Types of VAT in the UAE: Understanding Different VAT Rates

Value Added Tax (VAT) was introduced in the UAE on January 1, 2018, as a significant source of revenue to support the country's economic growth. As a business owner or accountant, it's essential to understand the different VAT rates and how they apply to your transactions. In this guide, we’ll explore the five different VAT rates in the UAE and how they are handled in Wafeq’s accounting system.

What is VAT?

VAT is a consumption tax levied on the value added to goods and services at each stage of the supply chain. The end consumer ultimately bears it, but businesses are responsible for collecting and reporting VAT to the government.

Read More: How to calculate VAT in UAE

Different VAT Rates in the UAE

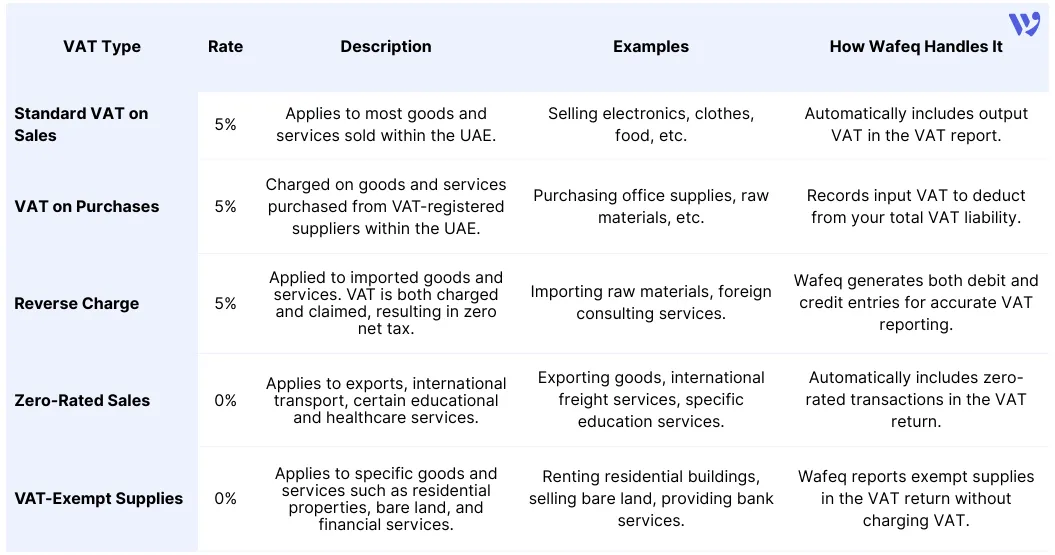

The UAE has five different VAT rates applicable to taxable supplies, which we’ll break down below.

VAT Types in the UAE

1. Standard VAT Rate on Sales: 5% As a VAT-registered supplier in the UAE, the standard VAT rate on all goods and services is 5%. This rate applies to most business transactions conducted within the UAE.

Example: If you sell a product worth AED 1,000, you must charge an additional 5%, making the total AED 1,050. The AED 50 collected as VAT is then reported to the Federal Tax Authority (FTA) in your VAT return. Wafeq automatically includes the output VAT collected from your customers in your VAT report, simplifying your tax filing process.

Example: If you sell a product worth AED 1,000, you must charge an additional 5%, making the total AED 1,050. The AED 50 collected as VAT is then reported to the Federal Tax Authority (FTA) in your VAT return. Wafeq automatically includes the output VAT collected from your customers in your VAT report, simplifying your tax filing process.

2. VAT on Purchases: 5% When you purchase goods or services within the UAE, a 5% VAT will be added by your suppliers if they are VAT-registered. This is known as input VAT, which can be deducted from your output VAT to calculate your net VAT liability.

Example: If you purchase materials worth AED 2,000 and pay 5% VAT (AED 100), this amount can be deducted from the VAT you owe on your sales.

Example: If you purchase materials worth AED 2,000 and pay 5% VAT (AED 100), this amount can be deducted from the VAT you owe on your sales.

