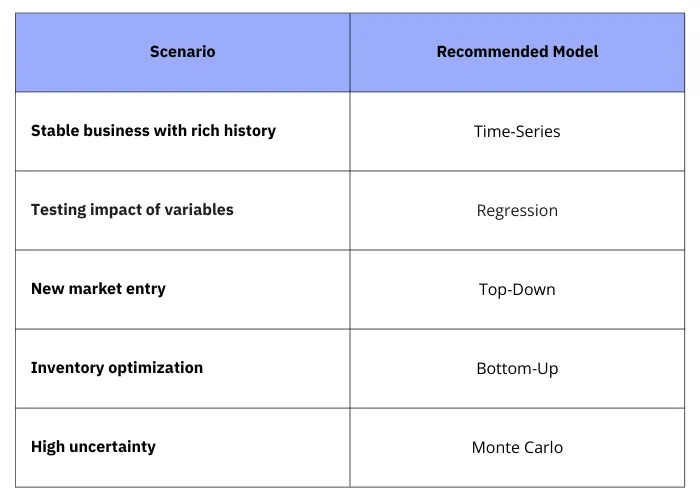

Model Selection Guide

How to Extract a Financial Forecast Report from Wafeq

To extract a Financial Forecast Report from Wafeq in two simple steps:

- Log in to your Wafeq account and select the

Reportssection from the main left menu، then chooseCash Forecastfrom the report options.

2. Select the currency you need from the options, then click on Export to export it as a PDF or Excel for more analysis.

Use Wafeq - an accounting system to manage all financial operations in your business, and build accurate, AI-powered reports and forecasts in minutes.

Use Wafeq - an accounting system to manage all financial operations in your business, and build accurate, AI-powered reports and forecasts in minutes.

Core Challenges Finance Leaders Face in Making Financial Forecasting Reports

Financial forecasting is a complex and high-stakes responsibility for finance leaders, who must balance accuracy, adaptability, and strategic insight in an increasingly volatile business environment. Below are the key challenges they face, explained in detail:

- Data Quality and Integration Issues Finance teams often struggle with inconsistent, siloed, or incomplete data from multiple sources such as ERP, CRM, and legacy systems. Manual data entry errors, formatting discrepancies, and delays in data consolidation can lead to flawed assumptions and unreliable forecasts. Without a unified data infrastructure, finance leaders waste valuable time cleaning and reconciling information rather than analyzing trends.

- Market Volatility and External Disruptions Unpredictable events—such as geopolitical conflicts, sudden regulatory changes, or supply chain breakdowns—can render even the most well-researched forecasts obsolete. For example, a company may forecast steady growth, only for an economic downturn or a competitor’s innovation to disrupt the entire market. Traditional models struggle to account for these rapid shifts, requiring dynamic, scenario-based forecasting.

- Over-Reliance on Historical Trends Many financial forecasts depend heavily on past performance, assuming that future trends will follow a similar trajectory. However, in fast-moving industries (e.g., technology or renewable energy)، historical data may not account for emerging risks or opportunities. This backward-looking approach can lead to missed growth potential or unexpected financial shortfalls.

- Stakeholder Misalignment and Pressure Finance leaders must reconcile competing expectations from executives, investors, and operational teams. Sales departments may push for aggressive revenue targets, while risk managers advocate for conservative projections. Striking the right balance between optimism and realism is a persistent challenge, especially when forecasts directly impact budgets, hiring, and investment decisions.

- Regulatory and Compliance Complexities Evolving accounting standards (e.g., IFRS 9, CECL) require companies to adjust their forecasting methodologies, often demanding more granular data and stress-testing. Additionally, auditors and regulators increasingly scrutinize AI-driven forecasts, requiring transparent, explainable models to justify projections.

- Technology and Resource Constraints Many organizations still rely on outdated Excel-based models that lack real-time analytics and automation. Implementing advanced forecasting tools (e.g., AI, machine learning) requires significant investment in software, training, and data infrastructure, which poses a hurdle for mid-sized firms with limited budgets.

Machine Learning for Non-Linear Pattern Detection in Financial Forecasting

Machine learning (ML) excels at identifying complex, non-linear patterns in financial data that traditional statistical models often miss. Unlike linear regression, ML algorithms like Random Forests, Neural Networks and Gradient Boosting can:

- Detect Hidden Relationships and uncover subtle correlations between disparate variables (e.g., social media sentiment → stock prices).

- Adapt to Volatility through modeling erratic market behaviors (cryptocurrency, commodities) using recurrent neural networks (RNNs).

- Automate Feature Engineering through Self-select predictive variables from large datasets (e.g., transaction logs, IoT sensor data).

- Improve Forecast Accuracy and reduce errors by 15–30% compared to ARIMA in backtesting (McKinsey, 2023).

Financial forecasting remains an indispensable tool for modern businesses, enabling leaders to navigate uncertainty, allocate resources strategically, and drive sustainable growth. While challenges like data fragmentation, market volatility, and stakeholder alignment persist, advancements in AI-powered analytics and integrated platforms, like Wafeq, are transforming forecasting from a reactive exercise into a proactive strategic advantage. By adopting dynamic, scenario-based approaches and leveraging real-time data, finance teams can move beyond static spreadsheets to generate accurate, actionable insights. The future belongs to organizations that treat forecasting not as a compliance requirement, but as a continuous process for risk management and opportunity identification. As regulatory landscapes evolve and markets grow more complex, the ability to anticipate change, rather than just react to it, will separate industry leaders from the competition.

.png?alt=media)