Understanding VAT Return: Definition, Importance, and Free Downloadable Template

As a business owner, you may have heard of the term "VAT return" before, but you may not be entirely sure of what it means or why it's important. In this article, we will define VAT return, explain its significance, and provide a free downloadable template to help you complete your own VAT return.

What is VAT Return?

A VAT return is a form that businesses registered for Value Added Tax (VAT) in certain countries must complete and submit to the tax authority at regular intervals.

The form includes details of the business's sales and purchases during the relevant period and shows the amount of VAT charged and paid.

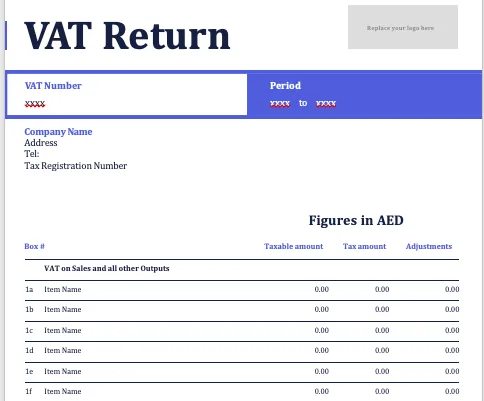

Download our free VAT Return template

Click here to download.

What Information Should a VAT Return Contain?

A VAT return should contain specific information required by tax laws in the country in which it is filed. Some of the common details that should be included in a VAT return are:

- The business's VAT registration number

- The VAT period covered by the return

- The business's sales and output tax are charged

- The business's purchases and input tax claimed

- The total amount of VAT due or refundable

- Any adjustments or corrections to previous VAT returns

Read more: How to file a VAT return in ZATCA.

Why is a VAT Return Important?

A VAT return serves several purposes, both for the business filing it and the tax authority receiving it. Here are some of the reasons why VAT returns are essential:

Legal Compliance: In countries where VAT is applicable, businesses registered for VAT are required by law to file VAT returns on a regular basis. Failing to do so can result in fines and penalties.

Accurate Record-Keeping: VAT returns provide a clear record of the business's sales and purchases, making it easier to keep accurate records for tax and accounting purposes.

Managing Cash Flow: Completing a VAT return can help businesses manage their cash flow, as they can claim back VAT paid on purchases against VAT charged on sales.

Claiming VAT Refunds: If a business has paid more VAT than it has charged, it may be eligible for a VAT refund, which can be claimed by completing a VAT return.

Read more: What are VAT and VAT returns?

How to Complete a VAT Return

Completing a VAT return can be a complex process, but it is essential to get it right to avoid penalties and ensure accurate reporting of your business's VAT obligations. Here's a step-by-step guide to help you complete your VAT return:

- Download our free VAT return template or use the one provided by your tax authority.

- Fill in your business's VAT registration number and the period covered by the return.

- Enter the total value of your sales and the amount of output tax charged.

- Enter the total value of your purchases and the amount of input tax claimed.

- Calculate the amount of VAT due or refundable, based on the difference between the output tax charged and the input tax claimed.

- Include any adjustments or corrections to previous VAT returns.

- Review the return to ensure that all the required information is included and that it is accurate and easy to read.

- Submit the VAT return to your tax authority by the deadline.

Learn How to create VAT returns using Wafeq.

Conclusion

In conclusion, VAT return is a necessary part of doing business in countries where VAT is applicable, as it serves legal, financial, and accounting purposes.

By following the guidelines for completing a VAT return and using our free downloadable template, you can ensure that your VAT returns are accurate, complete, and submitted on time. Remember, timely and accurate filing of your VAT returns can save you money and avoid penalties, so it's essential to make sure your VAT returns are filed correctly and on time.

For more advanced options and to run your business better, sign up now for Wafeq - Accounting software to track your expenses, and bills, run payroll, manage your inventory, and create more than 30 financial reports with just a single click.

For more advanced options and to run your business better, sign up now for Wafeq - Accounting software to track your expenses, and bills, run payroll, manage your inventory, and create more than 30 financial reports with just a single click.

![How to Prepare a Price Quotation for companies [with Free Template Download]](https://firebasestorage.googleapis.com/v0/b/wafeq-docs.appspot.com/o/medias%2F531f7990_كيفية إعداد نموذج عرض سعر للشركات [مع تنزيل مجاني].png?alt=media)

![Payment Vouchers Explained: Purpose, Format, and Best Practice [Free Template]](https://firebasestorage.googleapis.com/v0/b/wafeq-docs.appspot.com/o/medias%2F1af56400_سند الصرف_ الغرض والنموذج وأفضل الممارسات [مع نموذج مجاني].png?alt=media)