Choosing the Best Accounting Software in Qatar for VAT Compliance

Across Qatar, many businesses are experiencing rapid growth, yet their financial management often struggles to keep pace. Spreadsheets become crowded, invoices pile up, and compliance with evolving tax regulations grows more complex. Without the right systems, even well-managed companies risk inefficiency and costly errors. This is where accounting software plays a crucial role, helping organizations in Qatar achieve accuracy, compliance, and scalability in a competitive market.

Why Choosing the Right Accounting Software Matters in Qatar

Accounting software is no longer just a back-office tool—it has become a core driver of efficiency, compliance, and strategic growth for businesses in Qatar. The country’s economy is expanding across multiple industries, from construction and retail to technology and services. With this growth comes increasing financial complexity, tighter compliance requirements, and a push toward digital transformation. Choosing the right accounting software is critical for several reasons:

- Regulatory Compliance Qatar is moving toward stronger tax administration, with Value Added Tax (VAT) expected soon and e-invoicing regulations anticipated to follow. Software that ensures compliance with these rules will help businesses avoid penalties and stay audit-ready.

- Time and Cost Efficiency Manual bookkeeping consumes valuable resources and increases the risk of error. Modern accounting software automates repetitive tasks such as invoice generation, payroll processing, and expense tracking, freeing finance teams to focus on strategy.

- Scalability for Growth As businesses expand, financial operations become more complex. A scalable accounting system allows companies to manage higher transaction volumes, multiple branches, or even regional expansions without disrupting operations.

- Real-Time Financial Insights Decision-making in today’s fast-paced market requires access to accurate data at any moment. Accounting software provides dashboards, reports, and analytics that give management teams a clear picture of profitability, cash flow, and financial health.

- Integration with Local Systems Businesses in Qatar often need integration with banks, payroll systems, and local compliance platforms. The right solution ensures smooth connectivity, reduces administrative burdens and streamlines operations.

Key Features to Look for in Accounting Software

Not all accounting software is created equal, and businesses in Qatar must carefully evaluate the features that will best support their operations. The right system should not only simplify bookkeeping but also provide compliance, integration, and long-term value. Below are the most important features to consider:

- Cloud vs. On-Premise Solutions Cloud-based accounting software is increasingly popular because it offers flexibility, automatic updates, and access from anywhere. For businesses with multiple locations in Qatar—or remote teams— the solutions cloud reduces infrastructure costs and ensures scalability. On-premise solutions may appeal to companies with strict internal data policies but often involve higher setup and maintenance costs.

- Arabic Language and Local Support With Arabic being the official language in Qatar, many businesses require software with Arabic interfaces and documentation. Local customer support is equally important to resolve technical issues quickly and ensure smooth adoption across finance teams.

- VAT and E-Invoicing Compliance Qatar is preparing for VAT implementation and potential e-invoicing regulations. Choosing software that can easily adapt to local tax frameworks ensures businesses avoid penalties and remain compliant without manual adjustments.

- Integration with Banks and Third-Party Systems A strong accounting solution should integrate seamlessly with Qatari banks, payroll systems, and business management platforms. Integration reduces duplication, improves accuracy, and speeds up reconciliation processes.

- Customization and Scalability Each business has unique needs. The best accounting software should allow customization, such as a tailored chart of accounts, specific approval workflows, or industry-specific modules. It should also scale as the company grows, supporting higher transaction volumes or regional expansion.

- Security and Data Protection Given the sensitivity of financial data, robust security features are essential. Look for encryption, user access controls, and compliance with international security standards. For businesses in Qatar, ensuring data protection while leveraging cloud platforms is a top priority.

- Reporting and Analytics Beyond bookkeeping, accounting software should empower decision-making with dashboards, KPIs, and real-time financial reports. Advanced analytics can help identify trends, optimize cash flow, and forecast future performance.

Read Also: How Cloud-Based Accounting Software Solutions Are Revolutionizing the Industry.

Best Accounting Software Options in Qatar

Businesses in Qatar have a wide range of accounting software solutions to choose from. Each platform comes with unique strengths that appeal to different business sizes, industries, and compliance needs. Below is an overview of the most popular options and what they do best:

1. Wafeq

- Designed with compliance in mind, particularly for VAT and e-invoicing in the GCC.

- Arabic interface and local customer support tailored to businesses in Qatar.

- Cloud-based with scalability for SMEs and growing enterprises.

- Strong automation features for invoices, payments, and reconciliations.

