Pricing Strategies: How to Set, Test, and Optimize Your Prices for Growth

“Price is what you pay. Value is what you get,” Warren Buffett once said, capturing the essence of every pricing decision a business makes. Pricing is never just about covering costs or beating competitors—it’s about signaling value, shaping customer perception, and ultimately determining profitability. Get pricing wrong, and even the best product can struggle; get it right, and growth becomes far more sustainable. Before diving in, here’s a quick look at what this article will help you understand about pricing strategies.

- Why pricing shapes value, not just revenue.

- The main pricing strategies businesses rely on.

- When each pricing approach makes sense.

- The risks of pricing too high or too low.

- How pricing impacts growth and profitability.

What Are Pricing Strategies?

Pricing strategies are the approaches businesses use to set the prices of their products or services. They’re not just about covering costs—they signal value, influence customer behavior, and can even define your brand. From small startups to global corporations, every business needs a pricing strategy that aligns with its goals, market, and customers.

Some common types include cost-based pricing, where you calculate prices from production costs; value-based pricing, which focuses on the perceived value to the customer; and competition-based pricing, which considers what competitors charge. The right strategy depends on your industry, audience, and growth objectives.

Why does it matter? A solid pricing strategy can increase sales, improve margins, and make your business more resilient. Without one, even a high-quality product can struggle to find its place in the market.

