Accounting Software Requirements in Qatar: Compliance, Features & Best Practices

In Qatar’s regulated business environment, accounting systems play a critical role in ensuring financial accuracy, audit readiness, and regulatory compliance. As reporting and tax requirements continue to evolve, selecting the right accounting software has become a strategic business decision rather than a technical preference.

In this article, you will gain:

- A clear understanding of accounting and compliance requirements in Qatar.

- Insight into mandatory accounting standards and financial reporting expectations.

- An overview of VAT readiness and record-keeping obligations.

- Key criteria for evaluating and selecting compliant accounting software.

This guide is designed to help businesses make informed decisions when choosing accounting software aligned with Qatar’s regulatory framework.

Accounting and Regulatory Framework in Qatar

In Qatar, businesses are required to operate under a clearly defined accounting and compliance framework that influences not only reporting practices but also the choice of accounting software. Understanding these elements is essential before evaluating software solutions.

1. Mandatory Accounting Standards All companies operating in Qatar must prepare their financial statements and maintain accounting records in accordance with international accounting standards, specifically the International Financial Reporting Standards (IFRS) promulgated by the International Accounting Standards Board. This requirement is enforced under Qatari commercial and tax laws and applies to sole proprietorships, LLCs, partnerships, and corporations alike.

📌 Note: Companies subject to audit or with capital/profits exceeding certain thresholds must also submit audited financial statements as part of their tax filings.

📌 Note: Companies subject to audit or with capital/profits exceeding certain thresholds must also submit audited financial statements as part of their tax filings.

2. Record-Keeping Obligations One of the most critical regulatory requirements in Qatar is record retention. According to Qatari tax and commercial laws, businesses are required to keep all accounting books, registers, and supporting documents:

- For at least 10 years from the end of the relevant accounting period, unless ongoing disputes extend this period.

- In the physical location of the business or through contracted custodian arrangements, but the company remains legally responsible.

This long retention period means that accounting systems must enable archiving, retrieving, and storing historical financial data securely and in compliance with regulatory standards.

3. Audit and Tax Reporting Requirements Under Qatari tax regulations, Annual tax returns generally require accompanying audited financial statements if:

- A company’s capital or profits exceed certain thresholds.

- The head office is located outside Qatar. If these requirements are not met, the tax authority may reject the tax declaration.

In addition, emerging regulatory practices, such as the planned introduction of XBRL-based reporting for audited financial statements, suggest a future in which machine-readable, structured data formats will become standard for tax compliance. Businesses must stay informed and prepared for such transitions.

In addition, emerging regulatory practices, such as the planned introduction of XBRL-based reporting for audited financial statements, suggest a future in which machine-readable, structured data formats will become standard for tax compliance. Businesses must stay informed and prepared for such transitions.

4. Language and Submission Standards Ensuring transparency and accessibility for regulators, Financial statements, and tax filings must:

- Meet certain language requirements (including Arabic content where applicable)

- Be denominated in Qatari Riyals (QAR)

Read about: Types of Taxes and Compliance Requirements for Companies in Qatar.

Key Accounting Software Features for Compliance and Growth

Choosing the right accounting software depends not just on price or brand recognition — it depends on functional capabilities that support compliance with Qatar’s regulatory environment and the practical needs of your business.

Here are the key features every business should evaluate:

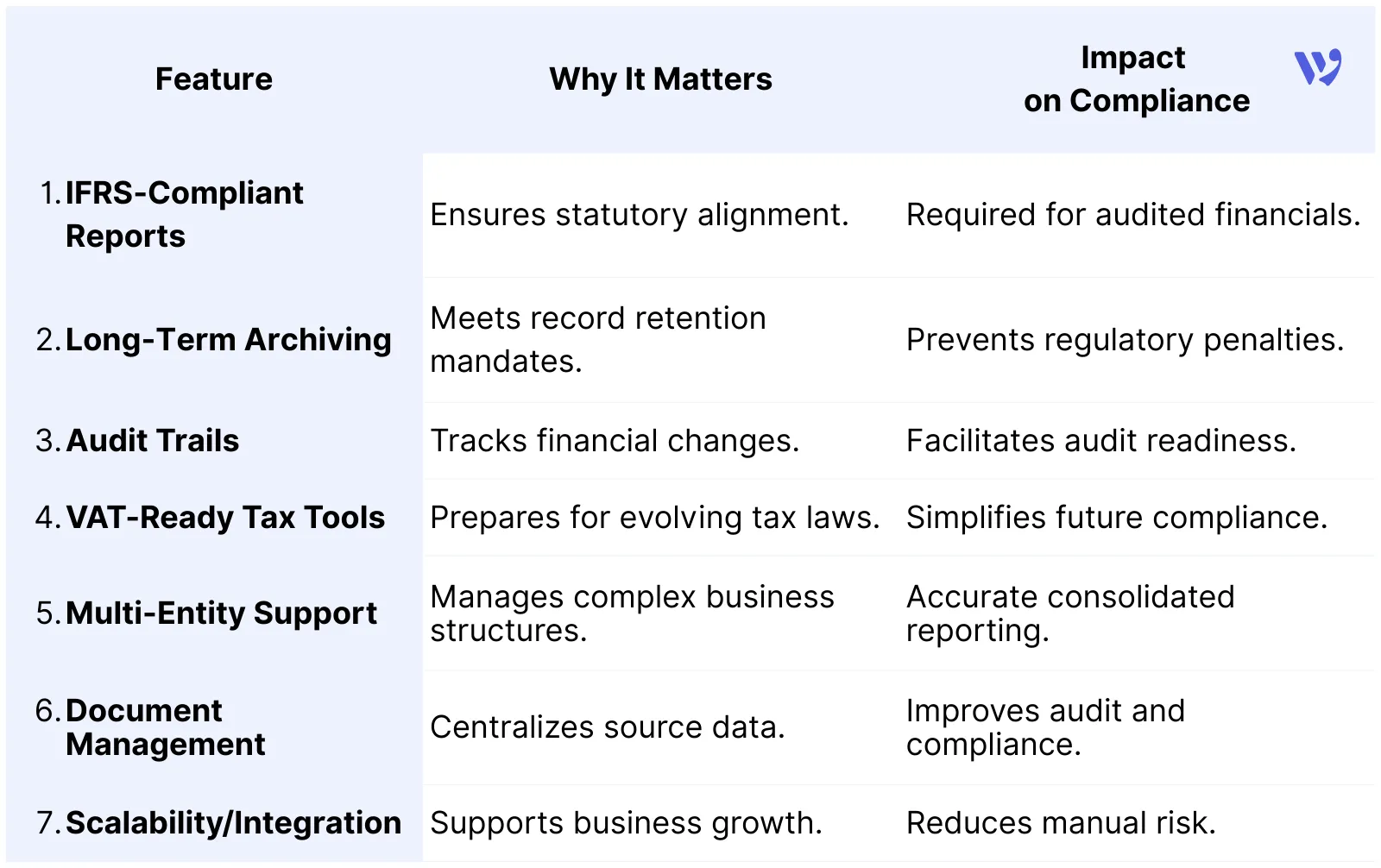

1. IFRS-Compliant Financial Reporting Because Qatar companies are required to prepare financial statements in accordance with International Financial Reporting Standards (IFRS), Accounting software must:

- Support IFRS-based chart of accounts and reporting templates.

- Enable multi-currency transactions with translation adjustments.

- Provide accurate balance sheets, income statements, cash flow statements, and equity reports.

2. Long-Term Data Storage and Archiving With a minimum 10-year record-keeping requirement, your accounting system must:

- Store full transactional histories securely.

- Allow easy retrieval of audited reports and source documents.

- Support data backups and retention policies.

3. Audit Trail and Controls An audit trail tracks every change made in the system — who changed it, when, and why. This feature is essential for:

- Preparing for external audits.

- Supporting internal financial controls and governance.

- Detecting unauthorized or erroneous entries.

Without a clear audit trail, auditors and regulators may question data integrity. Read about: Internal vs External Audits.

4. VAT Readiness and Tax Reporting Although Qatar has not yet implemented a Value-Added Tax (VAT) regime, the region (including neighboring GCC states) has moved in that direction. Many finance leaders are already preparing their systems for potential VAT compliance — including:

- Automated VAT calculation.

- Tax-ready invoice templates.

- Tax reporting modules.

- Audit-ready tax export files.

Having this built in or as an add-on capability prepares your business for future changes in tax law. Read Also: Preparing for Qatar’s Upcoming VAT and E‑Invoicing.

