Free GRN Template & Guide – Streamline Your Warehouse and Accounting

A delivery truck arrives at the warehouse, stacks of boxes piled high, labels barely visible, and a long list of items to verify. How can the team ensure every item is accounted for and matches the purchase order? This is where the **Goods Received Note (GRN)** becomes essential: a formal document that confirms all received goods are checked, accurate, and properly recorded.

Implementing an effective GRN process is critical for accurate inventory management, reliable financial records, and smooth operational workflows in any business handling goods

What is a Goods Received Note (GRN)?

It is an official document used in warehouse and inventory management to record details of goods delivered by suppliers, ensuring transparency between purchasing, accounting, and warehouse teams, and serves as a reference for stock updates, payment approvals, and auditing purposes. It typically includes:

- Supplier information and purchase order number.

- Date and time of delivery.

- Description, quantity, and condition of goods.

- Signatures of warehouse staff receiving the goods.

Goods Receipt Form and Its Use in Warehouses

The Goods Receipt Form is essentially the GRN template used by warehouses to standardize the receiving process. Using a standardized form minimizes errors, reduces disputes with suppliers, and ensures that inventory records are accurate.

It helps warehouse staff verify:

- Whether the delivered items match the purchase order.

- The quality and condition of goods.

- Correct labeling and packaging.

Download a Goods Receipt Form

A downloadable GRN template helps ensure:

- Standardized recording across all warehouse locations.

- Easy digital storage for audit purposes.

- Quick data entry and integration with inventory software.

Download a Goods Receipt Form for Free

What Information Should a GRN Contain? (Key Fields and Format)

A well-prepared Goods Received Note (GRN) must include specific information to ensure accuracy, traceability, and compliance with inventory and accounting controls. Missing or incomplete data can lead to stock discrepancies, audit issues, and payment delays. Essential Information in a GRN:

- GRN Number: A unique reference number for tracking and audit purposes.

- Purchase Order Reference: Links the GRN directly to the approved purchase order.

- Supplier Details: Supplier name, code, and contact information.

- Delivery Date and Time: Records when goods were physically received.

- Item Description: Clear description of each item received, including SKU or item code.

- Quantity Received: Actual quantity received, not the ordered quantity.

- Condition of Goods: Notes on damage, defects, or quality issues, if any.

- Warehouse or Storage Location: Identifies where goods are stored after receipt.

- Receiver’s Name and Signature: Confirms accountability for the inspection and the receipt.

- Approval Signature: Authorization from the warehouse or operations manager.

What is the Goods Receipt Form useful for?

The Goods Receipt Form (GRN) is essential for effective inventory and warehouse management, and without a GRN, businesses risk errors, delayed payments, stock discrepancies, and reduced operational efficiency. Its importance lies in its ability to:

- Ensure Accuracy: Confirms that delivered goods match purchase orders in quantity and quality.

- Support Financial Controls: Provides documentation needed for accounts payable and auditing.

- Prevent Disputes: Acts as a formal record in case of discrepancies with suppliers.

- Improve Inventory Management: Helps maintain real-time stock records and prevent stockouts or overstocking.

- Enhance Operational Efficiency: Streamlines the receiving process and ensures all teams are aligned.

GRN Example (Practical Scenario)

GRN Example (Practical Scenario)

A supplier delivers 100 units of office chairs against PO-4567. After inspection, the warehouse confirms:

- 98 units received in good condition

- 2 units damaged

The GRN records the actual received quantity (98), notes the damage, updates inventory accordingly, and informs the finance team before processing the invoice.

Essential Warehouse and Storehouse Forms

Efficient warehouse management relies not just on the Goods Received Note (GRN), but also on a set of essential forms that ensure smooth operations and accurate record-keeping. Some of the most critical warehouse and storehouse forms include:

- Goods Received Note (GRN): Confirms receipt, condition, and quantity of delivered goods.

- Stock Transfer Note: Tracks movement of goods between warehouses or storage locations.

- Delivery Note / Dispatch Form: Documents items leaving the warehouse for customers or other branches.

