A guide on how to prepare for an external audit using Wafeq's reports

External audits are essential components of sound financial management and corporate governance. They provide an independent evaluation of a company’s financial statements and compliance with applicable laws and standards. Proper preparation for an external audit can significantly reduce the time and effort involved while increasing the accuracy and transparency of the process.

Wafeq offers a suite of comprehensive reports designed to streamline audit preparation by giving finance teams clear, detailed, and real-time financial insights. This article serves as a practical guide for finance professionals on how to leverage Wafeq’s reporting tools to effectively prepare for an external audit and ensure a smooth audit experience.

Understanding External Audits

An external audit is an independent examination of a company’s financial records, performed by an external auditor or audit firm. The primary objective is to verify the accuracy and completeness of financial statements, ensuring they reflect the company’s true financial position. External audits also assess compliance with relevant accounting standards, tax laws, and regulatory requirements.

Companies often face challenges such as incomplete documentation, record discrepancies, or inefficient communication with auditors. Understanding the audit process and its objectives helps organizations prepare better and avoid delays or findings that could affect their reputation or financial standing.

Overview of Wafeq Reports for Audit Preparation

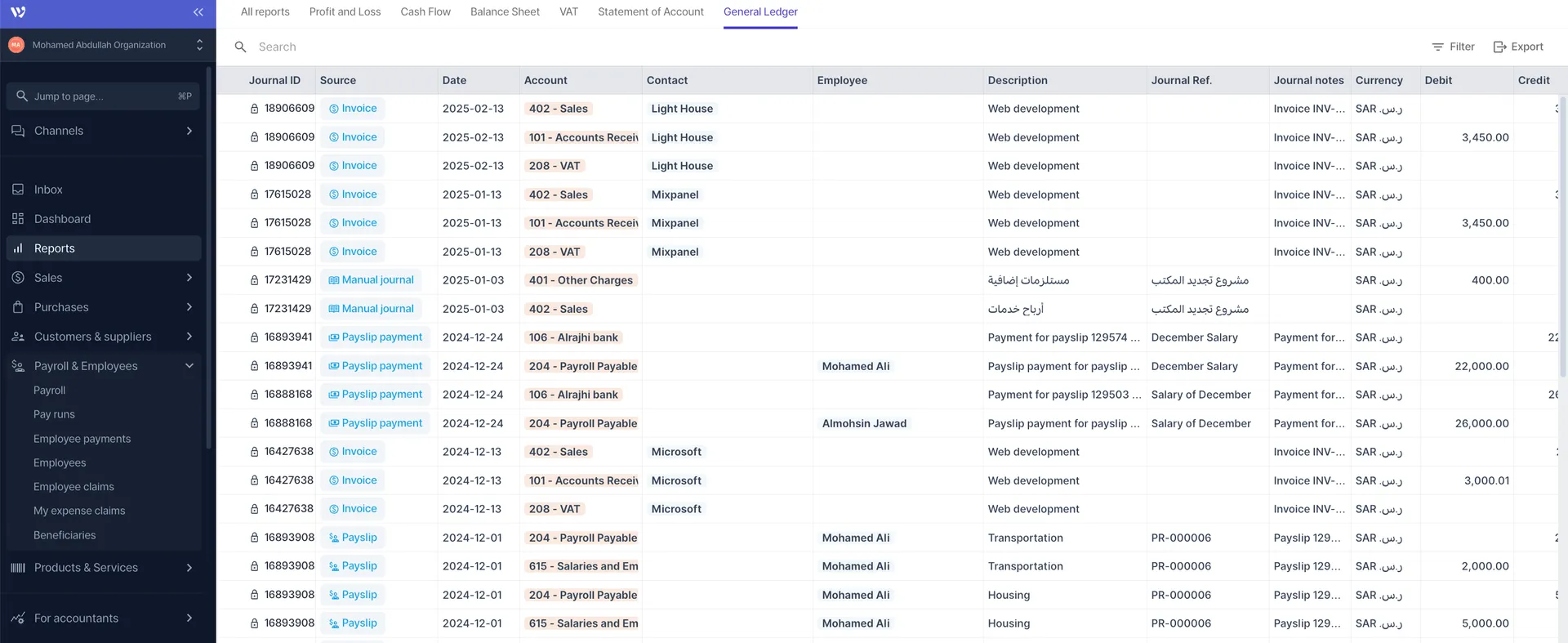

Wafeq provides a variety of detailed reports that play a critical role in preparing for external audits. These reports include financial summaries, transaction logs, expense tracking, compliance checks, and approval workflows. By consolidating all relevant data, Wafeq ensures finance teams have access to accurate and up-to-date information needed for audit readiness.