2. Zoho Books

- Affordable solution with a wide range of built-in features.

- Strong integration with Zoho’s ecosystem of business apps.

- Useful for small to medium-sized businesses looking for value for money.

- Cloud-native with mobile accessibility and multi-user collaboration.

3. QuickBooks

- Globally recognized and widely adopted accounting platform.

- Excellent for small businesses needing standardized processes.

- Strong reporting tools with customizable templates.

- An extensive third-party app marketplace for integrations.

4. Xero

- Intuitive and user-friendly interface with strong international adoption.

- Cloud-native with advanced collaboration features for accountants and clients.

- Good at handling multi-currency transactions, relevant for businesses in Qatar dealing with global trade.

- Strong add-on ecosystem with integrations for payroll, inventory, and more.

5. Tally Prime

- Known for simplicity and affordability, especially for small businesses.

- Strong at handling basic accounting functions like bookkeeping, invoicing, and inventory.

- An offline-first approach suits businesses that prefer on-premise systems.

- Easy to train staff and implement quickly.

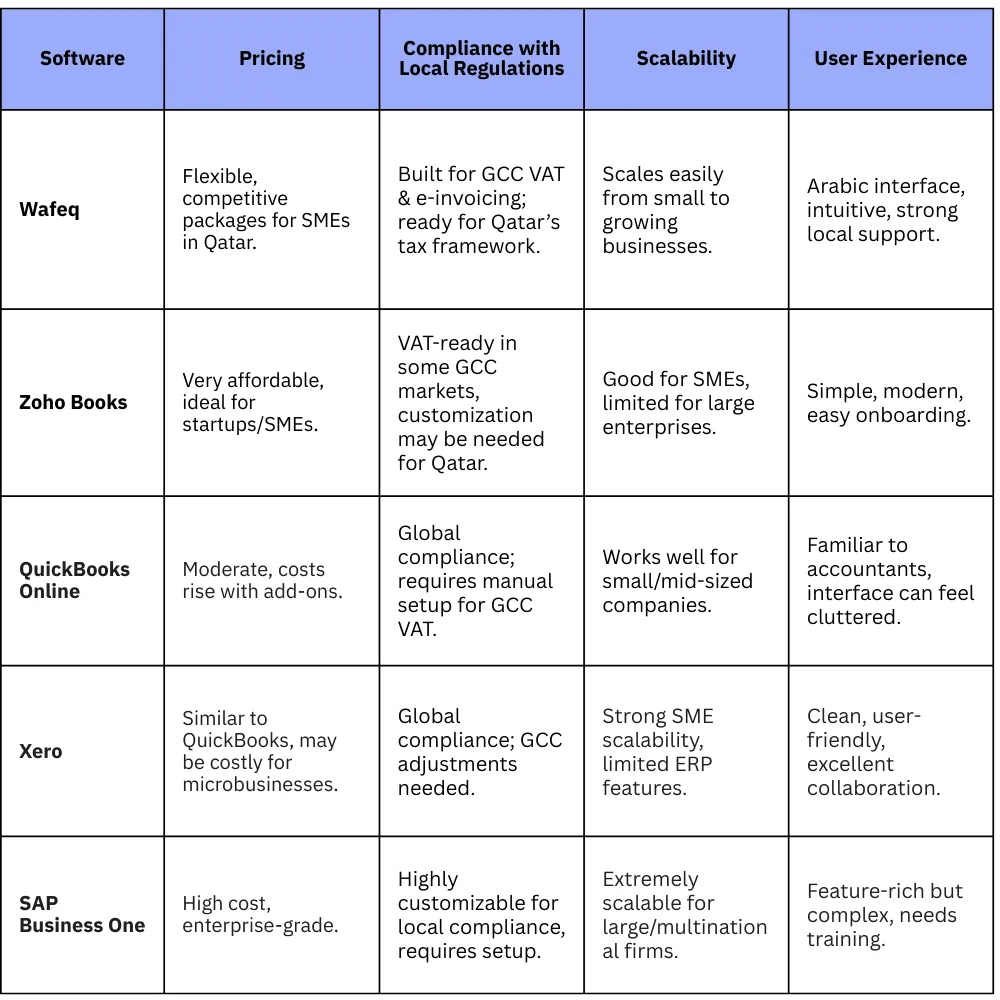

Comparing Accounting Software in Qatar

Qatar VAT & E-Invoicing: How Software Ensures Compliance

Qatar is preparing to introduce a Value-Added Tax (VAT) system in line with the GCC VAT framework, along with mandatory e-invoicing requirements. For finance teams, this shift means that manual processes will no longer be sufficient—companies must adapt to ensure accuracy, transparency, and full compliance with upcoming regulations.