- Inventory Count Sheet: Used during stock audits or periodic counts to verify actual vs. recorded inventory.

- Damage / Return Form: Records damaged, expired, or returned goods for proper adjustment in stock records.

Read also: Inventory Calculation Made Easy: Core Formulas & Practical Examples.

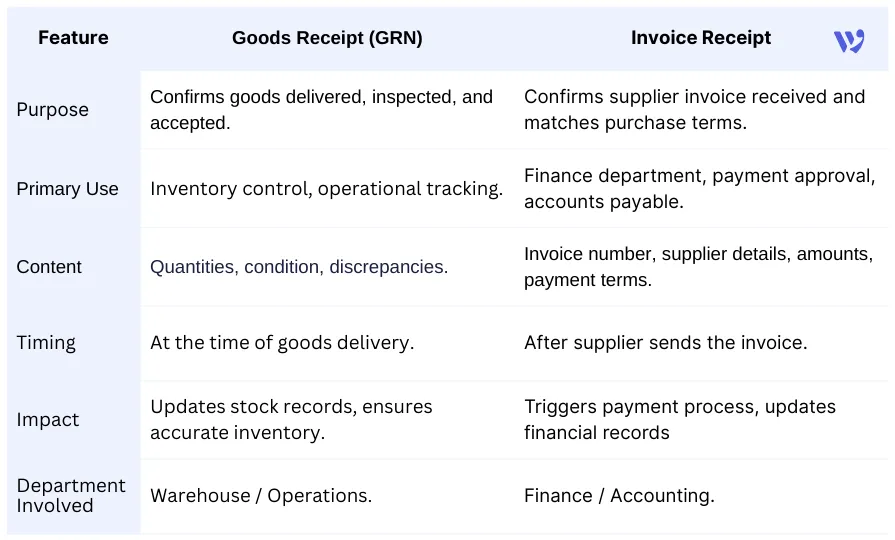

Goods Receipt vs Invoice Receipt: What is the difference?

In inventory and finance management, understanding the distinction between a Goods Receipt (GRN) and an Invoice Receipt is essential. While both documents are related to purchased goods, they serve different purposes:

- Goods Receipt (GRN): Confirms that the goods have been delivered to the warehouse, inspected, and accepted as per the terms of the contract. It records quantities, conditions, and any discrepancies. GRNs are primarily used for inventory control and operational tracking.

- Invoice Receipt: Confirms that a supplier’s invoice has been received and matches the agreed terms of purchase. It is mainly used by the finance department to approve payments and update accounts payable.

What Is the Correct GRN Process in Warehouse Operations?

Using a Goods Received Note (GRN) correctly is essential for maintaining inventory accuracy, financial control, and efficient warehouse operations. Below are the best practices businesses should follow:

- Verify Goods Against the Purchase Order Always compare received goods with the purchase order before issuing a GRN. This ensures quantities, specifications, and product conditions match what was ordered.

- Inspect Quality and Condition on Arrival Check for damage, defects, or expired items upon delivery time. Any discrepancies should be clearly noted on the GRN to avoid disputes with suppliers.

- Record GRN Immediately Delays in recording GRNs can lead to inaccurate stock levels and financial mismatches. GRNs should be issued and logged as soon as goods are received.

- Use Standardized Warehouse Forms Standard GRN and warehouse forms reduce manual errors, ensure consistency, and improve communication between the warehouse, procurement, and finance teams.

- Separate GRN from Invoice Processing GRNs confirm receipt of goods, while invoices trigger payment. Keeping these processes separate strengthens internal controls and supports accurate accounts payable procedures.

- Maintain Clear Audit Trails Store GRNs digitally or physically in an organized manner. This ensures traceability for audits, compliance reviews, and financial reporting.

- Integrate GRN with Inventory Systems Link GRN records directly to inventory or accounting systems to enable real-time stock updates and reduce manual data entry.

What is GRN Workflow? (Step-by-Step Process)

The Goods Received Note (GRN) workflow outlines how goods are received, verified, recorded, and approved within warehouse and accounting systems. This process ensures accuracy, accountability, and financial control.