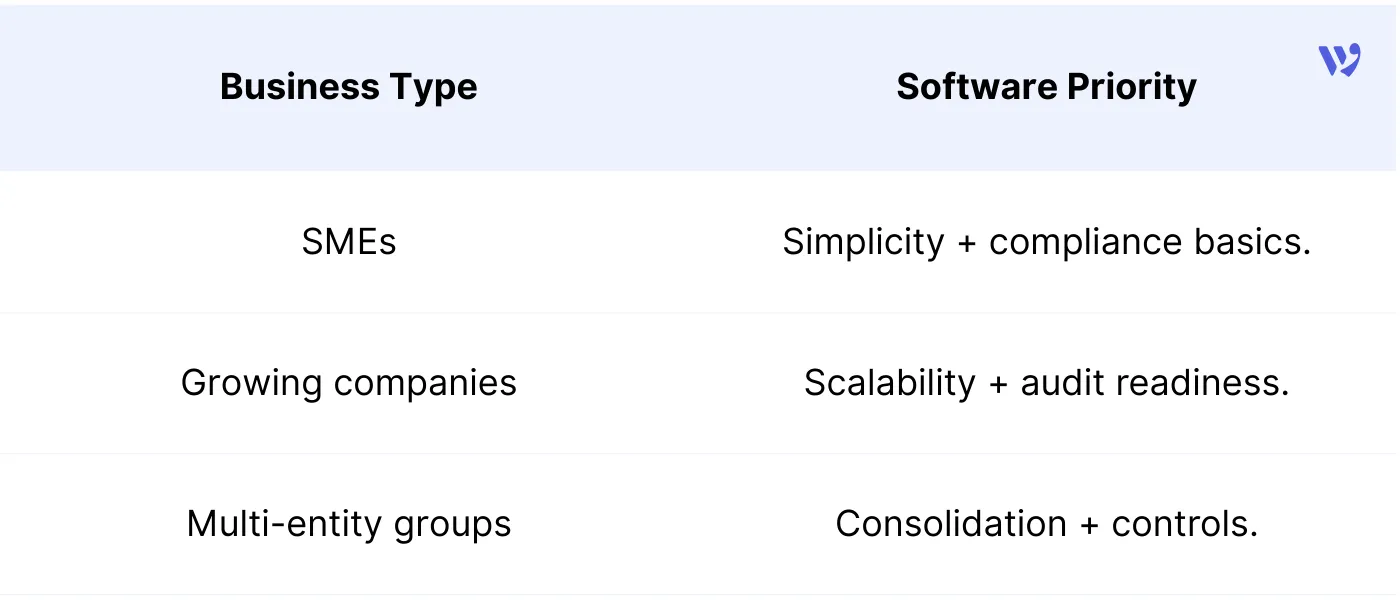

5. Multi-Entity and Consolidation Support Many businesses in Qatar operate across multiple legal entities or subsidiaries. Good accounting software should support:

- Consolidated financial statements.

- Inter-company eliminations.

- Cross-entity reporting.

6. Document Management and Digital Attachments Being able to attach source documents — such as invoices, contracts, and bank statements — directly to accounting entries:

- Speeds up audits and compliance checks.

- Reduces paperwork and manual filing.

- Improves internal review processes.

7. Scalability and Integration Systems that lack integration capabilities tend to create data silos and manual workarounds — increasing risk and operational friction. Finally, the software should be able to grow with your business:

- Integrate with CRM, payroll, and banking systems.

- Support customizable workflows.

- Provide access controls and role-based permissions.

Summary Table: Core Accounting Software Features

Comparing Accounting Software Options for Businesses in Qatar

When evaluating accounting software in Qatar, the comparison should go beyond feature lists and pricing pages. The real difference lies in how well each solution aligns with local regulatory requirements, reporting expectations, and long-term operational needs.

Rather than asking “Which software has more features?”, businesses should ask “Which system supports compliance, audit readiness, and scalability in Qatar?”

