UAE Corporate Tax: A Comprehensive Overview

The United Arab Emirates (UAE) has introduced ground measures regarding its instated Corporate Tax. This will bring drastic changes to all companies in the country, especially regarding accounting. In this article, we gathered all the important information one needs to know about this new tax, including what it is, who is subject to it, and more.

[Update: 14 October 2024]

The UAE Ministry of Finance announced the abolition of Economic Substance Activity reports and notifications for financial years ending after 31 December 2022. This follows Cabinet Decision No. (98) of 2024, amending Cabinet Decision No. (57) of 2020 after the introduction of the Corporate Tax system.

Companies are no longer required to submit reports for these years but must comply with obligations for previous years, including responding to authorities' requests and paying any penalties.

[Update: 10 April 2023]

The UAE’s Ministry of Finance has raised the minimum threshold for corporate tax from $100,000 (AED375,000) to $816,000 (AED3 million) for small and micro businesses, startups, and freelancers.

The law will go into effect at the beginning of June 2023, and continue until the end of December 2026.

[Update: 22 January 2023]

The Federal Tax Authority (FTA) has launched early registration for corporate tax through the EmaraTax platform for digital tax services, in line with “Corporate Tax Law”), which stipulates that Taxable Persons will become subject to

Corporate Tax from the beginning of their first financial year that starts on or after 1 June 2023.

The early registration period is available from January 2023 to May 2023 for certain categories of companies operating in the UAE. These selected companies will be receiving invitations from the FTA by email and SMS, allowing them to register.

Following this phase, the FTA will announce at a later date when registration will be open for other companies and businesses. The FTA will make sure to give ample time for companies and businesses to apply for registration and meet their legal obligations. When registration opens, priority will be given to companies and businesses that have a financial year starting on 1 June 2023.

-> How to register corporation tax in the UAE.

Main Takeaways

- The UAE published a corporate tax law on Friday, specifying that businesses reporting more than $816,000 (AED3 million) will be subject to a nine percent tax rate.

- Businesses in the UAE will be subject to the tax beginning with the financial year that ends on or after June 1, 2023.

- The Dh 3 million barrier was added to the law to promote startups, small and medium-sized businesses, and the economy's competitiveness.

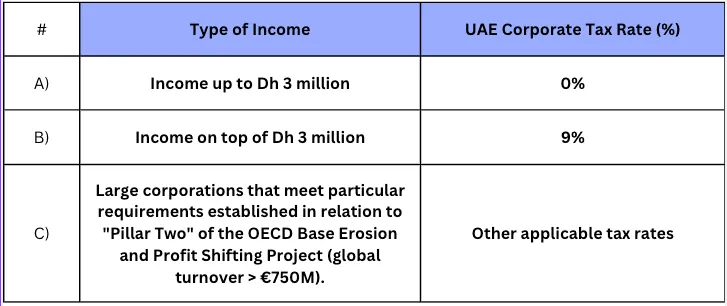

UAE Corporate Tax Rate

If your taxable income is more than AED 3 million, corporate tax will be charged at a headline rate of 9%. A 0% corporate tax rate below this cap will apply to Taxable Income.

Who Is Affected By The UAE Corporate Tax, And What Is It?

The net income of companies is subject to corporate tax, a type of direct tax. In certain other countries, it's also known as "Corporate Income Tax" or "Business Profits Tax." Naturally, as with many newly instated taxes, most of the country’s population will be affected, some directly, some indirectly.

Companies that pass the Dh 3 million threshold, for instance, will be directly impacted, while employees and consumers may experience indirect effects, like altered prices, different wages, and the sort.

Income Exempt from The UAE Corporate Tax

The Corporate Tax Law exempts some forms of revenue from Corporate Tax. As a result, a Taxable Person will not be charged Corporate Tax on such revenue and cannot deduct any expenses connected to it.

Taxable individuals who receive exempt income continue to be liable for paying corporate tax on their taxable income. The fundamental goal of exempting some income from corporate tax is to avoid taxing some forms of income twice.