Why VAT & E-Invoicing Matter in Qatar

- Transparency: VAT implementation ensures greater clarity in financial transactions.

- Government Oversight: E-invoicing enables regulators to track transactions in real-time.

- Accuracy & Accountability: Businesses are required to issue standardized invoices, reducing fraud and errors.

Challenges Businesses Face Without Software

- Manual invoice creation increases the risk of mistakes.

- Keeping track of VAT input and output tax manually is time-consuming.

- Regulatory updates may require frequent process changes that are difficult to handle on spreadsheets.

How Accounting Software Helps

The shift toward VAT and e-invoicing in Qatar makes accounting software not just useful, but essential. Businesses that adopt compliance-ready systems will avoid penalties, improve efficiency, and build trust with regulators. This is through:

- Automated VAT Calculations: Ensures accurate tax reporting without manual errors.

- E-Invoicing Integration: Generates invoices that meet government standards, ready for electronic submission.

- Real-Time Reporting: Helps finance teams monitor compliance and generate VAT returns with ease.

- Future-Proofing: Cloud-based solutions like Wafeq are updated automatically to align with new Qatari tax laws.

Read Also: Preparing for Qatar’s Upcoming VAT and E‑Invoicing.

Why Wafeq is the Best Choice for Qatari Businesses

Among the many accounting software options available, Wafeq stands out as a solution purpose-built for businesses in the GCC region, including Qatar. Unlike global tools that require heavy customization, Wafeq is designed with local regulations, languages, and business practices in mind.

- Compliance-Ready Wafeq is fully aligned with GCC VAT frameworks and is prepared for Qatar’s upcoming VAT and e-invoicing regulations, ensuring businesses stay compliant without additional configuration.

- Arabic & English Interface With a bilingual interface, Wafeq makes accounting accessible to both Arabic-speaking finance teams and international management, bridging communication gaps.

- Automation & Efficiency From automated invoice generation to bank reconciliations and recurring transactions, Wafeq reduces manual work and ensures accuracy across processes.

- Scalable for SMEs and Growing Companies Whether a small business or a growing enterprise, Wafeq adapts with flexible pricing, user options, and integrations tailored to each stage of growth.

- Local Support & Expertise Unlike global providers, Wafeq offers regional customer support and a deep understanding of Qatari and GCC business needs, making onboarding and troubleshooting smoother.

Know more about: What is Wafeq Accounting Software?

As Qatar moves closer to implementing VAT and e-invoicing, choosing the right accounting software is no longer optional; it is a strategic necessity. The best solutions combine compliance, automation, scalability, and bilingual support to help businesses stay efficient and competitive in a rapidly changing market.

Among the available options, Wafeq stands out as a compliance-ready, bilingual, and user-friendly solution built specifically for businesses in the GCC. It not only simplifies accounting but also supports growth, efficiency, and long-term success.

FAQs about accounting software in Qatar

Which accounting software is best for businesses in Qatar?

The best option depends on your business size and needs, but software like Wafeq stands out for compliance, automation, and bilingual support tailored to the Qatari market.

Is VAT implemented in Qatar?

Qatar is preparing for the Value-Added Tax (VAT) introduction in line with the GCC framework. Businesses must ensure their accounting systems can handle VAT reporting and compliance.

Does Qatar require e-invoicing?

Yes. Qatar is moving toward mandatory e-invoicing to improve transparency and government oversight. Choosing software that supports e-invoicing is essential.

Do I need Arabic support in accounting software for Qatar?

Yes. Since many businesses in Qatar have bilingual teams, having both Arabic and English interfaces ensures smoother adoption and communication.

Can cloud-based accounting software be trusted in Qatar?

Absolutely. Modern cloud systems like Wafeq use strong encryption and security protocols, providing safe access from anywhere, which is especially important for remote work and multi-branch businesses.

How does Wafeq compare to global accounting software?

Unlike global solutions that require customization, Wafeq is built for GCC compliance, bilingual needs, and local business practices, making it more efficient for companies in Qatar.

Equip your business in Qatar with Wafeq accounting software that ensures compliance, saves time, and scales with you.

Equip your business in Qatar with Wafeq accounting software that ensures compliance, saves time, and scales with you.

.png?alt=media)