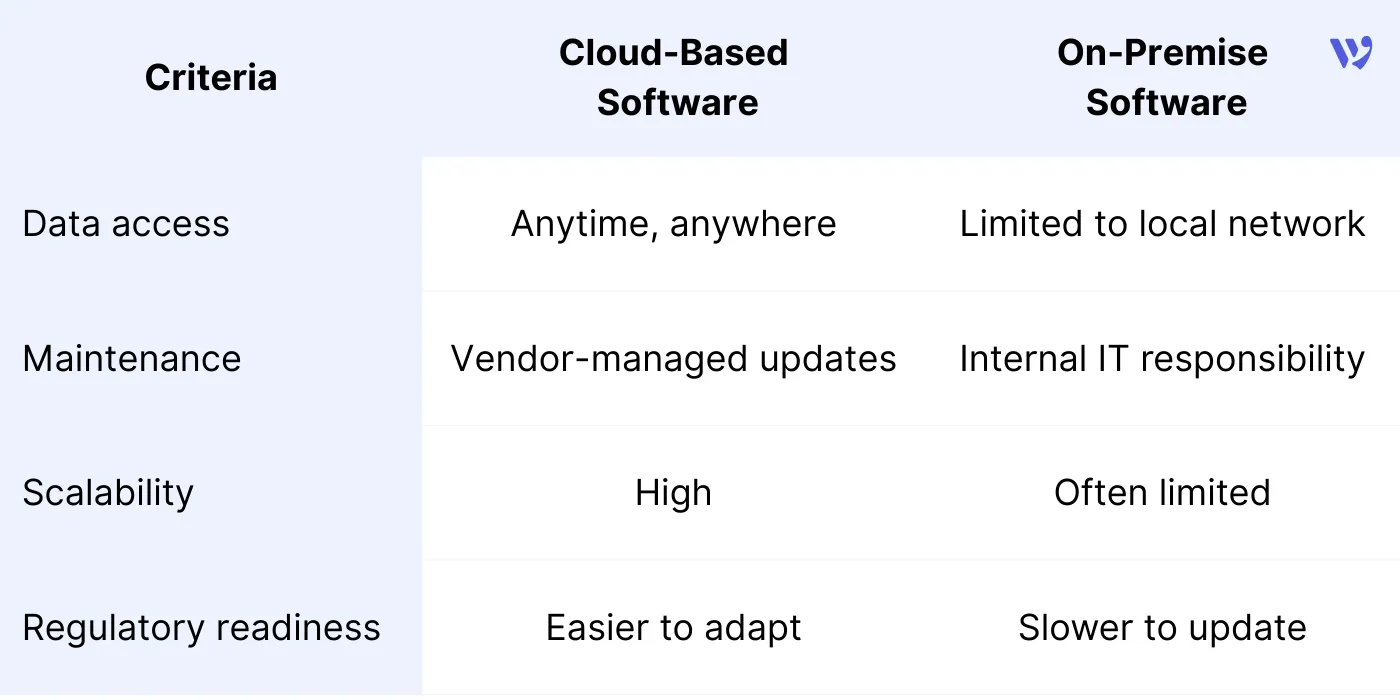

1. Cloud-Based vs On-Premise Accounting Software One of the first comparison points is the deployment model.

2. IFRS and Audit Readiness Not all accounting systems are equally prepared for IFRS-based reporting. Key comparison points include:

- Availability of IFRS-aligned financial statements.

- Consistency of reporting across periods.

- Built-in audit trails and change logs.

3. Localization and Regional Support Accounting software used in Qatar should support:

- Qatari Riyal (QAR) as a base currency.

- Regional tax and compliance configurations.

- Arabic language support (where required)

Software lacking regional localization often requires manual workarounds, increasing both risk and workload.

Software lacking regional localization often requires manual workarounds, increasing both risk and workload.

4. Compliance vs Convenience Some systems prioritize ease of use but fall short on compliance-critical features such as:

- Long-term document archiving.

- Structured financial reporting.

- Robust access controls.

Others are built with compliance in mind but may require more structured implementation. The right balance depends on the company’s size, audit exposure, and growth plans.

5. Business Size and Complexity Fit

A system that works well for a small business may not scale effectively for multi-entity or audited organizations.

know more about: Choosing the Best Accounting Software in Qatar for VAT Compliance.

Accounting software in Qatar is not simply a tool for recording transactions — it is a core part of regulatory compliance, audit readiness, and financial control. With clear requirements around IFRS reporting, long-term record retention, and increasing expectations for transparency, businesses must ensure their systems are built to meet both current obligations and future regulatory changes.

FAQs about Accounting Software Requirements in Qatar

What accounting software is compliant with Qatar regulations?

Most modern cloud-based accounting systems support IFRS-compliant reporting, audit trails, and long-term record retention. Popular solutions include ERP systems with local GCC configurations, but businesses should always check for the Qatari currency, Arabic-language support, and local regulatory alignment.

Do businesses in Qatar need software ready for VAT?

While Qatar has not yet implemented VAT, businesses are encouraged to choose systems that are VAT-ready, allowing automated calculations, tax-compliant invoice templates, and reporting capabilities in anticipation of future GCC alignment.

How long should accounting records be retained in Qatar?

Qatari law generally requires businesses to retain accounting books, invoices, and supporting documents for at least 10 years. Your accounting software must support secure archiving and easy retrieval.

Can small businesses in Qatar use cloud-based accounting software?

Yes. Cloud-based systems are increasingly popular for SMEs due to ease of access, automatic updates, and scalability, while also meeting audit and compliance requirements.

What features should I prioritize when selecting accounting software for Qatar?

Key features include: IFRS-compliant reporting, audit trails, long-term data retention, Arabic language support, multi-entity consolidation, security controls, and integration with banking/payment systems.

If your business operates in Qatar, now is the right time to assess whether your accounting system truly supports compliance, audit preparedness, and scalability — not just day-to-day bookkeeping.

If your business operates in Qatar, now is the right time to assess whether your accounting system truly supports compliance, audit preparedness, and scalability — not just day-to-day bookkeeping.

.png?alt=media)