- Purchase Order Issued The procurement team issues a Purchase Order (PO) to the supplier, detailing quantities, specifications, and delivery terms.

- Goods Delivered to Warehouse The supplier delivers the goods to the warehouse or storehouse as per the purchase order.

- Physical Inspection of Goods Warehouse staff inspect the goods to verify: Quantity, Quality, Condition, Packaging. Any discrepancies or damages are identified at this stage.

- GRN Creation A Goods Received Note (GRN) is prepared, capturing:

- PO reference number.

- Supplier details.

- Items received and quantities.

- Inspection notes and discrepancies.

5. GRN Approval The GRN is reviewed and approved by an authorized warehouse or operations manager. 6. Inventory Update Approved GRN data is recorded in the inventory or warehouse management system, updating stock levels. 7. Finance Notification The GRN is shared with the finance or accounting team to support invoice verification and payment processing.

Read Also: Understanding the Inventory Cycle: Key Steps and Challenges.

Can GRN Be Automated Using Accounting or ERP Systems?

Yes, the Goods Received Note (GRN) can be fully automated using modern accounting and ERP systems, significantly improving accuracy, speed, and control across warehouse and finance operations.

How GRN Automation Works

- Purchase Order Integration GRNs are generated directly from approved purchase orders, eliminating duplicate data entry.

- Digital Goods Receipt Warehouse teams record receipts electronically using tablets or systems, capturing quantities, conditions, and notes in real-time.

- Automatic Inventory Update Stock levels update instantly once the GRN is approved, ensuring real-time inventory visibility.

- Invoice Matching (3-Way Matching) GRNs are automatically matched with purchase orders and supplier invoices, reducing overpayments and disputes.

- Audit-Ready Records All GRNs are stored digitally with timestamps and user logs, simplifying audits and compliance reviews.

Know more about: Inventory Management: Techniques And Types Explained.

A well-structured Goods Received Note (GRN) process is more than a warehouse procedure—it is a critical control point that connects procurement, inventory, and accounting. By documenting what was actually received, GRNs protect businesses from overpayments, inventory discrepancies, and audit risks.

When combined with standardized warehouse forms and automated accounting systems, GRNs improve data accuracy, strengthen internal controls, and support faster and more reliable financial reporting.

FAQs about Goods Received Note (GRN)

What is the purpose of a GRN in accounting?

In accounting, a GRN supports inventory recognition, invoice matching, and internal controls. It helps ensure businesses only pay for goods that were actually received and approved.

Is a GRN mandatory?

While not legally mandatory in all jurisdictions, a GRN is considered a best practice and is essential for audit readiness, inventory accuracy, and strong financial controls.

What is the difference between GRN and Goods Receipt Form?

There is no practical difference. A Goods Receipt Form is the template or format used to create a GRN. Both refer to the same receiving document.

Who prepares a GRN?

A GRN is typically prepared by the warehouse or storekeeper after inspecting the delivered goods, and then approved by a supervisor or operations manager.

Can a GRN be issued without an invoice?

Yes. A GRN is issued when goods are received, regardless of whether the supplier invoice has arrived. This separation strengthens internal controls.

Can GRNs be digital?

Yes. Most modern accounting and ERP systems support digital GRNs, enabling real-time inventory updates, audit trails, and automated invoice matching.

With Wafeq, businesses can manage Goods Received Notes, inventory updates, and invoice matching in one integrated accounting system.

With Wafeq, businesses can manage Goods Received Notes, inventory updates, and invoice matching in one integrated accounting system.

![How to Prepare a Price Quotation for companies [with Free Template Download]](https://firebasestorage.googleapis.com/v0/b/wafeq-docs.appspot.com/o/medias%2F531f7990_كيفية إعداد نموذج عرض سعر للشركات [مع تنزيل مجاني].png?alt=media)

![Payment Vouchers Explained: Purpose, Format, and Best Practice [Free Template]](https://firebasestorage.googleapis.com/v0/b/wafeq-docs.appspot.com/o/medias%2F1af56400_سند الصرف_ الغرض والنموذج وأفضل الممارسات [مع نموذج مجاني].png?alt=media)