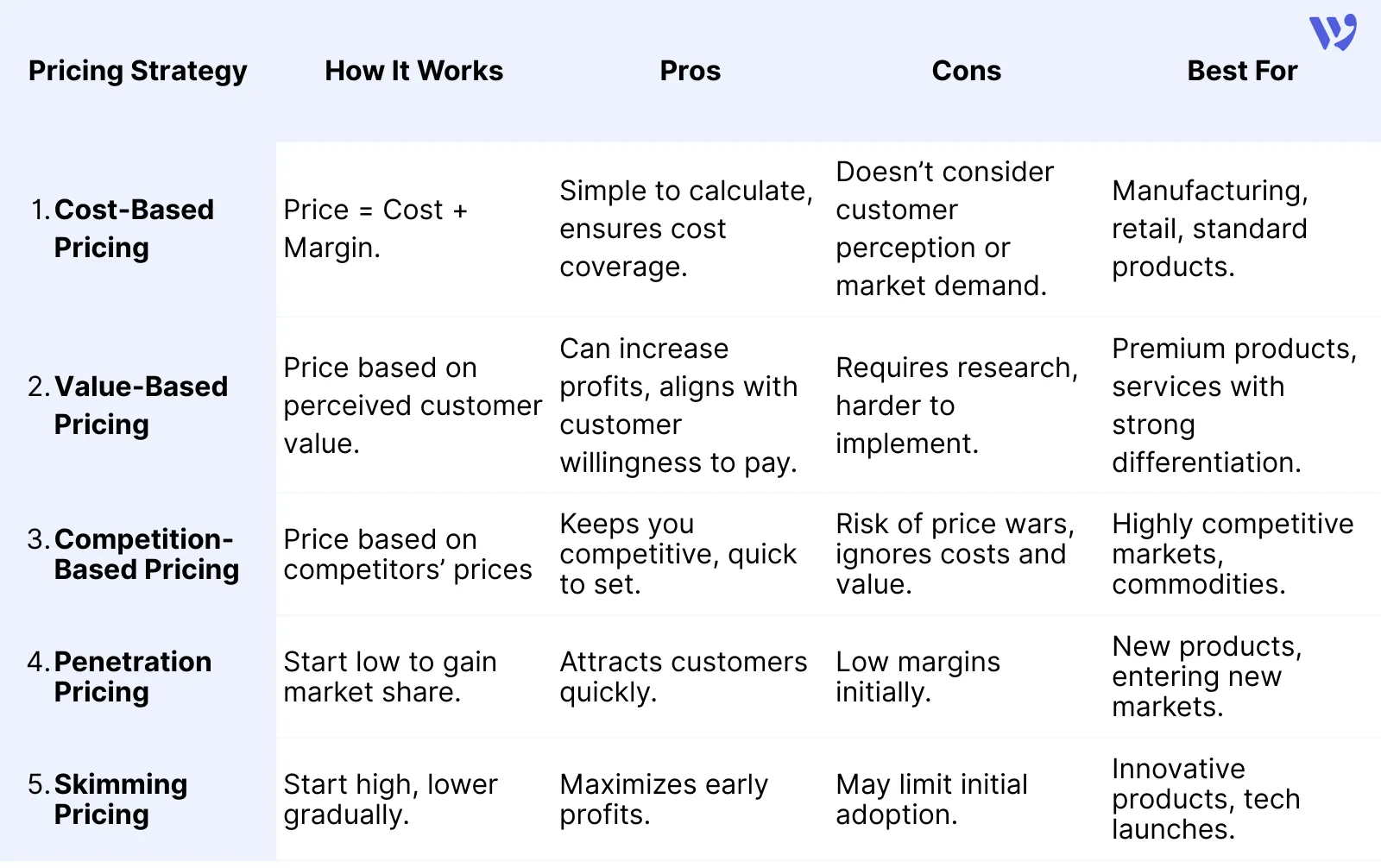

Comparison of Main Pricing Strategies

Understanding the differences between pricing strategies can help you pick the right one for your business. Here’s a simple comparison of the most common approaches:

Pricing Strategies by Business Model

Pricing doesn’t work the same way for every business. What fits a SaaS company may fail for a service provider or a retail brand. Aligning pricing strategy with the business model helps ensure sustainable revenue, competitive positioning, and customer satisfaction.

- SaaS and Subscription-Based Businesses SaaS companies often rely on tiered or subscription pricing. Monthly or annual plans, freemium models, and usage-based pricing help balance customer acquisition with recurring revenue.

- Service-Based Businesses Pricing for services usually reflects expertise, time, and outcomes. Hourly rates, fixed project fees, or value-based pricing are common, especially in consulting and professional services.

- Product-Based and Retail Businesses Retail pricing often depends on cost structures, volume, and competition. Markup pricing, bundle pricing, and promotional discounts are frequently used to drive sales.

- B2B Businesses B2B pricing tends to be customized and value-driven. Contract pricing, volume discounts, and negotiated rates reflect long-term relationships and higher transaction values.

- B2C Businesses B2C pricing focuses on simplicity and emotional appeal. Psychological pricing, competitive pricing, and limited-time offers are commonly used to influence buying decisions.

How to Choose the Right Pricing Strategy

Choosing the right pricing strategy requires more than intuition or competitor benchmarking. It involves a structured evaluation of costs, customers, market conditions, and business objectives to ensure pricing supports both short-term performance and long-term growth.

- Understand Your Cost Structure Start by identifying your fixed and variable costs. This helps you define the minimum price you can charge while staying profitable, regardless of the pricing model you choose.

- Evaluate Customer Willingness to Pay Pricing should reflect how customers perceive your product’s value. Market research, surveys, and purchasing patterns can indicate what customers are actually willing to pay.

- Analyze Market and Competition Review competitor pricing and market conditions carefully. Pricing too high may reduce demand, while pricing too low can hurt margins and brand positioning.

- Align Pricing with Business Goals Your pricing strategy should support your objectives. Growth-focused businesses may favor penetration pricing, while profit-driven businesses often lean toward value-based or skimming strategies.

- Test and Adjust Over Time Pricing is not a one-time decision. Regular testing and performance analysis help ensure your pricing remains competitive and effective as markets change.

The Impact of Pricing Strategies on Profitability and Growth

Pricing strategies don’t just determine how much customers pay—they influence how a business grows, competes, and sustains profitability over time. The right pricing approach can strengthen financial performance, while the wrong one can quietly erode margins.

- Profit Margins Even small pricing changes can significantly impact margins. A slight price increase often improves profitability faster than increasing sales volume.