Using Wafeq reports allows companies to identify inconsistencies early, maintain a clear audit trail, and demonstrate strong internal controls. This helps reduce audit risks and builds confidence with auditors.

Step-by-Step Guide to Preparing for an External Audit Using Wafeq Reports

Preparing for an external audit can be made much easier by following a structured approach using Wafeq’s reporting capabilities. Below are the essential steps to guide your audit readiness process:

1. Review and Reconcile Financial Data Use Wafeq’s financial summary reports to review your company’s total financial position. Reconcile account balances with your general ledger to ensure accuracy and completeness.

2. Verify Compliance through Transaction and Expense Reports Use detailed transaction and expense reports to confirm that all financial activities comply with company policies and regulatory requirements. Highlight any unusual or unauthorized transactions. 3. Generate Audit Trail Reports for Transparency Produce audit trail reports to track every transaction’s origin, approval, and modifications. This transparency is crucial for demonstrating accountability and control.

4. Identify and Address Discrepancies Carefully examine the reports to spot any discrepancies or anomalies. Investigate and resolve these issues before the audit to prevent negative findings. 5. Prepare Documentation and Supporting Evidence Gather all relevant supporting documents such as invoices, receipts, and approval forms. Wafeq’s report export features simplify compiling this documentation for auditors. 6. Utilize Budgeting and Approval Reports to Demonstrate Controls Use reports on budgeting and approvals to showcase your internal financial controls and spending limits, reassuring auditors of your company’s governance standards.

Tips for Effective Use of Wafeq Reports During Audit

Finance teams should adopt proactive habits and best practices to maximize the value of Wafeq’s reporting tools during an audit. The following tips will help ensure accuracy, efficiency, and auditor satisfaction:

- Schedule regular report reviews throughout the year, not just during audit season. This helps detect and resolve issues early.

- Customize reports to match auditor requirements by using Wafeq’s filtering and export options.

- Collaborate across departments using Wafeq’s user roles and permissions to ensure all data inputs are consistent and complete.

- Maintain digital records linked to reports (invoices, receipts, contracts) to support each transaction and simplify verification.

- Keep your chart of accounts and policies aligned with accounting standards to prevent misclassification errors.

Common Pitfalls and How to Avoid Them

Even with powerful tools like Wafeq, Certain mistakes can undermine audit readiness and lead to delays or audit findings. Being aware of these common pitfalls—and taking steps to prevent them—can make a significant difference in the outcome of your external audit:

- Incomplete or outdated data: Ensure that all financial entries and supporting documents are up to date in Wafeq. Delays in data entry or missing records can create audit red flags.

- Failure to reconcile accounts regularly: Waiting until audit time to reconcile accounts can result in accumulated discrepancies that are harder to resolve quickly.

- Overlooking approval workflows: Transactions processed without documented approval may raise compliance concerns. Always verify that approval flows are properly recorded.

- Ignoring system alerts or anomalies: Wafeq may flag unusual activity or inconsistencies; these should be reviewed and addressed promptly.

- Lack of centralized documentation: Scattered or inaccessible supporting documents slow down audit progress. Use Wafeq’s centralized features to organize and link documents to related transactions.

Preparing for an external audit doesn't have to be stressful or time-consuming. By leveraging Wafeq’s robust reporting tools, finance teams can establish a clear, organized, and proactive audit process. From reconciliation to compliance tracking and approval workflows, Wafeq centralizes the data and documentation that auditors need, saving valuable time and reducing the risk of errors.

Prepare for your next audit with confidence.

Prepare for your next audit with confidence.

Explore Wafeq’s powerful reporting tools and streamline your financial workflows today.

.png?alt=media)