In Wafeq, your input VAT is automatically recorded, making tracking and reporting your VAT payments easy.

3. Reverse Charge Mechanism (RCM): 5% The reverse charge mechanism applies when businesses import goods and services from outside the UAE. Under the RCM, the buyer accounts for both the output and input VAT. The effect is that while 5% VAT is applied, the net VAT payable is zero, as the VAT is both charged and claimed back.

Example: You import raw materials from a supplier in another country worth AED 5,000. The reverse charge mechanism requires you to apply a 5% VAT rate, but Wafeq will automatically record the output and input VAT, resulting in no net tax payable.

Example: You import raw materials from a supplier in another country worth AED 5,000. The reverse charge mechanism requires you to apply a 5% VAT rate, but Wafeq will automatically record the output and input VAT, resulting in no net tax payable.

Wafeq handles this process seamlessly by generating both a debit and a credit entry, ensuring accurate VAT reporting.

4. Zero-Rated Sales: 0% Certain goods and services in the UAE are subject to a 0% VAT rate. These zero-rated supplies include:

- Direct and indirect exports of goods and services.

- International transportation services.

- Educational services (certain conditions apply)

- Healthcare services (certain conditions apply)

Example: If you provide international shipping services worth AED 3,000, you charge 0% VAT but must report the total value of the sales in your VAT return.

Example: If you provide international shipping services worth AED 3,000, you charge 0% VAT but must report the total value of the sales in your VAT return.

In Wafeq, zero-rated sales are automatically included in your VAT return, ensuring compliance with UAE tax regulations.

5. VAT-Exempt Supplies: 0% Some goods and services are completely exempt from VAT in the UAE. These include: Residential buildings (with specific conditions), Bare land, Local passenger transportation services, and Financial services. VAT-exempt supplies do not require the collection of VAT, but they must still be reported in your VAT return.

Example: If you rent out residential property, you don’t charge VAT, but you still need to report the total value of the rental income.

Example: If you rent out residential property, you don’t charge VAT, but you still need to report the total value of the rental income.

Wafeq takes care of reporting exempt supplies in your VAT return automatically, helping you stay compliant with the FTA requirements.

Read more: How do I file for VAT return in the UAE?

Adding VAT in Wafeq

Managing VAT in Wafeq is straightforward. Here's how you can add different VAT types when creating invoices or bills:

- Sales VAT (5%): When creating an invoice, click on + Add Tax in the price column to apply the 5% VAT.

- Zero-Rated Sales (0%): Similarly, apply the 0% VAT rate for exports, educational, or healthcare services.

- VAT-Exempt (0%): Select this option for residential buildings, financial services, or other VAT-exempt supplies. 4- Purchase VAT (5%): When recording bills from suppliers, you can apply the 5% VAT to ensure accurate input tax records.

- Reverse Charge (5%): Apply this option for imported goods or services subject to the reverse charge mechanism.

Why Wafeq is the Best Tool for VAT Compliance in the UAE

Wafeq simplifies VAT compliance for businesses in the UAE by automating VAT calculations, reporting, and filing. Here are a few reasons why Wafeq is the preferred choice for businesses:

- Automatic VAT Calculation: Wafeq ensures accurate calculation of output and input VAT for every transaction, whether it’s domestic, import, or export.

- VAT Report Generation: Wafeq automatically generates VAT reports, making it easier for you to file your returns with the FTA.

- Reverse Charge Mechanism: Wafeq handles reverse charges efficiently by automatically accounting for both debit and credit entries.

- Comprehensive Tax Compliance: Wafeq ensures that you meet all UAE tax compliance requirements, including reporting zero-rated and exempt supplies.

Watch our video to learn more about filling a VAT return in Wafeq.

VAT in the UAE is an integral part of business operations, and understanding the different rates is crucial for compliance. By using Wafeq, you can easily manage VAT on sales, purchases, and imports, while ensuring compliance with the UAE’s VAT regulations. Whether your transactions involve standard-rated, zero-rated, or VAT-exempt supplies, Wafeq automates the entire process, saving you time and reducing errors.