Corporate tax will typically not be applied to dividends and capital gains derived from local and overseas shareholdings. In addition, for the UAE Corporate Tax, a Resident Person may choose, under certain circumstances, to exclude income from a foreign Permanent Establishment.

UAE Corporate Tax Deductibles

A text deductible is an amount that can lower the taxable income for companies. The timing of the deduction may vary depending on the type of expense and the chosen accounting system. Still, in general, any legitimate business expenses made entirely and exclusively to generate Taxable Income will be deductible.

For capital assets, expenses are typically recorded through amortization or depreciation deductions throughout the asset's or benefit's economic life.

Dual-purpose expenses, such as those incurred for both personal and company needs, must be allocated, with the relevant portion being considered deductible if it was incurred completely and solely for the taxable person's business.

For corporate tax purposes, some expenses that are deductible under normal accounting principles might not be entirely deductible.

For calculating the Taxable Income, these must be re-added to the Accounting Income.

Examples of expenses that are potentially fully or partially deductible are as follows:

Zero deduction:

- Bribes

- Penalties and fines (other than compensation for damages or breach of contract)

- Gifts, grants, or donations given to a non-qualifying public benefit organization

- Distributions of dividends and other profits

- Expenses not incurred entirely and only for the needs of the taxpayer's business

Potential deductible examples:

Costs incurred to get income exempt from corporate tax are deductible: Spending for client entertaining is partially deductible at 50% of the cost.

Expenditure on interest: Up to 30% of earnings before interest, tax, depreciation, and amortization may be deducted for net interest expenses that exceed a specified de minimis threshold (except for certain activities)

Other Exemptions From The UAE Corporate Tax

Free zone businesses operating in the United Arab Emirates that meet all requirements outlined in the Executive Regulations of the UAE Corporate Tax Law are exempt from paying corporate tax under the law.

Activities related to the extraction of natural resources are likewise exempt. However, they are still subject to any current emirate-level taxes.

Additionally exempt from corporate tax are public benefit organizations, pension funds, investment funds, and government institutions.

Taxpayers who generate an annual income of more than Dh 3 million, including residents, some non-residents, and people working in free zones, will be subject to corporate tax.

If non-residents have a permanent establishment in the UAE and receive income from the sale of goods and services, etc., there, they are also liable to 9% tax.

All taxable individuals are required to keep their records and paperwork for seven years after the tax period has ended.

The legislation mandates that yearly corporate tax returns be submitted by all taxable individuals no later than nine months following the conclusion of the applicable tax period.

Preparation For The UAE Corporate Tax Changes

Prepare your company and yourself by doing the following:

- Read the Corporate Tax Law and the supplementary materials on the Federal Tax Authority and Ministry of Finance websites

- Use the facts at your disposal to decide if and when your company will be liable for corporate tax

- Recognize the conditions that apply to your company under the Corporate Tax Law, such as:

- Whether and when your company must register for corporate tax;

- What is the accounting or tax period for your company;

- When your company would be required to file a corporate tax return;

- What elections or applications your company may or should make for corporate tax purposes;

- What financial data and records your company must maintain for Corporate Tax purposes;

- Routinely visit the websites of the Federal Tax Authority and the Ministry of Finance for more information and guidelines on the Corporate Tax regime.

Read Also: Mandatory UAE Corporate Tax Registration for SMEs.

The newly imposed UAE Corporate Tax will bring great changes to businesses, and thus the entire country’s economy. It might seem complex at first, but with proper due diligence and guidelines, companies’ accountants will be able to make the best out of this new system and potentially save some funds along the way.

Disclaimer:

Disclaimer:

The information displayed in this article is based on official announcements of the respective authorities, however, it is not exhaustive, and it is for marketing purposes. You should never rely entirely on any kind of information displayed in this article. For fully accurate, up-to-date, and official information, visit Ministry of finance Corporate Tax page.