- Customer Acquisition and Retention Competitive and transparent pricing attracts new customers, while consistent value-based pricing encourages repeat purchases.

- Brand Positioning Pricing sends a strong signal about quality. Premium pricing supports a high-value brand image, while low pricing may position the business as cost-focused.

- Revenue Stability Well-planned pricing strategies help businesses manage cash flow and maintain predictable revenue, especially during market fluctuations.

- Scalability and Long-Term Growth Sustainable pricing allows businesses to grow without sacrificing margins, operational capacity, or customer trust.

Read Also: Average Sales Price (ASP): How to Calculate, Analyze, and Use It Strategically

Common Pricing Mistakes Businesses Should Avoid

Even well-established businesses make pricing mistakes that quietly erode profits and weaken market position. Recognizing these errors early can protect margins and improve long-term performance.

- Ricing Based on Costs Only Focusing solely on costs ignores customer perception and market demand, often leading to underpricing or missed revenue opportunities.

- Ignoring Customer Value When pricing doesn’t reflect the value customers receive, businesses struggle to justify prices or differentiate themselves from competitors.

- Competing on Price Alone Constantly lowering prices to match competitors can trigger price wars and damage profitability without building loyalty.

- Not Reviewing Prices Regularly Markets change, costs rise, and customer expectations evolve. Stagnant pricing quickly becomes misaligned with reality.

- Overcomplicating Pricing Models Complex pricing structures confuse customers and slow purchasing decisions, especially in B2B environments.

How to Test and Optimize Pricing Over Time

Pricing is not a one-time decision. Markets shift, customer expectations change, and costs evolve. Businesses that regularly test and optimize their pricing are better positioned to protect margins, increase revenue, and stay competitive.

- Run A/B Pricing Tests Test different price points or pricing structures across similar customer segments to understand which option drives better conversion and revenue.

- Track Customer Behavior and Metrics Monitor key indicators such as conversion rates, churn, average revenue per customer, and customer lifetime value to evaluate pricing performance.

- Collect Direct Customer Feedback Surveys, sales conversations, and customer interviews can reveal how customers perceive price fairness and value.

- Analyze Competitor Price Changes Regularly review competitor pricing to ensure your prices remain competitive without sacrificing profitability.

- Test Pricing Changes Gradually Small, incremental adjustments reduce risk and help measure the impact of changes before applying them broadly.

- Review Pricing at Regular Intervals Set quarterly or annual pricing reviews to align prices with cost changes, market trends, and business goals.

When Should a Business Change Its Pricing Strategy?

Even the best pricing strategy isn’t permanent. Businesses need to adjust pricing to reflect market shifts, cost changes, and evolving customer expectations. Knowing when to change is key to maintaining growth and profitability.

- Market Changes When competitors adjust prices or new entrants disrupt the market.

- Cost Fluctuations Rising production or operational costs may require a price update.

- Customer Behavior Shifts Changes in buying patterns, preferences, or perceived value can signal a need for adjustment.

- Product Lifecycle Stages Launch, growth, maturity, or decline phases often require different pricing approaches.

- Business Objectives New growth, profitability, or positioning goals can justify a pricing revision.

Read Also: What is break-even analysis and how does it affect pricing decisions?

FAQs about Pricing Strategy

What is the most effective pricing strategy?

It depends on your industry, customers, and business goals—no one-size-fits-all approach exists.

Should I base pricing on cost or value?

Both methods are valid; value-based pricing usually generates higher margins if you understand your customer.

How often should I review prices?

Quarterly or annual reviews are recommended, but faster adjustments may be needed in fast-changing markets.

Can I change pricing frequently?

Yes, but communicate clearly with customers to avoid confusion or negative perception.

Ready to make smarter pricing decisions? Wafeq helps you test, track, and adjust your prices easily, so your business can maximize growth and profitability.

Ready to make smarter pricing decisions? Wafeq helps you test, track, and adjust your prices easily, so your business can maximize growth and profitability.

.png?alt=media)