How to Navigate the UAE's New Corporate Tax Law

On March 31, 2023, the UAE Ministry of Finance released the much-awaited Corporate Tax Law. The law, which is expected to come into effect on January 1, 2024, will apply to all companies operating in the UAE, including free zones.

This article provides an overview of the law and what it means for businesses operating in the UAE.

What is the Corporate Tax Law?

The Corporate Tax Law is a federal law that will introduce a corporate tax regime in the UAE. Under the new law, all companies that carry out commercial activities in the UAE will be subject to tax on their profits. The tax rate is set at 10%, with certain exemptions and deductions available.

Contact us today to learn how Wafeq can help you stay compliant with the UAE's new corporate tax law and maximize your tax savings.

Contact us today to learn how Wafeq can help you stay compliant with the UAE's new corporate tax law and maximize your tax savings.

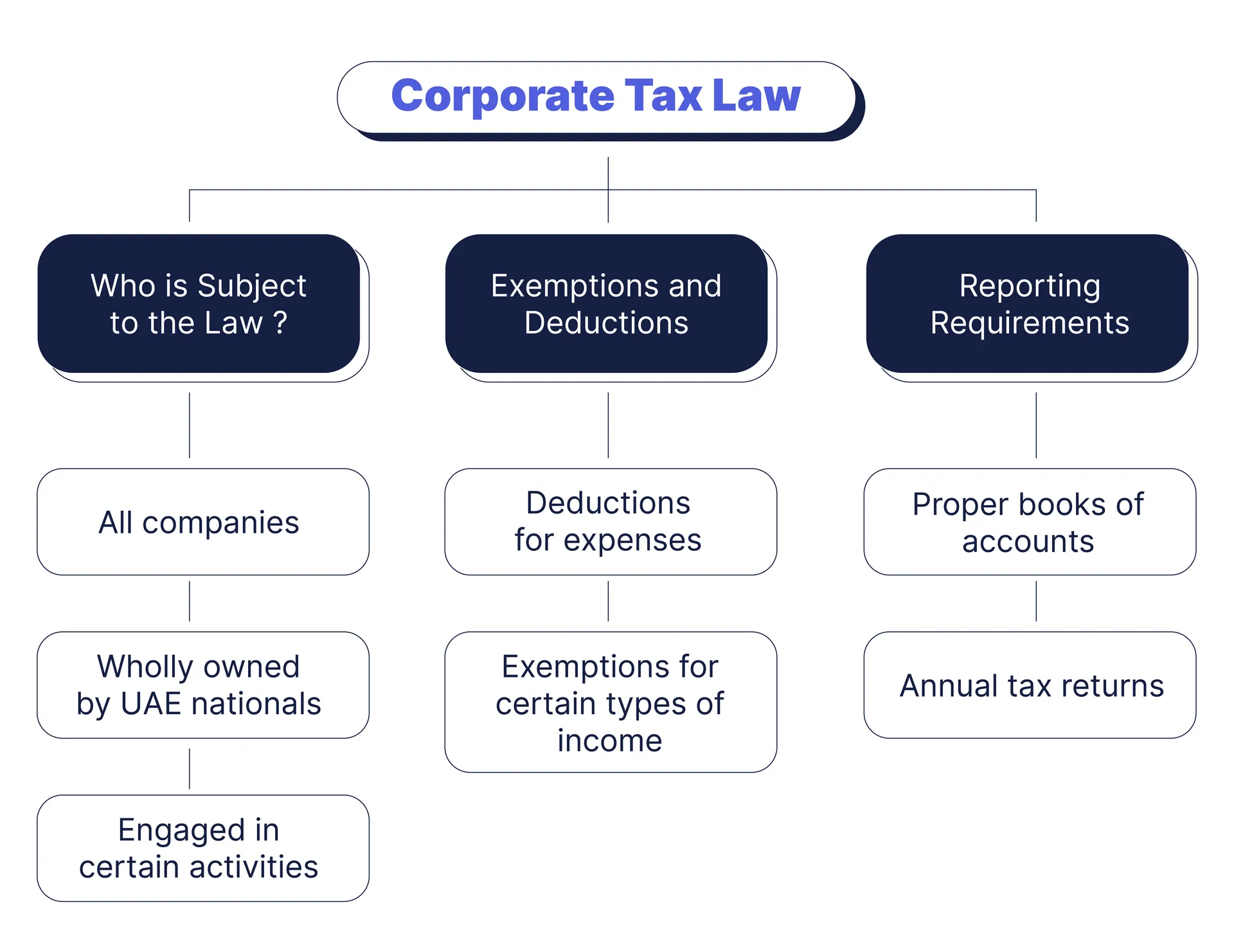

Who is subject to the law?

All companies that carry out commercial activities in the UAE will be subject to the new tax law, including free zone companies. However, companies wholly owned by UAE nationals and those engaged in specific activities, such as oil and gas exploration, will be exempt from tax.

What are the exemptions and deductions available?

Under the new law, companies will be able to claim deductions for expenses incurred in producing income, such as wages and salaries, rent, and interest. Additionally, there are exemptions available for certain types of income, such as income from the sale of shares and income derived from foreign sources.

What are the reporting requirements?

Companies will be required to maintain proper books of accounts and submit annual tax returns to the Federal Tax Authority. The first tax returns will be due in 2025 for the year 2024. Failure to comply with the reporting requirements may result in penalties.

Read more: UAE Corporate Tax: A Comprehensive Overview

What are the implications for businesses in the UAE?

The introduction of a corporate tax regime in the UAE is a significant change that will impact businesses operating in the country. Companies will need to factor in the cost of the tax when planning their operations and may need to consider restructuring their businesses to optimize their tax position. However, the tax is also expected to bring benefits, such as increased government revenue, which may lead to improved infrastructure and services in the country.

Conclusion

The Corporate Tax Law is a significant development in the UAE's tax landscape and will impact all companies operating in the country. While the introduction of a corporate tax regime may bring challenges, it also presents opportunities for businesses to optimize their tax position and contribute to the country's economic growth.

Use Wafeq - an accounting system to keep track of debits and credits, manage your inventory, payroll, and more.

Use Wafeq - an accounting system to keep track of debits and credits, manage your inventory, payroll, and more.